Depth of Market Introduction

What is Depth of Market(DOM)?

Depth of Market (DOM) refers to the number and total volume of orders placed by buyers and sellers at different price levels in a market. It reflects the liquidity of the market and the state of the order book, and is one of the important indicators for understanding market conditions. DOM is usually presented in the form of an Order Book, and by observing real-time buying and selling situations, it assesses the possible direction of prices.

In terms of trading style, Depth of Market (DOM) is a tool suitable for intraday trading.

Intraday trading is a trading method with a short holding period, without overnight positions, profiting from rapid price fluctuations. If a trader does not profit immediately after entering the market, they are prepared to exit quickly. Unlike long-term investors, intraday traders are less concerned with the intrinsic value of securities and focus more on obtaining immediate profits from market volatility. Intraday traders use various intraday strategies, such as trend trading strategies, breakout trading strategies, momentum trading strategies, moving average strategies, and news trading strategies.

How to use Depth of Market (DOM) for intraday trading?

Depth of Market (DOM) can be used in various ways for intraday trading.

Firstly, it can be used to identify potential support and resistance levels. If there are a large number of orders at a specific price level, that price is likely to become a support or resistance level in the short term.

Secondly, Depth of Market (DOM) can be used to identify imbalances in the market. If there are more buy orders than sell orders at a specific price, it may indicate that the market has a bullish attitude towards the security. Conversely, if there are more sell orders than buy orders, it may indicate that the market has a bearish attitude towards the security.

Additionally, Depth of Market (DOM) can be used to help assess the liquidity of a particular security. If a stock has very high liquidity, then there will be a large number of buy and sell orders. Buyers can purchase a large amount of stock without causing significant price fluctuations. Conversely, if a stock does not have strong liquidity, trading will not be as frequent. Purchasing a large amount of stock may significantly affect the stock price.

The Depth of Market (DOM) feature provided by Longbridge desktop also has powerful trading functions in addition to buying and selling order data. By clicking on the corresponding price to submit orders, it supports dragging the price to modify orders, and supports profit-taking and stop-loss additional orders, as well as batch order cancellation functions, enhancing the trading experience and efficiency of intraday traders.

However, when using Depth of Market (DOM) for intraday trading, there are some things to keep in mind. The most important thing is to remember that DOM is constantly changing and therefore needs to be monitored in real-time. Secondly, DOM should ideally be used in conjunction with other technical indicators, and it is recommended to use it together with chart trading to fully understand market dynamics.

Depth of Market (DOM) is a valuable resource for any intraday trader who wants to gain an advantage in the market. By monitoring and understanding order flow deviations, and combining your understanding of DOM with technical analysis and other resources, you can increase the likelihood of profitable trades.

How to use Depth of Market (DOM) ?

Under the flexible custom layout provided by Longbridge Pro, you can find the DOM feature in the following way.

Function Access

Open the Intraday Trading Panel

Click on a new tab, select the adaptive layout, and click on 'Intraday Trading'. This panel combines chart trading, depth of market, and orders of the day features and is ready to use directly.

