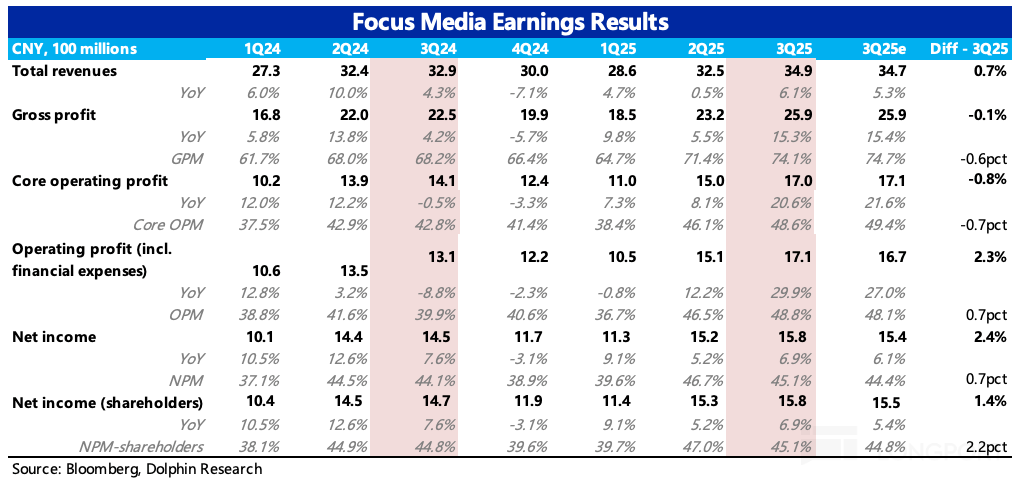

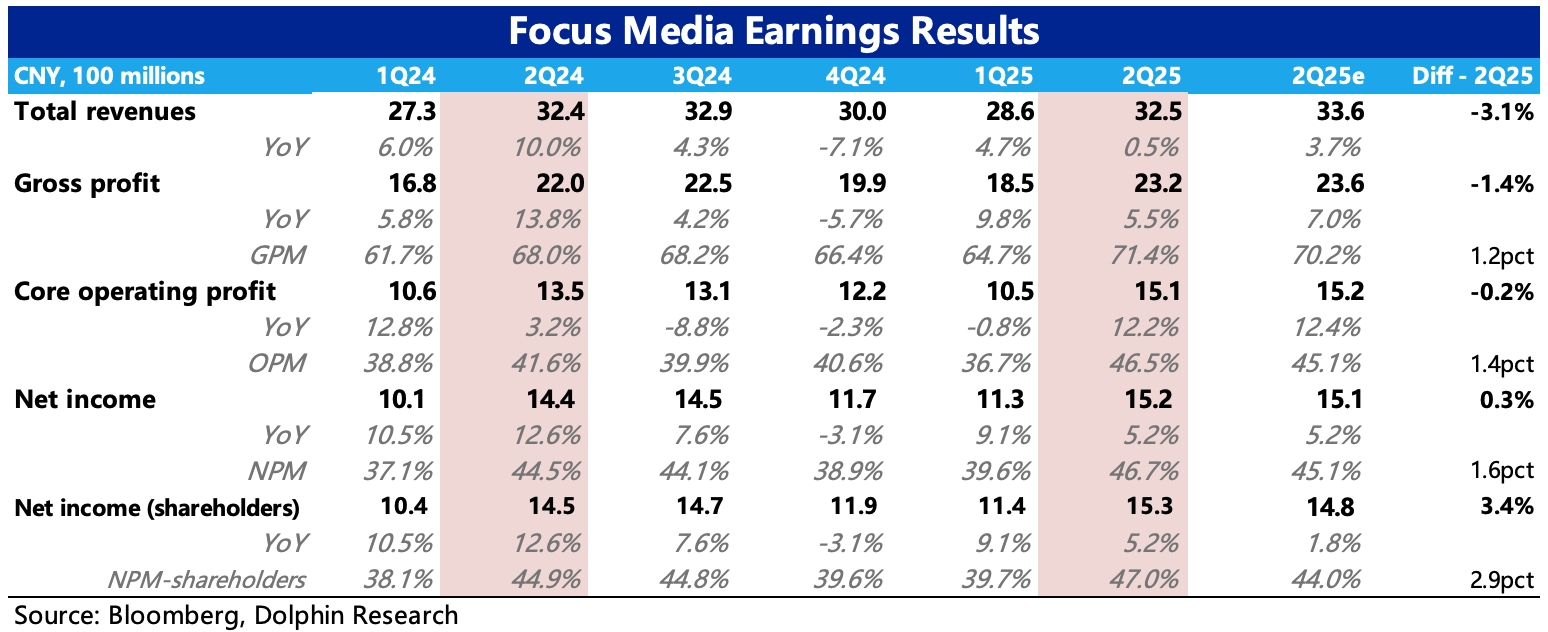

Focus Media 3Q25 Quick Interpretation: Third-quarter performance basically met expectations, with the final net profit beat mainly due to differences in expectations regarding interest, investment income, and other items.

