Netflix: Another Plunge! Has the 'King of Shows' Really Become Mediocre?

$Netflix(NFLX.US) released its Q3 2025 financial report after the market closed on October 21, Eastern Time. The sharp drop in stock price has already reflected the market sentiment, ostensibly as a punishment for missing earnings, but in reality, it replicates the previous quarter's scenario—under short-term high valuations, not exceeding expectations is equivalent to missing them.

Specifically:

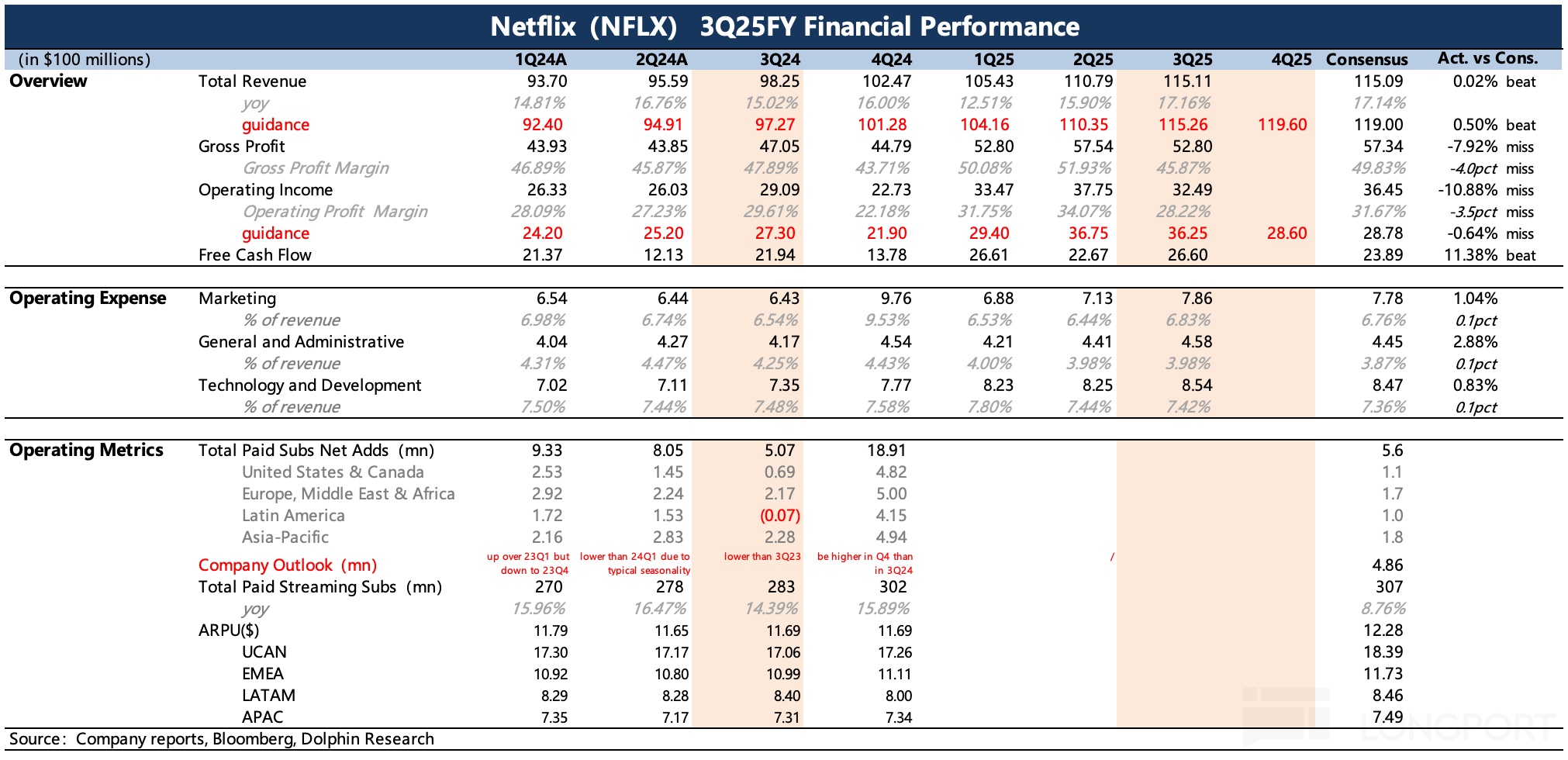

1. Earnings actually exceeded expectations: An additional cost provision of $619 million impacted the current profit margin by more than 5 percentage points, creating the illusion of missing expectations. This expense mainly involves municipal service taxes levied by Brazil on streaming companies, which had not been clearly provisioned by Netflix due to ongoing disputes. In Q3, Netflix likely recognized the unavoidable nature of this tax and confirmed the cumulative expenses from 2022 to date, recording them as a one-time charge under other cost items, significantly impacting Q3 performance.

The guidance provided last quarter did not include this expenditure. Excluding this impact, the actual operating profit was $3.87 billion, up 33% year-on-year, with a profit margin of 33.6%, exceeding market consensus. The subsequent impact of this tax on the company's overall profit is relatively small, so the company's guidance for Q4 performance is roughly in line with market expectations.

