MU: AI Ignites Memory; Supercycle Starting?

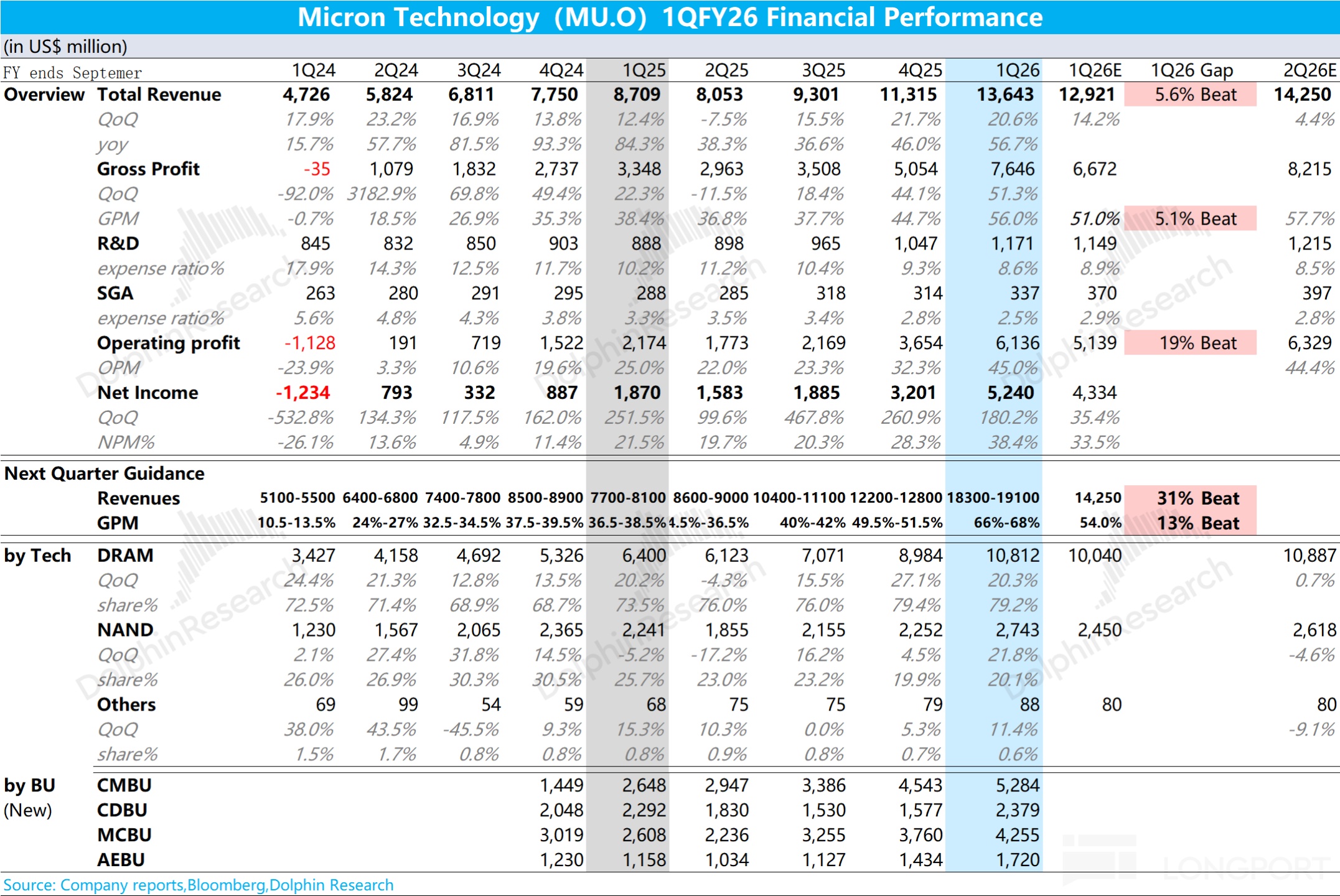

Micron (MU.O) released FQ1 FY26 results (quarter ended Nov 2025) after the U.S. market close on Dec 18 Beijing time. Key takeaways below:

