Company Encyclopedia

View More

MEITU

01357.HK

Meitu, Inc., an investment holding company, engages in the development and provision of products that streamline the production of photo, video, and design with other AI-powered products in Mainland China and internationally. Its product portfolio includes Meitu app, Wink, DesignKit, QIMI; BeautyCam, Kaipai, WHEE, MeituYunxiu, and MOKI; ecosystem products, such as ZCOOL, ZCOOL HelloRF, ZCOOL Education, ZCOOL Design Service, and RoboNeo; and MiracleVision. The company also provides Meitu PC version, Meitu AI Open Platform, MeituEve, Meidd, and The Meitu Imaging & Vision Lab. In addition, it is involved in the provision of online advertising and other IVAS by offering a portfolio of photo and community apps, as well as information technology services; smart hardware business; and solutions for beauty industry.

6.404 T

01357.HKMarket value -Rank by Market Cap -/-

Valuation analysis

P/E

1Y

3Y

5Y

10Y

P/E

-

Industry Ranking

-/-

- P/E

- Price

- High

- Median

- Low

P/B

1Y

3Y

5Y

10Y

P/B

-

Industry Ranking

-/-

- P/B

- Price

- High

- Median

- Low

P/S

1Y

3Y

5Y

10Y

P/S

-

Industry Ranking

-/-

- P/S

- Price

- High

- Median

- Low

Dividend Yield

1Y

3Y

5Y

10Y

Dividend Yield

-

Industry Ranking

-/-

- Dividend Yield

- Price

- High

- Median

- Low

Institutional View & Shareholder

Analyst Ratings

- Price--

- Highest--

- Lowest--

News

View More

Posts

View More

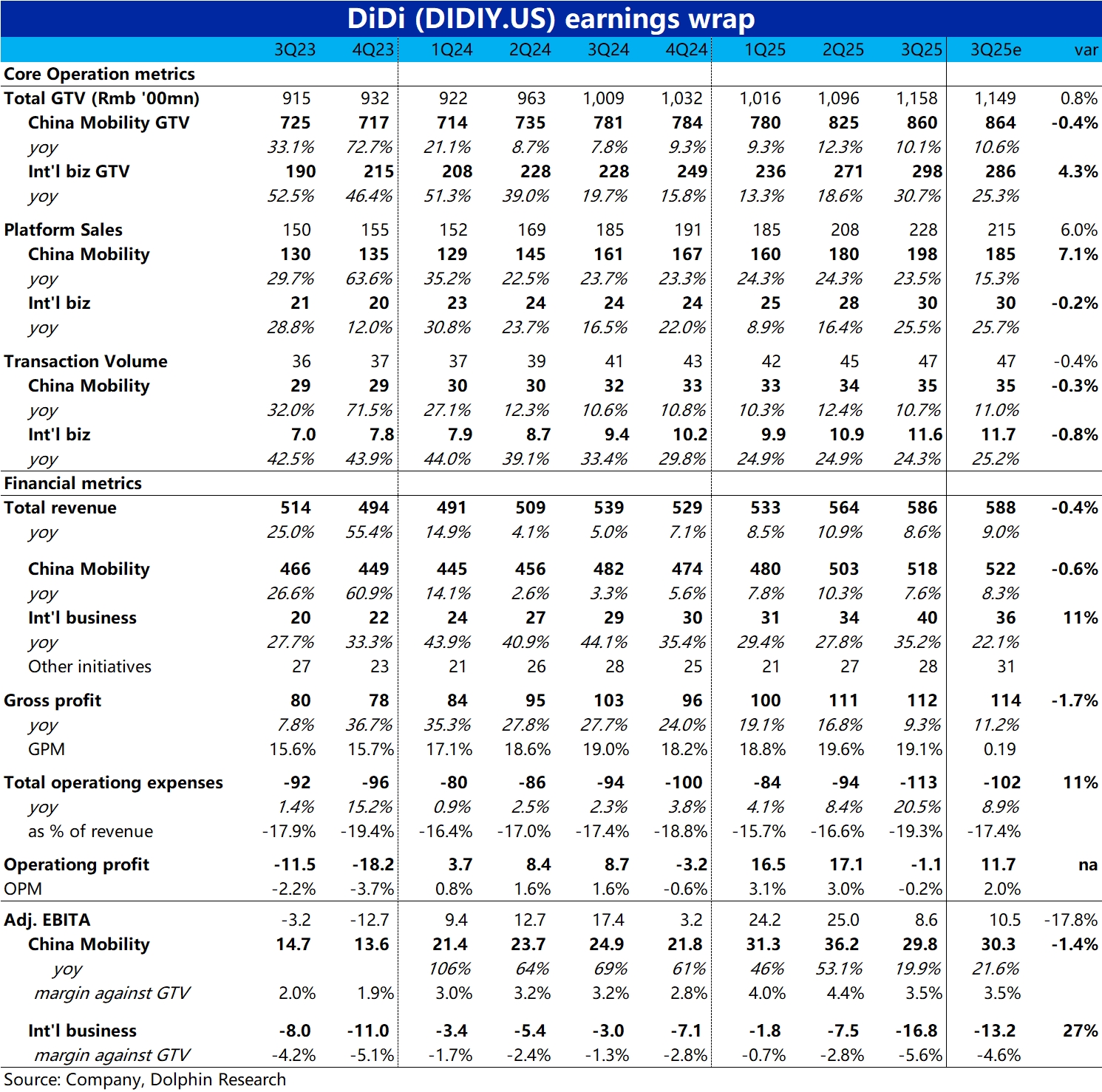

Didi 3Q25 Quick Interpretation: In early November, Didi updated the market with guidance on its 3Q performance, mainly mentioning two issues:

1. The investment in the food delivery business in Brazil ...

$KUAISHOU-W(01024.HK) This should be released by Goldman Sachs. Keling's monthly revenue declined, and the AI concept $MEITU(01357.HK) also retreated.