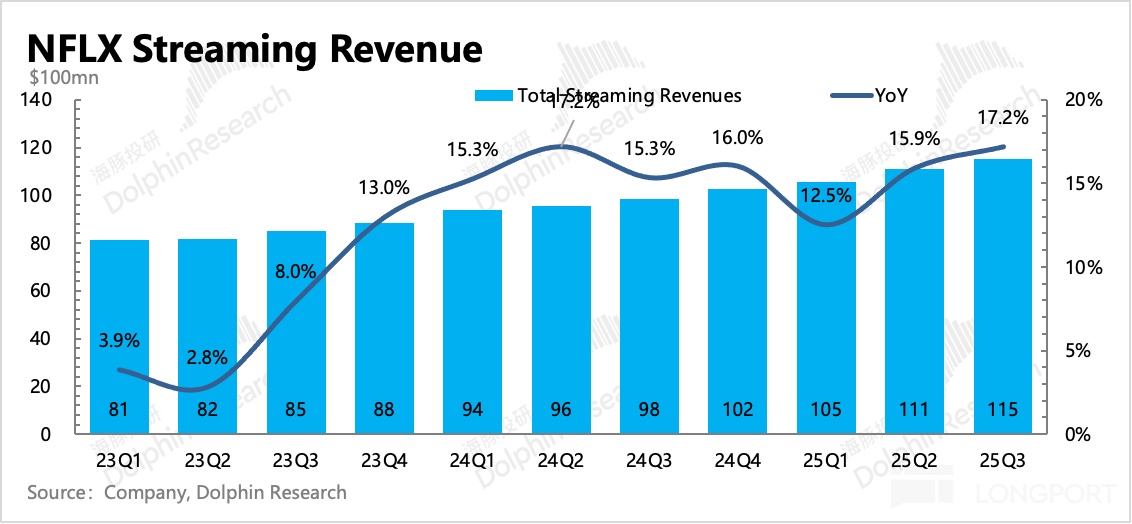

2. Flat revenue is the main reason for the decline: The revenue side, which reflects growth, remains unremarkable, with both current and next quarter guidance basically meeting expectations. Q3 revenue grew by 17% year-on-year, with exchange rate impacts of the US dollar in different regions being hedged, showing no significant forex tailwind as anticipated.

Revenue growth is still driven by price increases and advertising.

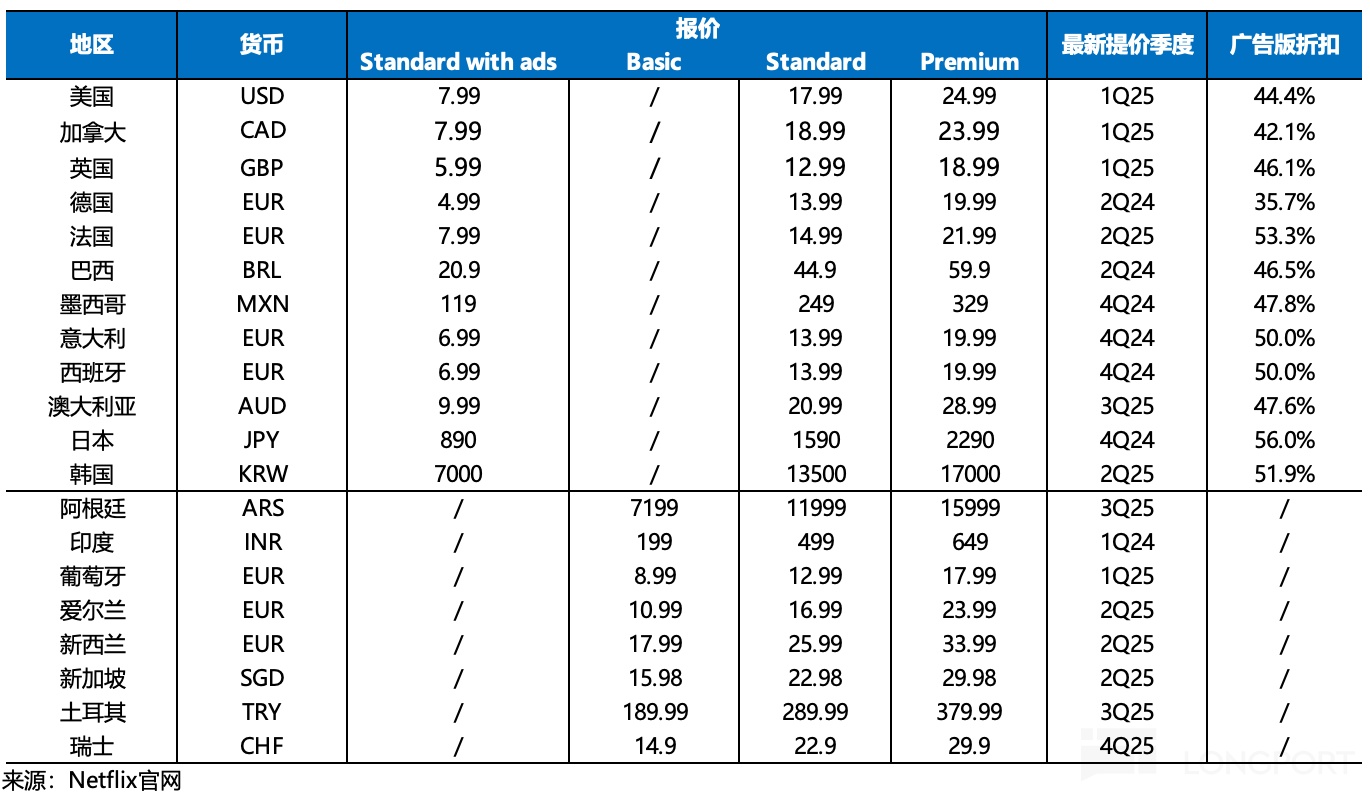

(1) Subscriptions

Based on our simple estimates, prices in core regions of Europe and America have gradually increased since the beginning of the year (mostly by 10%-20%), but after offsetting the impact of ad package penetration (short-term ad tier users' overall ARPPU is lower than the original Base tier), it is estimated that ARPPU in Europe and America only grew by about 6-8%. After being diluted by the Asia-Pacific region, which did not see price increases, and the high-inflation Latin American region, the overall ARPPU is estimated to have increased by only 3-5%. Therefore, the remaining growth is mainly contributed by the number of subscriptions, but on a quarter-on-quarter basis, the estimated net increase in subscribers is only about 4 million, lower than the net increase in each quarter over the past two years.