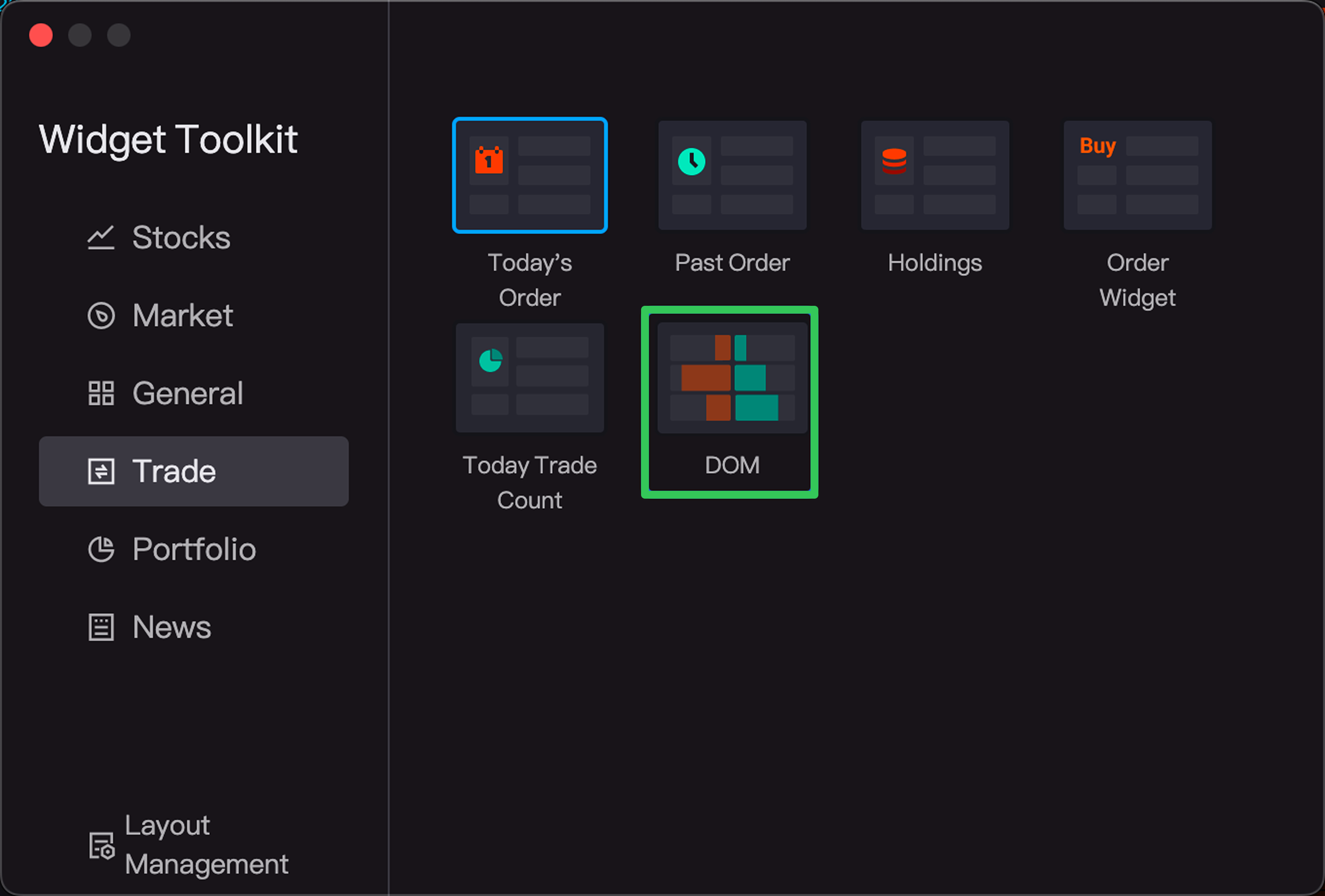

In the Component Toolbox, add "Depth of Market"

Alternatively, from the Component Toolbox, select "Trading" - "Depth of Market", and then drag the component directly onto the current panel for use.

