INTC: Hot AI-CPU hype, but a 'cold' guide douses expectations?

INTC released its Q4 2025 results (quarter ended Dec 2025) after the U.S. market close on Jan 23, 2026 Beijing time. Key takeaways are as follows.

1) Core metrics: $Intel(INTC.US) reported revenue of $13.67bn, down 4% YoY, in line with guidance ($12.8–13.8bn), mainly on weaker Client. GPM was 36.1%, meeting the Street (35.6%). The QoQ margin decline was driven by low initial yields during the 18A ramp.

2) Layoffs and cost control: OpEx came in at $4.36bn, and management continued to cut headcount and expenses. R&D edged down to $3.22bn, with the R&D ratio falling to 23.5%.

Total headcount fell again to 85k, down 3.3k QoQ, but progress was slower than the prior target to reach ~75k by year-end. The pace of layoffs remains behind plan.

3) Biz mix: After revising disclosure, the company’s main revenue still comes from Client and Data Center & AI. Together they account for over 90% of sales.

a) Client: Q4 revenue was $8.19bn, down 6.6% YoY. With global PC shipments up 11% YoY in the quarter, INTC continued to lose share in PCs.

b) Data Center & AI: Q4 revenue was $4.74bn, up 8.9% YoY. The segment remains centered on data center CPUs, and strengthened on downstream demand recovery. After striking a strategic tie-up with NVIDIA, INTC integrated NVLink into x86 CPUs, giving customers more choice.

As AI shifted from training to inference, CPUs’ roles in data prep and resource orchestration became more important. Demand for server CPUs has risen visibly.

c) Intel Foundry: Q4 revenue was $4.5bn, up 4% YoY. Foundry revenue still came mainly from Intel 7 and Intel 10, largely for internal products.

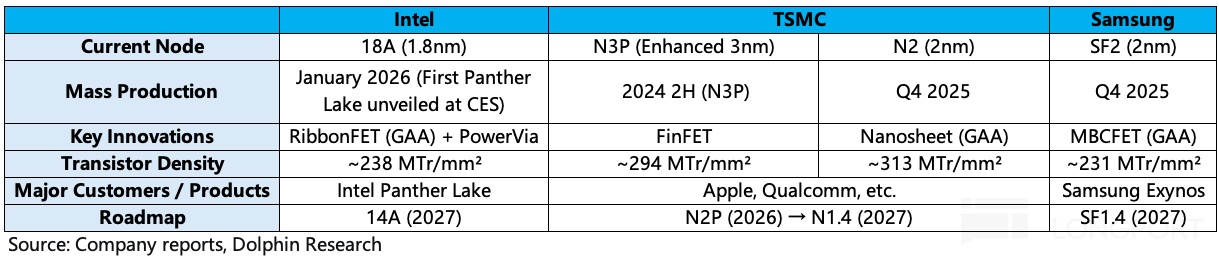

At CES 2026, INTC launched its Panther Lake products on the latest 18A process, a positive signal that it has re-entered leading-edge competition. 18A still trails TSMC on transistor density, but with yield improvements it could become an alternative for downstream customers.

4) Next-quarter guide: Q1 2026 revenue is guided to $11.7–12.7bn vs. Street $12.5bn. Q1 2026 GPM is guided to 32.3%, well below the Street at 38%.

Dolphin Research view: 18A + AI CPU hopes dampened by a weak guide

Revenue and GPM were broadly in line with expectations. The YoY revenue decline was mainly dragged by Client. The QoQ margin drop reflected early-stage 18A yields.

To meet data center needs, INTC prioritized internal wafer capacity to Data Center & AI. Client partly relied on external wafers (TSMC), which weighed on PC performance.

The guide is underwhelming. Notably, the GAAP GPM guide of 32.3% for next quarter is far below the Street’s 38%, implying 18A’s margin impact and yield ramp are disappointing.

The stock’s recent rally has been driven by Panther Lake (18A in volume) and stronger server CPU demand (planned 10–15% price hikes), embedding expectations for margin recovery and foundry traction. This weak guide pours cold water on that enthusiasm.

The market mainly watches the following:

a) CPU share: INTC’s core earnings base

INTC faces AMD competition, especially as AMD has overtaken INTC in desktop CPUs. While INTC still leads in overall CPU share, the trend is down.