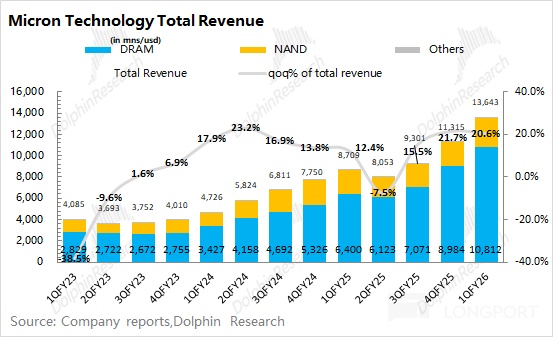

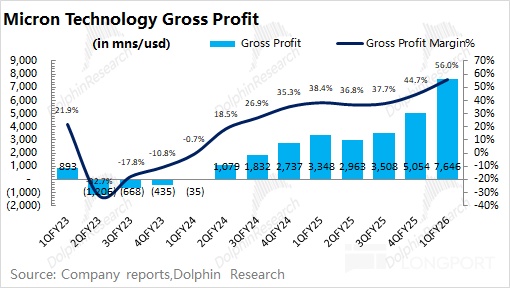

1. Headline results: $Micron Tech(MU.US) revenue of $13.6bn, up 20% QoQ, beating consensus ($12.9bn), driven by both DRAM and NAND. GPM reached 56%, ahead of sell-side (51%) and even the raised buy-side bar (52.5%), as memory pricing rose more than expected with double-digit ASP gains in both DRAM and NAND.

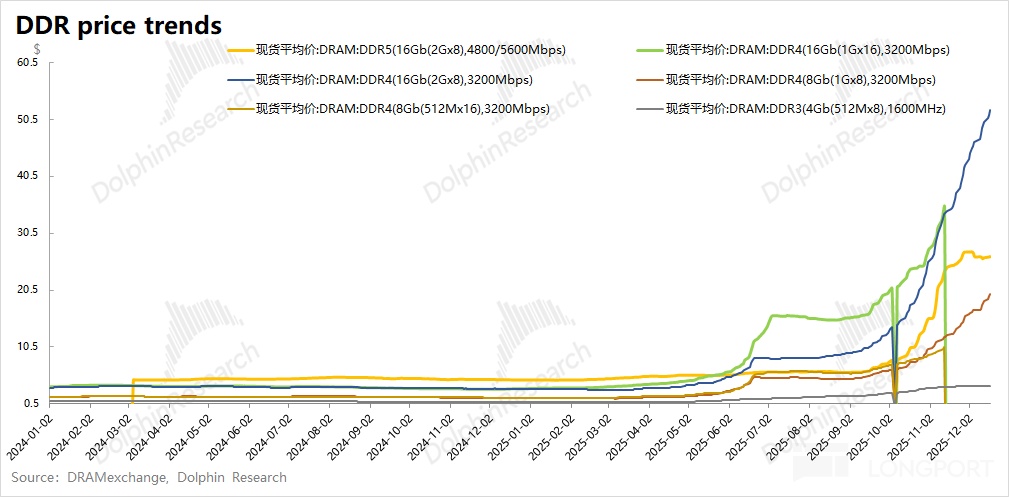

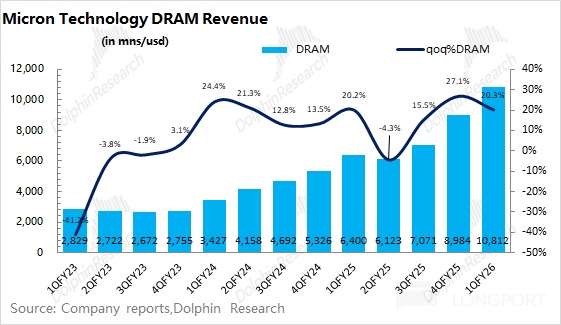

2. DRAM: revenue of $10.8bn, +20% QoQ, mainly on higher pricing. DRAM ASP rose ~20% QoQ with shipments slightly higher.

Breakdown: 1) Conventional DRAM delivered the largest delta, at an estimated ~$8.4bn, +21% QoQ, as AI demand began to lift DDR products. 2) Dolphin Research estimates HBM revenue at ~$2.4bn, up ~$0.3–0.4bn QoQ, supported by demand for HBM3E from Nvidia’s GB series.

