3% US 2026 GDP—New Policy Floor of AI Era?

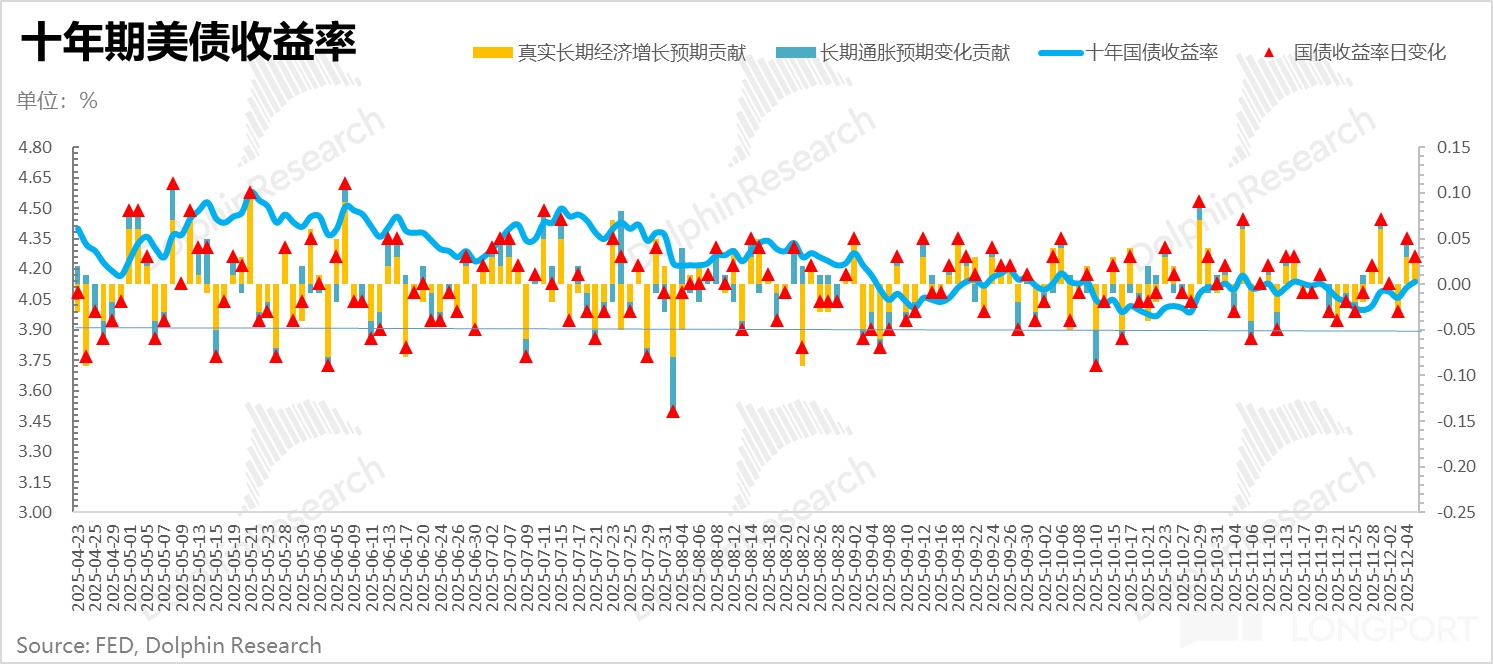

After a volatile year, 2025 is drawing to a close. From a macro trading angle, the top question is who will lead the Fed in 2026, alongside a slate of incoming data. Together, these will shape the rate-cut path for 2026.

At the same time, 2026 could see a wave of long-dated corporate issuance to fund AI capex, the IRA rolling through, and a more dovish Fed. How will the long end respond, and can long yields be contained?

Next, Dolphin Research will work through the issues one by one. Here is our take.

一、当下经济,支持降息吗?

