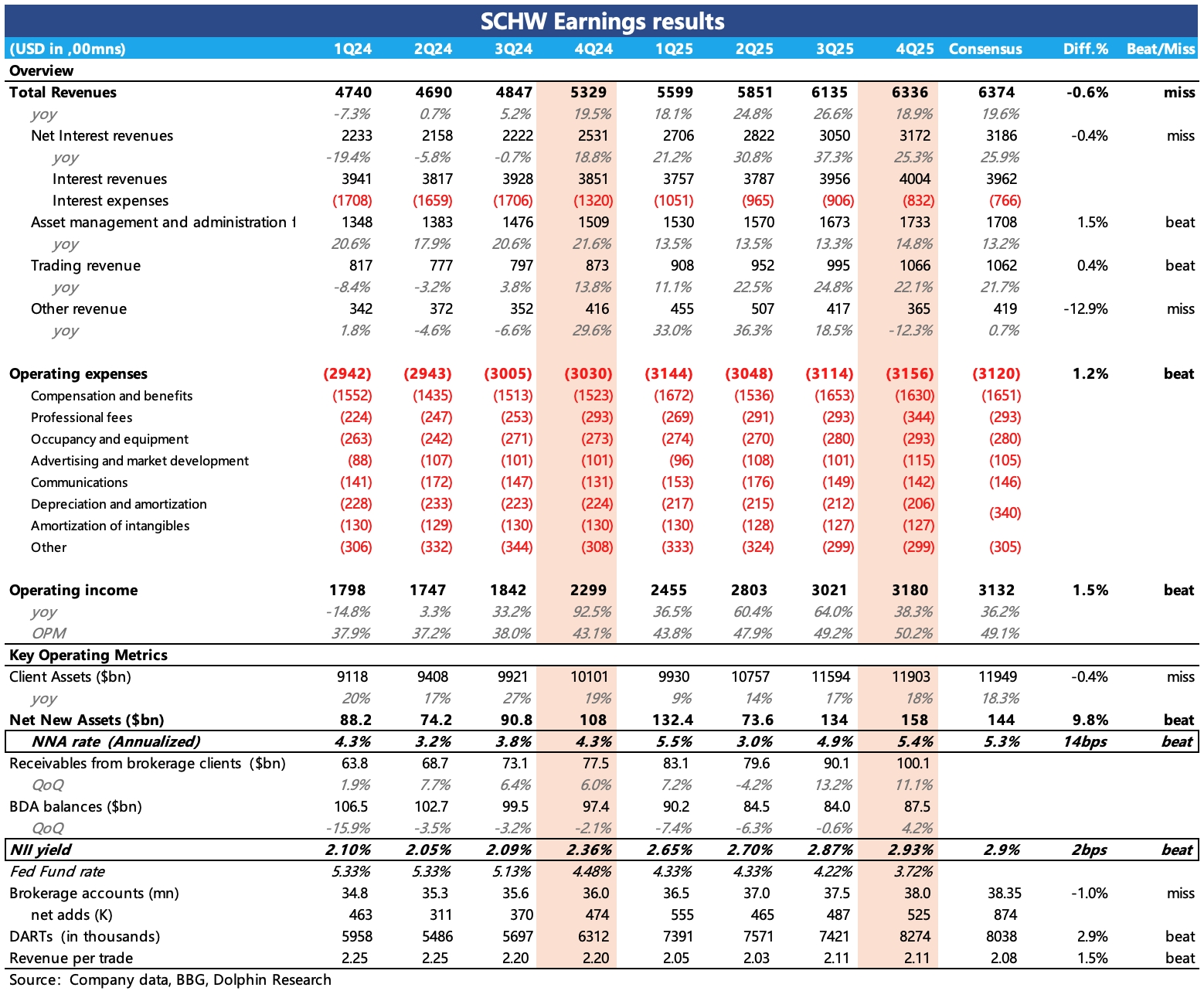

SCHW 4Q25 First Take: Q4 stayed steady, with overall financials broadly in line. Revenue was a slight miss (mainly on BDA fees), but tighter cost control drove a profit beat. Core operating metrics that Dolphin Research tracks topped expectations, underscoring stable organic growth momentum.

(1) First, the two key drivers of organic growth. NNA and NIM.

NNA was 158 bn in Q4, implying a 5.4% annualized pace. The rebound in Dec. brought growth back within the 5–7% guidance range.

NIM printed at 2.93% in Q4. Despite rate cuts in Sep. and Dec., NIM still rose vs. Q3. The setup echoed Q3, with both higher interest income and lower funding costs at work, as financing activity stayed robust and balances grew while rates eased only modestly.

Funding costs fell on two fronts. Short-term borrowings declined (net down 5 bn QoQ, vs. 2.1 bn in Q3), reflecting accelerated repayment of high-coupon funding taken during the crisis period. In addition, the rate on flexible savings dropped sharply alongside rate-cut expectations, from 0.43% to 0.29% QoQ.

(2) In trading, DARTs rose 31% ahead of expectations. The lift came from a 6% increase in active users, a 12% increase in assets per client, and a supportive Q4 tape. Derivatives penetration climbed to 22.4%, boosting average revenue per trade.

(3) NII rose 25% YoY, though the pace moderated vs. Q3 given the tough base. Interest-earning assets were up ~1%. Expansion was mainly driven by higher NIM and the rapid runoff of short-term debt, which reduced interest expense.

(4) Asset management revenues accelerated to 15% growth despite a high base. With take rates still drifting down slightly, growth was primarily AUM-led across the platform.

(5) The company continued to leverage scale to improve efficiency in Q4. Total opex rose 4%, well below revenue growth of 19%. OP reached $3.2 bn, up 38% YoY, and OPM expanded ~700 bps YoY to above 50%.

(6) Investments & M&A: the Forge acquisition is slated to close in 1H this year. SCHW repurchased 29.2 mn shares in Q4 for $2.7 bn and paid a dividend of $0.27 per share. Shareholder returns were roughly unchanged vs. last quarter, with an annualized yield of 6% that remains attractive in a cutting cycle. $Charles Schwab(SCHW.US)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.