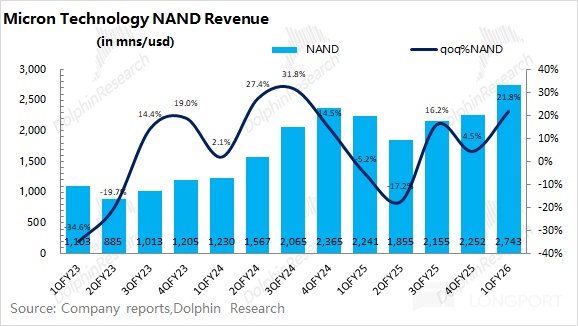

3. NAND: revenue of $2.74bn, +22% QoQ. Shipments rose ~7% QoQ, while ASP rose ~14% QoQ. Prior cyclical weakness led to industry capacity cuts, and as AI capex spills over into NAND, tightening supply-demand is lifting prices.

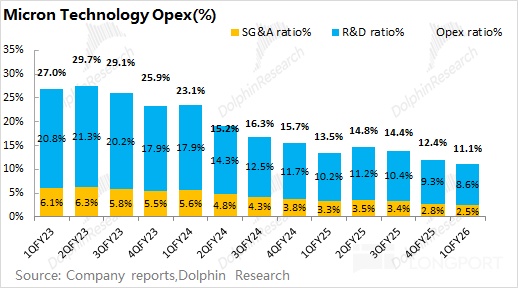

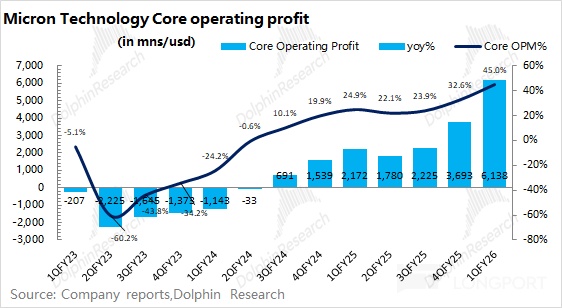

4. Opex: With revenue scaling, R&D and SG&A ratios declined. Core OP was $6.1bn, with OPM up to 45%. Profit improvement is primarily driven by revenue and GPM expansion, with memory ASPs continuing to rise.

5. Guidance: FQ2 FY26 revenue of $18.3–19.1bn, far above consensus ($14.3bn). GPM guided to 66–68%, also well above consensus (54%). The beat is mainly on continued price hikes in conventional memory products.

Dolphin Research view: a ‘blowout’ guide amid a powerful memory upcycle

Revenue and GPM beat on stronger-for-longer pricing, and the company issued a substantially above-consensus next-quarter outlook. Micron guides next-quarter revenue to ~$18.7bn (±$0.4bn), up by ~$5.1bn QoQ. GPM is guided to ~67% (±1%), well ahead of buy-side (55–56%), implying further sizable price increases next quarter.

Reviewing this cycle, with traditional end-markets still soft, the rebound is primarily AI-led. Strength first emerged in HBM, then broadened to conventional DRAM/NAND, driving a broad-based recovery.

As Micron did not disclose HBM figures, Dolphin Research estimates HBM revenue at ~$2.4bn (~20% of total). If AI demand were confined to HBM, the impact on the company would be limited. Only when recovery extends into conventional products do earnings and the stock see outsized upside.

Beyond the print, key focus areas include:

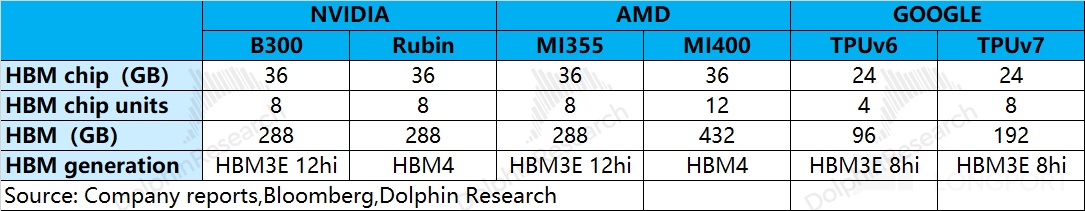

1) HBM competition: Nvidia remains the dominant AI chip customer, so share gains in its supply chain directly matter to HBM. HBM supply to Nvidia has mainly been from SK hynix and Micron, but reports indicate Samsung’s HBM3E has been qualified, putting all three back on an even footing.

