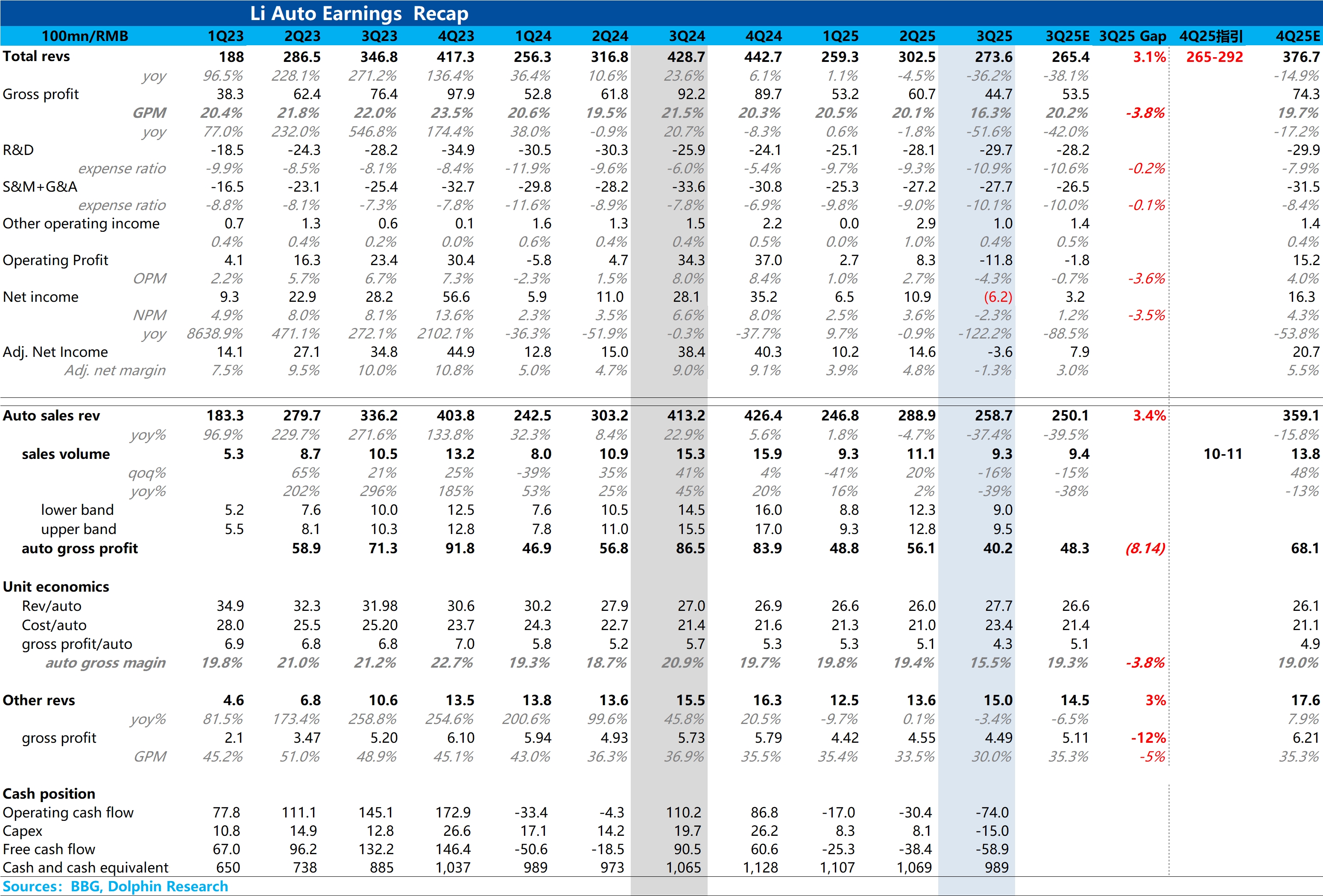

Li Auto 3Q25 Quick Interpretation: Dolphin Research's first glance at Li Auto's financial report can only be described as 'unbearable to look at,' with a significant drop in gross margin and net profi......