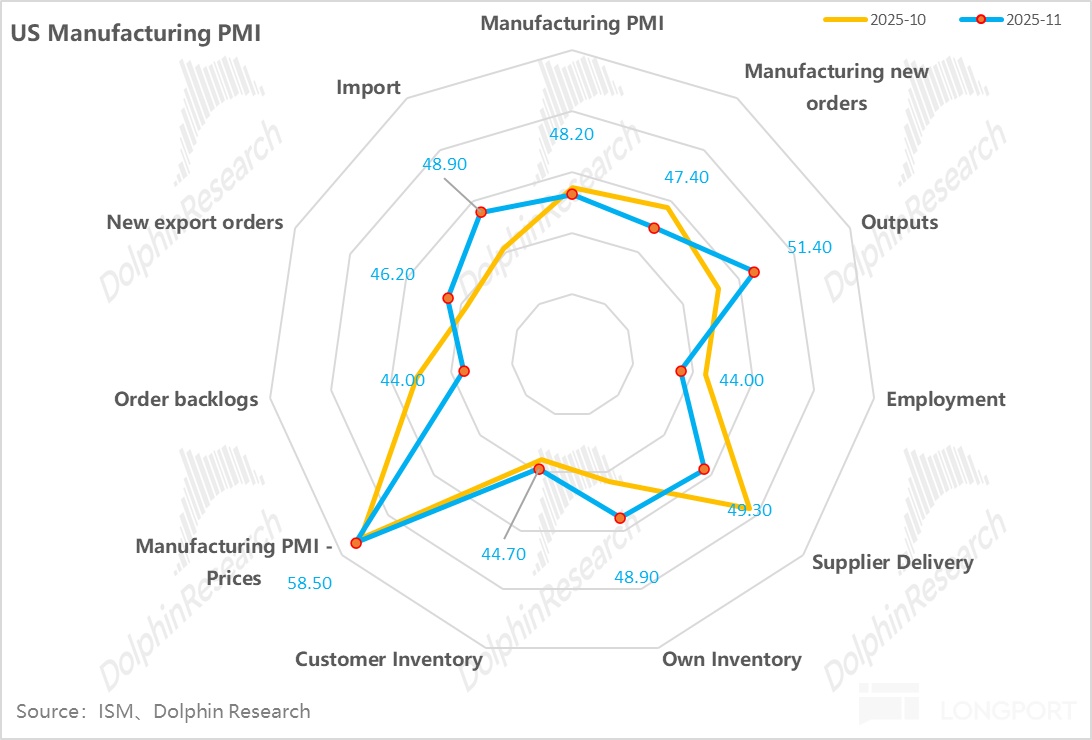

Recent data show that after the Gov. shutdown, US manufacturing PMI softened. The most important sub-index, new orders, stayed below the 50 threshold in Nov., and continued to deteriorate.

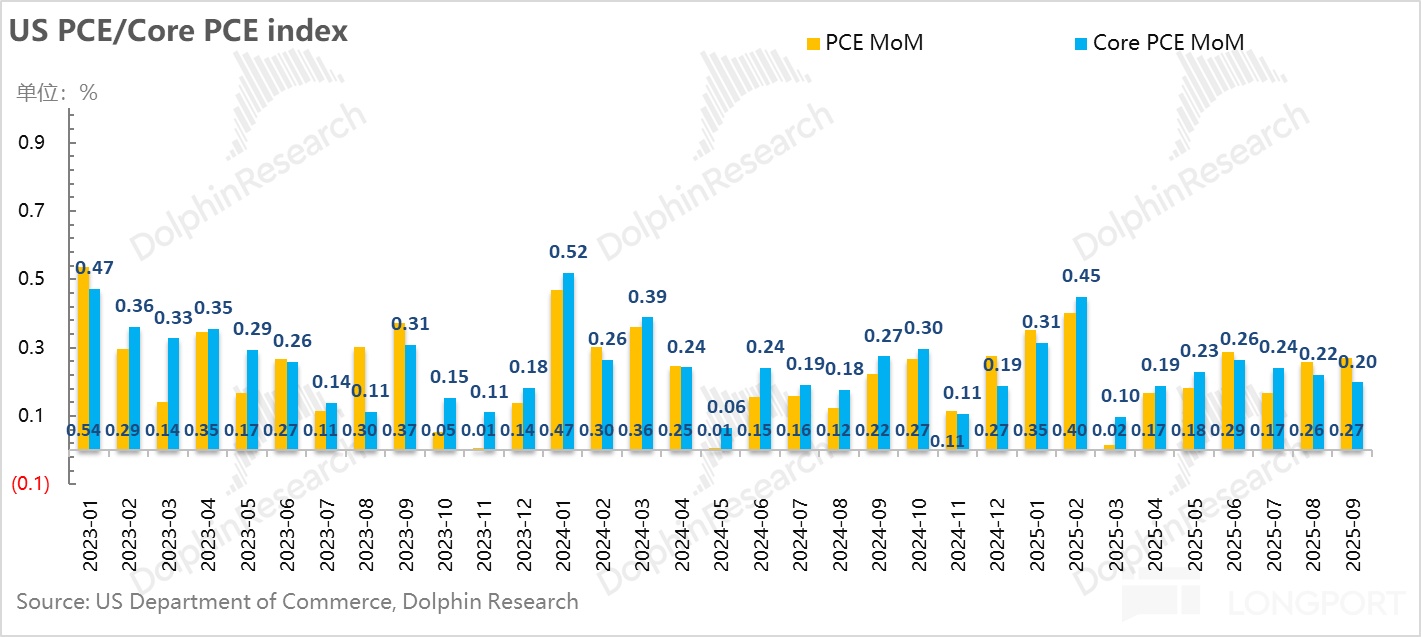

While Sept. PCE is somewhat dated, core PCE inflation has eased sequentially. The 0.2% MoM print in Sept. annualizes to ~2.4% YoY, which, vs. a 3.75–4% policy rate, is a key macro input supporting further cuts.