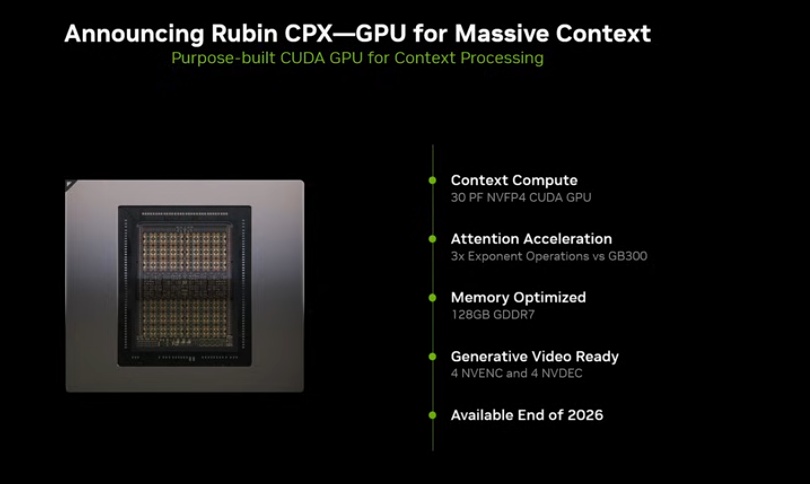

Micron’s current HBM revenue is largely from HBM3E, while all three vendors (SK hynix, Micron, Samsung) are now focused on HBM4 qualifications. Nvidia’s Rubin and AMD’s MI400, expected in 2026, will use HBM4; first movers with customer quals and shipments gain a clear early-mover advantage.

2) AI capex and memory: This upcycle began as a structural move led by AI capex, where HBM is the most direct incremental demand, tied to GPU/custom ASIC shipments.

Micron’s share rally since Aug has accelerated with a broader recovery in conventional memory. Traditional end-markets like smartphones have not shown a major demand step-up, with most incremental pull still from AI cloud.

As large models shift from training to mass inference, ‘memory for compute’ helps lower cost and improve efficiency. Nvidia’s Rubin CPX inference cards, due next year, will carry high-capacity GDDR7, trading bandwidth for cost versus HBM.

Inference must also ‘feed data’, not just compute. High-performance read/write SSDs for real-time data, in some cases displacing nearline HDDs, should support a NAND upturn.

3) Outlook and capex: Micron had guided FY26 capex at ~$18bn, but management raised it to ~$20bn post-earnings (street now at $20–25bn). The industry outlook is constructive.

With a current market cap of ~$253.7bn, Micron trades at ~7x FY26 post-tax core OP on assumptions of +100% YoY revenue, 68% GPM, and 12% tax. Given the industry’s cyclicality, peak-cycle valuation during price-up phases has typically been 5–15x PE, putting today’s multiple toward the low end.

The street largely agrees on further price hikes next year, but is split on sustainability into the following year. GPM is already 56% and guided to ~67% next quarter, a new high.

Such a ‘blowout’ guide highlights the pricing upside, but it also raises questions about durability. If GPM hits a record 67% next quarter and prices keep rising into 2026, GPM could move above 70% in H2, which would pressure traditional end-markets and underscores the cycle’s nature.

If the pricing upcycle runs through next year, Micron’s earnings peak likely lands next year. Historically, as long as prices are still climbing, the multiple can expand toward ~10x PE; beyond that, risk-reward becomes less compelling. More to come in Dolphin Research’s management call takeaways.

Below is Dolphin Research’s deep dive on Micron’s print:

I. Overall performance: continued recovery, stronger guide

1.1 Revenue

FQ1 FY26 revenue was $13.6bn, +20.6% QoQ, beating consensus ($12.9bn), driven by both DRAM and NAND.

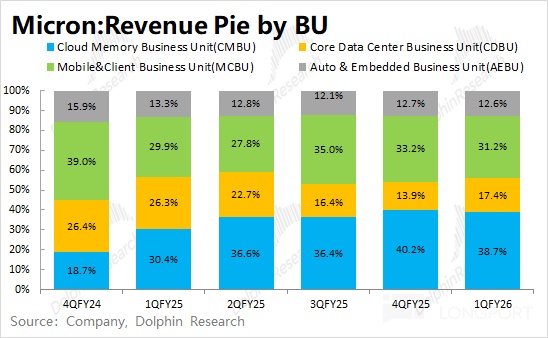

By end-market, data center and networking contributed the largest delta this quarter, while smartphones benefited from seasonal restocking and rising memory prices.

For next quarter, management guides $18.3–19.1bn (+~37% QoQ), far above the $14.3bn street. Dolphin Research believes the increase is primarily pricing-led across memory products.

1.2 Gross margin

FQ1 FY26 GP was $7.65bn, with GPM at 56%, up 1,130bps QoQ. The uplift reflects broad price increases in conventional DRAM and NAND.

