Company Encyclopedia

View More

BYD COMPANY

01211.HK

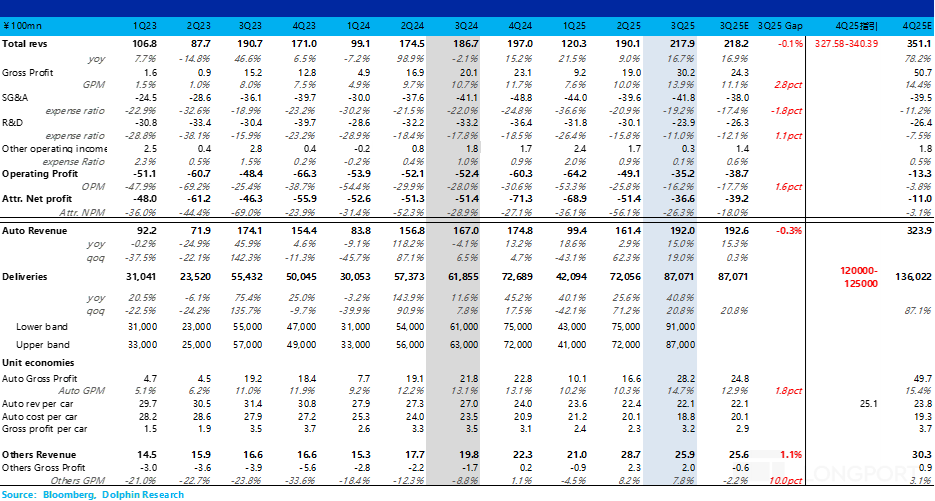

BYD Company Limited, together with its subsidiaries, engages in automobiles and batteries business in the People’s Republic of China, Hong Kong, Macau, Taiwan, and internationally. It operates in two segments, Mobile Handset Components, Assembly Service and Other Products; and Automobiles and Related Products and Other Products. The Mobile Handset Components, Assembly Service and Other Products segment manufactures and sells mobile handset components, such as housings and electronic components; and offers assembly services. The Automobiles and Related Products and Other Products segment is involved in the manufacturing and sale of automobiles, and auto-related molds and components; rail transport and related business; and provision of automobile leasing and after sales services, automobile power batteries, lithium-ion batteries, photovoltaic, and iron battery products.

2.208 T

01211.HKMarket value -Rank by Market Cap -/-

Valuation analysis

P/E

1Y

3Y

5Y

10Y

P/E

-

Industry Ranking

-/-

- P/E

- Price

- High

- Median

- Low

P/B

1Y

3Y

5Y

10Y

P/B

-

Industry Ranking

-/-

- P/B

- Price

- High

- Median

- Low

P/S

1Y

3Y

5Y

10Y

P/S

-

Industry Ranking

-/-

- P/S

- Price

- High

- Median

- Low

Dividend Yield

1Y

3Y

5Y

10Y

Dividend Yield

-

Industry Ranking

-/-

- Dividend Yield

- Price

- High

- Median

- Low

Institutional View & Shareholder

Analyst Ratings

- Price--

- Highest--

- Lowest--

News

View More

Posts

View More

$BYD COMPANY(01211.HK) :Month of November ,Tesla sold 3,784 EVs in the UK , while BYD sold 3,217 vehicles, including hybrids. Given this, is it a good time to buy shares in BYD or Tesla?

I choose BYD b...

Accumulate BYD. Not Tesla

Single Choice

- Yes

- No

- Don’t know

Why does Li Auto want to divert its energy to making glasses? Glasses seem more like an AI label to make up for the sales decline, including the previously independent app of Li Auto's assistant, whic...

Reshaping the Global Industrial Landscape: In-Depth Strategic Evaluation Report of China's Top 10 Leading Enterprises Benchmarking Against Global Giants (2024-2025)

Why are there two Alibaba icons? 😂, I don't know either, Gemini, do you have any special thoughts? Executive Summary: A Historic Leap from Follower to Definer In the 2024-2025 cycle, as the global ec...

Nio (3Q25 Minutes): Expects 20% vehicle gross margin in 2026, achieving full-year Non-GAAP profitability

Confident in achieving quarterly breakeven in the fourth quarter

The pace of new energy transition continues to accelerate