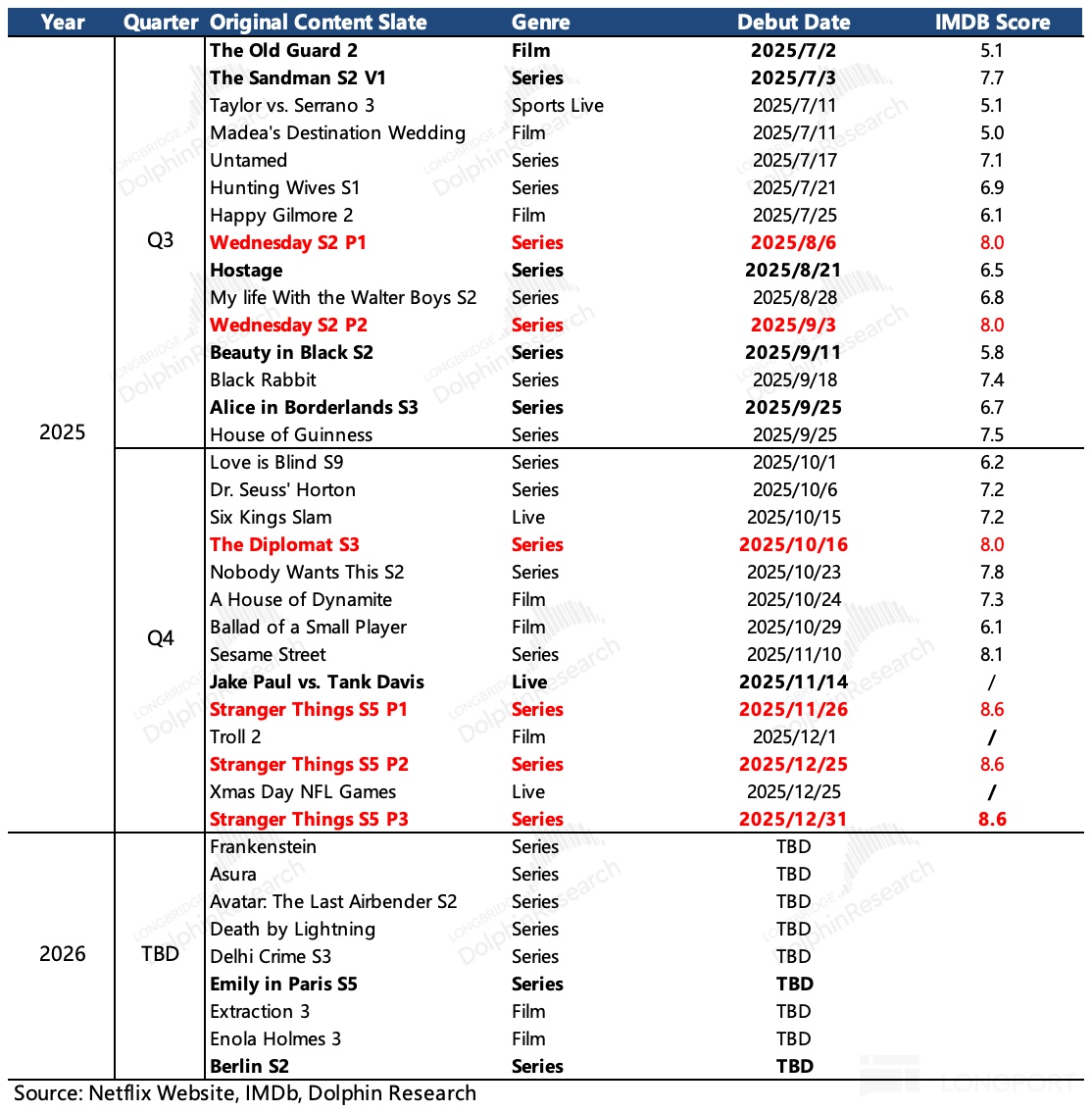

However, the actual Q3 content was not dull, with titles like "KPop" becoming Netflix's most popular movie, "Squid Game" wrapping up its third season, and "Wednesday" season two gaining immense popularity, with viewership entering the historical top 10. This series of high-profile releases led to high market expectations for Netflix's Q3 performance.

Yet the results were quite average, seemingly disconnected. Coupled with Musk's early October initiative to "cancel Netflix subscriptions," Dolphin Research speculates that the price increases in core regions since the beginning of the year may have gradually increased the payment pressure on standard and premium packages for some users, and the permanent cancellation of the low-cost ad-free Base package forced users to switch to ad packages that affect viewing experience. During the short-term adaptation period, the same scale and quality of content supply are difficult to leverage the previous net increase scale. However, Dolphin Research remains confident in the fourth quarter, which is supported by top IP content, and is expected to reverse the flat user growth situation.

(2) Advertising

Q3 marked the first full quarter of operation for the 1P advertising system after its launch in 12 core regions, but this self-developed system may still need optimization through data collection and backtesting. Additionally, the macroeconomic volatility caused by tariffs is unfavorable for Netflix's high-priced ads. However, the company has not changed its advertising revenue target for this year, still aiming for double growth, with Amazon DSP system to be introduced in Q4. Based on market expectations, we estimate this year's advertising revenue to be around $1.5 billion.