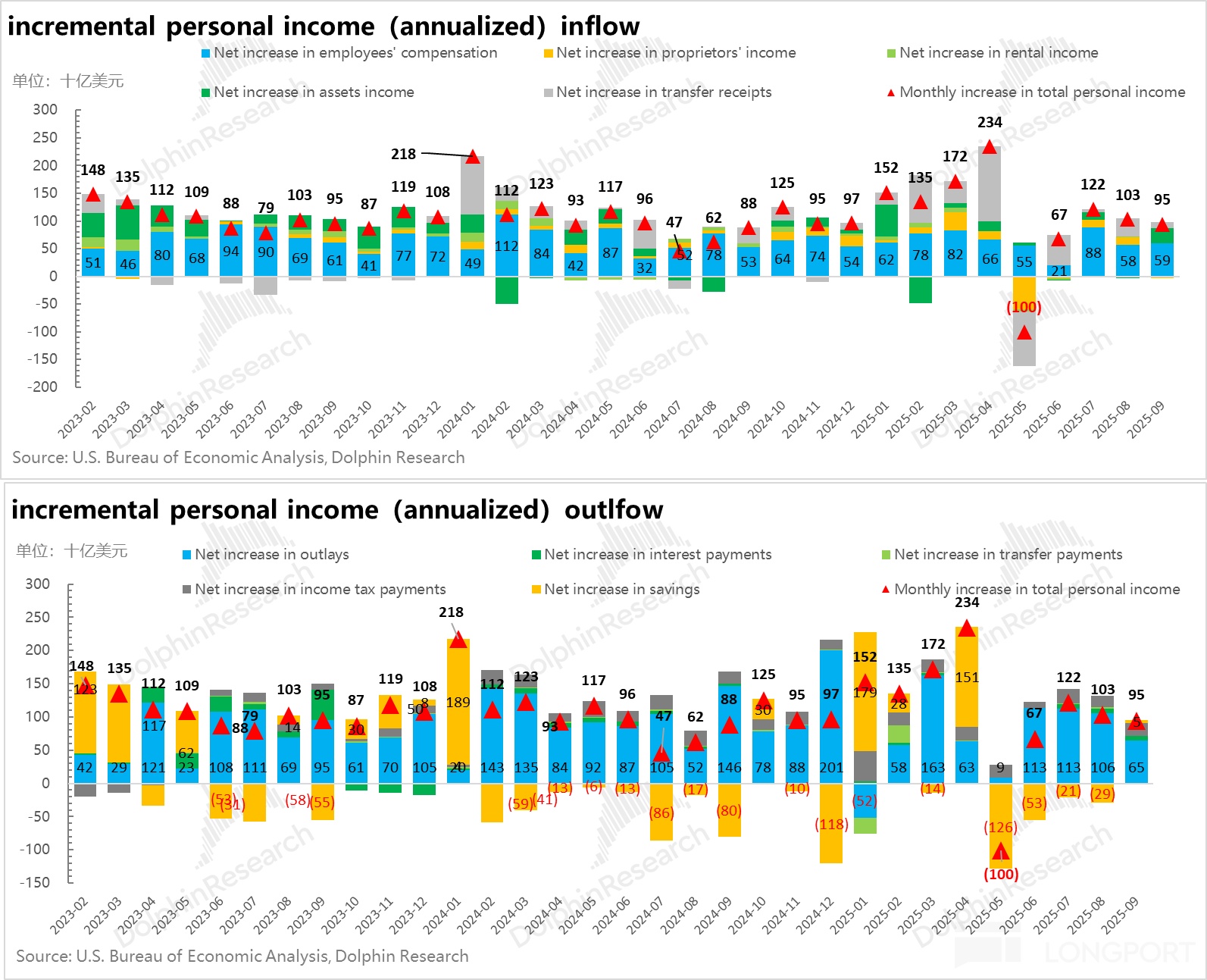

On household flows, US consumers in Sept. essentially lived within their means. Consumption no longer encroached on would-be savings, with nominal spending growth slowing from 0.5% MoM to 0.3%.

Although other income components were volatile, wage income was steady and asset income (interest + dividends) remained elevated. Together they kept overall household income growth broadly stable in Sept.

Overall, the data point to a steady-but-slowing economy. With tariff noise, Sept. core PCE still returned to a 0.2% MoM pace, consumption was steady with a soft bias, and the Nov. PMI slipped modestly into contraction.

Setting aside how Powell frames it, the logic from shadow Fed chair Hassett (see below) is that realized inflation has cooled, inflation risk is contained, and the macro remains soft even with AI investment. With rates overly restrictive, the Fed should let AI’s growth impulse play through; if growth runs below that potential, cuts are warranted.

二、影子联储来了,周五的降息到底要怎么看?

