Recently watching $BYD ELECTRONIC(00285.HK) and $LK TECH(00558.HK) this trend, intraday fluctuations, the "death cross" made me want to sell, but then it rose a tiny bit.

On the other hand, $FIT HON TE.........

Reshaping the Global Industrial Landscape: In-Depth Strategic Evaluation Report of China's Top 10 Leading Enterprises Benchmarking Against Global Giants (2024-2025)

Why are there two Alibaba icons? 😂, I don't know either, Gemini, do you have any special thoughts? Executive Summary: A Historic Leap from Follower to Definer In the 2024-2025 cycle, as the global ec...

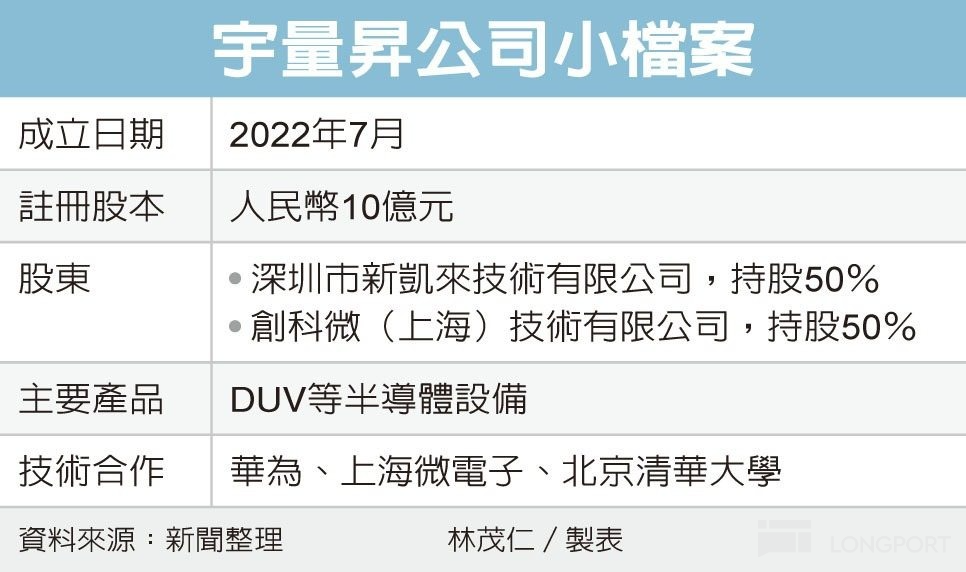

Originally, in the mid-September Madrid negotiations, the U.S.-China talks resolved the long-standing major conflict over TikTok. However, Trump's emotional essay on a 100% tariff seemed to have set b...

$AUX ELECTRIC(02580.HK) This is cost-effective.

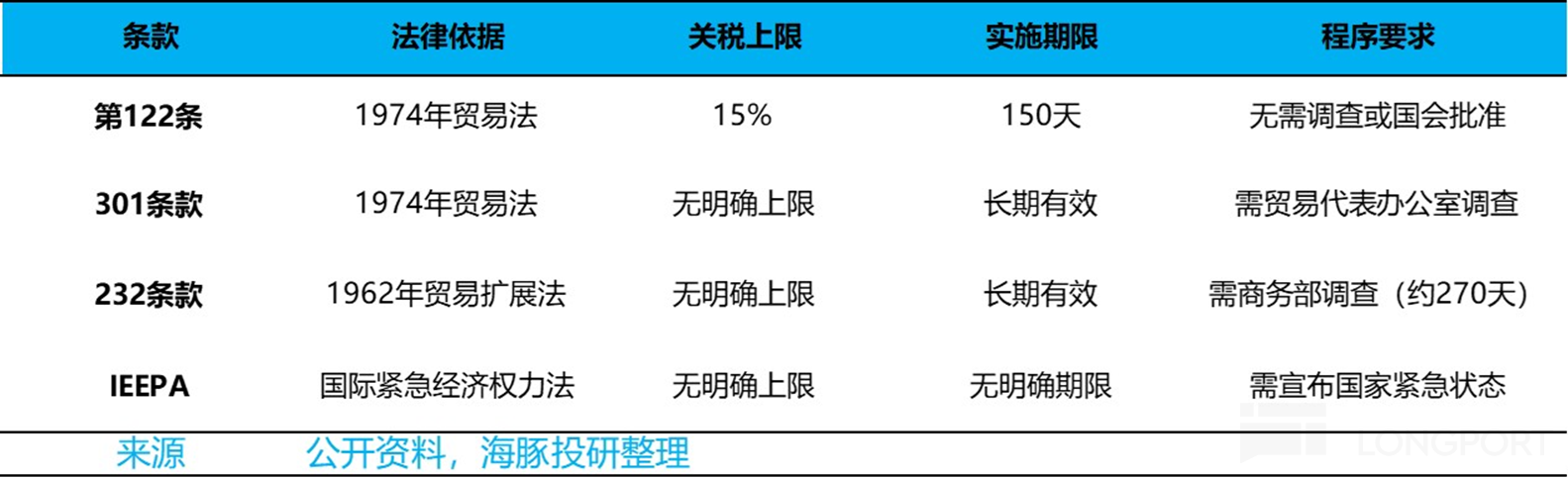

0331|Dolphin Research focuses on: 🐬 Macro/Industry 1. China's official manufacturing PMI for March is 50.5, an increase of 0.3 percentage points from last month, with data generally meeting expectati.........