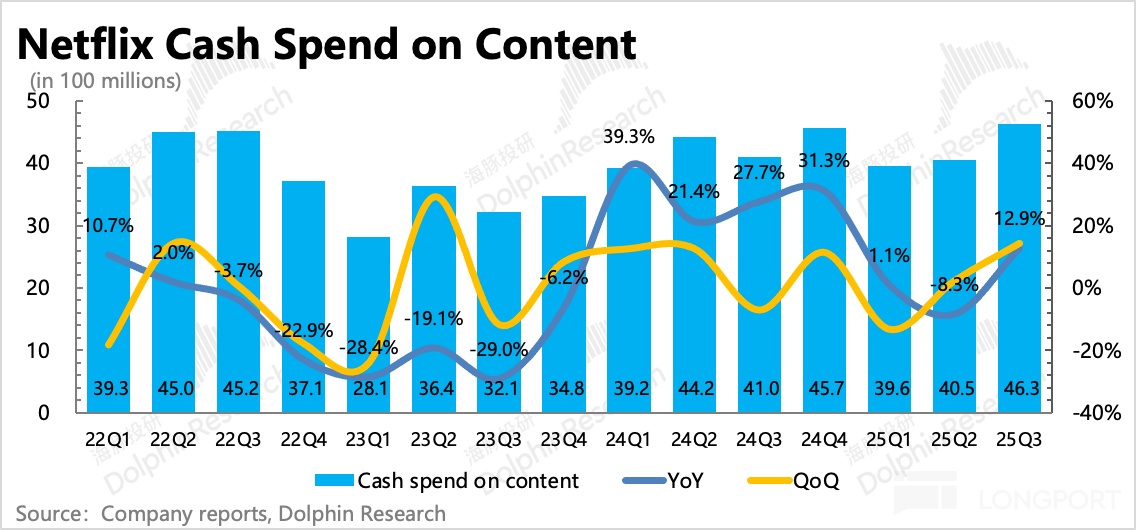

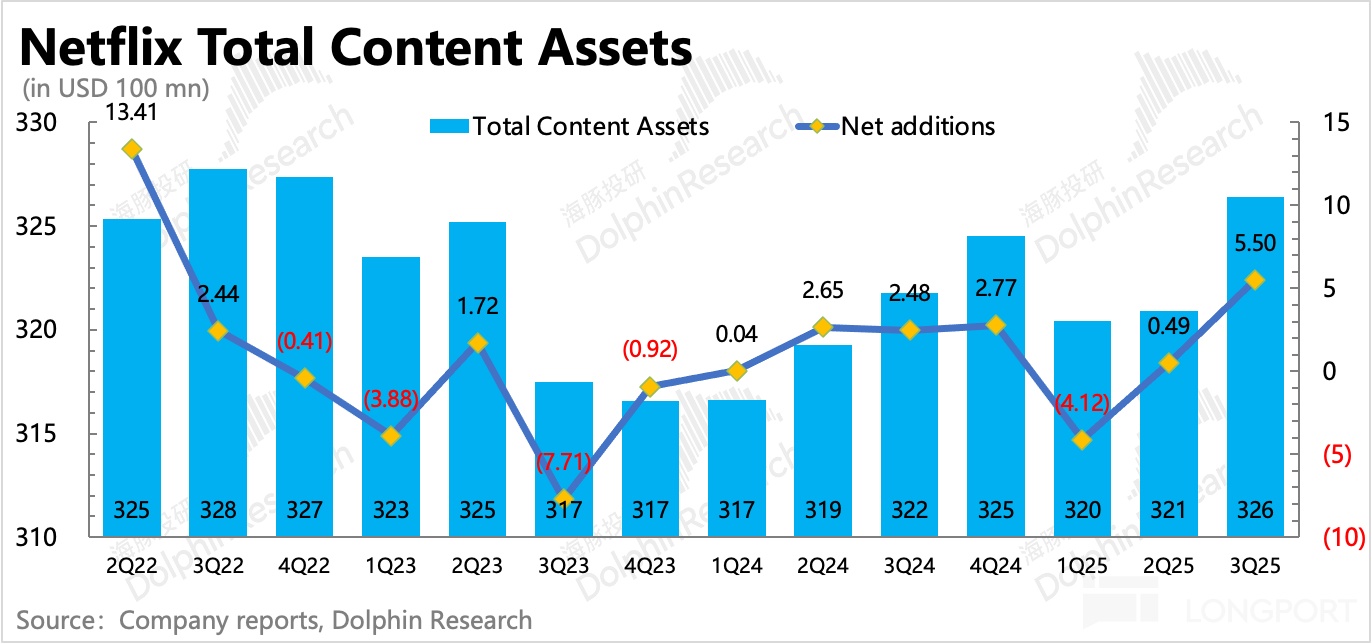

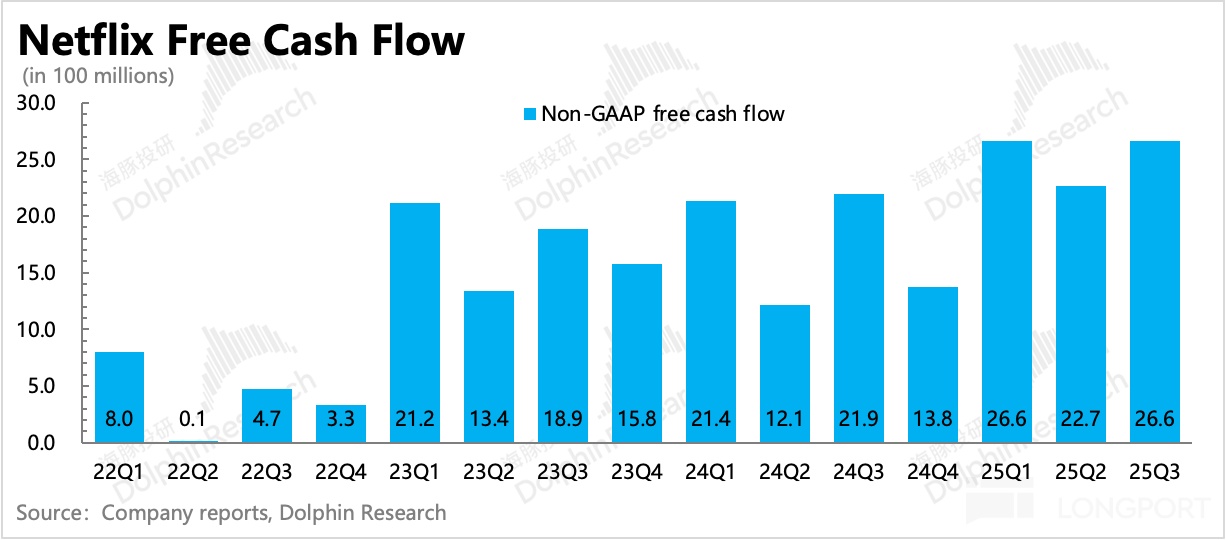

3. Controlling content investment: In terms of cash flow usage, the focus is on content investment and shareholder buybacks. Q3 saw $1.9 billion spent on repurchasing 1.5 million shares, at an average price of around $1,250, with the buyback scale increased compared to the previous quarter. Content investment amounted to $4.6 billion, an increase of $500 million compared to the previous quarter.

However, the scale of content investment is visibly shrinking, with only $12.6 billion invested so far this year, lagging behind the annual target of $18 billion set at the beginning of the year. While the annual profit guidance was lowered due to the Brazilian service tax, the free cash flow target was raised again from $8-8.5 billion to $9 billion for the year.