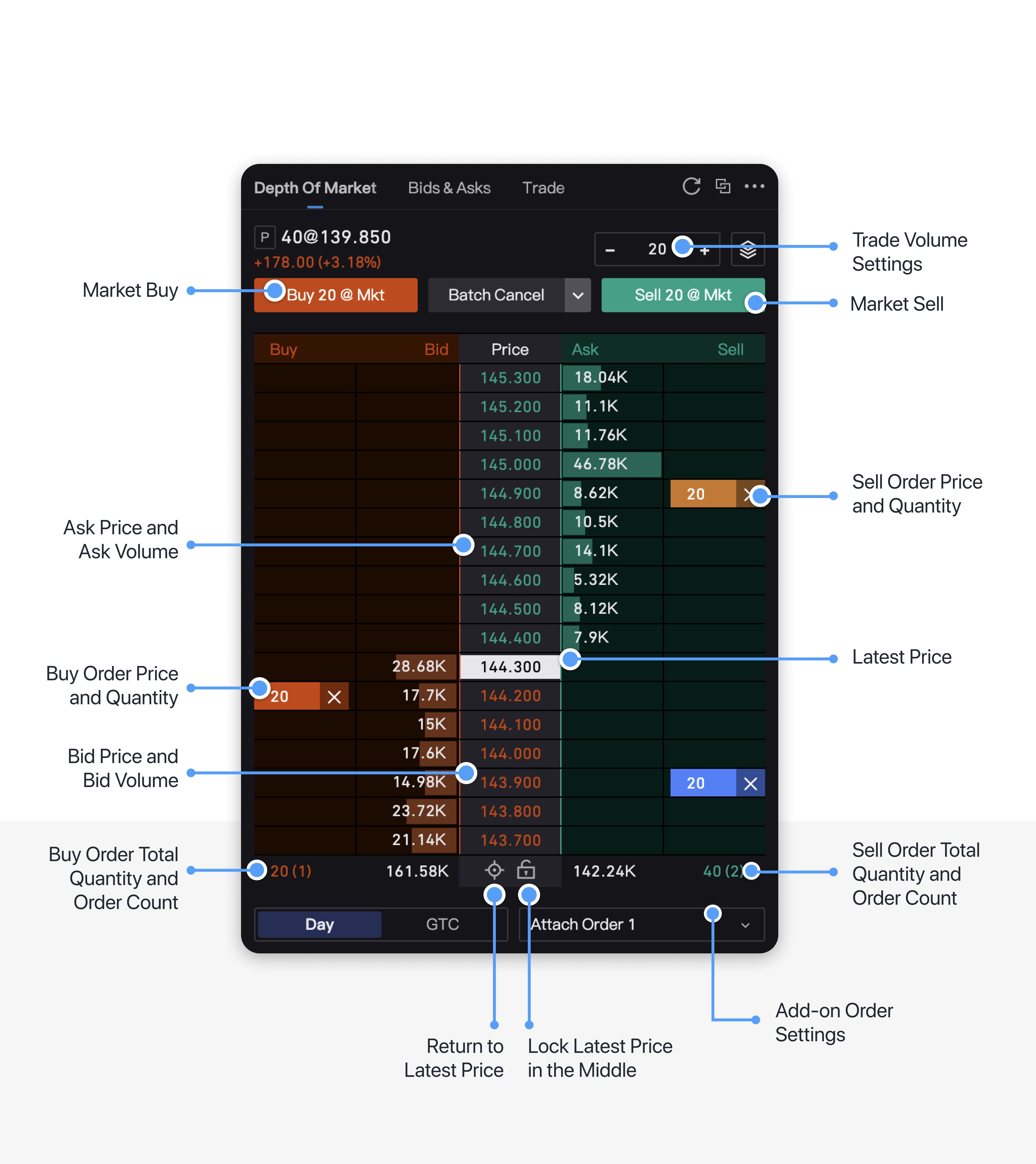

Depth of Market (DOM) Interface Explanation

Depth of Market (DOM) Trading

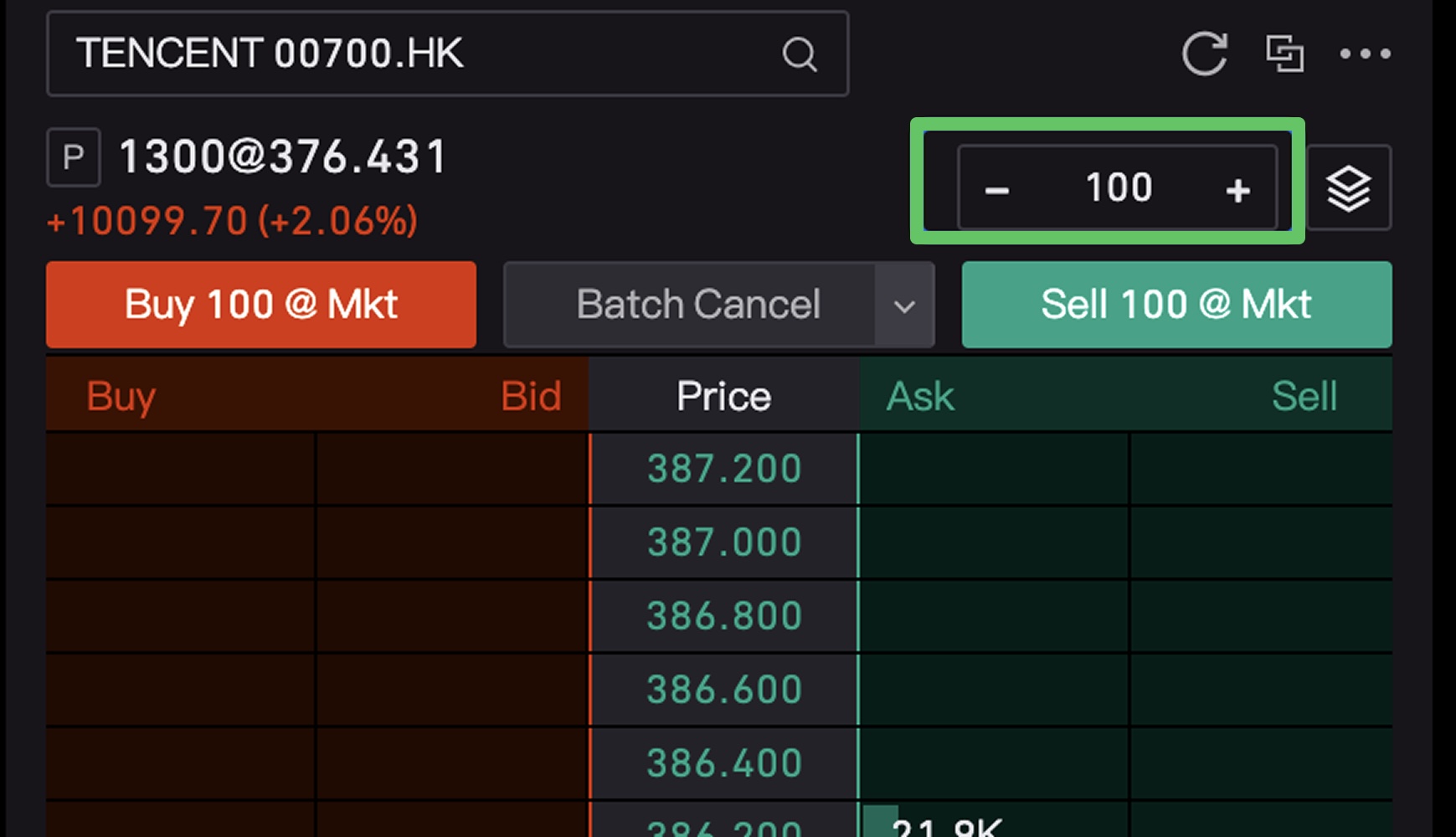

1. Set Trade Volume

Enter the trade volume at the top

2. Trade

You can click to place an order directly at the desired price on the market depth board. After placing the order, the corresponding order quantity will be displayed.

3. Modify Order

If you need to modify an order, you can directly drag the corresponding order to make changes; you can also drag take-profit or stop-loss orders to modify them.

4. Cancel Order

(1)Individual Order Cancellation

For orders that have been submitted, you can directly click on the "X" next to the order to cancel it.

