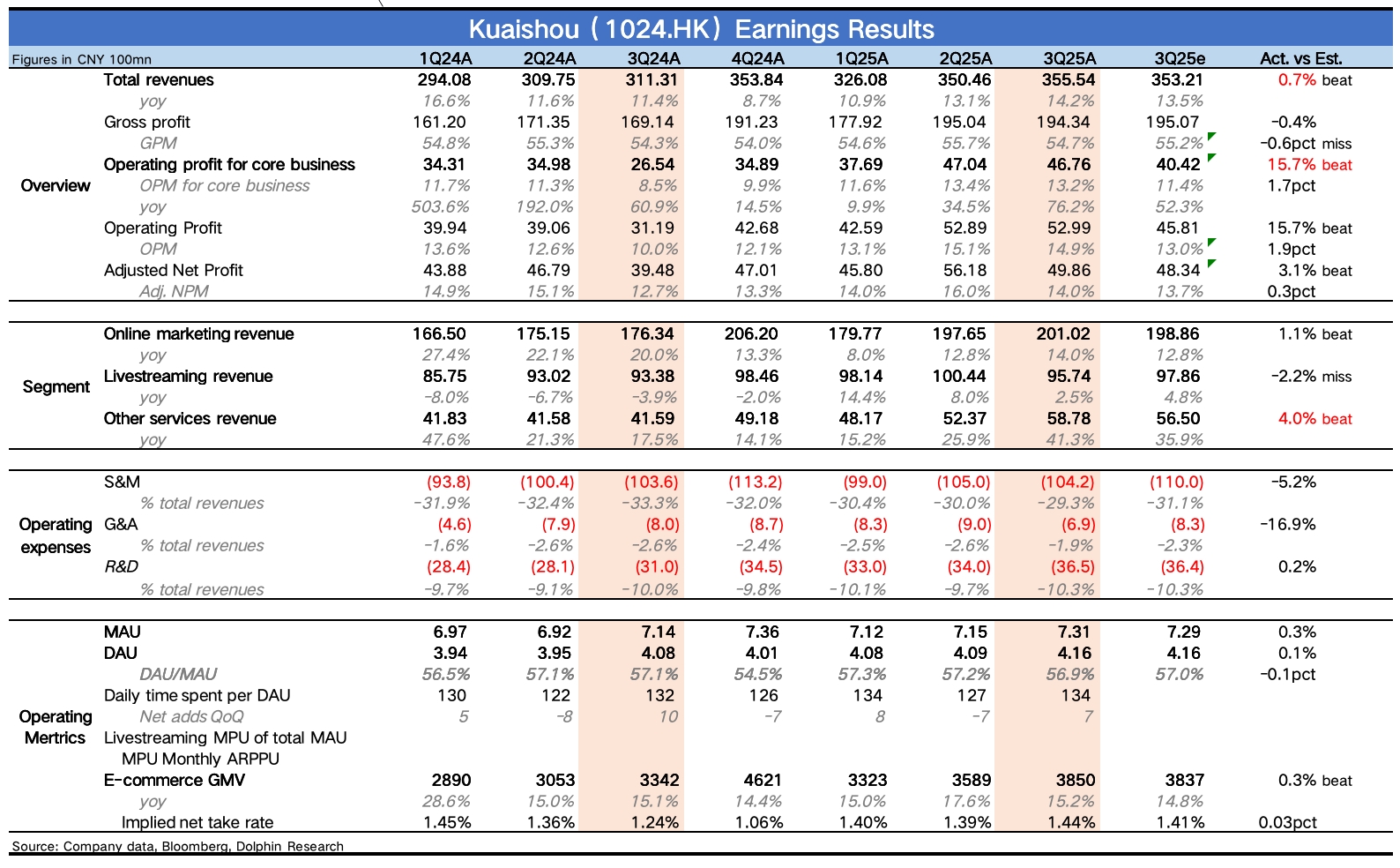

Kuaishou 3Q25 Quick Interpretation: The third-quarter performance slightly exceeded expectations overall, not as poor as recent stock prices suggest.

The current valuation corresponds to approximately 15x P/E for this year's core business (13x for next year), indicating that the premium for the Keling segment has not been significantly factored in. Therefore, the price adjustment from HKD 90 to HKD 60 is mainly related to the competitive impact of Sora 2 at the end of September and the overall decline in AI sentiment.