However, Dolphin Research noticed that some institutions slightly adjusted their expectations downward before the financial report (due to poor consumption and additional marketing expenses), so from the perspective of the latest expectation differences, Q3 performance is actually acceptable.

1. Revenue growth of 6.1%: Whether looking at the year-on-year growth rate or the usual seasonal changes, it is a slight recovery, mainly driven by Focus Media's own Alpha in the elevator media field rather than environmental Beta.

Additionally, accounts receivable increased in the third quarter, leading to a decline in turnover rate, which also reflects some environmental pressure.

2. Gross margin increased to 74% quarter-on-quarter: This remains the most impressive aspect of the financial report.

Despite the drag from the consumption environment on the revenue side, the gross margin has continued to approach historical highs, just one step away from the 75% peak in 2017, reflecting Focus Media's competitive advantage in the industry and its strong bargaining power in the supply chain.

Dolphin Research believes that one key logic remains: although New Wave has not yet been formally acquired, from the perspective of customers and property owners, they have already started considering risks, thus enhancing Focus Media's bargaining power. In a poor consumption environment, the main focus is on squeezing the profit margin of property owners.

3. Overall stable expense expenditure: Core operating expenses are basically consistent with revenue changes, stable quarter-on-quarter, but the expense ratio has shrunk by 3 percentage points compared to last year.

The core operating profit margin (revenue - cost - three expenses - business tax) continues to rise, reaching nearly 49%, close to the peak level range.

4. Final net profit attributable to the parent company is 1.58 billion, slightly exceeding the original market expectations, with the expectation difference contributed by non-core business income such as interest and investment income.

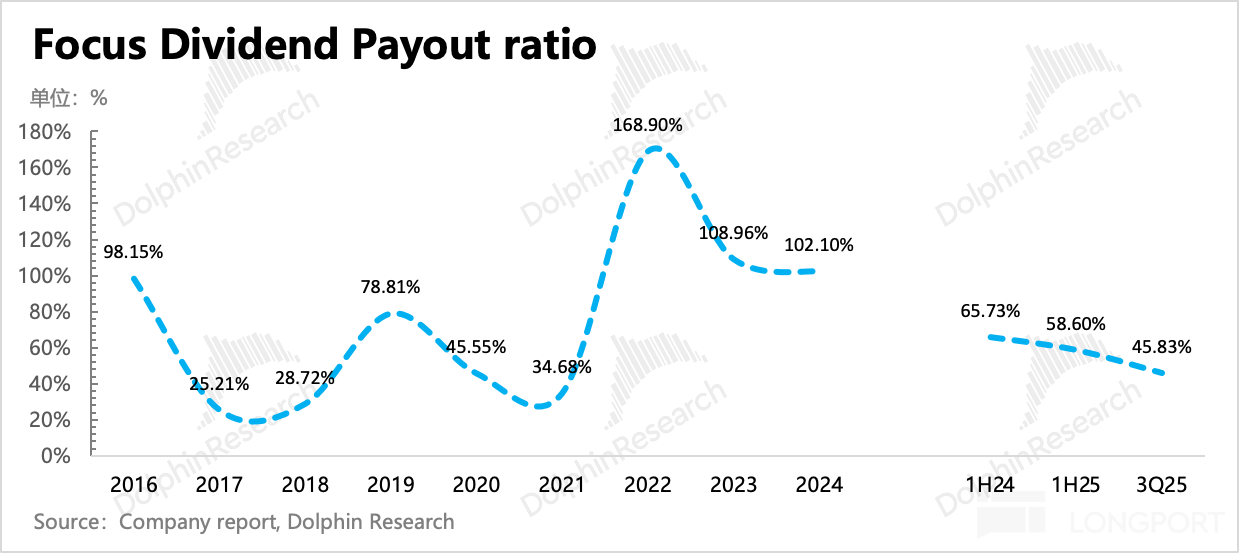

5. Early dividend distribution: This time, it is quite special as the dividend for the second half of the year is distributed in the third quarter instead of waiting until the end of the year, with a total dividend of 722 million yuan, accounting for 46% of the third-quarter net profit attributable to the parent company, which is lower than the first half of the year. As of Q3, the cumulative dividend for this year is 2.1 billion yuan, accounting for 2% of the current market value of 110 billion yuan. $Focus Media(002027.SZ)