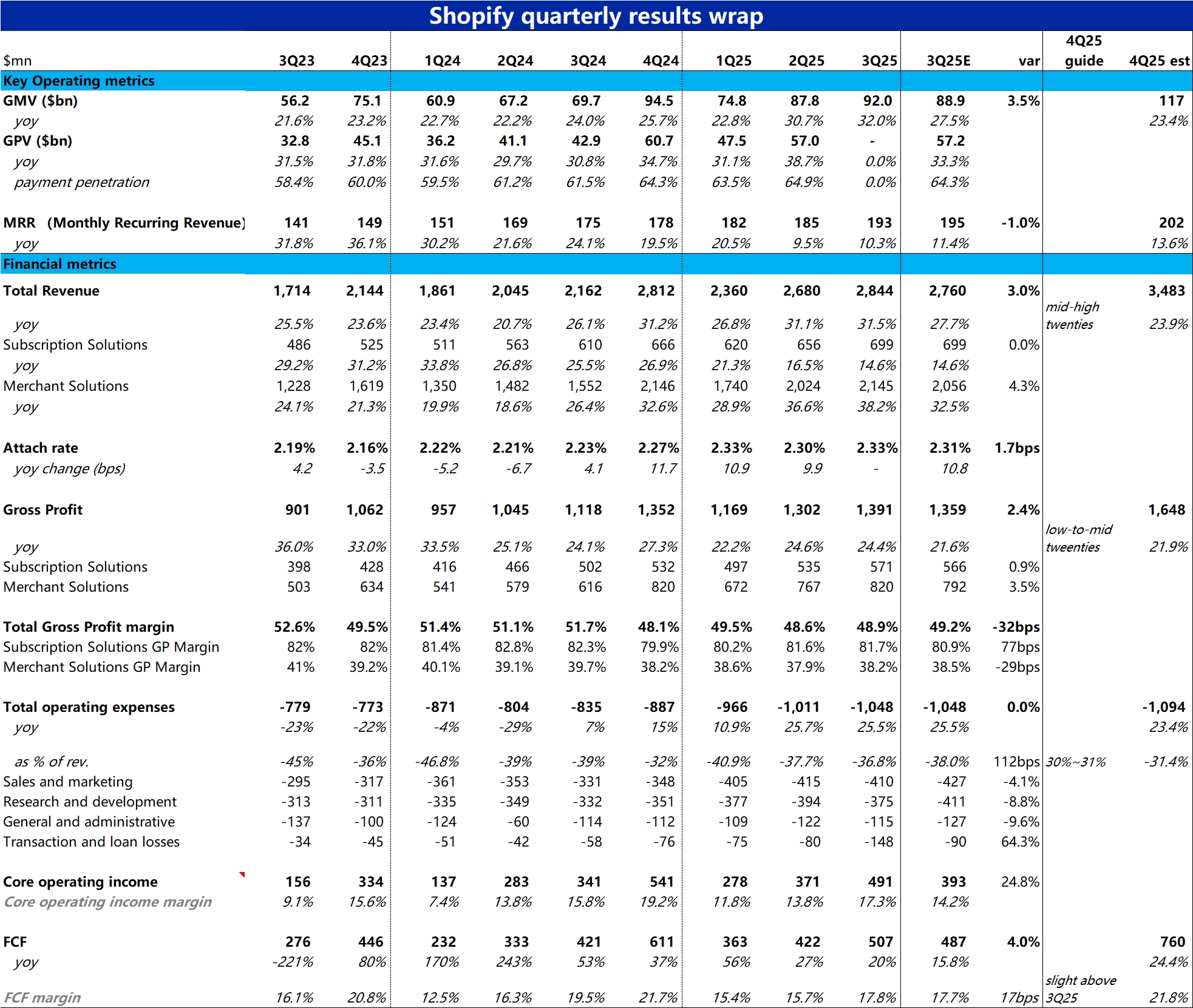

Shopify 3Q25 Quick Interpretation: As one of the e-commerce players currently expected to benefit significantly in the AI era, Shopify's financial report this quarter remains impressive, with various metrics generally exceeding expectations. Among them, the most important growth indicator, GMV growth rate continues to accelerate quarter-on-quarter.

The biggest drawback is the guidance for next quarter's FCF margin as "slightly higher than this quarter" (17.8%), which implies a significant contraction compared to 21.7% in the same period last year, suggesting that next quarter's FCF year-on-year growth may slow down significantly to only about 10%. Specifically:

1) Core growth indicator—GMV grew by 32% year-on-year this quarter, accelerating by another 1.3 percentage points quarter-on-quarter on a not-low base from the previous quarter, significantly outperforming market expectations. Driven by this, merchant services revenue increased by 38% year-on-year this quarter, also continuing to accelerate quarter-on-quarter and exceeding expectations. Besides the acceleration of GMV, the change in PayPal-related income to a gross basis also contributed.

2) As some sell-side expectations suggested, possibly due to the continued extension of free subscriptions, the core metric MRR of the subscription business was 193 million this quarter, with a year-on-year growth rate of only 10%, slightly underperforming expectations, resulting in subscription business revenue performance merely meeting expectations.

3) Compared to the impressive growth, the profit was less remarkable. Although the aforementioned change in PayPal business basis benefited revenue growth, it had no effect on gross profit growth (and was negative for gross margin). Meanwhile, free trials were also negative for the gross margin of the subscription business. Therefore, the gross margin narrowed by 2.8 percentage points year-on-year, with gross profit growth at 24.4% (lower than revenue growth).

At the same time, due to re-entering the expansion phase, total expense growth reached 25.5%, higher than gross profit growth, resulting in a contraction of the FCF profit margin. This quarter's FCF year-on-year growth was "only" 20%, significantly slowing compared to previous quarters, and guidance suggests it will slow down significantly again next quarter.

Therefore, overall, the growth performance is impressive, but the profit growth momentum continues to decline. In the context of high valuation & high expectations, the market's somewhat negative reaction to this "limping" performance does not surprise Dolphin Research.$Shopify (SHOP.US)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.