Valuation analysis

- P/E

- Price

- High

- Median

- Low

- P/B

- Price

- High

- Median

- Low

- P/S

- Price

- High

- Median

- Low

- Dividend Yield

- Price

- High

- Median

- Low

Institutional View & Shareholder

Analyst Ratings

- Price--

- Highest--

- Lowest--

Global Markets Hit by 'Cold Wave'; Google AI Advances in Travel Services Track | Today's Important News Recap

1118 | Dolphin Research Focus: 🐬 Macro 1. Today, both Hong Kong and A-shares collectively declined as the market's expectation for a December rate cut by the Federal Reserve continued to decrease. Ac...

The following are the minutes of the FY25Q3 earnings call for $Trip.com(TCOM.US) organized by Dolphin Research. For an interpretation of the earnings report, please refer to "Trip.com: Awaiting the Re...

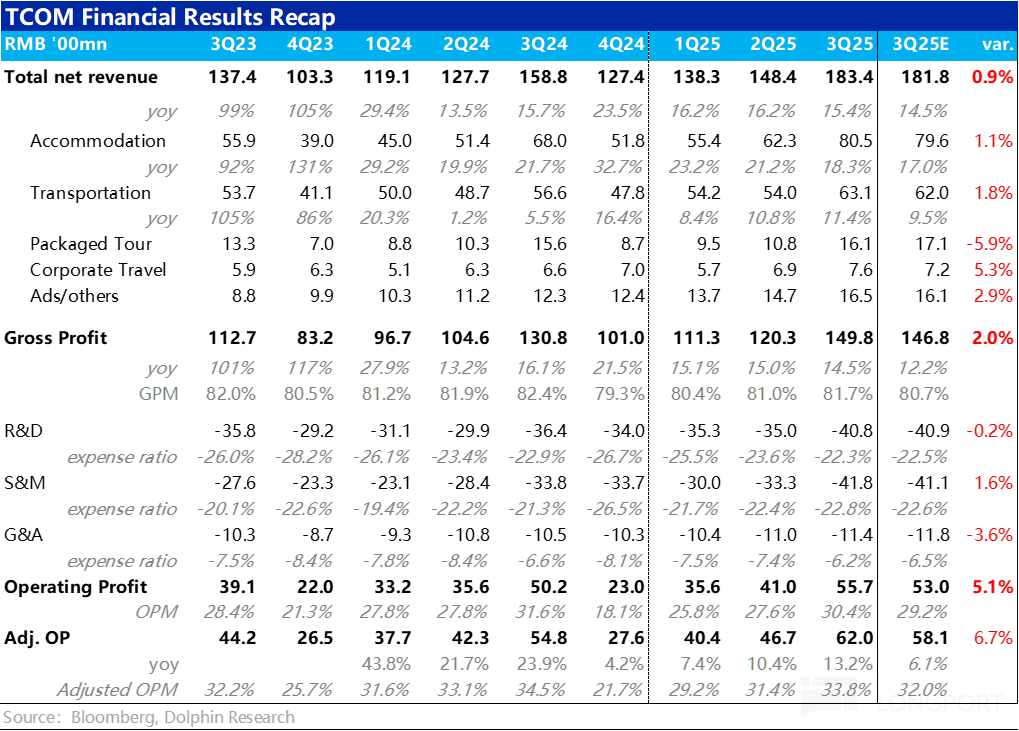

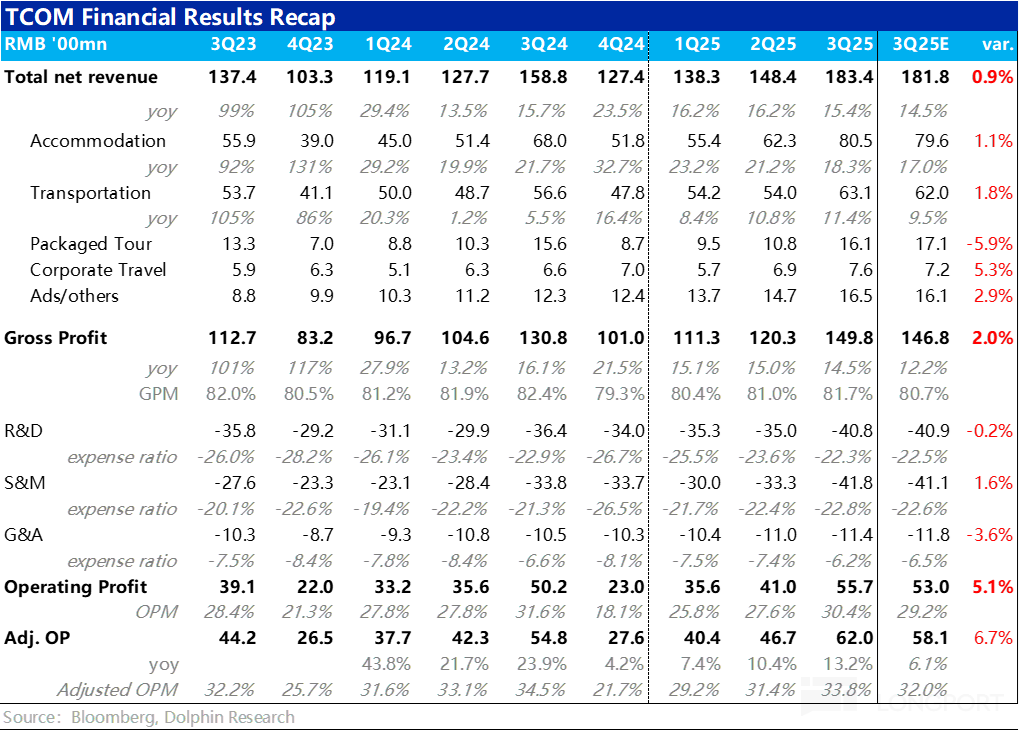

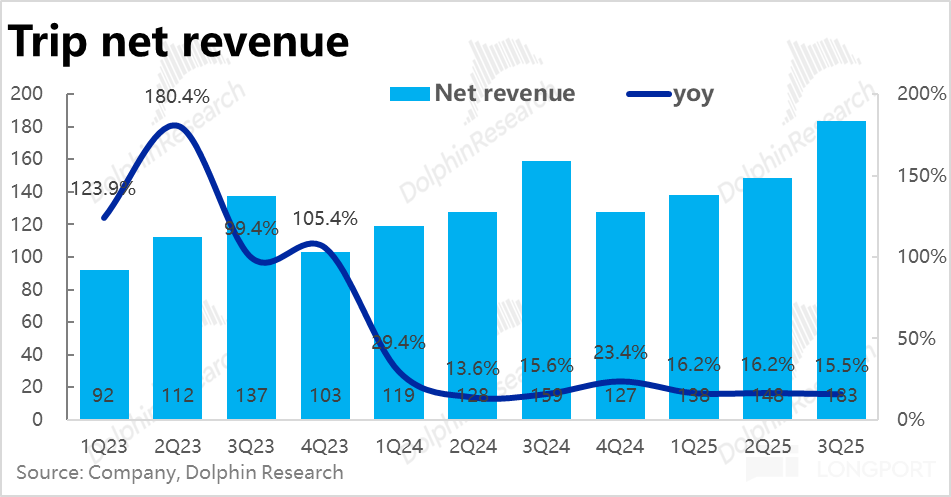

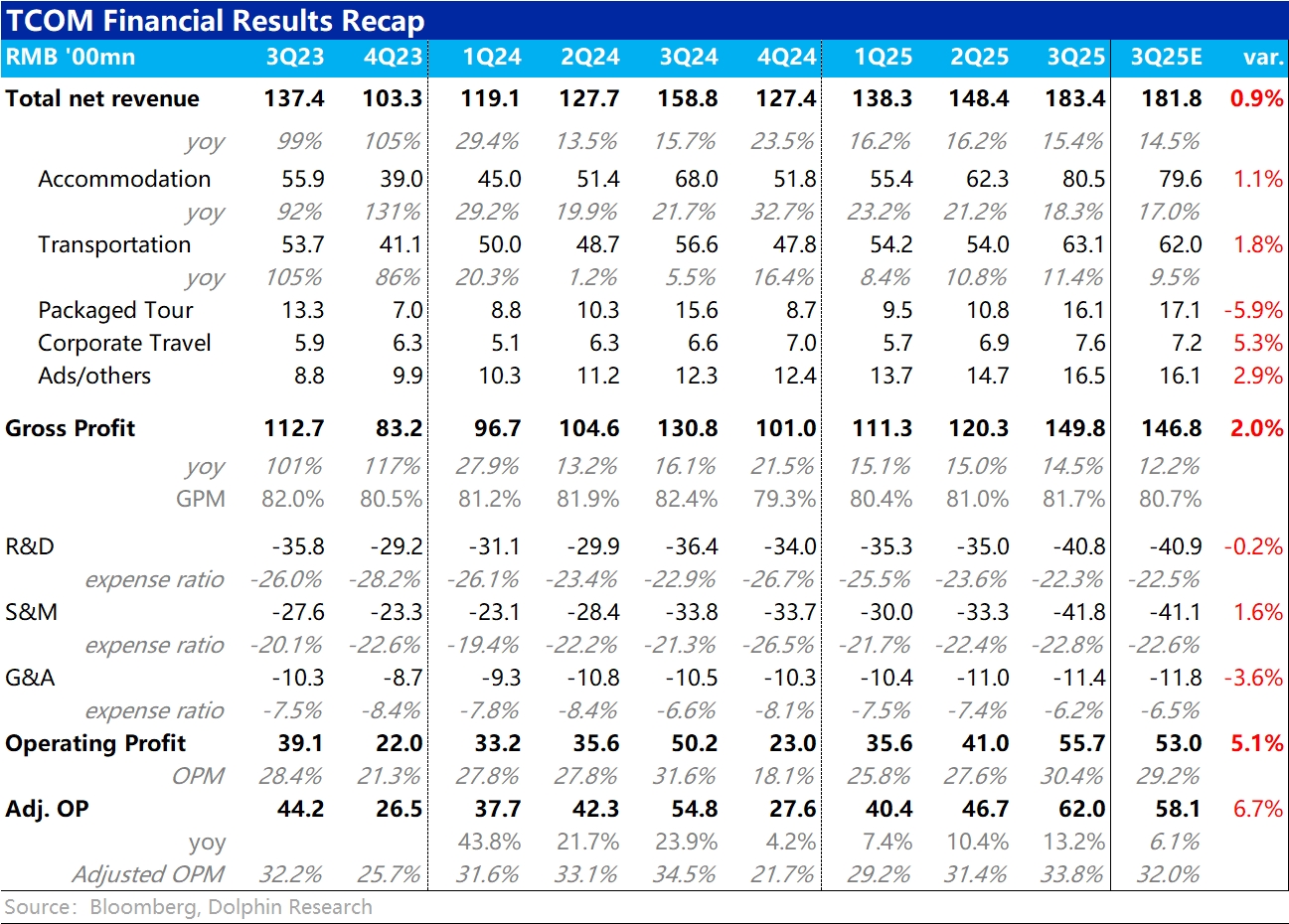

After the US stock market closed on November 18, $Trip.com(TCOM.US) announced its financial results for the third quarter of fiscal year 2025. The performance remained stable, with both revenue and pr...

Trip.com 3Q25 Quick Interpretation: Overall, Trip.com's performance this quarter remains generally stable and better than market expectations. In terms of trends, growth remains steady, but due to rel...

Alibaba Qianwen App Goes Viral on Launch Day;Google Gemini 3.0 May Arrive This Week | Today's Important News Recap

1117 | Dolphin Research Focus: 🐬 Stocks 1. $BABA-W(09988.HK) $Alibaba(BABA.US) Alibaba announced that its personal AI assistant, Qwen APP, has officially started public testing, with simultaneous lau...