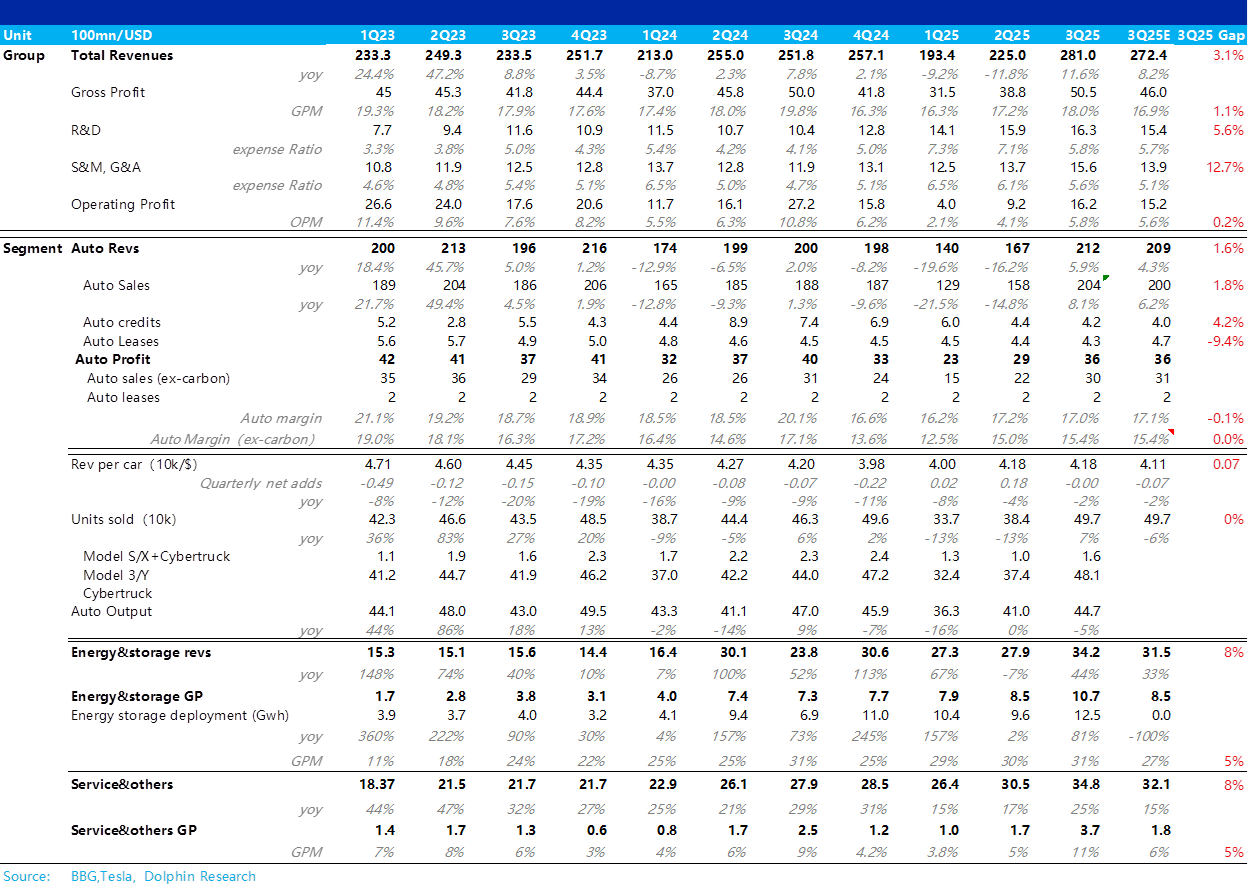

1. Significant internal efficiency improvement: The highlight of the financial report is the profit performance, with the core operating profit margin increasing by nearly 5 percentage points year-on-year, more significantly than in Q1 and Q2. The contraction in selling and administrative expenses deviates from market expectations.

2. Keling slightly exceeds expectations: The company guided Keling's third-quarter revenue to be between 280-300 million, and it is expected to increase in the fourth quarter due to the release of Kling 2.5 Turbo, with actual Keling revenue exceeding 300 million. Currently, Kling 2.5 Turbo remains at the top of the WenSheng video and TuSheng video large model rankings in terms of performance ELO scores.

3. Slowing growth in e-commerce transactions, potential increase in short drama monetization rate: Excluding Keling (calculated at 330 million), other income in Q3 grew by 34% year-on-year, significantly higher than the 20% growth in Q2. However, the year-on-year growth rate of Q3 e-commerce GMV was 15%, showing a slowdown.

Considering changes in the year-on-year base, the growth rate is slightly below past levels when viewed from an inter-seasonal perspective. Therefore, the incremental income in other revenue items likely comes from paid short dramas, games, etc., and possibly from an increase in e-commerce commission rates. The actual situation can be monitored in the conference call.

4. Steady recovery in advertising: The growth rate of marketing and advertising revenue in the third quarter was 14%, continuing to recover from the second quarter, mainly benefiting from AI model iterations, new features enhancing ROI, and the penetration of intelligent delivery solutions, with UAX's penetration rate in external circulation ads reaching 70%. Additionally, the prosperity of the short drama industry itself will bring more traffic revenue and IAA revenue sharing.

5. Finally, let's look at the ecosystem: Kuaishou's user metrics have not performed well on third-party platforms in recent years. Although the data is not comprehensive, the pressure is greater compared to peers at least in horizontal comparison.

The user metrics disclosed in the Q3 financial report also show low-speed stability, but the average daily user duration reached a new high, possibly related to growth driven by rich content such as short dramas and exclusive galas.

The growth bottleneck of the ecosystem is one of the core factors suppressing Kuaishou's valuation. Although there is still room for improvement in current profitability (as shown in Q2 and Q3), the valuation is slightly inferior to the expected profit growth level. $KUAISHOU-W(01024.HK) $KUAISHOU-WR(81024.HK)