This can only indicate that this year's investment scale is unlikely to reach the set target, expected to be in the range of $17-17.5 billion. As a leader, Netflix has controlled the expansion of investment scale for two consecutive years, possibly due to the relatively relaxed competitive environment and the optimization effect of generative AI. As for the 100% tariff threat on foreign-produced films, since there is still room for negotiation, it should not be the main reason for Netflix's reduced content investment.

4. Performance indicators at a glance

Dolphin Research Viewpoint

In the last quarter's review, Dolphin Research summarized: Netflix is more suitable to be understood from a perspective of long-term stable growth, using time to exchange for space, to comprehend Netflix's valuation premium or belief. Stepping out of short-term expectation fluctuations, recognizing Netflix's 35x forward valuation norm, while cherishing every opportunity to fall below 30x.

The situation in the third quarter report is equally applicable. Although there are many long-term logic and growth stories to tell (cord-cutting, price increases, advertising, sports, games, IP, etc.), there are not many points to verify short-term performance, so market expectations rise with each event catalyst (progress of long-term logic) but are disappointed in each short-term performance.

In this case, Dolphin Research chooses to judge opportunities around the "valuation anchor." Since the second quarter report, Netflix's stock price has been in a sideways state, anchored at 35x forward P/E fluctuations (with a minimum drop to 32x P/E during the period), performing relatively lagging in the Mag 7. There have been many disturbances (such as 100% overseas film production tariffs, Musk's call to cancel Netflix subscriptions, etc.), but the core reason for the stock price pressure is still the concern about growth after the short-term peak of the content cycle, as mentioned in the second quarter report review.

In other words, the market is worried that Netflix's future growth cannot support the current valuation. A simple calculation: if Netflix's revenue growth rate remains at 10%-15% in the future (ARM+5%, subscription user count +10%), the original trend target of increasing OPM by 3 percentage points annually, due to the continuous expansion of R&D investment brought by the short-term advertising technology deployment, under the pressure of this year's high base, when profit growth slows to 20% or below, the current 35x P/E valuation seems to have some bubbles.

But as mentioned earlier, Netflix's short-term performance does not reflect the changes and development potential of its long-term business. The promotion of the ad package layer, for example, has a bit of a front-loaded loss and input-output mismatch effect—the cost of advertising technology deployment is invested first, but short-term delivery technology needs optimization, and macro impacts on advertising promotion effects, making the per capita output value of ad package users, low subscription fee + ad revenue, combined less than the ad-free basic package subscription fee (the ad-free package has been canceled in ad regions). But if the technology matures, referring to Hulu's experience, the actual output value should be significantly higher than the basic package.

The investment in sports content is also the same. These are unreflected potentials but also need time to gradually realize. This disconnect between long-term ideals and short-term realities makes the short-term valuation appear inflated. In the long run, Dolphin Research believes that the 35x valuation anchor remains solid. However, considering the safety margin and return space, we still suggest that positions below 30x would be more comfortable.

The following is the detailed content

I. High-quality content can't drive users anymore?

Starting this year, the company no longer discloses subscription numbers, so Dolphin Research mainly estimates the approximate growth of subscription users based on subscription revenue and price increase situations.

Q3 subscription revenue grew by 17%, as the US dollar moved in different directions in different regions (depreciating against the euro and pound, appreciating against the Korean won, Australian dollar, and Argentine peso), the overall forex impact was minimal.

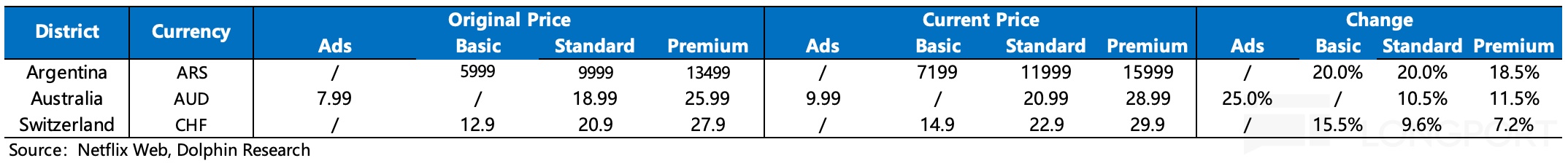

In Q3, Netflix mainly raised prices in Argentina, Australia, and Switzerland. Argentina had already seen a price increase this year, but due to severe inflation and rapid currency depreciation, another increase was necessary. Australia and Switzerland follow the usual 1-2 year price increase cycle in Europe and America. However, the effect of the price increase will need to be reflected in the next quarter, and from the current year-on-year growth rate, the fastest ARPPU growth in Q3 should still be in North America, the UK, and the EU, which were the focus of price increases in the previous two quarters.

Dolphin Research estimates a global subscription user increase of about 4 million, which is relatively weak compared to the past two years. However, the actual Q3 content was not dull, with top IPs like "Squid Game" wrapping up its third season and "Wednesday" season two gaining immense popularity, with viewership entering the historical top 10. In addition, quality series like "Your Majesty," "Happy Gilmore 2," and "Alice in Borderlands S3" received positive feedback. The animated film "KPop Demon Hunters," released at the end of Q2, became Netflix's most popular movie, and in Q3, Netflix actively promoted related IP business extensions.

Therefore, it can only be said that external factors have surpassed the content itself, unless more explosive content supply can offset the impact. However, for Netflix, which has controlled investment scale over the past two years, infinitely raising user thresholds increases its operational difficulty, which is not beneficial from a long-term perspective.

For Q4 2025, Dolphin Research is not pessimistic. Based on revenue guidance, Dolphin Research expects a net user increase of 10 million. This is mainly based on the broadcast of the final season of the top IP "Stranger Things," as well as "The Diplomat" season three, Emmy-nominated work "Nobody Wants This," and major boxing matches (Jake Paul vs. Tank Davis).

