Coinbase (Trans): Last Year Was an 'Investment Year,' This Year Will See Prudent Cost Control</p>

Below is Dolphin Research's transcript of Coinbase's FY25 Q4 earnings call. For earnings analysis, see Bad Market + Bad Earnings: When Will Coinbase Hit Bottom?

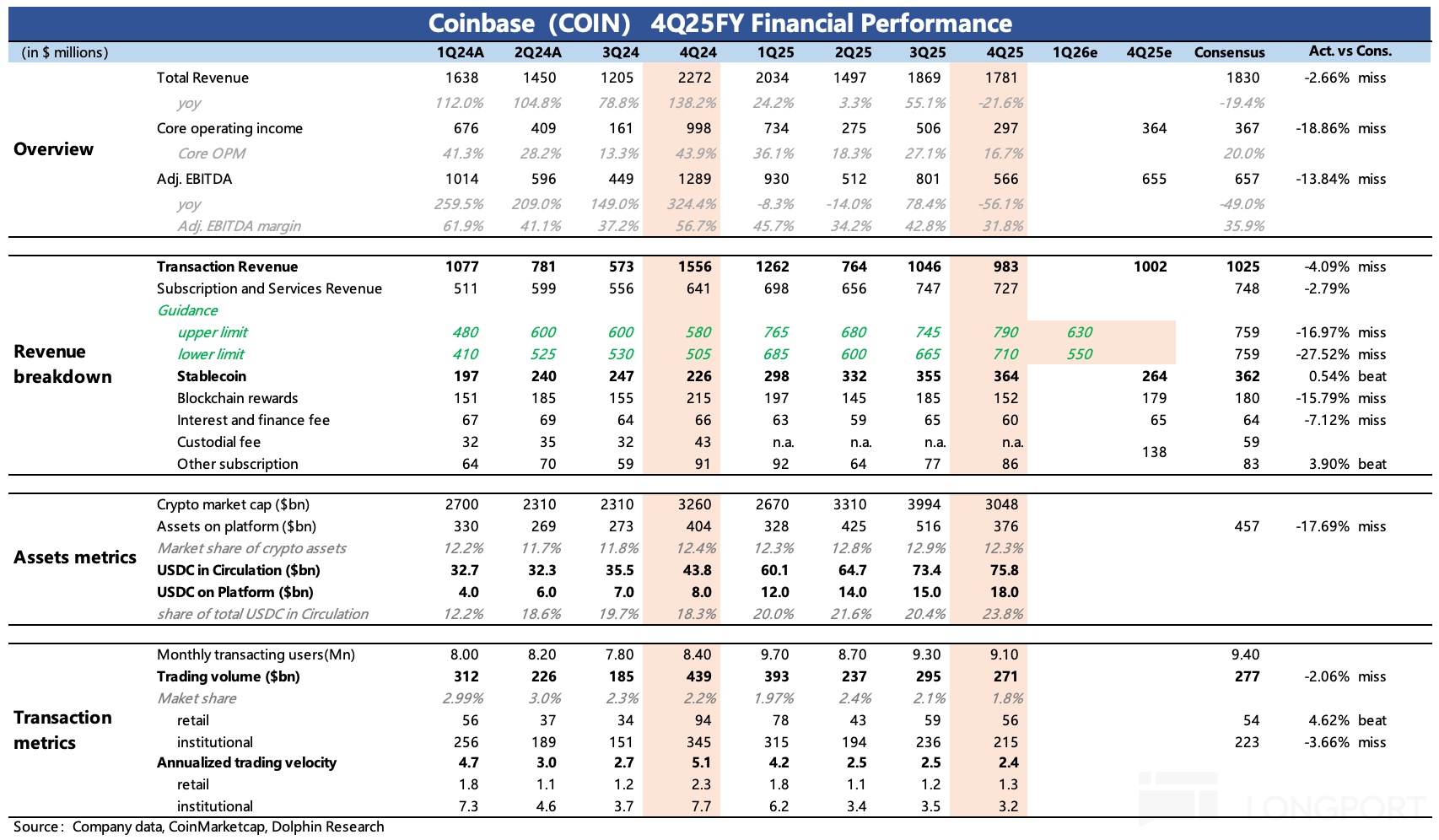

I. Key Earnings Highlights

1. Capital Management:

a. Buybacks: $1.7bn spent in 2025 (fully offsetting SBC dilution).

b. New authorization: BOD approved additional $2bn buyback program.

c. Asset accumulation: Committed to buying Bitcoin dips with cash flow.

2. 2026 Q1 Guidance:

a. Trading revenue: ~$420mn generated as of Feb. 10.

b. Subscriptions & services: Projected at $550-630mn (impacted by lower rates and crypto price declines).

c. Opex: Expected to remain flat at $925-975mn for T&D + G&A.

II. Earnings Call Details

2.1 Management Commentary

1. Everything Exchange

a. Vision: "One platform for all assets". Now offers derivatives, prediction markets, and ~10,000 US equity tickers.

b. Users increasingly cross-trade crypto with commodities and stocks. Q4 derivatives volume and revenue hit records.

c. Echo acquisition aims to tokenize private equity; engaging SEC on compliant tokenized equities.

