Valuation analysis

- P/E

- Price

- High

- Median

- Low

- P/B

- Price

- High

- Median

- Low

- P/S

- Price

- High

- Median

- Low

- Dividend Yield

- Price

- High

- Median

- Low

Institutional View & Shareholder

Analyst Ratings

- Price--

- Highest--

- Lowest--

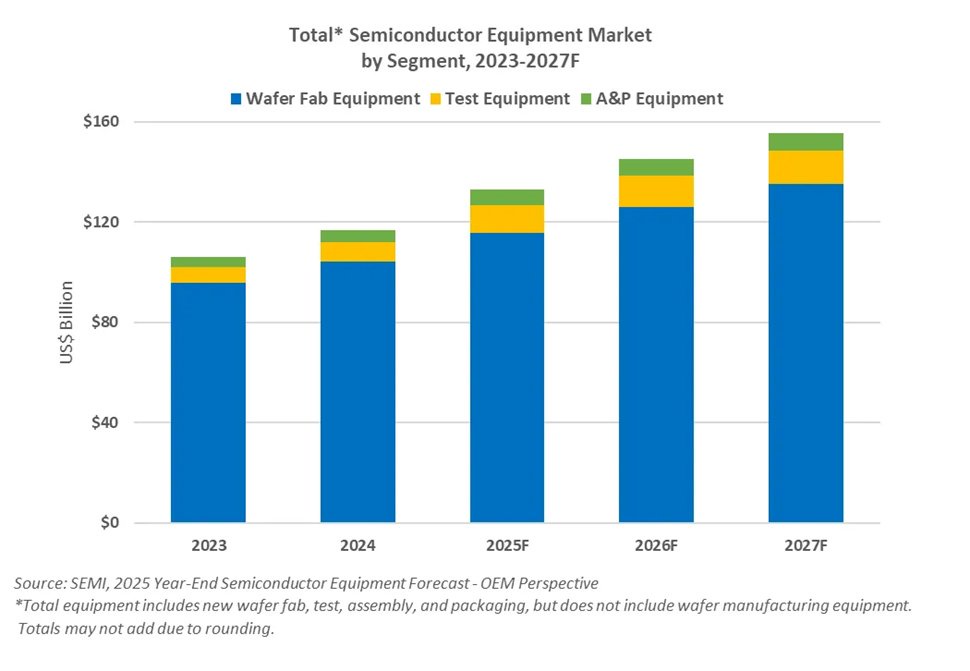

SEMI: Global semiconductor equipment sales will hit US$145 billion in 2026, after rising 13.7% to a record high $133 B this year, driven by AI-related spending in leading-edge logic and memory chip ma...

..........................................TSMC mass production of 2nm chips heralds a new era of chip manufacturing marked by a fundamental change in basic transistor structure to new GAA transistors – from FinFETs – that requires an upgrade ........................

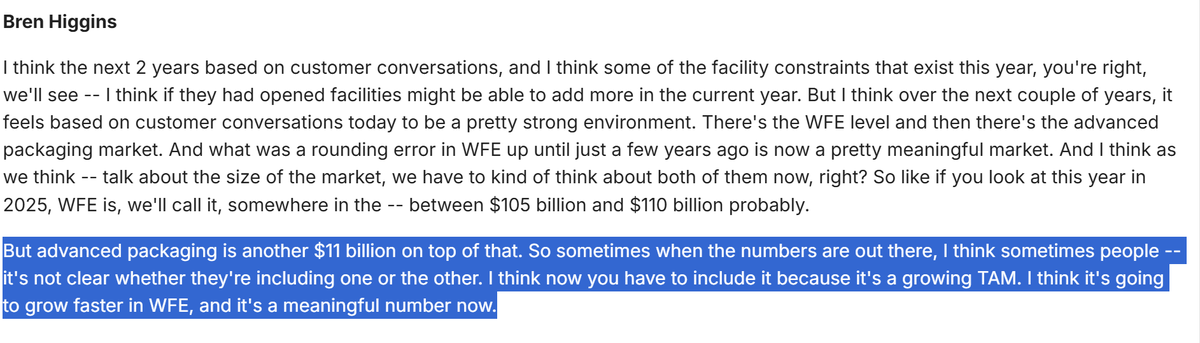

Advanced packaging has become a meaningful number in WFE (up to 9-10% in CY25 vs 1-2% in CY21). $11B in CY25 from $3-$4B in CY21. KLA's AP revenue will grow by 70% to $925M in CY25 from $500M+ in CY24...

TSMC’s certainty over capacity needs now extends 2-years out instead of one, media report, as the chip giant now engages contractors for new chip fabs or packaging plants 2-years ahead of time instead.....................

TSMC plans to build three more 2nm fabs in Tainan, south Taiwan, on top of the seven already planned for Hsinchu and Kaohsiung, media report, as it scrambles to keep up with runaway demand for AI chip.................................