After a period of messy signaling, markets now price a ~95% probability of a cut this week. The Fed aims to avoid surprises, so a 25bps cut looks locked in.

With 25bps a consensus, Powell’s post-decision guidance will be the marginal signal. Given intensifying internal debate over cuts, he may deliver a ‘hawkish cut’, warning that the path is uncertain and that the Fed should not pre-commit to further easing.

Dolphin Research’s view: if markets pull back on a ‘hawkish’ tone, it should not be feared. A shadow Fed is already forming, so while Powell’s guidance matters, in a leadership transition markets will also watch the chair-in-waiting.

Judging by Hassett’s latest remarks, he has set a very high bar for the 2026 macro start. If the bar is missed, the takeaway will likely be that rates are too high and are muting AI’s productivity lift.

In other words, Powell’s authority to steer expectations could fade. Markets will begin to discount his signals.

三、哈塞特 vs 鲍威尔:财政主导的美联储时代要来了?

As we noted in our prior strategy weekly, heading into the 2026 midterms, Republicans need to reclaim the ‘Make America Affordable Again’ narrative. Otherwise, they risk broad losses to Democrats.

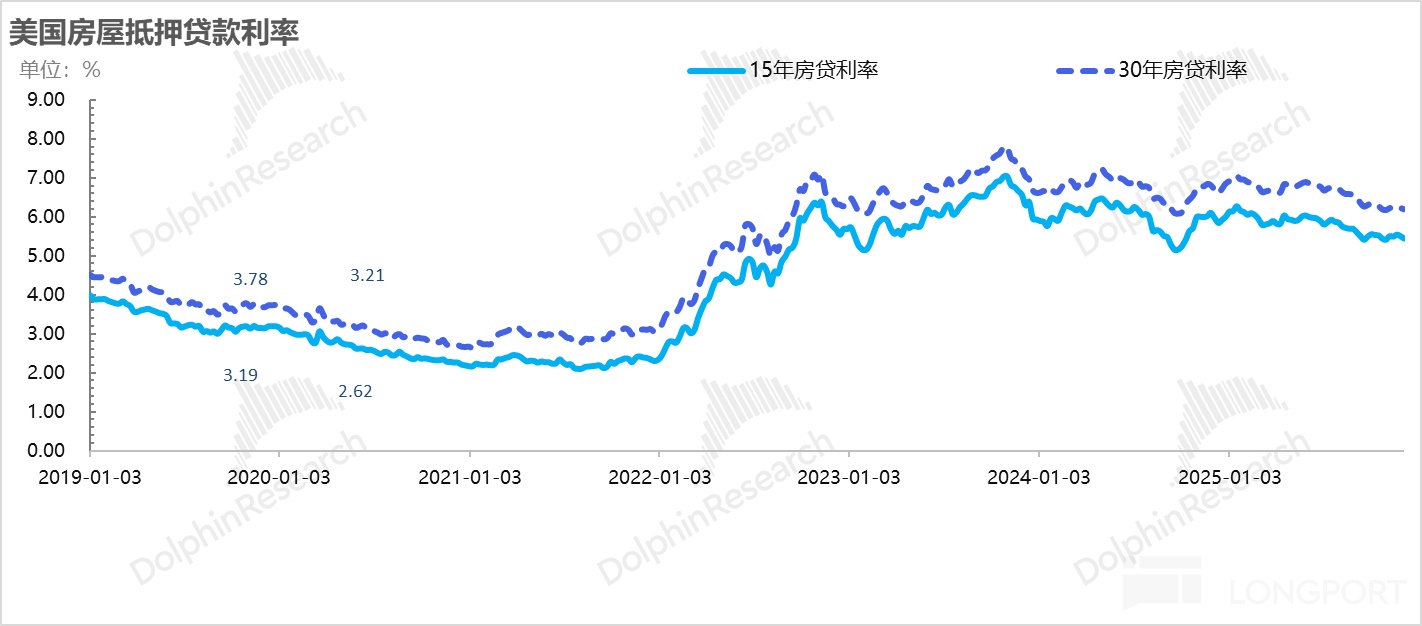

A core piece of that narrative is rent affordability, which is tightly linked to mortgage rates. Therefore, Trump will push the new Fed chair to advance rate cuts.

Hassett is now the frontrunner for Fed chair. He served as CEA director, a top White House economic adviser, and a key voice for Trump’s economic agenda.

In a recent interview, he made several important forward-looking calls for 2026. Dolphin Research highlights the key points.

a: With AI, US productivity could jump to 3–4% next year. That would mark a step-change vs. recent trends.

b: Productivity at 3–4% should map to roughly 3–4% real GDP growth. He would even be ‘disappointed’ with 3%.

c: He cited the 1990s under Greenspan, when computing boosted productivity and some FOMC members wanted hikes because unemployment was too low. Greenspan resisted, arguing higher productivity would naturally cap inflation, paving the way for several years of expansion.

