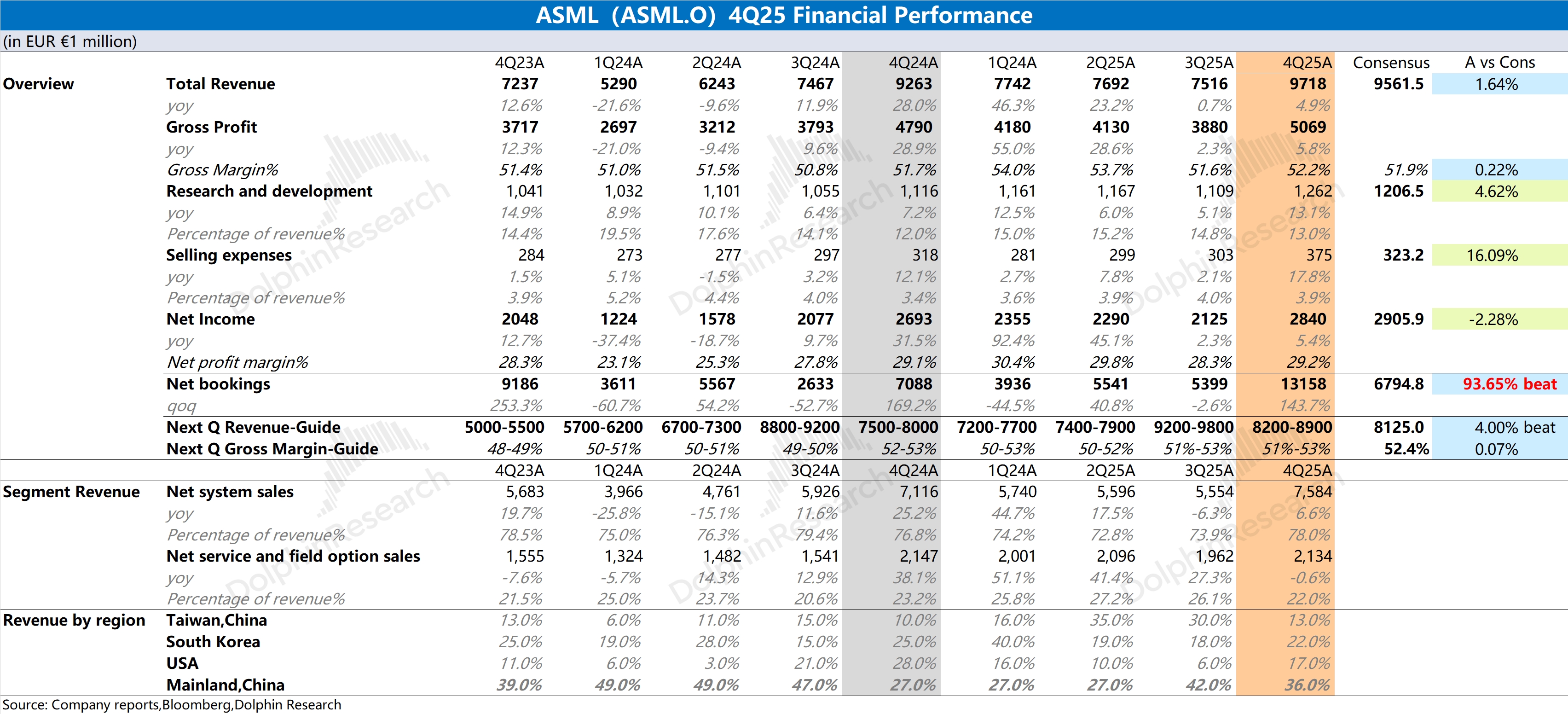

ASML First Take: Solid print, with revenue and GPM in line with guidance. Beyond the quarter's numbers, investors focused more on bookings and the forward operating outlook.

1) Orders: Net bookings came in at EUR 13.16bn, well above consensus (EUR 6.8bn). Seasonally strong Q4 aside, the upside was driven by sizable add-on orders from memory makers.

Within the quarter's mix, logic orders rose EUR 3.0bn QoQ, roughly in line with seasonal patterns. Memory orders rose EUR 4.8bn QoQ, far above the historical Q4 avg. of ~EUR 1.5bn.

2) Next-quarter outlook: The company guides Q1 2026 revenue to EUR 8.2–8.9bn, vs. prior consensus of EUR 8.13bn. After TSMC raised its 2026 capex, major houses lifted their Q1 estimates to around EUR 8.5bn. Management's range is broadly in line with the revised Street.

Management also issued FY26 guidance. It expects revenue of EUR 34–39bn (+4–19% YoY) and GPM of 51–53%.

With memory makers and TSMC boosting capex, the Street now models 20%+ growth for the year. Against that, the company's guidance looks conservative.

Overall, Dolphin Research sees orders as the standout, fueled by additional demand from memory customers. The operating outlook largely meets expectations. The blowout bookings strengthen confidence in ASML's high-growth path. For more, follow Dolphin Research's upcoming detailed review and call Trans.$ASML(ASML.US)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.