Company Encyclopedia

View More

SPEED

300322.SZ

Huizhou Speed Wireless Technology Co.,Ltd. engages in the research and development, production, and sale of wireless communication terminal antennas and communication product accessories, fingerprint modules, wiring harnesses, and other products in China. The company offers mobile smart terminal antennas, vehicle-mounted electronic products, wireless charging products, biometric modules, and heat pipes and radiator, as well as precision structural parts, wireless charging products, fingerprint and sensor modules, semiconductor packaging, testing, and intelligent detection equipment and products. Its products are used in mobile phones, tablets, wearable devices, laptops, automobiles, unmanned aerial vehicles, security monitoring, and other fields.

2.202 T

300322.SZMarket value -Rank by Market Cap -/-

Valuation analysis

P/E

1Y

3Y

5Y

10Y

P/E

-

Industry Ranking

-/-

- P/E

- Price

- High

- Median

- Low

P/B

1Y

3Y

5Y

10Y

P/B

-

Industry Ranking

-/-

- P/B

- Price

- High

- Median

- Low

P/S

1Y

3Y

5Y

10Y

P/S

-

Industry Ranking

-/-

- P/S

- Price

- High

- Median

- Low

Dividend Yield

1Y

3Y

5Y

10Y

Dividend Yield

-

Industry Ranking

-/-

- Dividend Yield

- Price

- High

- Median

- Low

Institutional View & Shareholder

Analyst Ratings

- Price--

- Highest--

- Lowest--

News

View More

Posts

View More

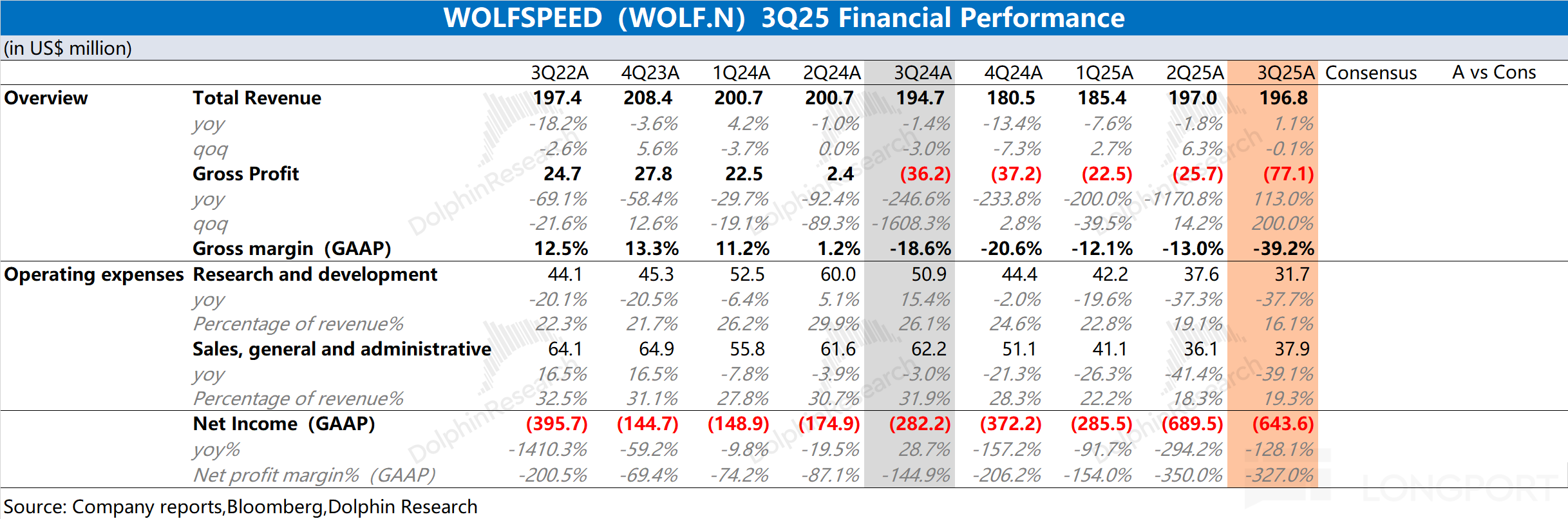

The following is the minutes of the Q1 FY2026 earnings call for $Wolfspeed(WOLF.US). For an interpretation of the earnings report, please refer to "Post-Debt Wolfspeed: Layoffs and Cost Reductions Can...