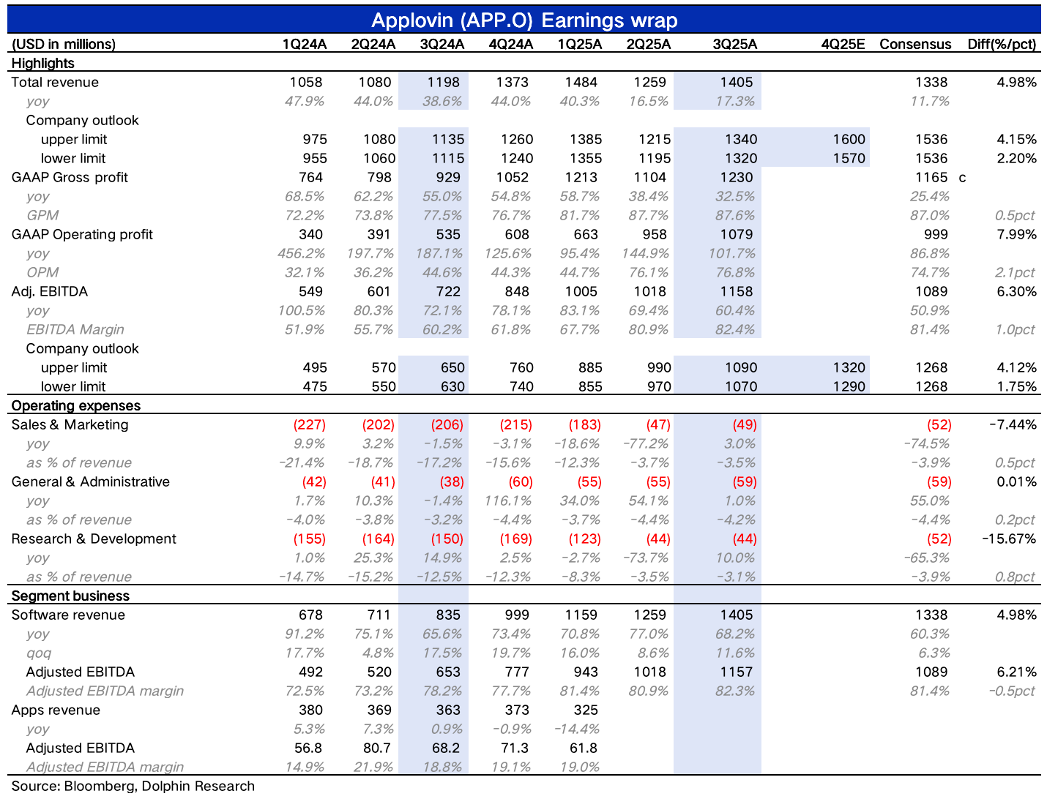

Applovin 3Q25 Quick Interpretation: Overall, it was a slightly better-than-expected strong growth, and the post-market reaction aligned with the extent of the surprise.

Before the earnings report, asid...