2. Stablecoin & Payments

a. USDC custody at all-time high, supporting $75bn market cap.

b. "AI agents will default to stablecoin payments". Bots already settling via Base chain (cost <1¢, instant).

c. 2026 focus: Expand utility via deeper payment platform integration.

3. On-chain Ecosystem

a. Base becoming "home" for AI on-chain activity with rising volume.

b. 2026 plan: More DeFi features in main app to boost self-custody adoption.

4. Institutional Services

a. Custodies ~12% of global crypto assets (more than next 4 competitors combined).

b. Partners include 5 G-SIBs and 150 govt agencies with strong stickiness.

2.2 Q&A

Q: CLARITY Act progress - any breakthroughs?

A: Optimistic about material progress in coming months. Senate and agencies making good progress. Industry united on core demands - a win-win for banks, crypto firms and citizens.

Focus remains on customer priorities: preserving crypto advantages while ensuring fair competition. Given GENIUS Act passed just 6 months ago, we're ensuring no conflicts with existing laws. Confident in positive outcome.

Q: Base's contribution to 2026 subscription revenue?

A: Clarification: Base monetization has direct/indirect paths. Sequencer fees go to "other trading revenue", not subscriptions.

Indirectly, Base powers full-stack products (e.g. USDC activity drives interest income). No specific 2026 target, but goal is attracting quality users/developers.

Q: Developer incentives?

A: Multiple approaches: Base Grants funding, improved toolkits (especially for agent wallets), and potential Base token. Helping devs grow across payments, trading and DeFi.

Q: Most exciting underappreciated opportunities?

A: Two standouts: 1) Everything Exchange's vision for 24/7 global transparent trading. Goal is tokenizing all tradable assets to democratize access.

2) Stablecoin payments - still early stage. Global payments follow least resistance - stablecoins dominate on speed/cost/coverage. Just 0.5% of GDP is on-chain today; could reach 10-20% in 10 years.

Q: Everything Exchange monetization timeline?

A: Diversification remains core. 2026 focus: expanding tradable assets. Derivatives leading growth post-options integration. Prediction markets and equities launched recently - will share details after full quarter.

12 products now generate >$100mn annually (6 over $250mn). Flywheel: more assets → more user retention → more monetization.

Q: Would CLARITY Act hurt USDC revenue if rewards banned?

A: No. Senate draft discusses reward limits vs. House bipartisan version. Ironically, ban would boost our margins as we currently rebate most Circle economics to users. But we oppose this - regulated stablecoins need global competitiveness.

Q: Buybacks/M&A in downturn?

A: Strong $11bn cash position. Repurchased $1.7bn (8.2mn shares) from Q4 2025-Feb 10 2026. 2025 saw 10 deals including Deribit (largest crypto acquisition). Will continue Bitcoin accumulation, buybacks and opportunistic M&A.

Q: Prediction markets adoption?

A: Fully launched 2 weeks ago - early but strong interest. Super Bowl drove first-time usage. Partnered with Kalshi (non-exclusive) but could build own platform.

Q: Crypto winter indicators?

A: Avoid predictions. Actually "enjoy" downturns for focused building and cheap Bitcoin/stock buys. Current metrics healthy - users net buying. Volatility more psychological than fundamental.

Q: 2026 spend prioritization?

A: 2025 was heavy investment year (marketing, USDC rewards, M&A costs). 2026 more cautious - Q1 opex flat. Will stay flexible adjusting to market conditions.

Q: Yesterday's trading halt - technical or systemic?

A: Isolated technical issue (retail/Prime only) unrelated to volume/market. Resolved quickly. Ongoing infrastructure upgrades improve resilience.

Q: Everything Exchange customer acquisition?

A: "Asset accumulation flywheel": Trust → custody → multiple products → higher retention. Crypto upgrades global finance - better services drive asset growth.

Q: 2026 M&A focus?

A: 2025 saw 10 deals accelerating roadmap. 2026 priorities: Everything Exchange capabilities, on-chain infrastructure, stablecoin/payments.

Q: Base's value amid L2 competition?

A: Base leads as "universal tool" - payments, trading, DeFi at L1 security + L2 speed. Adding privacy features and exploring token to boost ecosystem.

Q: Stablecoin growth drivers?

A: Recent pause due to: 1) Risk-off reducing speculative activity. 2) Shift from reserves to higher-frequency payments/remittances.

2026 optimism from: Deeper product integration and GENIUS Act adoption (150 companies onboarded in 3 months). US regulated stablecoins must stay competitive globally via rewards.

Q: USDC balances update?

A: No Jan/Feb 2026 data. Refer to shareholder letter for YE 2025 details.

Q: Fee compression from Simple to Advanced/Coinbase One?

A: More volume shifting to Advanced/One. Members get low/zero fees but we earn spreads. No timeline but One membership growth is key focus.

Q: USDC commercialization timeline?

A: Focused on building payment verticals. Competing with Circle in some areas. 2026 goal: Make Base's USDC the best for biz payments. Revenue lags adoption curve.

Q: Retail trader activity?

A: Historically HODL in downturns, trade more in high volatility. Current active retail users net buying dips. Diversification (stocks, derivatives etc.) reduces cycle dependence.

<End>

Disclosures:Dolphin Research Disclaimer