Valuation analysis

- P/E

- Price

- High

- Median

- Low

- P/B

- Price

- High

- Median

- Low

- P/S

- Price

- High

- Median

- Low

- Dividend Yield

- Price

- High

- Median

- Low

Institutional View & Shareholder

Analyst Ratings

- Price--

- Highest--

- Lowest--

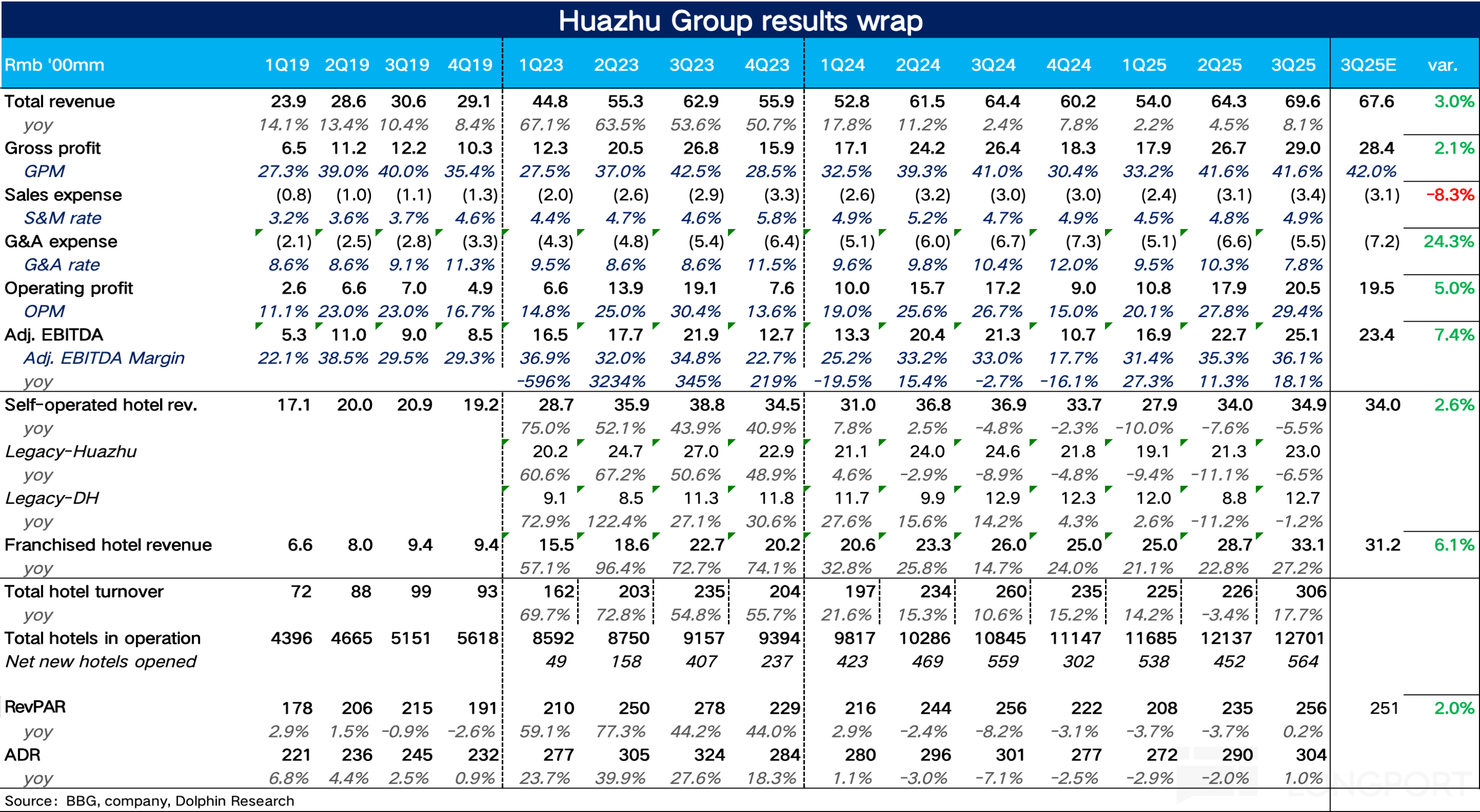

The following are the minutes of Huazhu's 3Q25FY earnings conference call organized by Dolphin Research. For a review of the financial report, please refer to 'Huazhu: Deep Squat and Jump! Huazhu is s...

TSMC will expand 3nm capacity over 60% this year to meet strong demand for AI and high-performance computing chips, media report, citing VP T.S. Chang speaking at the TSMC Technology Symposium (Taiwan..................

Japan’s Ajinomoto, producer of ABF film for the substrates used in GPU and CPU packaging, will invest ¥25 billion (US$166 million) to boost capacity of the insulating material by 50% over 5-years, Nik............

Xiaomi's stock price has been rising recently, mainly driven by the implementation of national subsidies for electronic products such as smartphones. Dolphin believes that Xiaomi's performance in 2025...

$XTALPI(02228.HK) is experiencing severe fluctuations at a high level, shaking and shaking, are you leaving or not, if you don't leave, I'm going to drop. 😜 Since you’re not leaving, I’ll keep shakin...