Valuation analysis

- P/E

- Price

- High

- Median

- Low

- P/B

- Price

- High

- Median

- Low

- P/S

- Price

- High

- Median

- Low

- Dividend Yield

- Price

- High

- Median

- Low

Institutional View & Shareholder

Analyst Ratings

- Price--

- Highest--

- Lowest--

TSMC filed for an environmental assessment in the Andong District of Tainan, south Taiwan, putting it on the map as the location of 3 new 2nm fabs the chip giant plans to build, Liberty Times reports,............

TSMC’s certainty over capacity needs now extends 2-years out instead of one, media report, as the chip giant now engages contractors for new chip fabs or packaging plants 2-years ahead of time instead.....................

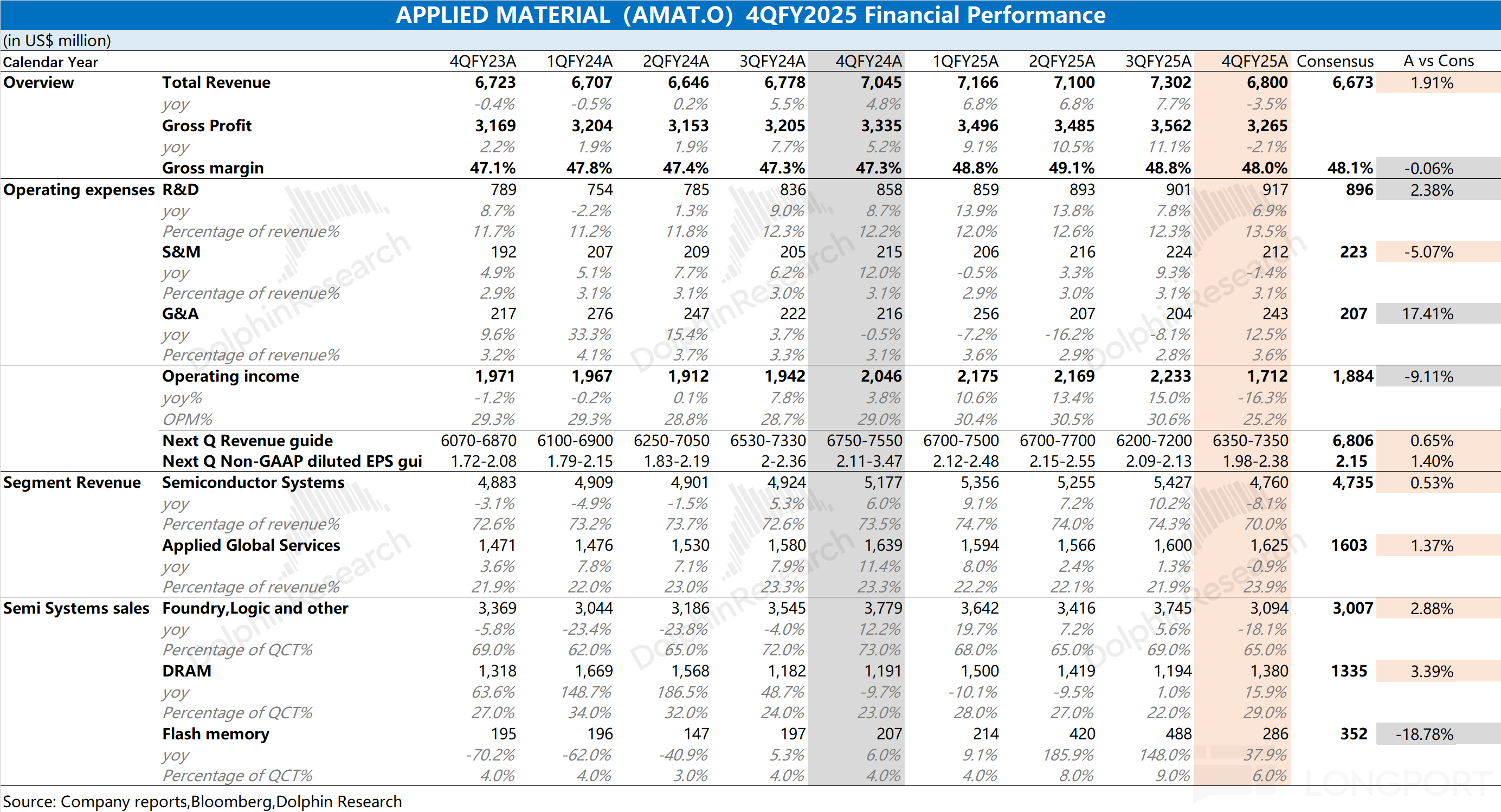

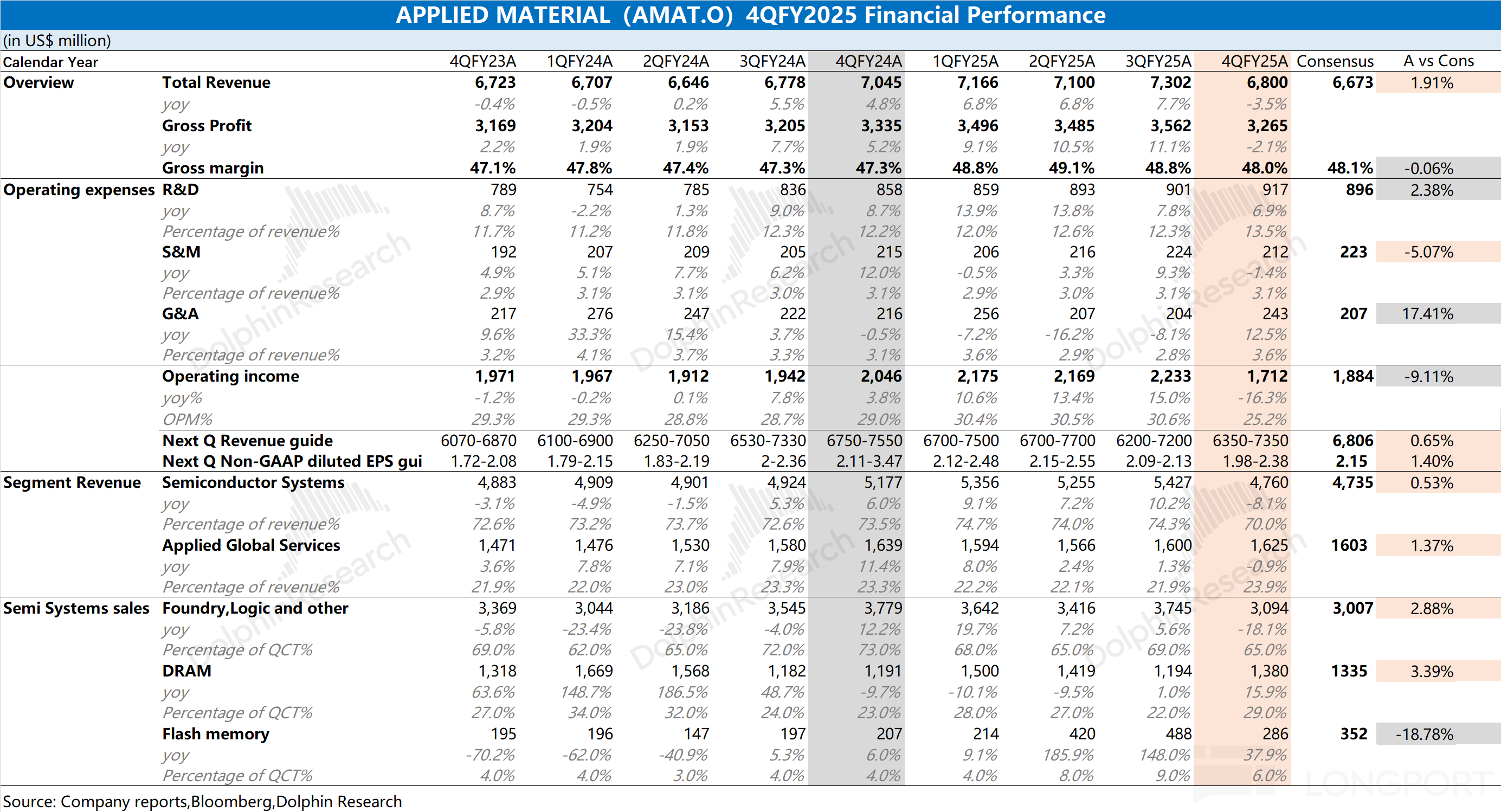