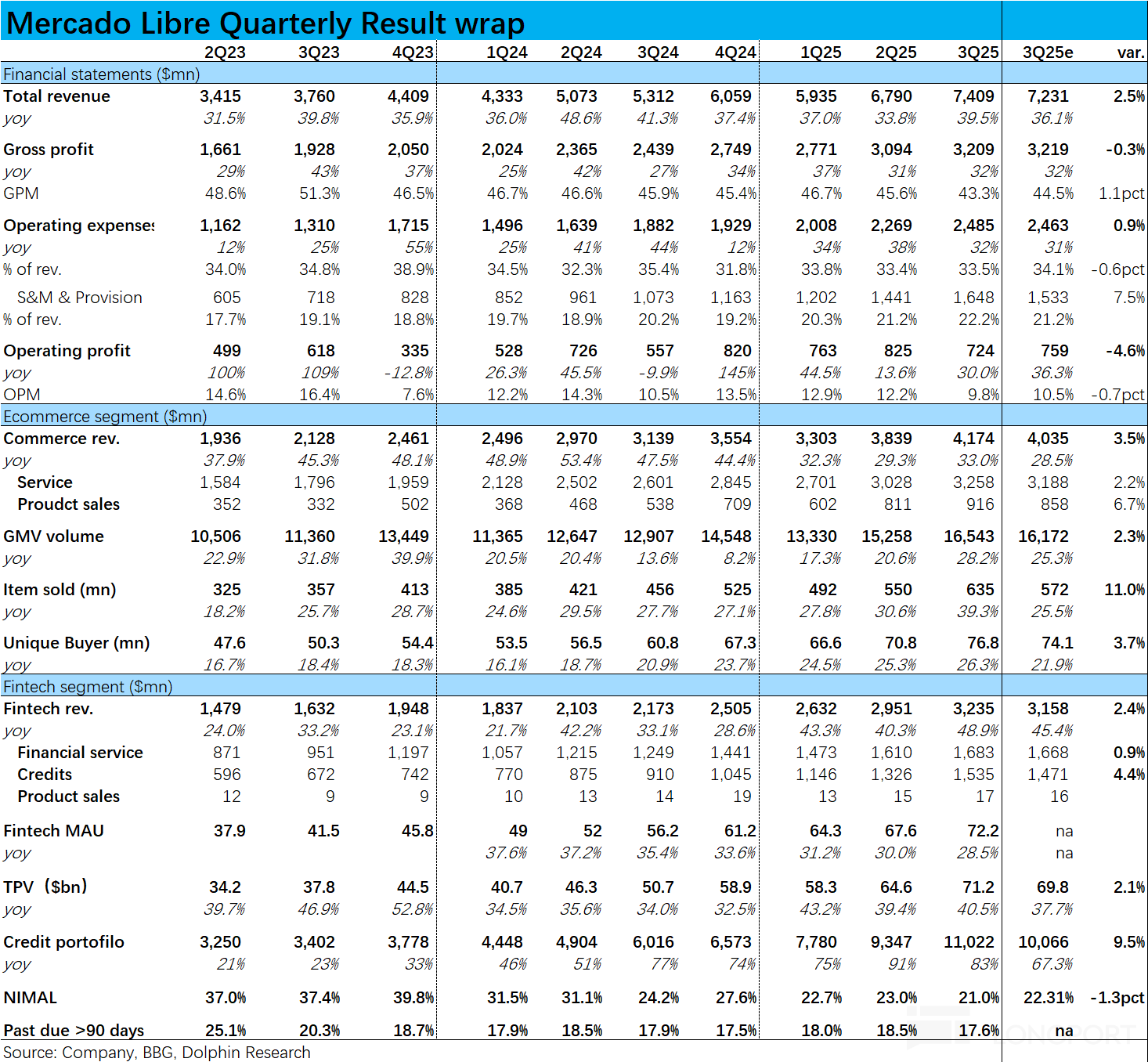

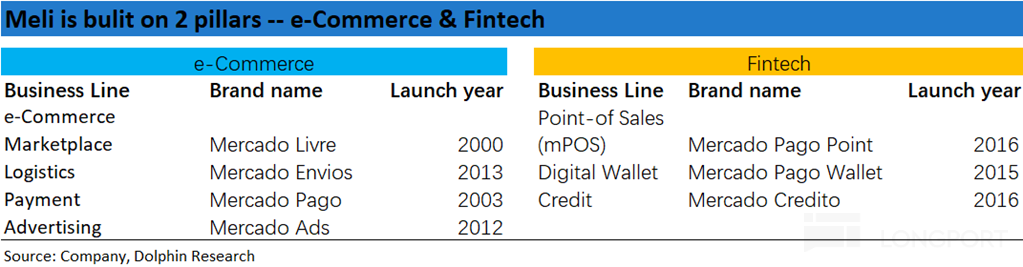

The Latin American version of "Alibaba"—$Mercadolibre(MELI.US) (hereinafter referred to as Meli) released its financial report for the third quarter of 2025 on October 30. Overall, the revenue side pe...

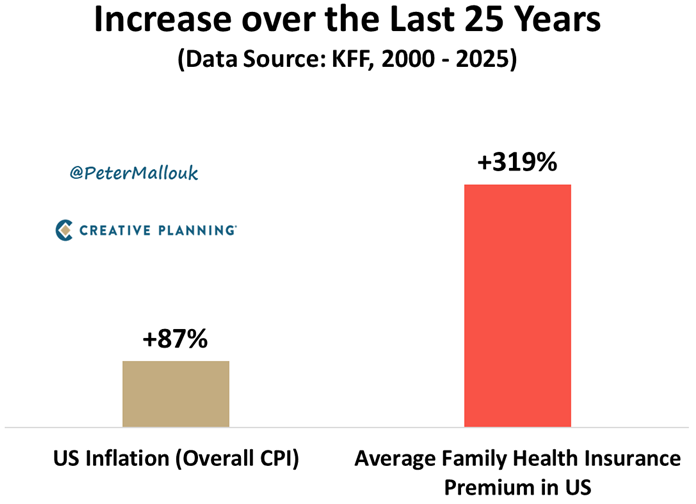

Over the past 25 years, inflation has gone up about 87%. Not great but at least somewhat predictable. What’s completely out of line is how health insurance premiums exploded 319% in that same span. Th...

...............