II. Continuing to control content investment, relaxed competition, tariff threats, or Gen AI?

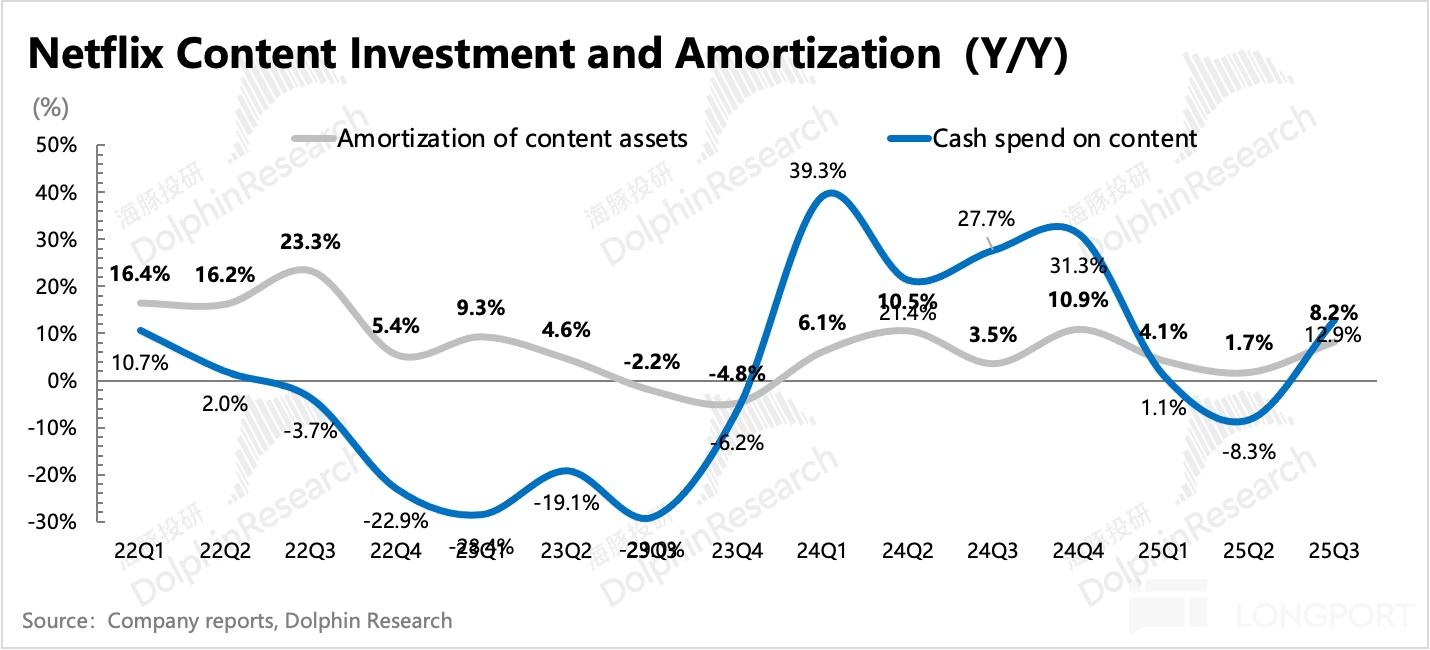

The content investment pace of a leader often reflects the tightness of industry competition, so Dolphin Research generally tracks the content investment trends of Netflix and Disney. Although Netflix's content investment in Q3 resumed growth year-on-year and quarter-on-quarter, the annual cash flow target implies that this year's investment scale will be lower than the $18 billion target set at the beginning of the year.

As a leader, Netflix has controlled the expansion of investment scale for two consecutive years, possibly due to the relatively stable competitive environment in the short term and the optimization effect of generative AI. As for the 100% tariff threat on foreign-produced films, since there is still room for negotiation, it should not be the main reason for Netflix's reduced content investment.

However, there are also news reports today that Netflix is interested in participating in the acquisition of Warner Bros. Discovery (WBD), which marks a change from Netflix's consistent "priority for more cost-effective internal production" business style. Dolphin Research believes it is not necessary to speculate too much for now and will continue to monitor subsequent developments.