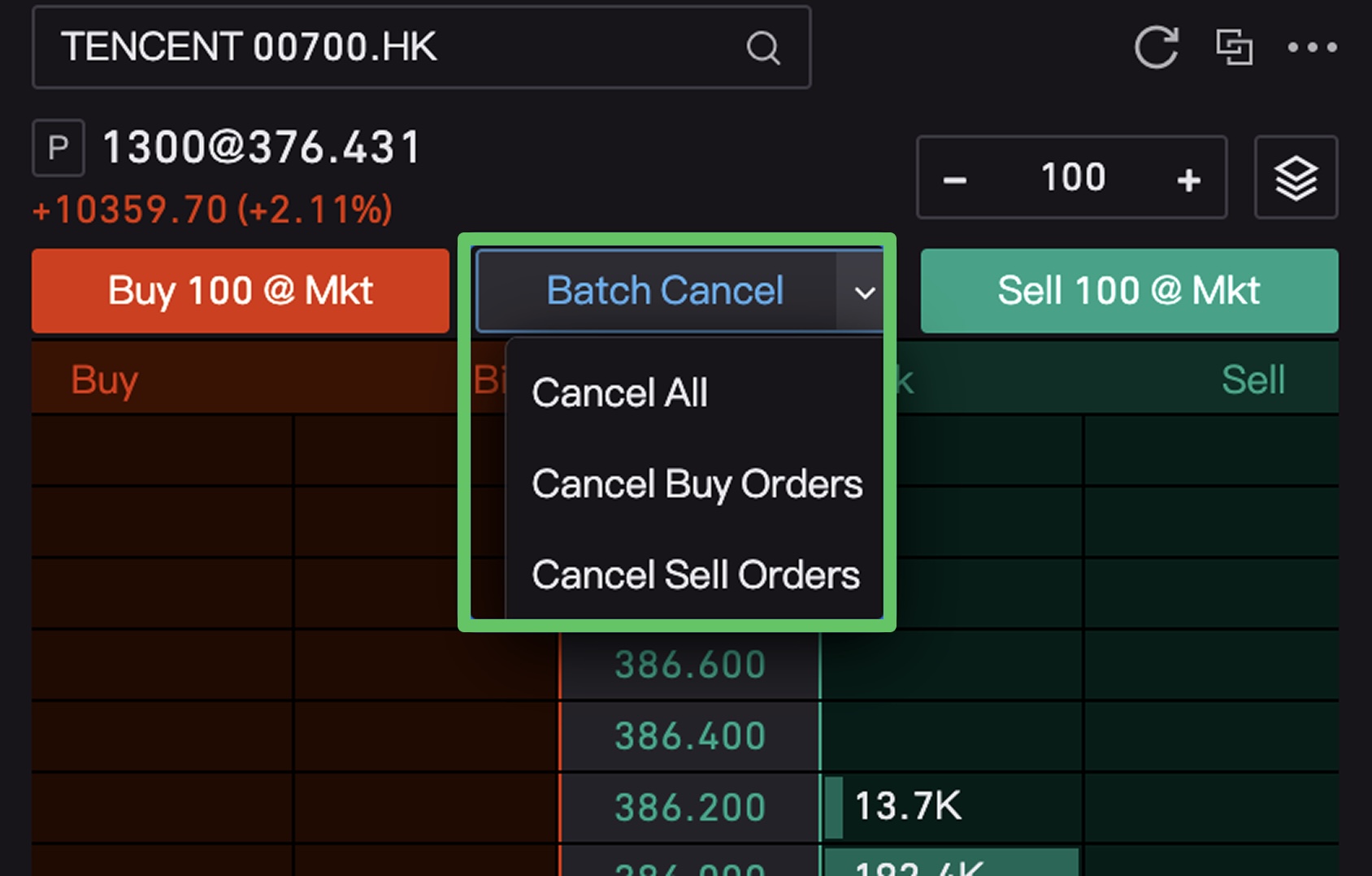

(2)Batch Cancel

Alternatively, you can click on the header to quickly batch cancel orders, including: Cancel All, Cancel Buy Orders, Cancel Sell Orders.

5. Go to Latest Price / Lock Latest Price

If the price fluctuates rapidly during the trading session, the latest price will change quickly. To address this situation, you can set it up as follows:

- Click on 'Go to latest price.' to quickly locate the latest price position.

- Click on 'Latest price fixed in the middle' to fix the latest price in the center for display.

