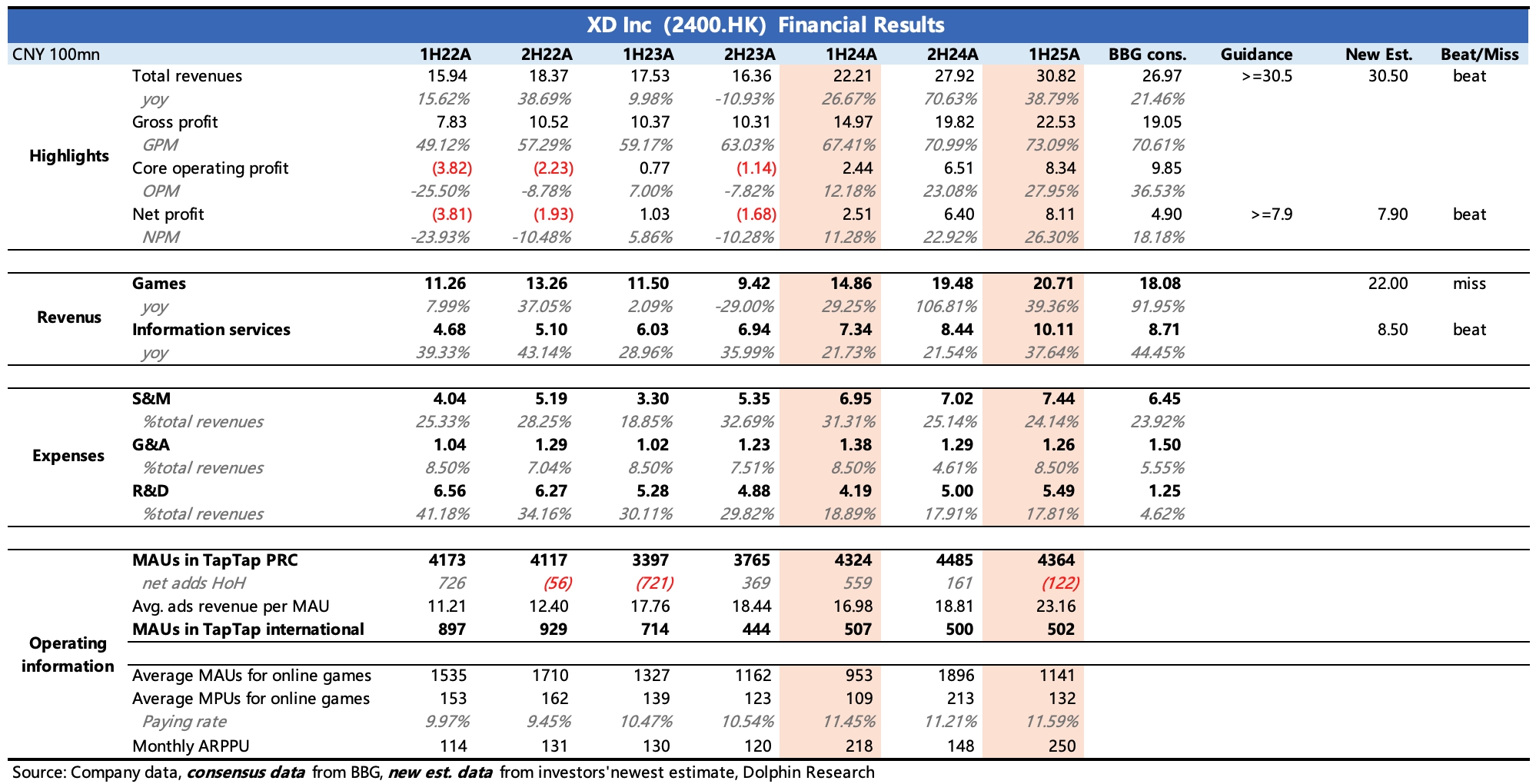

XD Inc. 1H25 Quick Interpretation: The overall performance in the first half slightly exceeded expectations, specifically in TapTap and profitability. (The expectations in the chart are relatively lagging, with significant data deviation. It is recommended to refer to company guidance or the latest expectations from investment banks as excerpted by Dolphin Research.)

1. Acceleration of TapTap Commercialization: Although TapTap's monthly active users showed no fluctuations in the first half, remaining basically flat year-on-year, this may be related to the fact that the games with impressive revenue in the first half were mainly targeted overseas.

However, the advertising revenue per user increased by 36% year-on-year and 23% quarter-on-quarter, reflecting the acceleration of TapTap's commercialization, with the final monetization effect exceeding market expectations.

The main driver behind this is the optimization of the advertising model, which has improved eCPM (according to research information, yoy +15%).

In addition, the first half saw the launch of the TapTap PC version, further promoting the interconnection of multi-platform accounts, encouraging more games to integrate into the TapSDK ecosystem services, providing developers with more comprehensive user data and conversion.

2. High Growth in Games as Expected: The game segment grew by 39% in the first half, with increases in both the number of players and average spending per player. Besides the overseas launch of the new game 'RO Origin Server', 'HeartBeat Town' and the revenue recovery of 'Torchlight' after major adjustments were sources of incremental growth.

However, the final revenue fell short of market expectations. Dolphin Research speculates that this discrepancy may be related to the recognition of revenue on a net basis for some overseas games (such as 'Origin Server') and changes in the ratio of revenue recognition to game revenue.

3. Efficient Operation from Classic IP: Compared to a brand-new mobile game, developing sequels or re-operating classic games can achieve high monetization with low promotion.

Reviewing changes over the past year, Tencent and NetEase have adopted this strategy, not only achieving record-high revenue scales but also raising profitability levels.

For HeartBeat, while games saw high growth in the first half, sales expenses only increased by 7% year-on-year, and excluding personnel expenses, pure promotion expenses even declined by 3.6%.

Moreover, classic games do not overly rely on external channels, naturally guiding players to download and pay on official servers.

This also led to a decrease in channel commission costs for games recognizing revenue on a gross basis in the first half, down by 3 percentage points compared to the same period last year and 1 percentage point compared to the second half of last year.

Finally, core operating costs were 830 million, with a profit margin of 28%, an increase of 5 percentage points quarter-on-quarter. The final net profit was 811 million, slightly exceeding company guidance and market expectations.