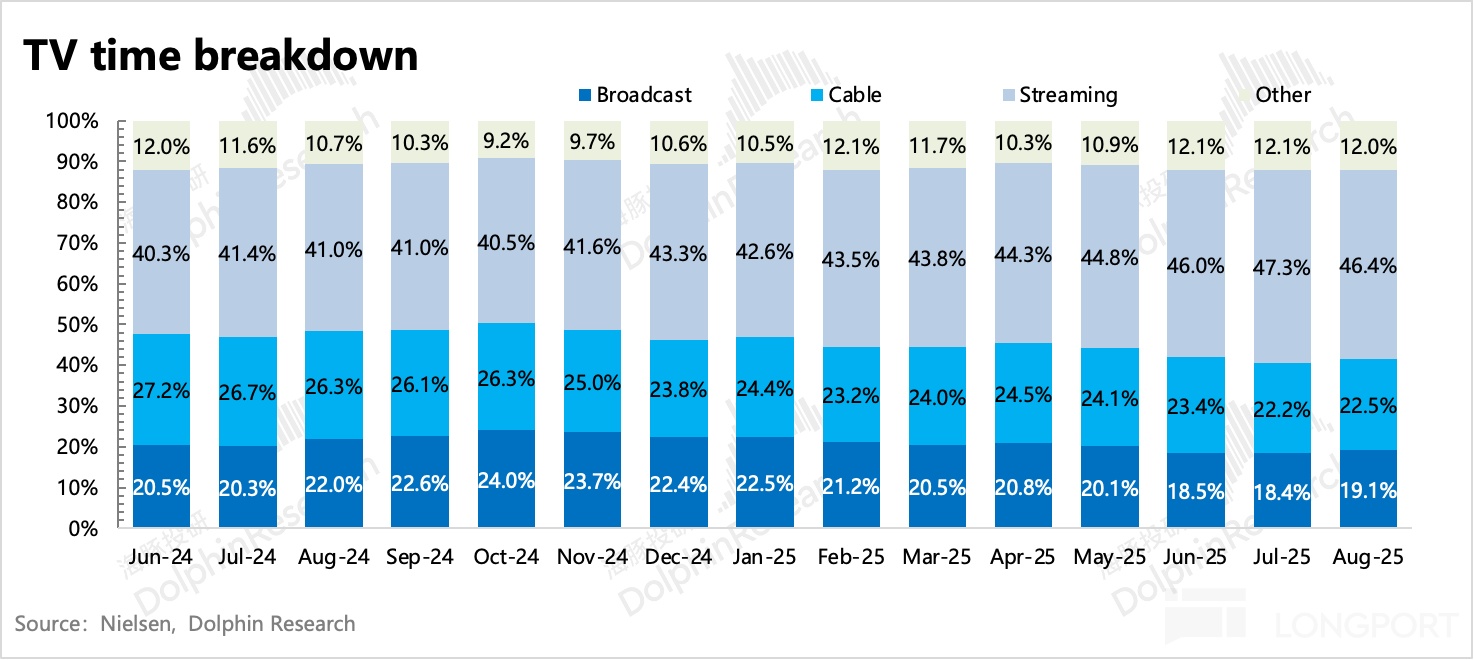

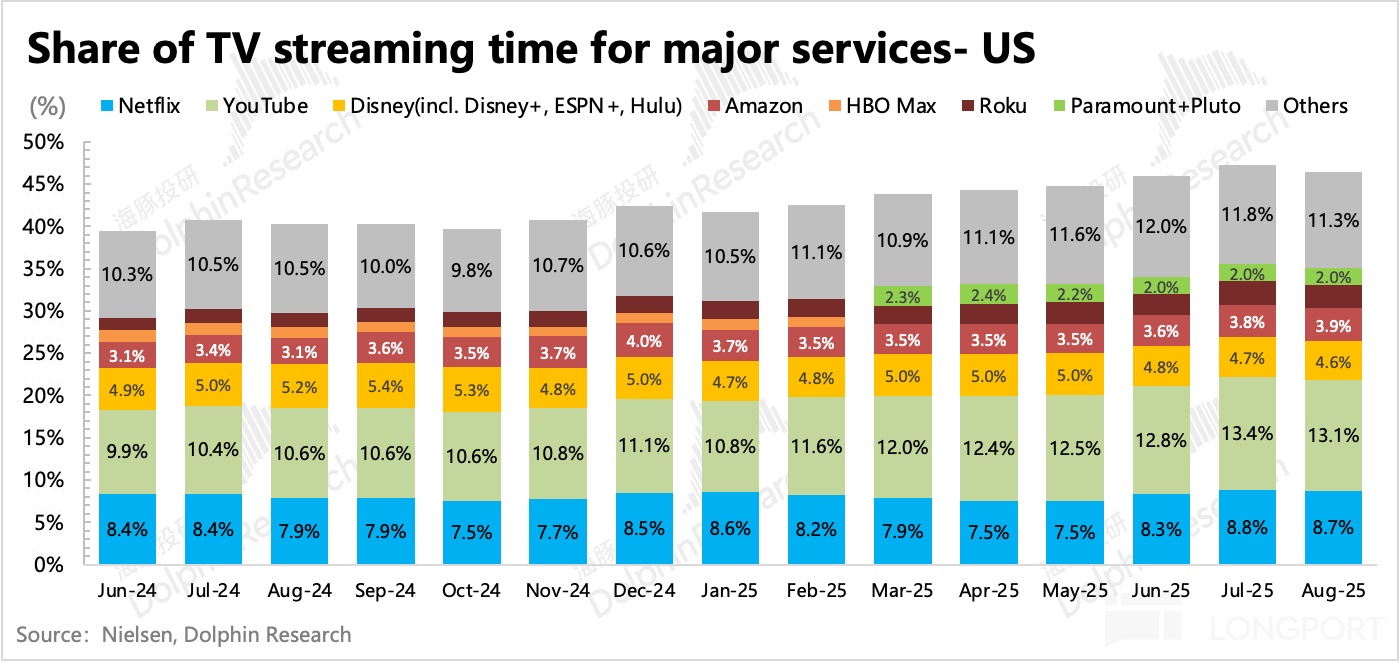

According to Neilsen's viewership share data, as content giants actively transition to streaming media, the cord-cutting trend continues to accelerate. Among streaming media, Netflix's share continued to steadily increase in Q3, but the overall trend still lags behind YouTube.

