Valuation analysis

- P/E

- Price

- High

- Median

- Low

- P/B

- Price

- High

- Median

- Low

- P/S

- Price

- High

- Median

- Low

- Dividend Yield

- Price

- High

- Median

- Low

Institutional View & Shareholder

Analyst Ratings

- Price--

- Highest--

- Lowest--

$Ford Motor(F.US) announced it is taking a massive $19.5B write down of its EV assets, in a strategic shift away from pure EVs and toward extended range hybrids. The write down was the latest admissi...

1209 | Dolphin Research Focus: 🐬 Macro/Industry 1) Hong Kong Exchanges and Clearing Ltd. (HKEX) announced the HKEX Tech 100 Index, tracking the 100 largest Southbound Stock Connect-eligible tech name...

......Prices of the electronic material, CCL (copper clad laminate) are on the rise in step with surging copper prices, media report, with Nan Ya Plastics hiking prices 8% and rivals Taiwan Union, ITEQ Corp...

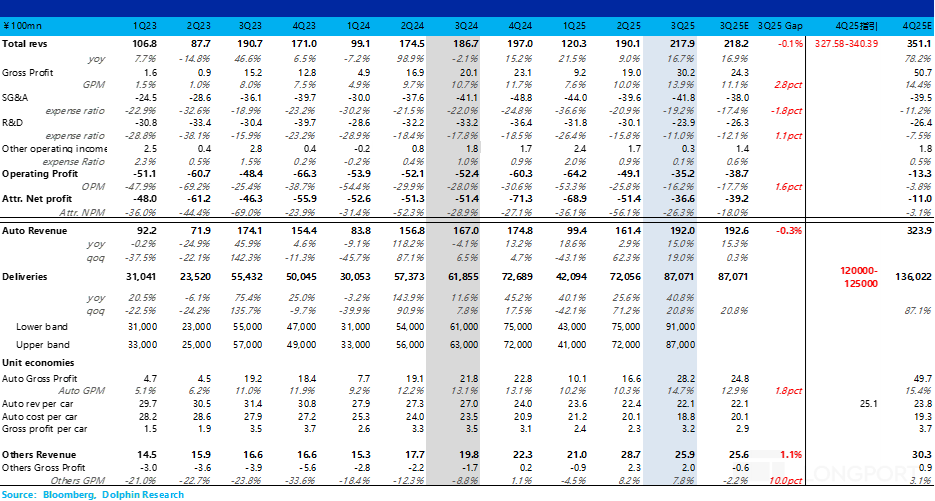

Nio (3Q25 Minutes): Expects 20% vehicle gross margin in 2026, achieving full-year Non-GAAP profitability

Confident in achieving quarterly breakeven in the fourth quarter

Ali Qianwen surpasses ten million downloads; Hang Seng Index adjusts, Leapmotor and Hesai surge|Today's Important News Recap

1124 | Dolphin Research Focus: 🐬 Macro/Industry 1. On November 21st, Hang Seng Indexes Company announced the results of its quarterly review, with the changes to be implemented after the market close...