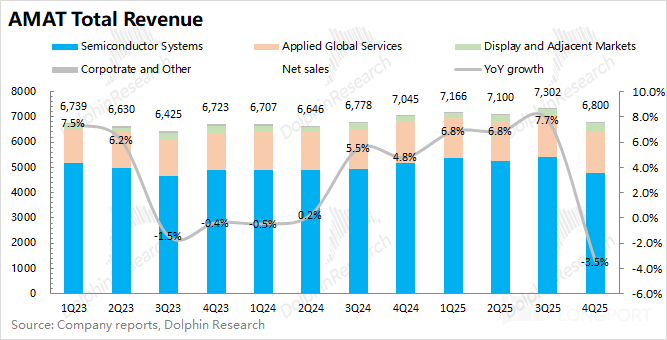

Applied Materials AMAT (Minutes): Stable in the first half of next year, growth concentrated in the second half.

The following are the minutes of the AMAT FY2025 Q4 earnings call organized by Dolphin Research. For an interpretation of the earnings report, please refer to the article titled 'Storage is 'Red Hot',......

Applied Materials (AMAT.O) released its financial report for the fourth quarter of fiscal year 2025 (ending October 2025) after the U.S. stock market closed on the morning of November 14, 2025, Beijin......

Powertech, Taiwan’s 2nd biggest semiconductor packaging firm, will more than double 2026 capex to over NT$40 billion (US$1.3 billion), from NT$19 billion this year, media report, adding US$1 billion i...............