US Options Trading Flexible for Diverse Market Conditions

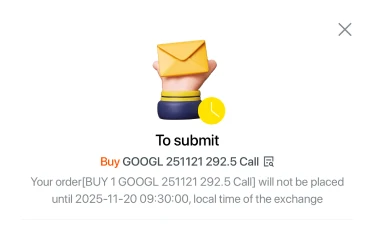

World’s First Pre-Market U.S. Options

Trade at $0 Commission^

Three Steps to Trade

Comprehensive Options Strategies

Practical trading guides for easy onboarding|Diverse strategy combinations for advanced users|Flexible allocation based on market conditions

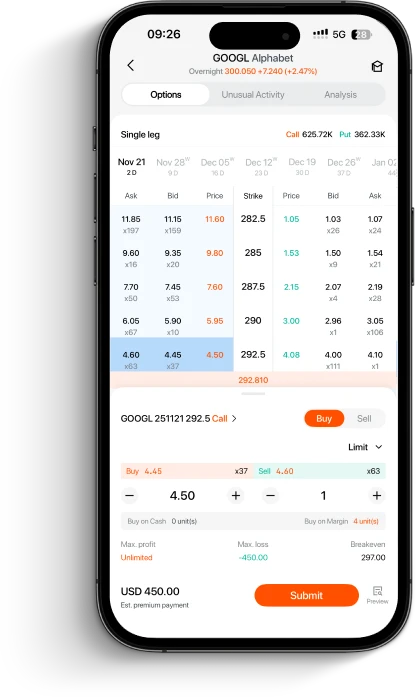

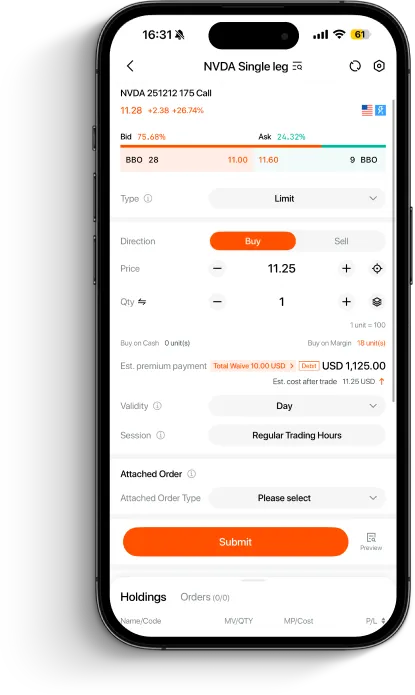

Single-Leg Option

Buy or sell a single options contract (call or put), suitable for beginners tracking trend direction.

Vertical Spread

Simultaneously buy or sell options of different strike prices to flexibly capture asset price movements of the underlying asset.

Covered Call

Hold the underlying stock and sell call options simultaneously to receive regular premiums and boost portfolio returns.

Collar Strategy

Buy puts while selling calls to hedge against downside risk in the underlying asset.

Straddle Strategy

Simultaneously buy call and put options with the same strike price to profit from large price moves, up or down.

Strangle Strategy

Buy both call and put options with different strikes but same expiry to benefit from major moves regardless of direction.