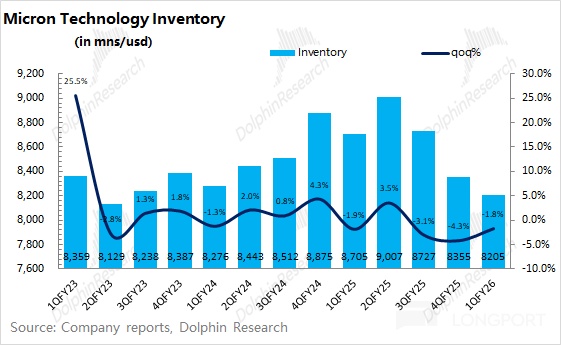

Inventory stood at $8.2bn, down 1.8% QoQ. Supported by data center and AI demand, days inventory remained at a relatively low ~124 days.

GPM guidance is 66–68% for next quarter, implying another ~1,100bps QoQ expansion, pointing to further substantial price gains ahead.

1.3 Operating expenses

FQ1 FY26 opex was $1.51bn, +8% QoQ. With revenue growing faster, the opex ratio fell to 11%.

R&D and SG&A both increased in dollar terms but grew slower than revenue, so both ratios declined. Core OP reached $6.14bn, lifted by higher sales and margins, with profits primarily driven by revenue and GPM.

II. Segment details: broad-based memory price upcycle

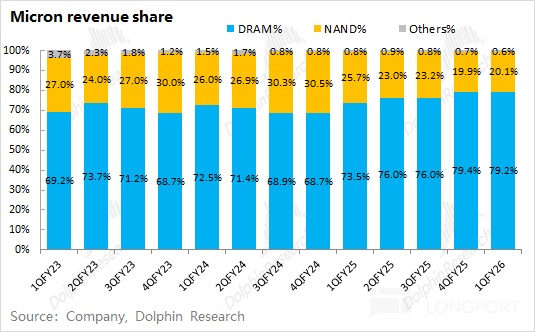

DRAM and NAND remain the key revenue drivers, roughly at a 4:1 mix, with DRAM the dominant contributor.

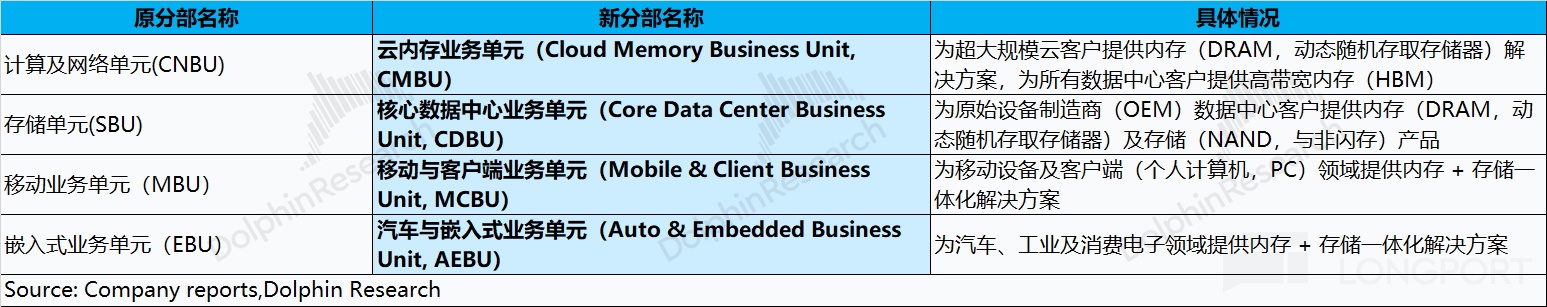

Also, from last quarter Micron adjusted its reporting by end-markets. The former CNBU, SBU, MBU, and EBU were reorganized into CMBU, CDBU, MCBU, and AEBU, underscoring focus on data center and cloud.

Data center and cloud now account for over 55% of total revenue.

2.1 DRAM

DRAM is nearly 80% of revenue. DRAM revenue rose to $10.8bn this quarter, +20% QoQ, with ~20% ASP gains and slightly higher shipments.

Dolphin Research estimates HBM at ~$2.4bn this quarter (+$0.3–0.4bn QoQ), and conventional DRAM at ~$8.4bn (+21% QoQ).

DRAM is Micron’s core, split between HBM and conventional DRAM.

