Company Encyclopedia

View More

HS#ICBC RC2711A

59181.HK

News

View More

Posts

View More

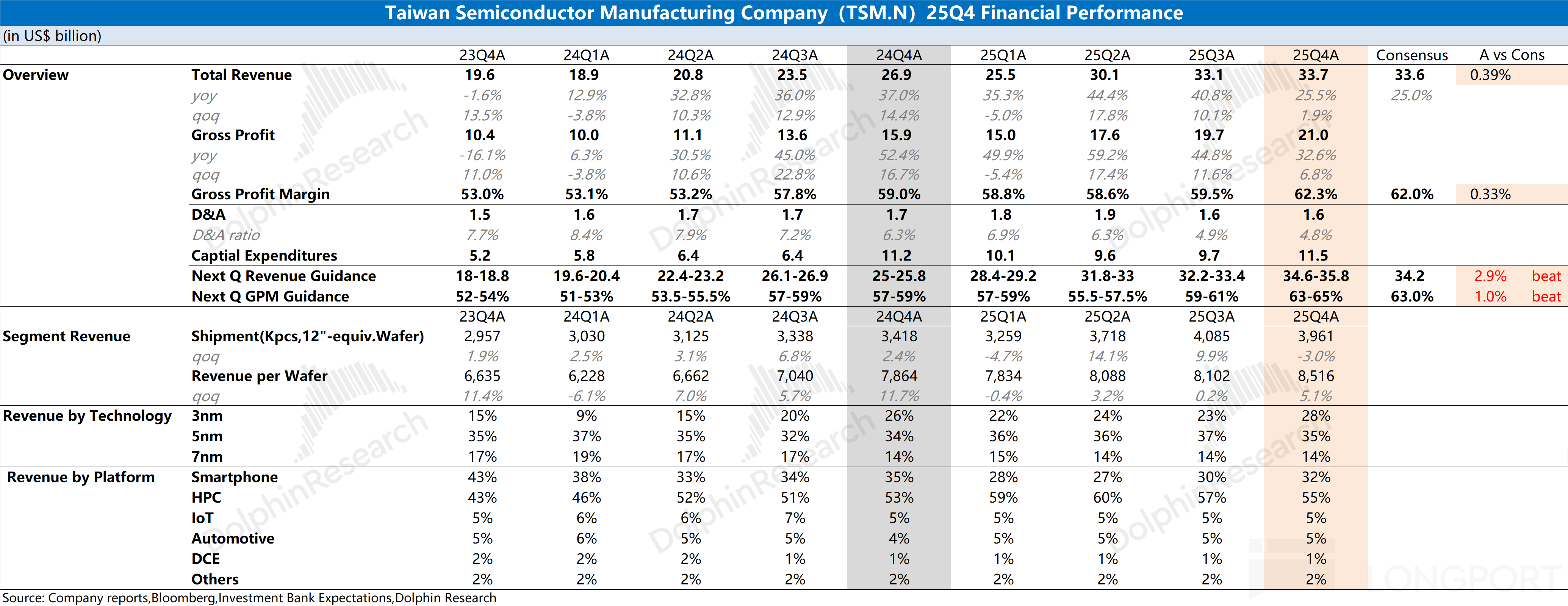

TSM (Trans): Capex to rise by tens of billions YoY, a decision made after talks with downstream customers.

Below is Dolphin Research's Trans of the Q4 2025 earnings call for $Taiwan Semiconductor(TSM.US). For our earnings analysis, please see 'TSMC: the real heavyweight in AI — who would say no?'.

Key takea......Reshaping the Global Industrial Landscape: In-Depth Strategic Evaluation Report of China's Top 10 Leading Enterprises Benchmarking Against Global Giants (2024-2025)

Why are there two Alibaba icons? 😂, I don't know either, Gemini, do you have any special thoughts? Executive Summary: A Historic Leap from Follower to Definer In the 2024-2025 cycle, as the global ec...