Valuation analysis

- P/E

- Price

- High

- Median

- Low

- P/B

- Price

- High

- Median

- Low

- P/S

- Price

- High

- Median

- Low

- Dividend Yield

- Price

- High

- Median

- Low

Institutional View & Shareholder

Analyst Ratings

- Price--

- Highest--

- Lowest--

The following are the 3Q25 earnings call minutes of $Duolingo(DUOL.US) organized by Dolphin Research. For financial report interpretation, please refer to "Duolingo: Weak Guidance + Uncertainty of Sho...

Duolingo: Weak Guidance + Uncertainty of Short-term Changes, Green Bird Falls from High Valuation Pedestal

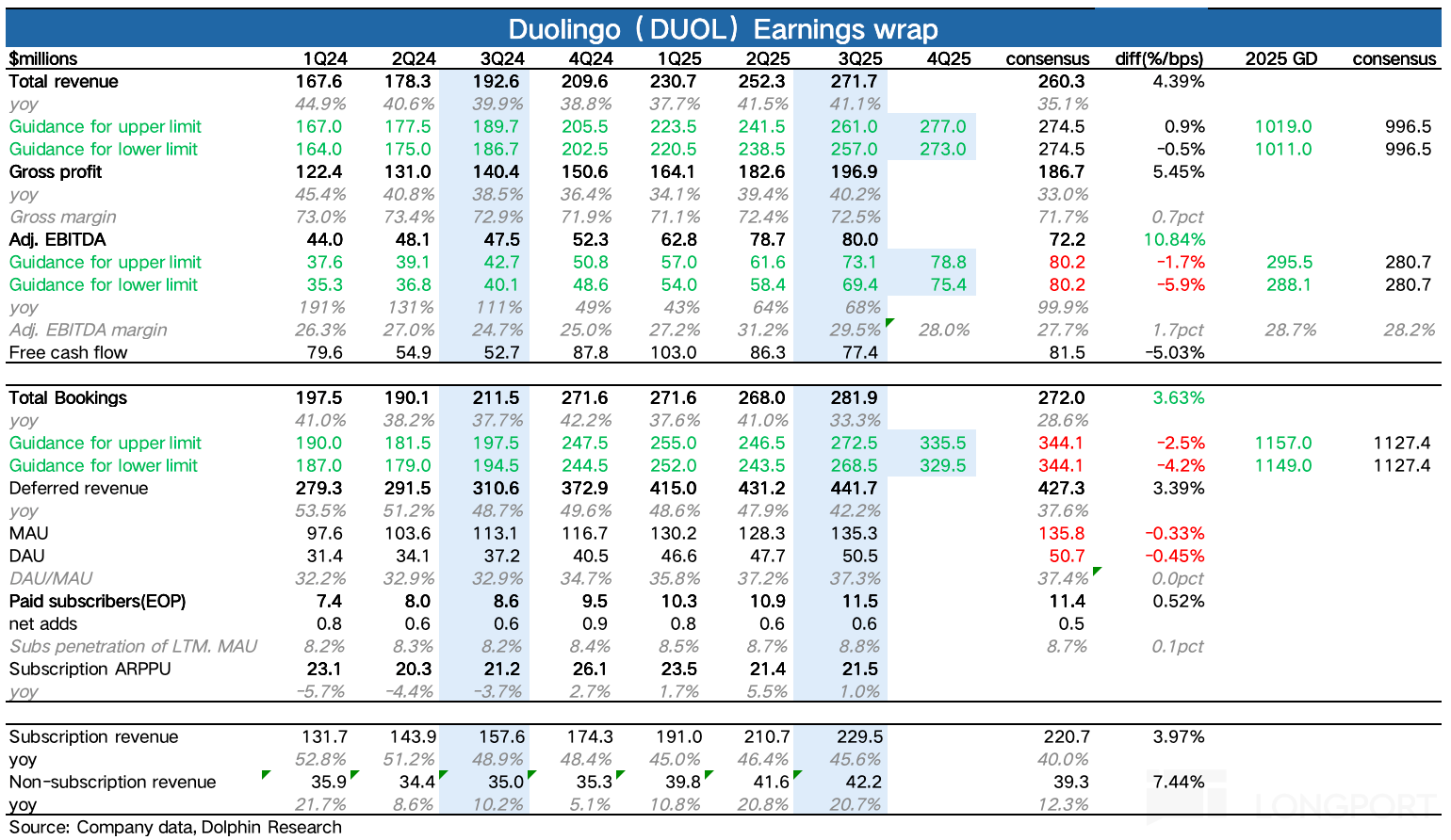

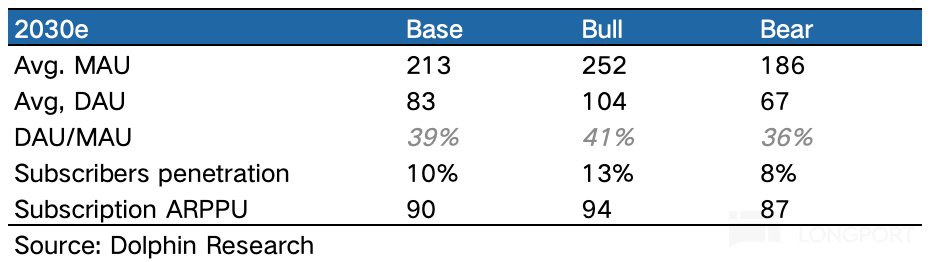

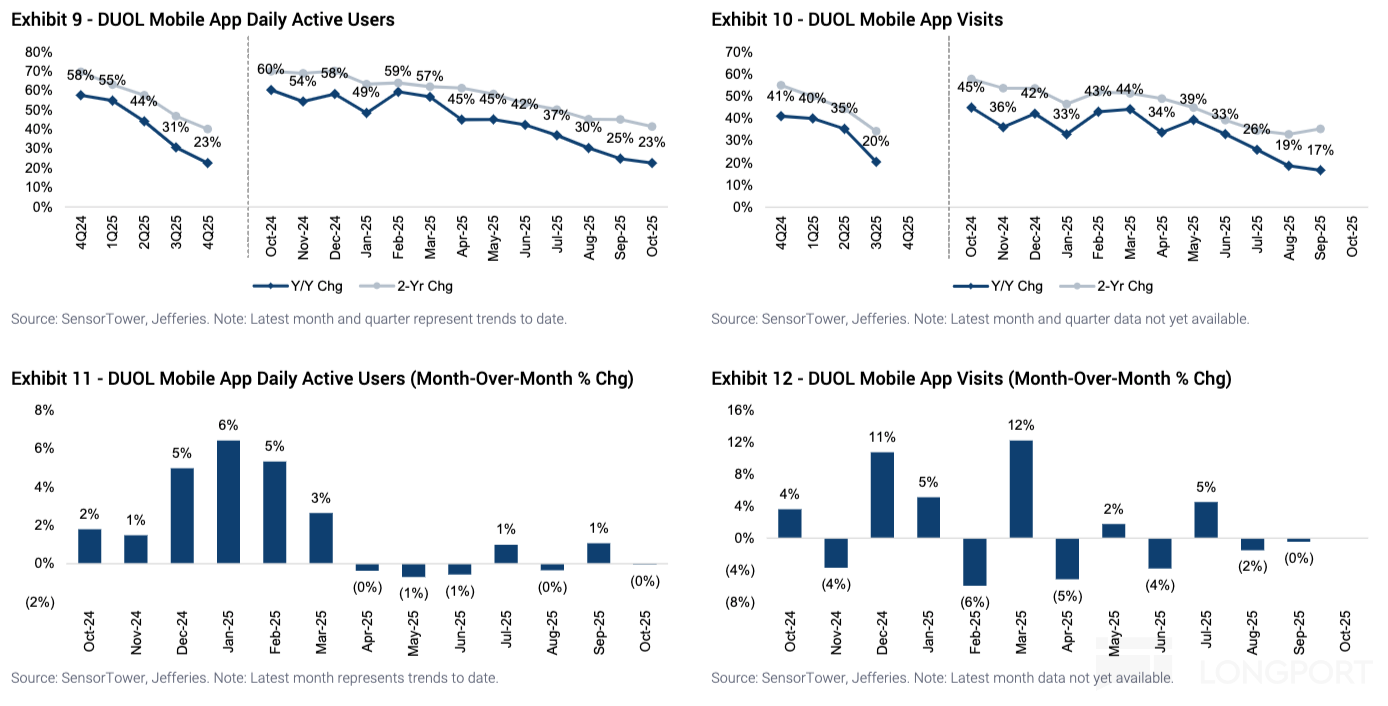

$Duolingo(DUOL.US) released its third-quarter 2025 earnings after the market closed on November 5th, Eastern Time. Due to fourth-quarter guidance falling short of expectations (implying a significant ...

Elon Musk reveals new information about Tesla AI5; CDF plans its first interim dividend | Today's Important News Recap

1105 |Dolphin Research Key Focus: 🐬 Macro/Industry 1. China has made adjustments to its tariff policy on the United States, announcing the suspension of the previously imposed 24% tariff rate on cert...

The following is a summary of the Q2 2025 earnings call for $Duolingo(DUOL.US) organized by Dolphin Research. For an interpretation of the earnings report, please refer to the article "Duolingo: User ...

$Duolingo(DUOL.US) released its Q2 2025 earnings after the market closed on August 6th, Eastern Time. Before the earnings report, the market was concerned about the decline in active users. Although t...