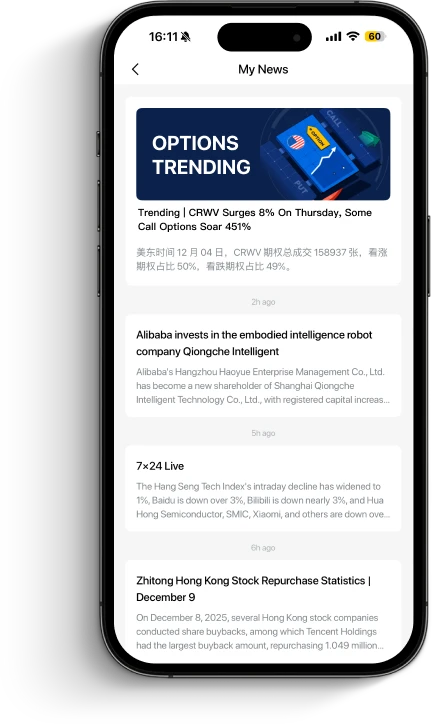

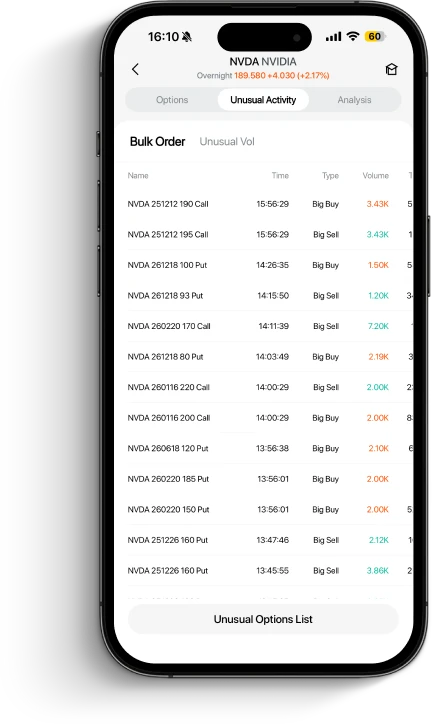

Real-Time Market Monitoring

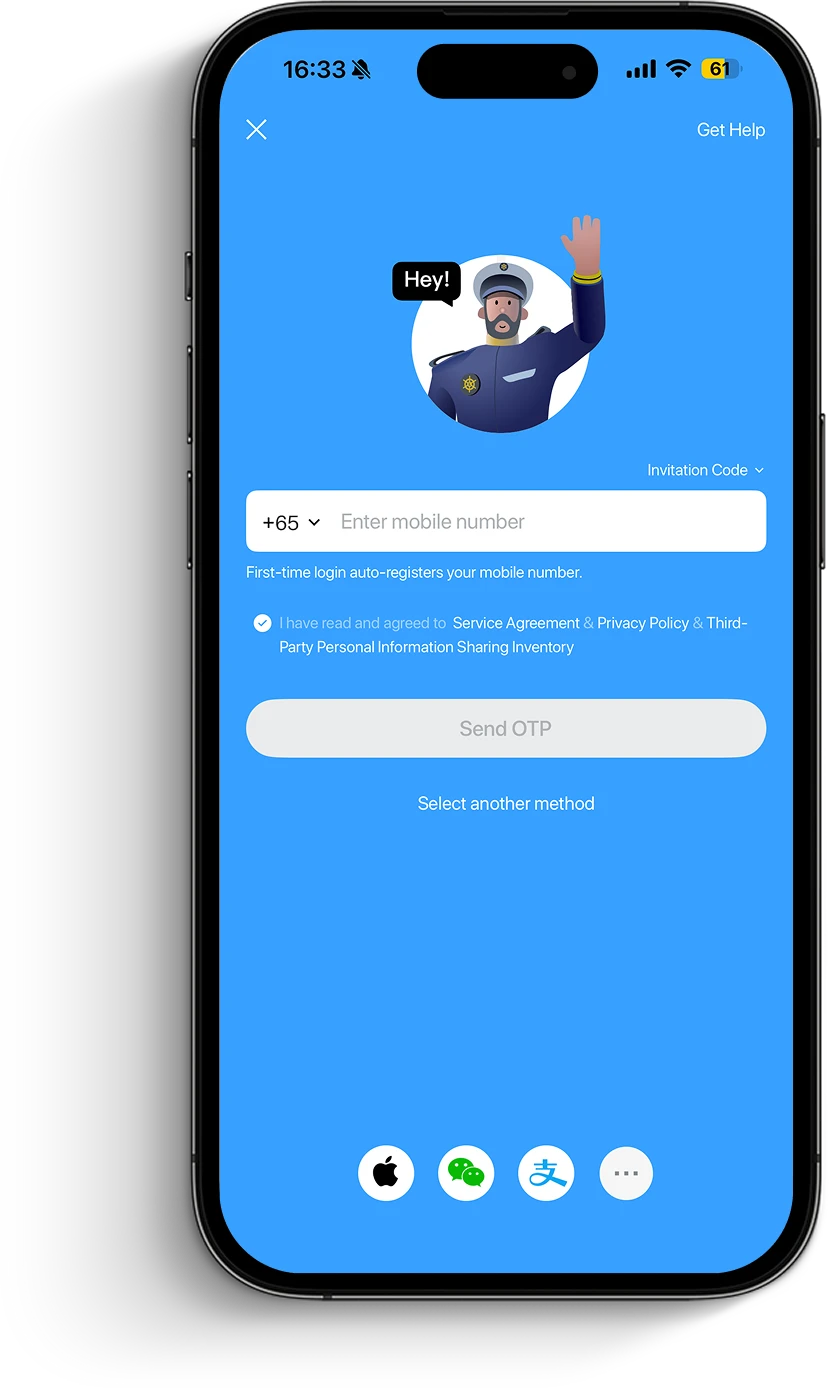

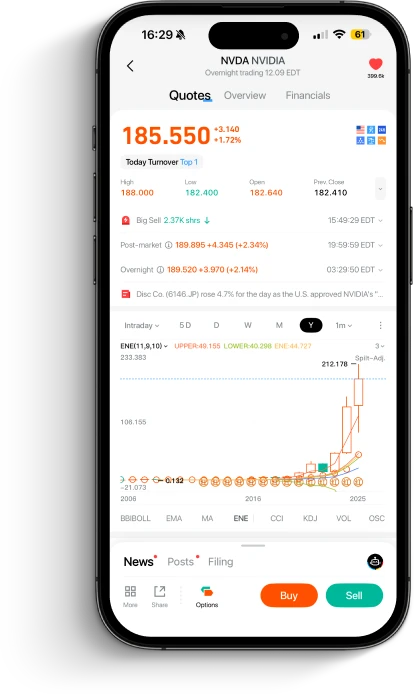

Three Steps to Start Your Options Trading Journey

Log in to your Longbridge account

Select a supported US stock and enter the options page

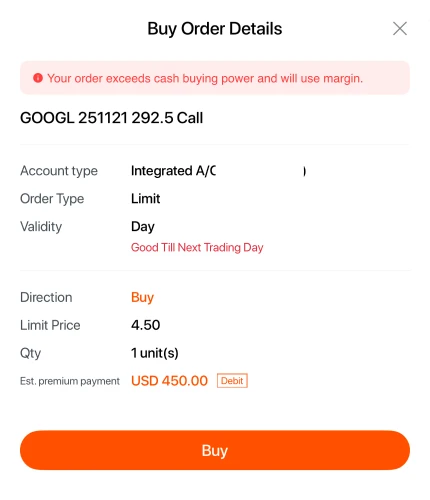

Place an order on the options page

Frequently Asked Questions

1. What is an option?

An option is a contract-based financial derivative that grants the holder the right, but not the obligation, to buy or sell a specific asset (such as stocks, indices, bonds, or commodities) at a predetermined price before the contract expires. It can be used to hedge positions, mitigate risk, or amplify potential returns, offering flexibility to navigate various market conditions.

2. How are options traded?

Option investors may choose to buy or sell option contracts, which specify an agreement to trade the underlying asset at a predetermined price on a future date. Purchasing an option contract requires paying a premium. If market conditions become favorable, the holder may exercise the option or sell the contract outright for profit.

3. What is the premium?

The premium is the fee paid by investors when purchasing an option contract, granting the right to buy or sell a specific asset. The premium is determined by multiple factors including market supply and demand, asset price volatility, and contract expiration date.

4. What are the risks of options trading?

Options possess leverage effects that can amplify potential gains but may also magnify losses. The maximum loss for an option buyer is limited to the premium paid, while the seller faces greater potential losses during periods of high market volatility. Before investing, it is advisable to fully understand the risks associated with each strategy and operate with caution.

5. What do “call” and “put” mean in options trading?

A “call option” grants the right to buy an asset. If the underlying asset's price rises, the holder can purchase it at the strike price—lower than the market price—making it suitable for investors bullish on future price movements. A “put option” grants the right to sell an asset. If the underlying asset's price falls, the holder can sell it at the strike price—higher than the market price—making it useful for hedging positions or when bearish on market trends.

6. Can options be traded during night session hours?

Longbridge Securities offers the world's exclusive U.S. stock options night session service, enabling users to trade ahead of U.S. market open hours. This eliminates constraints of traditional trading hours, allowing Asian investors to bypass time zone challenges and seize global investment opportunities in real time.