Wolfspeed is preparing to file for bankruptcy within weeks as it struggles with a pile of debt, the WSJ reports, citing unnamed sources. The compound semiconductor materials (SiC) and power chip maker......

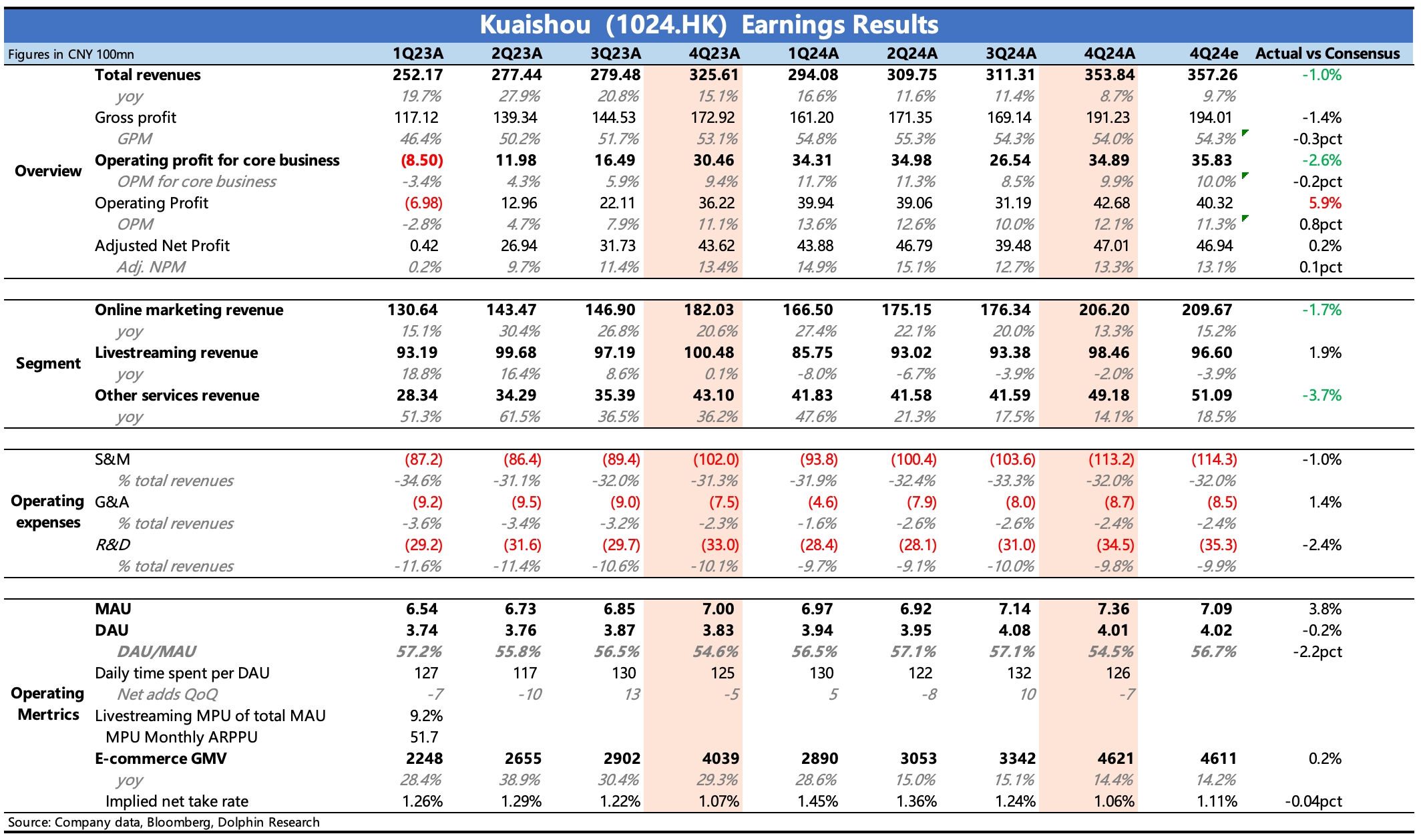

$KUAISHOU-W(01024.HK) Q4 2024 Financial Report Quick Interpretation: Q4 performance is not good, with slight misses in core advertising and e-commerce commission revenues. Gross margin remains flat, a...