Valuation analysis

- P/E

- Price

- High

- Median

- Low

- P/B

- Price

- High

- Median

- Low

- P/S

- Price

- High

- Median

- Low

- Dividend Yield

- Price

- High

- Median

- Low

Institutional View & Shareholder

Analyst Ratings

- Price--

- Highest--

- Lowest--

BOE Technology Group Co., Ltd. (000725.SZ) released its financial report for the third quarter of 2025 (as of September 2025) after the A-share market closed on the evening of October 30, 2025, Beijin...

The US-China meeting ends with market volatility; Google and Meta experience 'two different worlds' after hours | Today's Important News Recap

1030 |Dolphin Research Focus: 🐬 Macro/Industry 1. On October 29th, Eastern Time, the Federal Reserve announced its second rate cut of the year by 25 basis points, lowering the interest rate range to ...

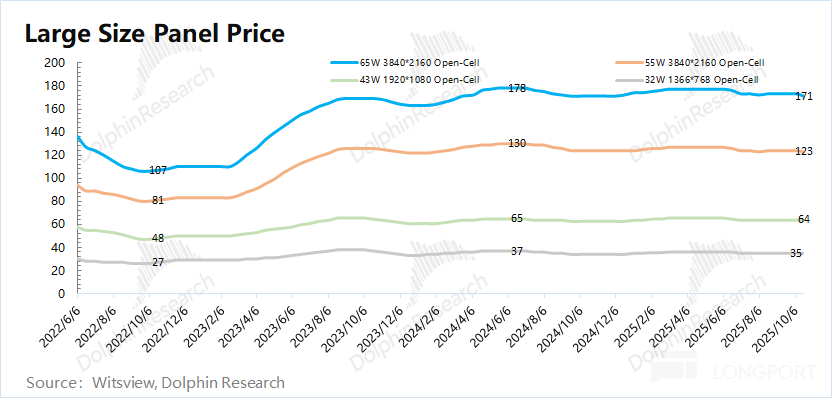

BOE: Core business slightly exceeds the breakeven point, when will price increases 'come to the rescue' again?

BOE Technology Group Co., Ltd. (000725.SZ) released its Q2 and mid-year financial report for 2025 (up to June 2025) after the A-share market closed on the evening of August 27, 2025, Beijing time. The...

BOE (000725.SZ) released its 2024 annual financial report (as of December 2024) after the A-share market close on April 21, 2025 Beijing time. Key highlights are as follows: 1. Overall performance: Bo......

Once again, it falls back to the breakeven line