He believes AI will lift efficiency faster and more visibly than PCs did then. The Fed should not suppress this kind of supply-side shock.

Taken together, he sketched a very optimistic floor for US growth from next year: above 3%. If growth undershoots 3%, he can argue policy failed to unlock AI-driven productivity.

Consensus for 2026 is around 2% growth, so his view is far above the street. He also flagged several Q1 upside drivers — factory buildouts, AI capex deployment, the IRA kicking in, and household tax cuts — suggesting a strong start to 2026.

With that narrative reset, if early 2026 growth does not come in near 4%, it will pave the way for cuts under his Fed. The groundwork for easing would then be in place.

That said, the 2026 rate path will not be a one-man call. The Fed’s rate decisions are, by design, collective.

a. 7 Board members. Nominated by the President and confirmed by the Senate.

b. The New York Fed president, with a permanent vote. This role anchors policy implementation.

c. 4 of the other 11 regional Fed presidents voting on rotation. The rotation resets annually.

How long this setup persists is uncertain. Scott Bessent is already calling for institutional reforms, including requiring regional Fed presidents to have at least three years of local residency.

How much of the collective model survives any reform remains to be seen. We will monitor developments.

四、如果 26 年财政货币大放水 + 海量公司债,长债利率还能刹得住吗?

Dolphin Research notes that recent USD liquidity has been tight, with frequent usage of the Fed’s SRF. Markets now expect the Fed may ‘expand the balance sheet’ at the margin.

One approach would be to buy T-bills to add reserves and keep bank reserves amply supplied. This liquidity support is not genuine QE.

If the Fed can manage the front end, it can also manage the long end. Under new leadership, it could target both ends of the curve, anchoring long yields via purchases of benchmark long bonds to serve the AI infrastructure era.

After all, even top-tier issuers like Meta placed 24-year paper at 6.58%. Funding an AI buildout at such high coupons implies very demanding project IRRs.

In short, Trump will likely focus on cost-of-living items in 2026, using administrative levers to push prices down. Think drug procurement akin to China’s centralized tenders, moving quickly to end the Russia war to lower oil prices, accelerating domestic traditional energy including nuclear, and pressing for lower rates to curb housing costs — creating administratively ‘controlled’ prices.

In parallel, he can manufacture a boom via AI infrastructure, the IRA and tax cuts, balancing a medium-term AI agenda against short-term price goals and securing the 2026 midterms. US macro risks in 2026 look contained.