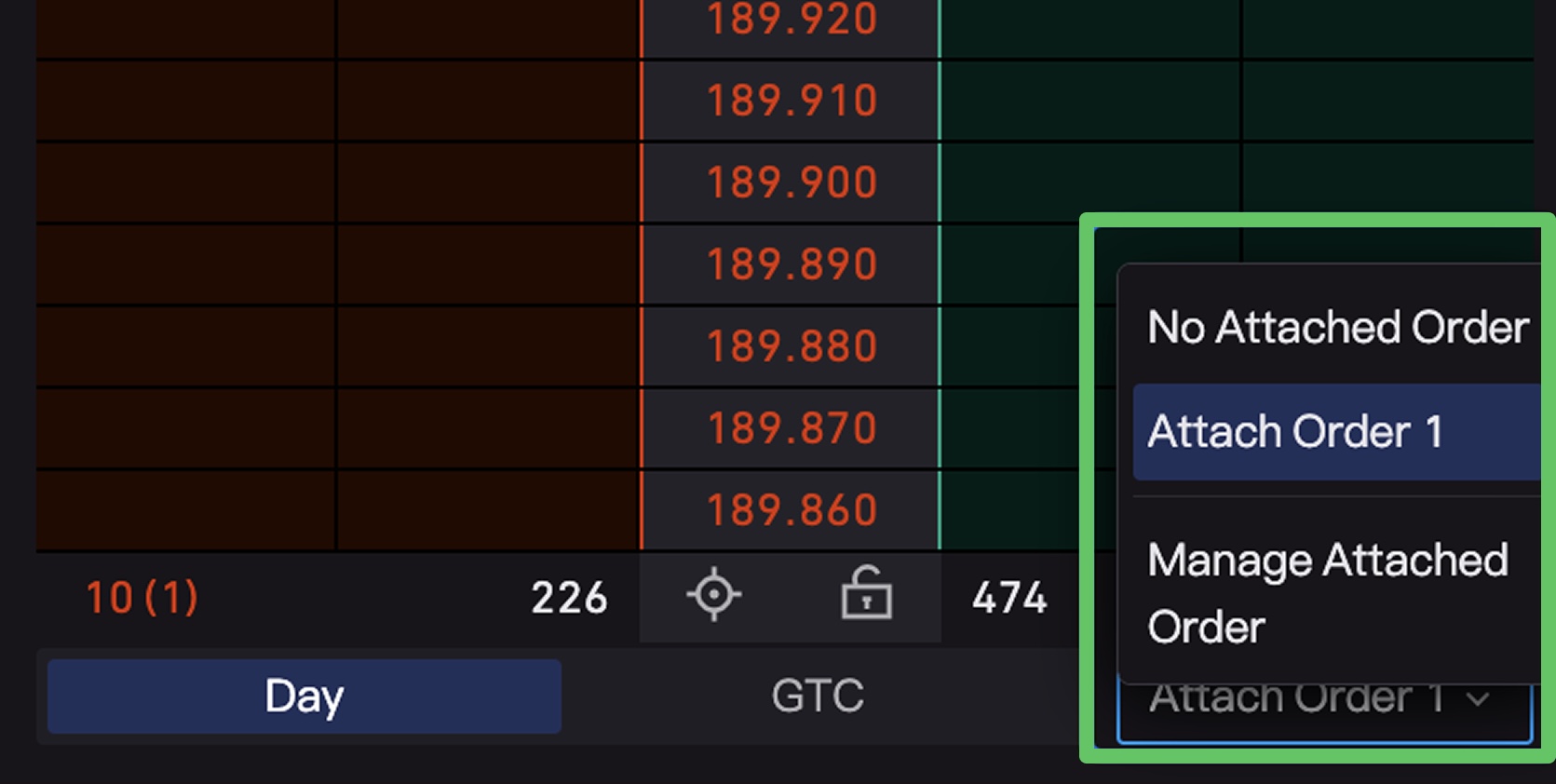

6. Attached Order Settings

(1)By clicking on the attached order settings at the bottom of the ladder trading, you can set take-profit and stop-loss orders, which currently support three types of settings:

- Levels, that is, the levels of take-profit and stop-loss relative to the latest price;

- Spread, that is, the price difference between take-profit and stop-loss relative to the latest price;

- Price, that is, directly set the take-profit trigger price, stop-loss trigger price.

(2)Example: The current latest price is 278.20, the order entry price is 278.00, and the stock price difference is 0.01.

- If you choose levels, with a take-profit of 5 and a stop-loss of 2, then the take-profit price = 278.00 + 5 * 0.01 = 278.05, and the stop-loss price = 278.00 - 2 * 0.01 = 277.98;

- If you choose price difference, with a take-profit of 5 and a stop-loss of 2, then the take-profit price = 278.00 + 5 = 283, and the stop-loss price = 278.00 - 2 = 276;

- If you choose price, with a take-profit of 270 and a stop-loss of 285, then the take-profit price = 270, and the stop-loss price = 285.

(3) After setting the take-profit and stop-loss prices, when placing an order, you can directly check the box for the attached orders you need to set.

7. View Position Quantity and Cost

You can view the current stock's position quantity, holding cost, and corresponding profit and loss information at the top.

Other Questions?

Q1: Does not having advanced market data permissions affect trading?

Without advanced market data permissions, you will be unable to view order book data and will only see price fields. While you can still place orders directly, this may impact the accuracy of trading decisions. It is recommended to purchase advanced market data permissions in the "Market Data Store" before using the "Market Depth" feature.

US stocks currently support up to 60-tier market depth, while Hong Kong stocks support a maximum of 10-tier depth. It is recommended to purchase access before use.

Q2: How to Use Market Depth with Chart Trading?

Market Depth displays prices within a limited tier range. When set stop-loss/take-profit levels deviate significantly from the current price, the full range may not be visible within a single screen. Combining Market Depth with chart trading allows clearer visualization of price positions relative to chart patterns, enhancing intuitiveness. See example below: