These consumer sector stocks are really laid back: Nongfu Spring, Mengniu, and Anta are as stable as a rock, with gains relying solely on a snail's pace, and occasional news stimulation barely makes a...

$INSILICO(03696.HK) first all in this, then top up $FOREST CABIN(02657.HK)

$Alibaba(BABA.US) released its Q2 FY2026 results during US pre-market trading on 25 November. The two key market concerns this quarter centred on investments driven by its food delivery business and t...

The meeting between China and the U.S. is approaching; focus on tonight's Federal Reserve interest rate decision | Today's Important News Recap

1029 | Dolphin Research Key Focus: 🐬 Macro/Industry 1. On October 28th, Eastern US time, the Federal Reserve began its two-day FOMC meeting, with the latest interest rate decision to be announced on ...

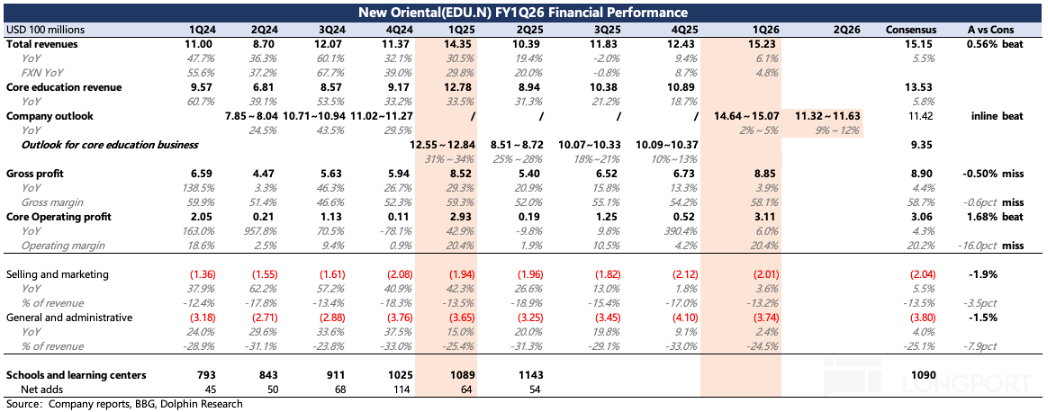

The following is a summary compiled by Dolphin Research regarding the FY26 Q1 earnings call minutes of $New Oriental EDU & Tech(EDU.US). For an interpretation of the financial report, please refer to ...