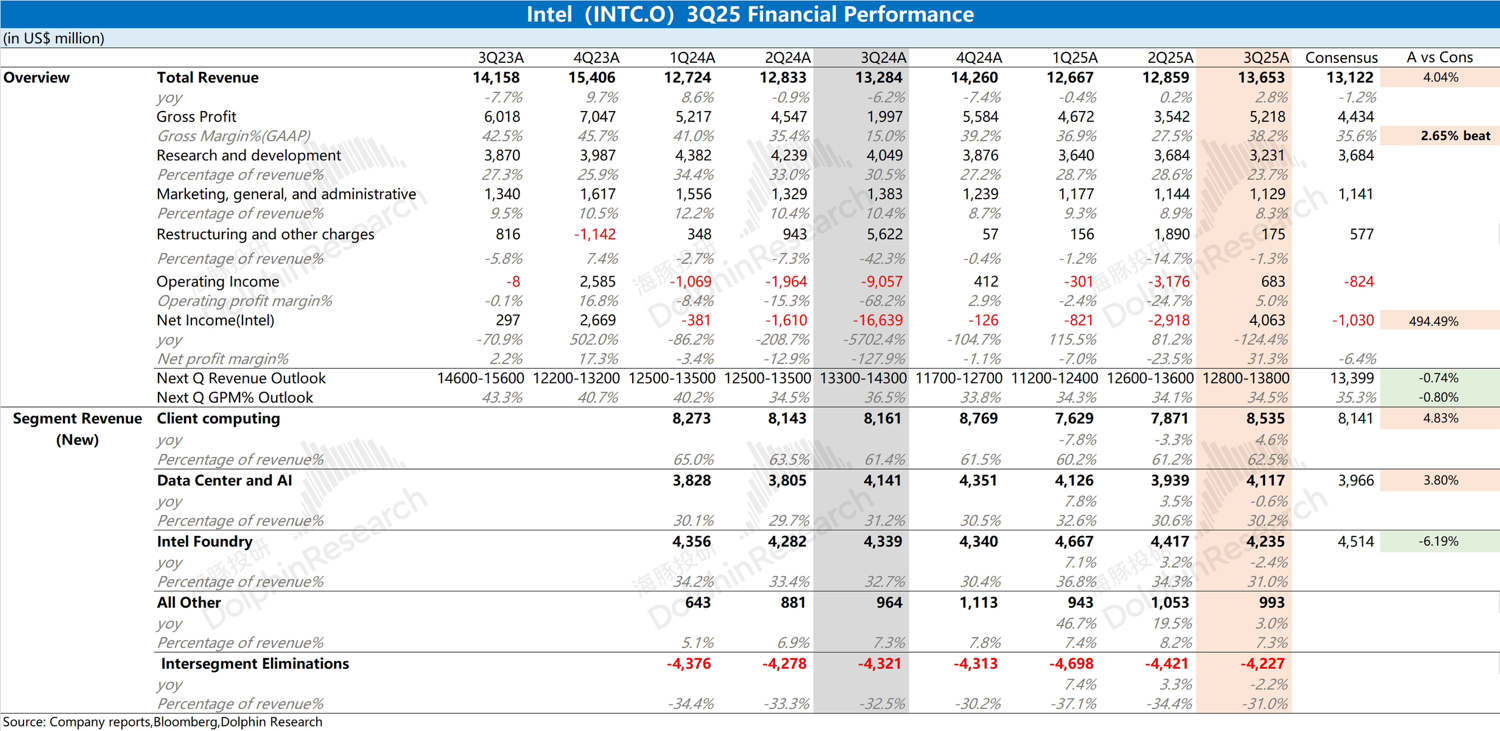

Intel Quick Interpretation: The company's quarterly financial report is positive, with both revenue and gross margin exceeding guidance expectations. Notably, the company's gross margin has significantly rebounded this quarter, surpassing market expectations, primarily due to the recovery in the PC market and downstream demand.

The company's current cost-cutting and layoffs are ongoing, with the workforce further reduced to 88,400 employees this quarter, moving closer to the year-end target of 75,000 employees.

As layoffs continue, the company's R&D and sales expenses have both declined this quarter, with the R&D expense ratio dropping to 23.7%.

On the specific business front, the company's data center and AI business remained relatively flat this quarter, with growth mainly driven by the client business. Influenced by the overall recovery of the PC industry, the company's client business grew by 4.6% this quarter.

The market is relatively more focused on the progress of the company's foundry business, which this quarter still mainly comes from Intel 7 and Intel 10, primarily for Intel's own products.

The 18A process has now entered mass production, initially used for the company's own Panther Lake products. If it demonstrates good performance and yield, it will bring more orders and growth opportunities for the company.

Overall, the biggest highlight for the company this quarter is the gross margin, which is far better than market expectations.

Additionally, this quarter is particularly important for the company, as with the support of the U.S. government, SoftBank, and Nvidia, the company has secured funding while avoiding a 'bankruptcy-style' valuation scenario.

If the company achieves breakthroughs in AI PCs, data centers, or foundry business in the future, it will inject confidence into the market once again. For more information, please follow Dolphin Research's subsequent detailed commentary and management communication content. $Intel(INTC.US)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.