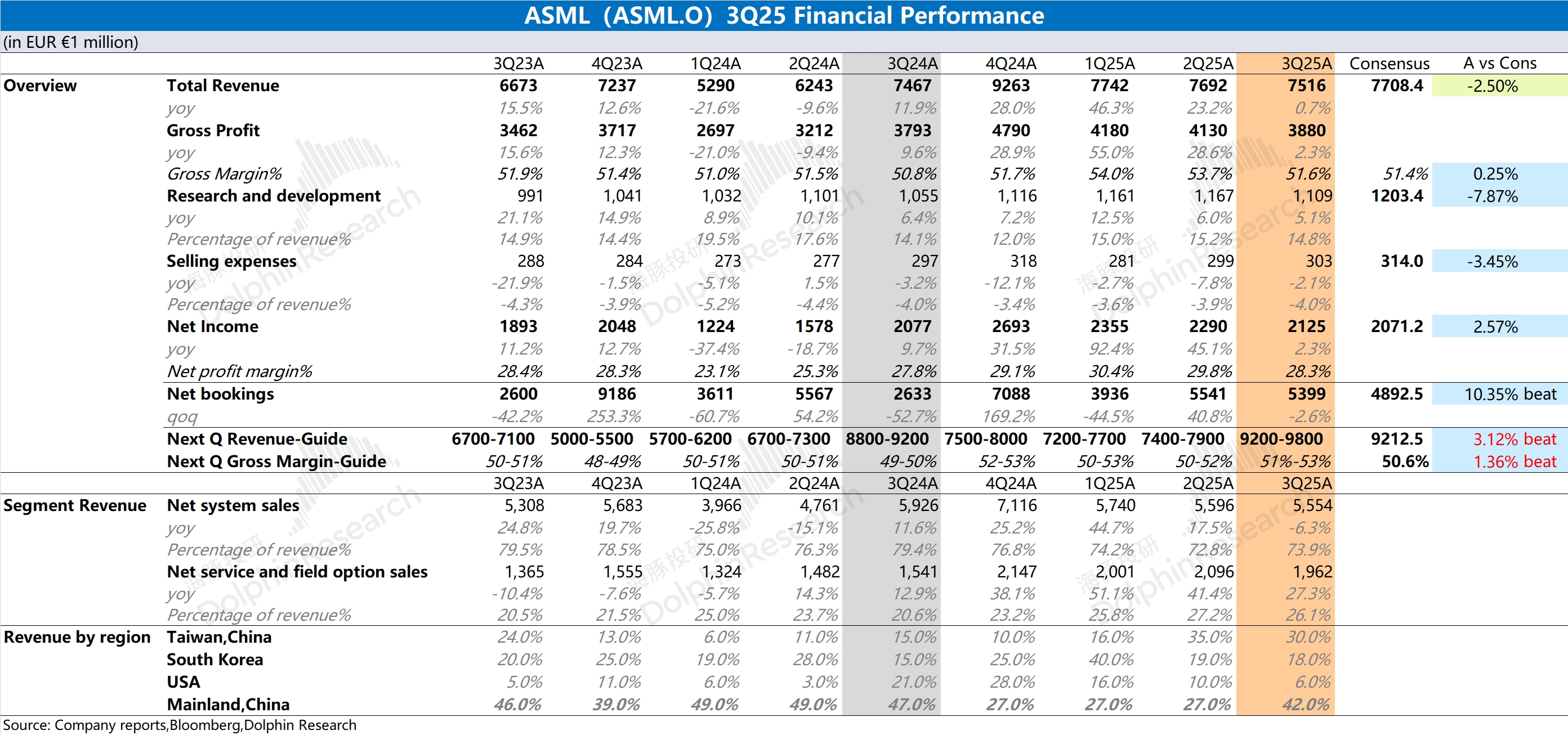

ASML Quick Interpretation: Although the company's revenue and gross margin for this quarter met the guidance expectations, they did not significantly exceed them. The company's R&D and sales expenses remained stable, resulting in a moderate profit for the quarter.

Compared to this quarter's data, the market is more focused on ASML's order metrics and next quarter's guidance, as these two aspects better reflect the company's operational trend changes.

① Order Metrics: ASML's net orders for this quarter remained at 5.4 billion euros, better than the market expectation of 4.9 billion euros. After experiencing a 'flash crash' in order data at the beginning of the year, the company's orders have returned above 5 billion euros, mainly due to the weakening impact of tariffs and the recovery of downstream confidence;

② Next Quarter Guidance: The company expects fourth-quarter revenue to reach 9.2-9.8 billion euros, better than the market expectation of 9.2 billion euros. The fourth quarter is often a peak season for the company's product deliveries, and from the guidance, the company is likely to continue the momentum of year-on-year revenue growth.

Although AI semiconductors remain hot, ASML has been under multiple pressures in the first half of the year, especially from the capital expenditure contraction of major clients Samsung and Intel, which has put significant pressure on the company's operations.

However, with the recovery of the memory cycle, Intel's 'rebirth expectations,' and the progress in Samsung's HBM certification, ASML's pressure is gradually being released. As the absolute leader in the lithography market, ASML will also benefit from the current AI Capex boom.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.