In server CPUs, INTC’s shipments have been squeezed below 80%. This quarter’s Data Center & AI growth was largely driven by broader server CPU demand.

b) Capex: After investments by the U.S. Gov., SoftBank and NVIDIA in Aug 2025, INTC has effectively become a ‘U.S. SOE’, with the U.S. Gov. the largest single shareholder. Backed by this support, investors grew more confident on future capex and operations, and the stock has climbed off the lows.

Q4 capex was $3.5bn, up $1.0bn QoQ. Full-year 2025 capex was $14.6bn, below prior guidance (net capex ~$18bn). With U.S. backing and TSMC’s aggressive capex plans, the market stays constructive on 2026+ capex.

c) Foundry and process: top focus

At CES 2026, INTC officially unveiled Intel Core Ultra 3 (Panther Lake), the first consumer product in volume on Intel 18A, signaling a return to leading-edge process competition. This is a key milestone.

Per the prior roadmap, 18A entered volume on schedule, with yields at an ‘acceptable’ ~60%. 18A currently serves in-house products; shipping to external customers would better validate INTC’s foundry capabilities.

Demand for high-end smartphone and AI chips remains concentrated at TSMC. With TSMC capacity tight, companies like Qualcomm and Microsoft are seeking alternatives.

INTC’s latest 18A still trails TSMC in density, but Panther Lake’s volume shows it has not stopped catching up. If INTC and Samsung improve yields, they can win some ‘overflow’ orders.

All in, after the U.S. Gov. stake, INTC has moved past a ‘bankruptcy valuation’, and expectations have risen, especially around foundry. Panther Lake volume is a positive signal, and the market now looks for tangible external foundry orders.

At a current market cap of $259.1bn, INTC implies roughly 40x PE on 2027 post-tax core earnings (assumes 6% revenue CAGR, 43% GPM, 10% tax rate). Versus TSMC’s 20–25x, INTC’s richer multiple already bakes in foundry share gains and margin improvement.

Overall, Q4 was okay, but the next-quarter GPM guide is too low and misses expectations for margin uplift. The early 18A ramp is the main drag, suggesting current 18A margins and yields are underperforming.

Server CPUs and legacy lines will drive near-term numbers, but investors care more about a foundry breakthrough to capture TSMC ‘overflow’, which is partly embedded in the multiple. Even so, some institutions worry about resource contention between internal products and external customers, potentially hindering foundry progress.

Only when INTC secures substantial external foundry orders will the stock gain firmer support.

Below is Dolphin Research’s deeper dive on INTC. Details follow.

I. Core metrics: Margin guide is weak

1.1 Revenue: Q4 2025 revenue was $13.6bn, down 4% YoY, within the $12.8–13.8bn guide. Data Center & AI grew, while Client was the main drag.

1.2 GP and GPM: Q4 2025 GP was $4.9bn, down 5% QoQ, mainly on lower margins. GPM was 36.1%, above the Street (35.6%). Early 18A volume diluted margins.

The weakest point was the next-quarter guide: GAAP GPM at 32.3% vs. Street 38% implies underwhelming margins and yields for 18A today. With 18A scaling and server CPU demand, margins could stabilize and recover.

1.3 OpEx: Q4 2025 OpEx was $4.36bn, down 15.6% YoY. After the new CEO set a mandate to cut costs, OpEx remains a key focus area.

Details: (i) R&D $3.22bn, down 17% YoY. (ii) SG&A $1.17bn, down 5% YoY.

Headcount fell to 85k, down 3.3k QoQ, but short of the year-end target of ~75k. As a result, OpEx only edged down QoQ.

1.4 Net income: Q4 2025 net loss was $590mn. On an operating basis, OP was about $580mn, which better reflects ongoing operations. OP softened QoQ due to margin pressure from the 18A ramp.

II. Segment details: Inference boosts CPUs; 18A still needs work

Following the CEO change, INTC again revised its reporting. Client and Data Center & AI now capture the in-house product businesses, with separate Foundry and ‘All other’ buckets.

Network & Edge is no longer separately disclosed, while Altera, Mobileye and IMS are grouped into ‘All other’. After Altera and Mobileye were deconsolidated, ‘All other’ mainly includes IMS and early-stage projects.