III. Profit: Actual outperformance behind one-time impact

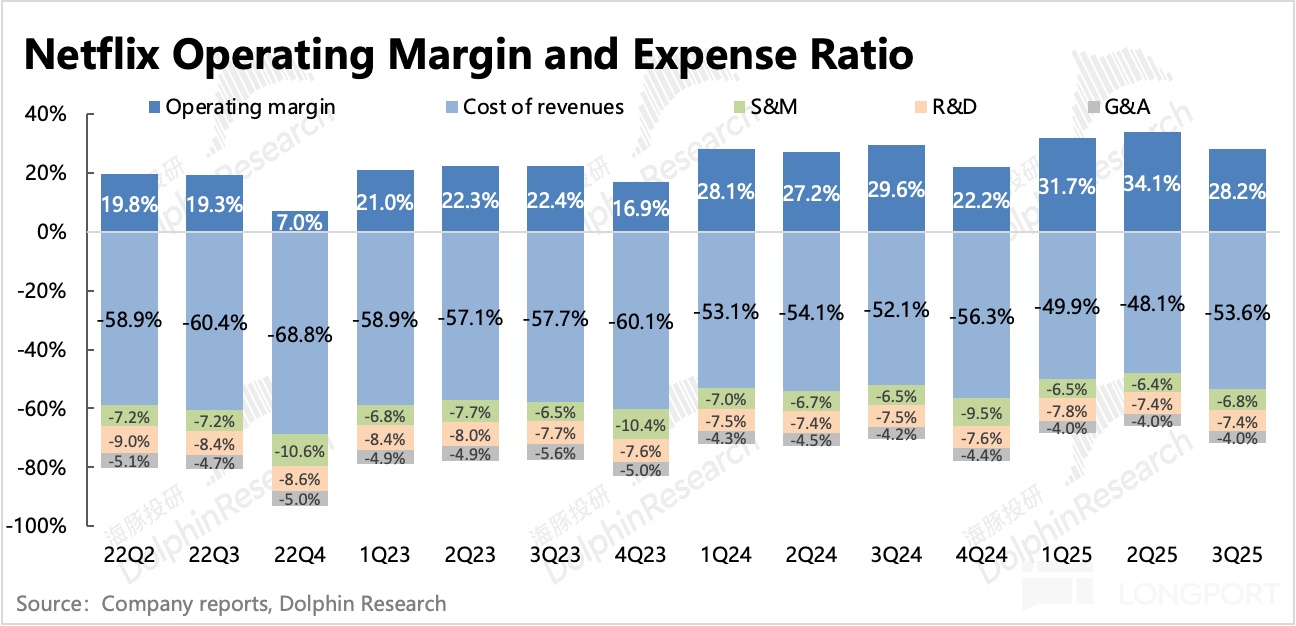

Netflix achieved an operating profit of $3.25 billion in Q3, including an additional cost recognition of $619 million, mainly involving municipal service taxes levied by Brazil on streaming companies. This cumulative expense covering 2022 to date was recorded as a one-time charge under other cost items, impacting the current gross margin by more than 5 percentage points.

Excluding this impact, the actual operating profit was $3.87 billion, with a profit margin of 34% (up 4 percentage points year-on-year), growing 33% year-on-year, exceeding market expectations. The original core business content production costs and operating expenses grew faster compared to the first half of the year, partly due to seasonality, as content supply is often higher in the second half of the year, leading to increased costs and sales promotion expenses quarter-on-quarter.

On the other hand, the current investments in new businesses such as advertising and gaming by Netflix also contribute to the overall expenditure growth. However, from the perspective of expenditure as a proportion of revenue, it remains relatively stable. Due to the impact of Brazilian taxes, this year's annual profit margin has been revised down from 29.5% to 29%.

Q3 free cash flow was nearly $2.66 billion, slightly exceeding market expectations. Despite the downward revision of annual earnings, the company raised its cash flow target from $8-8.5 billion to $9 billion again. We mentioned last quarter that the $8-8.5 billion guidance was conservative, likely leaving some room for adjustment. Besides being conservative, the cash flow increase may also be due to controlled content investment, as discussed earlier.

In Q3, the company spent $1.9 billion repurchasing 1.5 million shares, at an average price of around $1,250. The buyback amount increased compared to the previous quarter, but compared to the $540 billion market cap, the buyback yield is below 2%, mainly serving as a statement.

The current buyback scale has very limited impact on stock price support, unless a sudden addition of hundreds of billions in buyback plans occurs, otherwise, the impact of seasonal fluctuations is minimal. After all, Netflix itself does not have much cash reserves, with only $9.3 billion in short-term cash equivalents, mainly pre-received subscription revenue, so cash flow does not pose a shortage risk.

<End here>

Dolphin Research "Netflix" Historical Articles

Earnings Season (Past Year)

July 18, 2025, Conference Call "Netflix (Minutes): Very confident in the content pipeline for the second half of the year and 2026"

July 18, 2025, Earnings Review "Netflix: Can the recognized good student still create surprises?"

April 18, 2025, Conference Call "Netflix (Minutes): Entertainment content usually has resilience during economic pressure periods"

April 18, 2025, Earnings Review "Netflix: Does the tariff understand the current "golden safe haven"?"

January 22, 2025, Conference Call "Netflix: Efficient investment, the entertainment prospect is still broad (4Q24 Conference Call Minutes)"

January 22, 2025, Earnings Review "The dream that iQIYI can't catch? Netflix plays to "fly high""

October 18, 2024, Conference Call "Continue efficient investment, Netflix's eyes are not only on streaming media (3Q24 Conference Call Minutes)"

October 18, 2024, Earnings Review "How high can the exhilarating Netflix "fly"?"

July 19, 2024, Conference Call "Netflix: Advertising will become the main growth driver in 2026 (2Q24 Conference Call)"

July 19, 2024, Earnings Review "The answer sheet is not bad, but expectations are higher, will Netflix be a preview of the Seven Sisters?"

April 19, 2024, Conference Call "Netflix: Focus on user interaction metrics rather than single user numbers (1Q24 Conference Call Minutes)"

April 19, 2024, Earnings Review "Netflix: Fierce now, but about to "virtual"?"

January 24, 2024, Conference Call "Netflix: Expand content investment, use good content to drive price increases (Netflix 4Q23 Conference Call Minutes)"

January 24, 2024, Earnings Review "Netflix: The content king has a thick foundation, real gold is not afraid of fire"

October 19, 2023, Conference Call "Netflix: Hope to return to the original investment level to drive growth (3Q23 Performance Meeting Minutes)"

October 19, 2023, Earnings Review "Growth questioned? Netflix responds with price increases"

July 20, 2023, Conference Call "The effect of cracking down on account sharing will further manifest (Netflix 3Q23 Performance Conference Call Minutes)"

July 20, 2023, Earnings Review "Netflix: Squeezed user growth, the market is not buying it?"

April 19, 2023, Conference Call "Focused on discussing the prospects of advertising and account paid sharing (Netflix 1Q23 Conference Call Minutes)"

April 19, 2023, Earnings Review "Freeloaders are hard to beat, the ripe Netflix "can't fly""

January 20, 2023, Conference Call "High-level changes do not hinder content strategy, advertising revenue target is over 10% (Netflix 4Q22 Conference Call Minutes)"

January 20, 2023, Earnings Review "Blockbuster series save ads, Netflix perfectly interprets "content is king""

October 19, 2022, Conference Call "Netflix: In addition to advertising, next year will focus on cracking down on account sharing (3Q22 Conference Call Minutes)"

October 19, 2022, Earnings Review "Netflix: Another counter-trend surge, good content is the real "cure""

In-depth

February 16, 2022, In-depth "The "King of Competition" in the consumer internet, Meta, Google, and Netflix are fighting with knives"

November 23, 2021, In-depth "The long video battle is coming to "American version," Netflix and Disney are in trouble?"

Risk Disclosure and Statement of this Article:Dolphin Research Disclaimer and General Disclosure

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.