五、组合收益

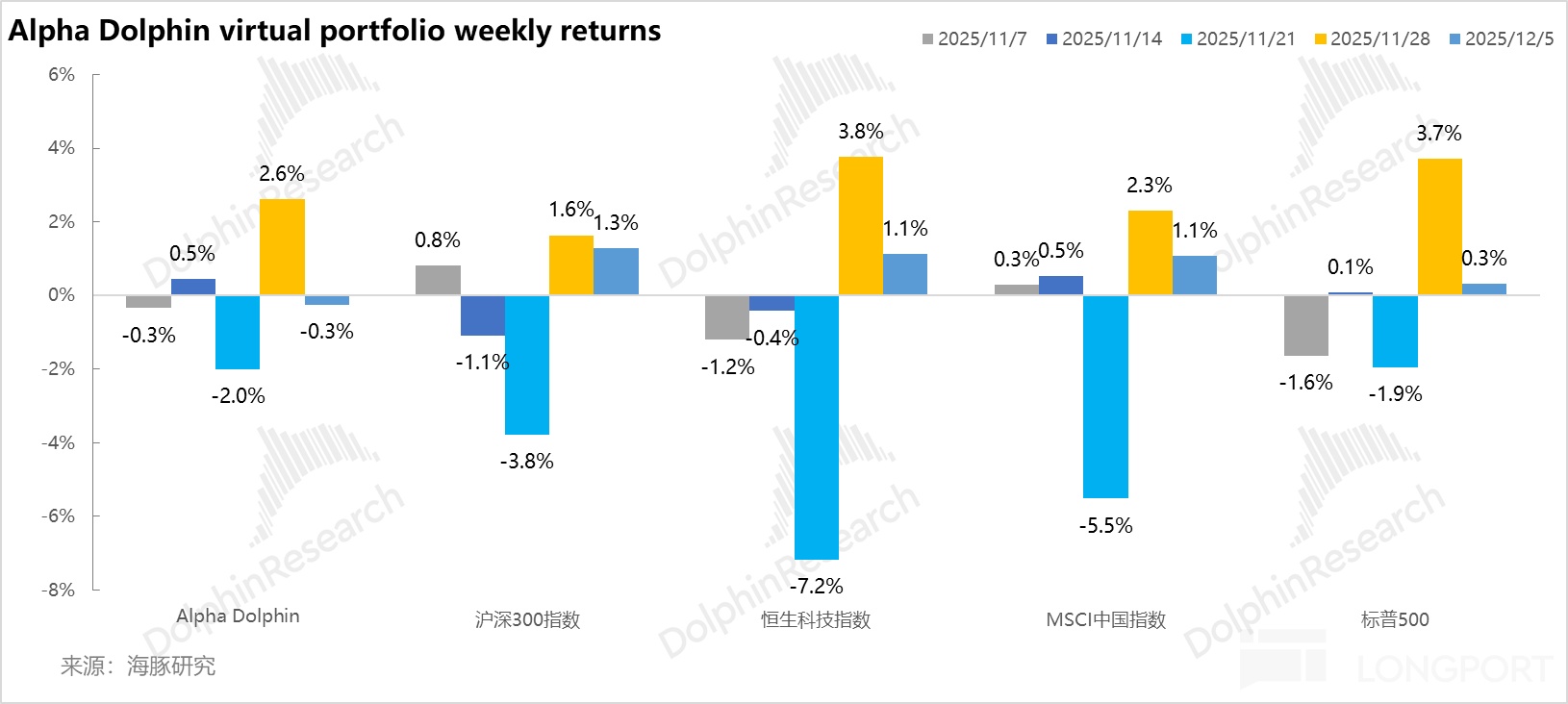

Last week, Dolphin Research’s virtual portfolio Alpha Dolphin made no changes. It fell 0.3%, underperforming CSI 300 (+1.3%), MSCI China (+1.1%), Hang Seng Tech (+1.1%), and the S&P 500 (+0.3%).

The drag mainly came from gold and US Treasuries. Within equities, weakness in consumer names also weighed.

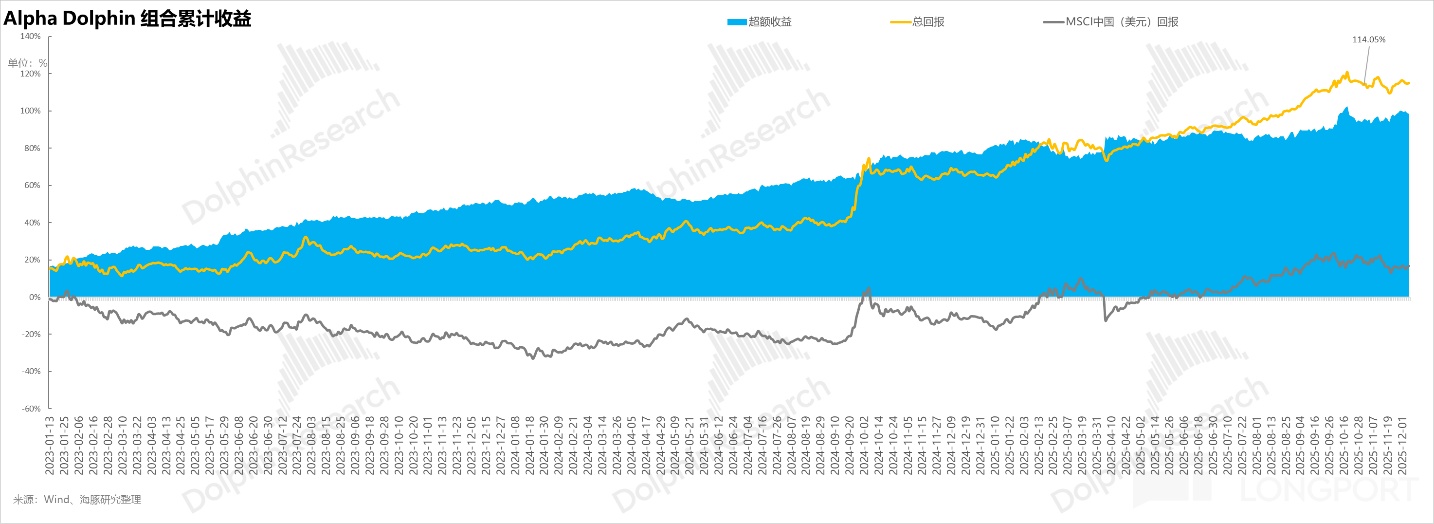

Since inception (Mar 25, 2022) through last Fri., absolute return stands at 115%, with 98% excess vs. MSCI China. From a NAV perspective, the initial $100mn has grown to over $217mn.

六、个股盈亏贡献

The portfolio lagged the indices last week as impending cuts sent niche, high-quality growth names rallying, where our exposure is light. Hence the underperformance vs. benchmarks; the main movers are summarized below.