1) HBM:

The company will not disclose HBM quarterly figures. Based on industry checks and company context, Dolphin Research estimates ~$2.4bn for the quarter, up $0.3–0.4bn QoQ.

Micron is currently a second source to Nvidia in HBM and trails SK hynix on product timing. With Samsung’s HBM3E reportedly qualified by Nvidia, HBM share will be rebalanced, putting all three vendors back on equal footing.

With Nvidia’s Rubin GPUs and AMD’s MI400 expected to adopt HBM4 in 2026, attention turns to HBM4 progress and qualifications. Early qualifiers and shippers will enjoy a first-mover advantage in share.

2) Conventional DRAM:

Conventional DRAM revenue is estimated at ~$8.4bn, a quarterly high for this line, largely pulled by data center and AI.

While smartphones and other traditional end-markets remain soft, AI data center demand has reshaped supply-demand, pushing up DDR pricing. In inference, swapping some HBM for DDR can deliver better cost-performance, lifting DDR pricing. Nvidia’s CPX next year will use GDDR7 (not HBM), further boosting conventional DRAM expectations.

2.2 NAND

NAND is the second-largest business at ~20% of revenue. NAND revenue was $2.74bn, +22% QoQ, with shipments +7% QoQ and ASP +~14% QoQ.

Earlier, AI capex uplifted memory mostly through HBM, leaving NAND lagging DRAM. As focus shifts from training to inference, AI capex impact is broadening and NAND is starting to benefit.

NAND has visibly recovered since Aug, because: 1) high-performance SSDs for real-time data can even replace nearline HDDs in some scenarios; 2) prior downturn led some vendors to cut NAND capacity, and the recent demand rebound has met a tight supply side; 3) the move from TLC to QLC eSSD boosts random I/O for AI with higher density, larger capacity, and better cost-performance.

<此处结束>

Dolphin Research Micron archives:

Earnings season

Sep 24, 2025 call notes: 美光(纪要):全面拉指引,AI 之风终于吹到传统半导体了?

Sep 24, 2025 earnings take: 美光:AI Capex 疯投不止,终于要拉起存储超级周期了?

Jun 26, 2025 call notes: 美光(纪要):HBM4 已送样,HBM3E 12Hi 顺利量产

Jun 26, 2025 earnings take: HBM 放量在即,美光能否乘胜追击?

Mar 21, 2025 call notes: 美光(纪要):HBM 25 年连续爬坡, 2026 年收入会更高

Mar 21, 2025 earnings take: 美光:“东风” 是不远,但等风有风险

Dec 19, 2024 call notes: 美光:预计 2025 年 HBM 收入将达到数十亿美元(FY25Q1 电话会)

Dec 19, 2024 earnings take: 美光:AI 再火也填不平 “周期坑”

Sep 26, 2024 earnings take: 美光:大起大落,压舱石还得看周期

Sep 26, 2024 call notes: 美光:2025 财年的资本开支集中在 HBM(FY24Q4 电话会纪要)

Jun 27, 2024 earnings take: 美光:涨价也撑不住厚厚的期待

Jun 27, 2024 call notes: 美光:下半年毛利率将持续提升(3QFY24 电话会)

Mar 21, 2024 earnings take: 美光:存储大涨价,掀开 HBM3E 争夺战

Mar 21, 2024 call notes: 美光:HBM3E 量产,供货英伟达(2QFY2024 电话会议纪要)

Dec 21, 2023 earnings take: 美光科技:存储寒冬已过,涨价迎春

Dec 21, 2023 call notes: 毛利率,将迎来持续提升(美光 1QFY24 电话会纪要)

Sep 28, 2023 earnings take: 美光科技:虚回暖,真低迷

Sep 28, 2023 call notes: 库存难题不再,价格何时迎来涨?

Jun 29, 2023 earnings take: 美光科技:AI 浪潮掀起,拐点已至?

Jun 29, 2023 call notes: 库存去化尾声,AI 再添新火(美光 3QFY23 电话会)

Mar 29, 2023 call notes: 经历最差时期,半导体或渐现曙光(美光 FY23Q2 电话会)

Mar 29, 2023 earnings take: 美光的 “大出血”,或许不是坏事

Deep dives

Jun 18, 2024: AI 存储:HBM 抓着英伟达的命门

Apr 13, 2023: 美光:GPT 降温,无碍存储冲底回暖

Mar 15, 2023: 美光:存储芯片大厂冬天熬完了吗?

Risk disclosure and statements: Dolphin Research disclaimer and general disclosures

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.