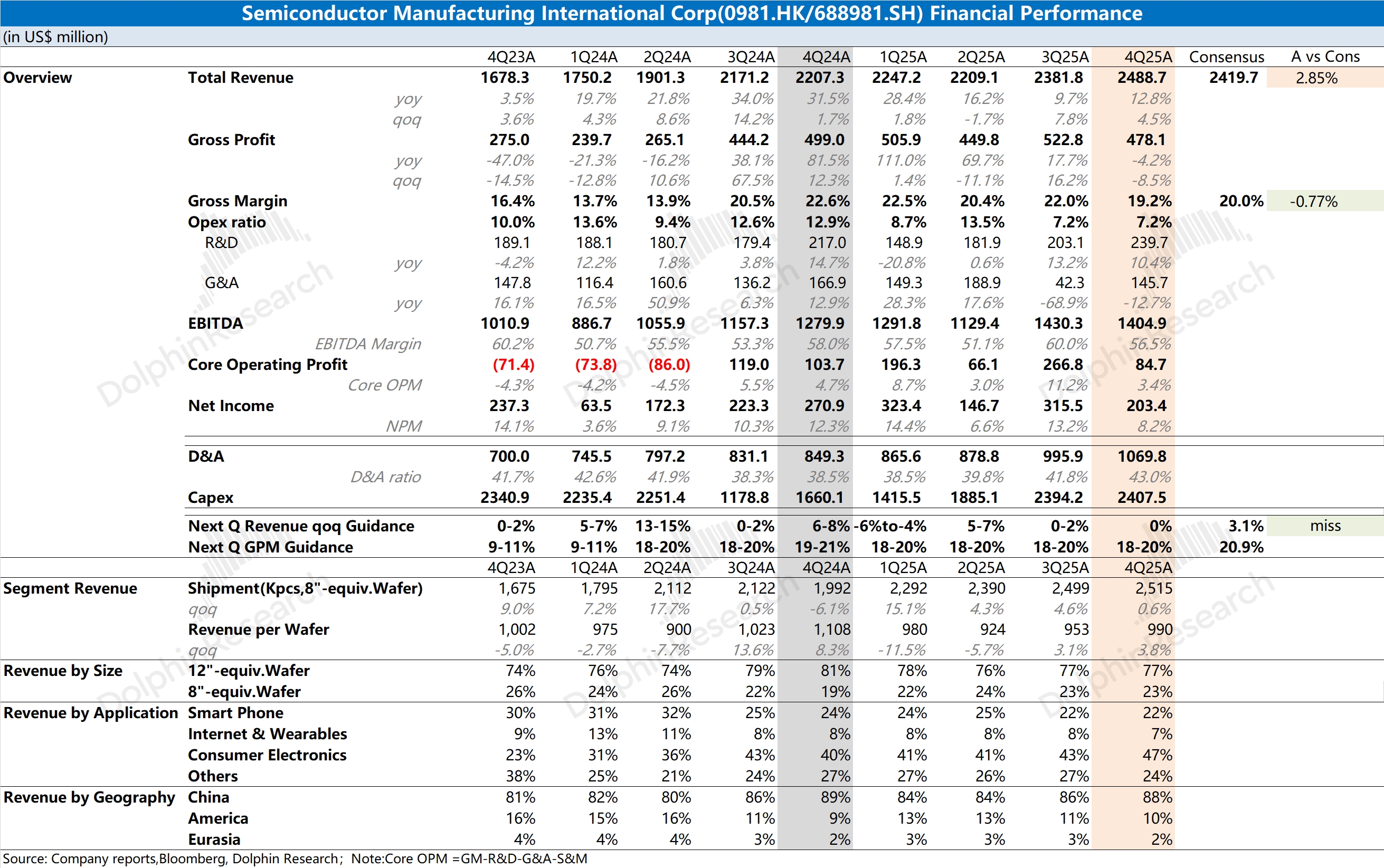

SMIC 4Q25 First Take: headline was mixed — revenue met expectations, but GPM underwhelmed.

On the margin bridge, ASP rose by $37/wafer QoQ while unit cost increased by $56/wafer, driving GPM compression. While the company has pushed advanced nodes to a 7nm‑equivalent, lower yield continues to weigh on margins.

Guidance matters more than the print, and the outlook remains muted. Management guides flat QoQ revenue vs. the Street at +3%, and GPM at 18–20% vs. the Street at 21%, implying continued margin pressure.

Despite AI semis staying hot, results remain soft, largely due to a sluggish traditional semi market. Management is still cautious on the legacy demand recovery. Given SMIC’s unique positioning, valuation is not fully tethered to near‑term fundamentals.

The company sits in the foundry industry’s second tier but is working to close the gap with TSMC, which keeps optionality and expectations alive. For more, follow Dolphin Research for subsequent commentary and Trans. $SMIC(00981.HK) $SMIC(688981.SH)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.