Post-recast, Client and Data Center are the largest revenue contributors. Considering Foundry and inter-segment eliminations, INTC remains largely make-to-use, with limited external foundry revenue today.

2.1 Client

Client revenue was $8.19bn in Q4 2025, down 6.6% YoY. Although the PC market continued to recover in the quarter, Client underperformed.

Note: In Q1 2025 the company recast reporting and moved part of former Network & Edge into Client. This affects comparability.

IDC data show global shipments of 76.4mn units in the quarter (+11% YoY), indicating continued industry recovery. Against this, INTC’s Client revenue fell 6.6%, confirming ongoing PC share losses. In desktop CPUs, AMD has overtaken INTC.

INTC’s cooperation with NVIDIA aims to counter AMD. With little progress in discrete GPUs, INTC’s PC competitiveness has slipped; by pairing with NVIDIA GPUs for AI PCs and offering SoCs, it seeks to regain share at the high end.

2.2 Data Center & AI

Data Center & AI revenue was $4.74bn in Q4 2025, up 8.9% YoY, driven by AI server demand. The line had hovered around $4.0bn previously and saw a lift as the focus shifted from training to inference.

As INTC has yet to break through on GPUs, the segment still revolves around CPUs. With the NVIDIA partnership, INTC’s x86 data center CPUs connect to NVLink, giving cloud providers more optionality.

As large models shift from training to inference, server CPUs matter more. CPUs handle scheduling and data preprocessing, directly affecting throughput, latency, cost, and workload fit. With rising demand, server CPUs have seen planned price hikes of 10–15%.

The new CEO has refocused the company on manufacturing improvements. INTC will concentrate on CPUs in the data center and on advancing foundry nodes; a foundry breakthrough could let INTC play the core data center game via external orders even without its own GPU.

2.3 Intel Foundry

Foundry revenue was $4.5bn in Q4 2025, up 4% YoY. With $4.34bn of inter-segment eliminations this quarter, it’s clear most Foundry output serves internal needs, with minimal external revenue.

The new CEO has explicitly prioritized Foundry, seeing it as a turnaround opportunity. U.S.-based manufacturing is INTC’s core advantage and a key reason the U.S. Gov., SoftBank, and NVIDIA provided capital.

Foundry revenue remains concentrated on Intel 7 and Intel 10. 18A entered volume in H2 2025 and currently powers in-house Panther Lake products.

18A still trails TSMC in density, but Panther Lake shows INTC is back in the leading-edge race. The weak next-quarter margin guide suggests early 18A margins and yields are not yet satisfying.

Only with improved yields and performance can INTC become a true ‘alternative’ for downstream customers. That is what the market cares about most.

<End here>

Dolphin Research prior coverage on INTC:

Oct 24, 2025 call. Intel (Trans): 18A expected to contribute profit by end-2026

Oct 24, 2025 earnings take. Intel: Back to breakeven; can the ‘U.S. SMIC’ poach from TSMC?

Sep 19, 2025 quick take. Intel: Now that it’s tied to NVIDIA’s ‘big leg’, who really wins?

Jul 25, 2025 call. Intel (Trans): 18A output to peak around 2030

Jul 25, 2025 earnings take. Intel: After big layoffs, is a ‘U.S. SMIC’ the endgame?

Apr 25, 2025 call. Intel (Trans): Full-year capex cut from $20bn to $18bn

Apr 25, 2025 earnings take. Intel: Selling assets and cutting staff — can a CEO swap save it?

Jan 31, 2025 call. Intel (Trans): Foundry services to break even by end-2027

Jan 31, 2025 earnings take. Intel: Cost cuts working, but growth is still the hard part

Nov 1, 2024 earnings take. Intel: Can it get back up after shedding the big burden?

Aug 2, 2024 earnings take. Intel’s across-the-board meltdown: a shattered dream

Apr 26, 2024 earnings take. Intel: A marginalized onlooker in AI

Jan 26, 2024 call. Intel 3, is it an opportunity? (Q4 2023 call)

Jan 26, 2024 earnings take. Intel: Processor crown lost, AI war in tatters

Jan 17, 2024 deep dive. Intel: Are AI PCs the toothpaste maker’s lifeline?

Risk disclosure and disclaimer: Dolphin Research disclaimer and general disclosure

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.