七、资产组合分布

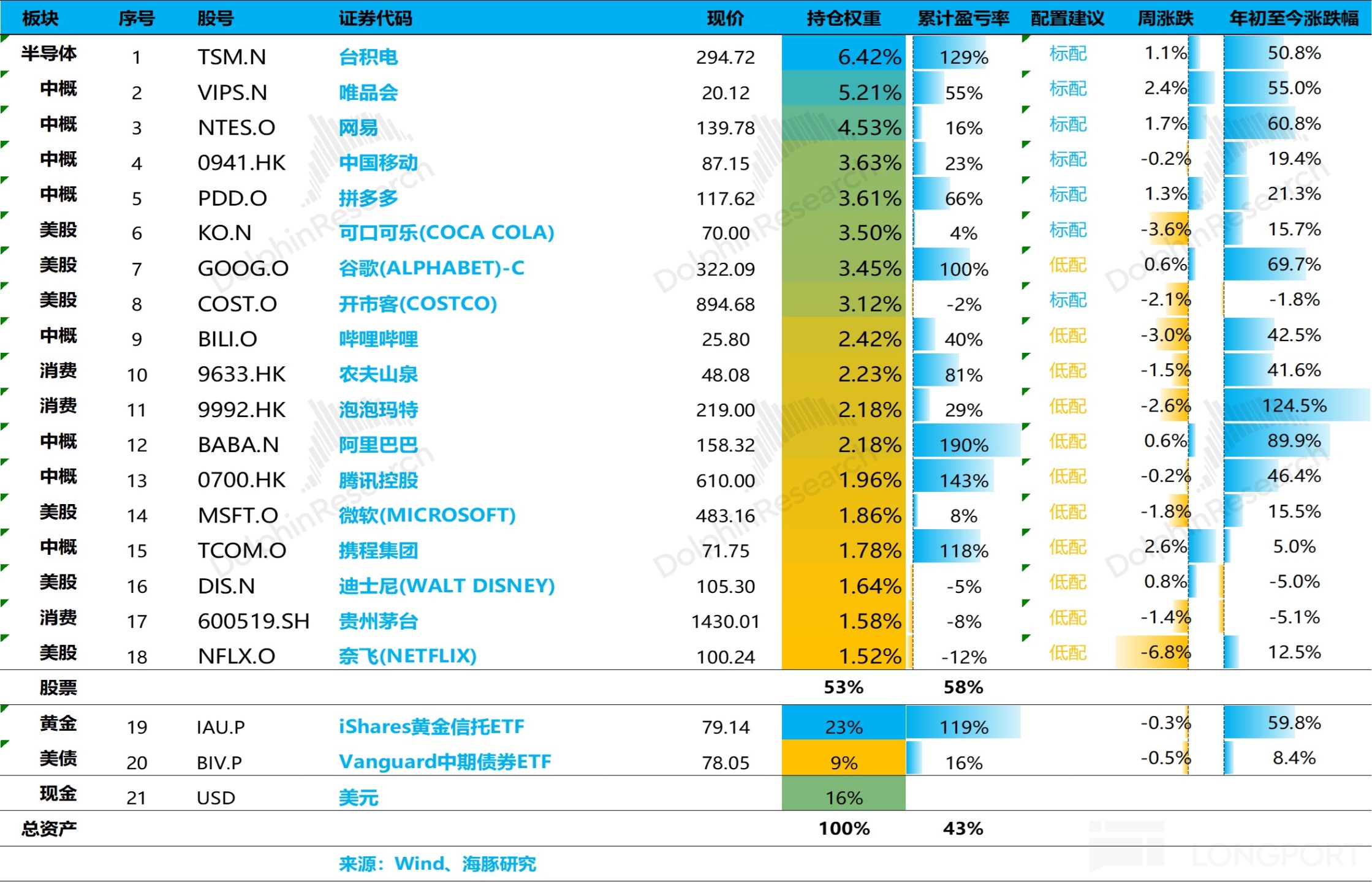

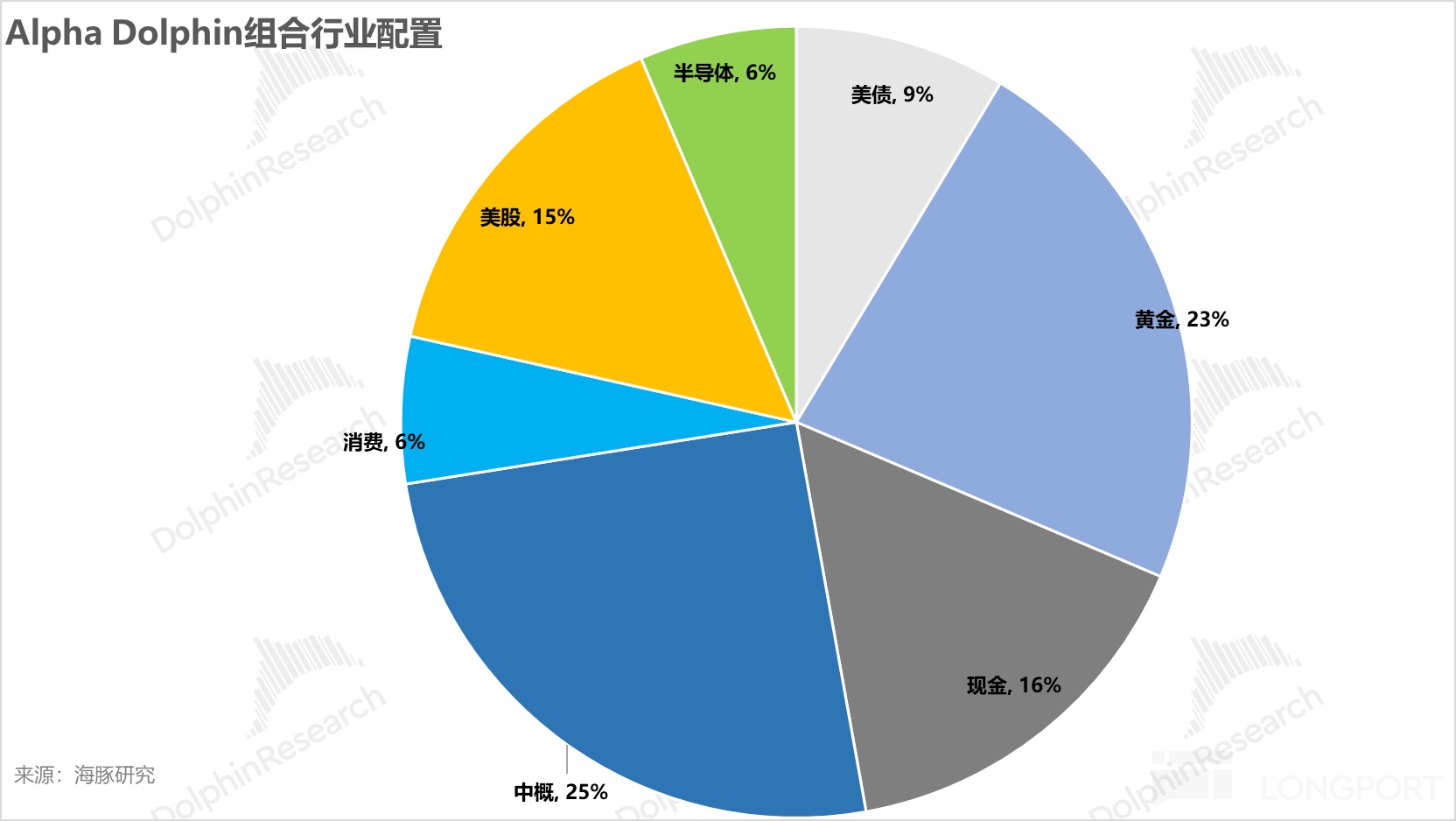

Alpha Dolphin holds 18 stocks and equity ETFs, with 7 core positions and the rest underweight. Outside equities, assets are mainly in gold, US Treasuries, and USD cash, with equity vs. defensive roughly 55:45.

As of last Fri., the asset allocation and equity position weights are as follows. See the charts below.

八、下周重点事件

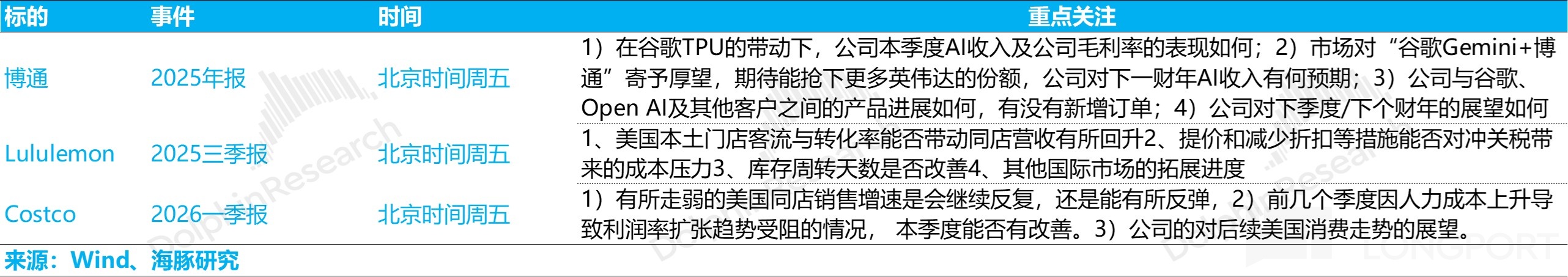

It is the tail end of US earnings season, with only Broadcom left among AI names to gauge orders for cost-efficient compute ASICs. Two relatively soft consumer names, Lululemon and Costco, will also report; key watch items are below.

<End of main text>

本文的风险披露与声明:海豚投研免责声明及一般披露

For recent weekly portfolio reports by Dolphin Research, please refer to the articles below. See the link for details.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.