Company Encyclopedia

View More

Formfactor

FORM.US

FormFactor, Inc. designs, manufactures, and sells probe cards, analytical probes, probe stations, thermal systems, cryogenic systems, and related services in the United States and internationally. The company offers probe cards to test various semiconductor device types, including systems on a chip products, mobile application processors, microprocessors, microcontrollers, and graphic processors, network and digital signal processing integrated circuits, radio frequency amplifiers, filters and antenna in package devices, analog, mixed signal, image sensors, electro-optical, DRAM memory, NAND flash memory, NOR flash memory, and quantum computer processor devices; and analytical probes, which are used for device characterization, electrical simulation model development, failure analysis, and prototype design debugging. It also offers probe stations for semiconductor design engineers to capture and analyze accurate data; thermal subsystems, which include thermal chucks and other test systems used in probe stations and other applications for precise temperature management; cryogenic systems, which includes the manufacture of precision cryogenic instruments and semiconductor test and measurement systems; and services and support, including installation services.

1.254 T

FORM.USMarket value -Rank by Market Cap -/-

Valuation analysis

P/E

1Y

3Y

5Y

10Y

P/E

-

Industry Ranking

-/-

- P/E

- Price

- High

- Median

- Low

P/B

1Y

3Y

5Y

10Y

P/B

-

Industry Ranking

-/-

- P/B

- Price

- High

- Median

- Low

P/S

1Y

3Y

5Y

10Y

P/S

-

Industry Ranking

-/-

- P/S

- Price

- High

- Median

- Low

Dividend Yield

1Y

3Y

5Y

10Y

Dividend Yield

-

Industry Ranking

-/-

- Dividend Yield

- Price

- High

- Median

- Low

Institutional View & Shareholder

Analyst Ratings

- Price--

- Highest--

- Lowest--

News

View More

Posts

View More

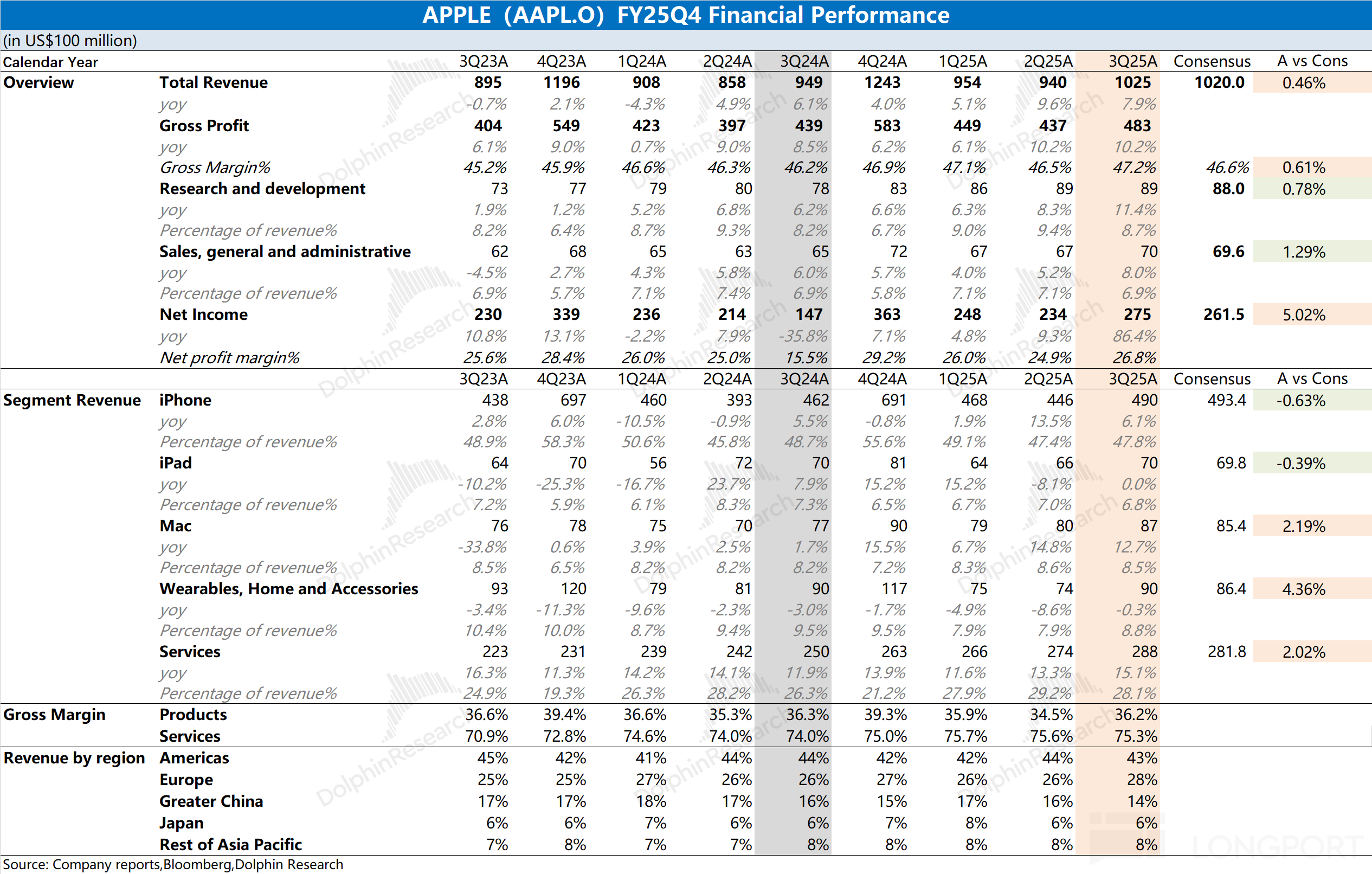

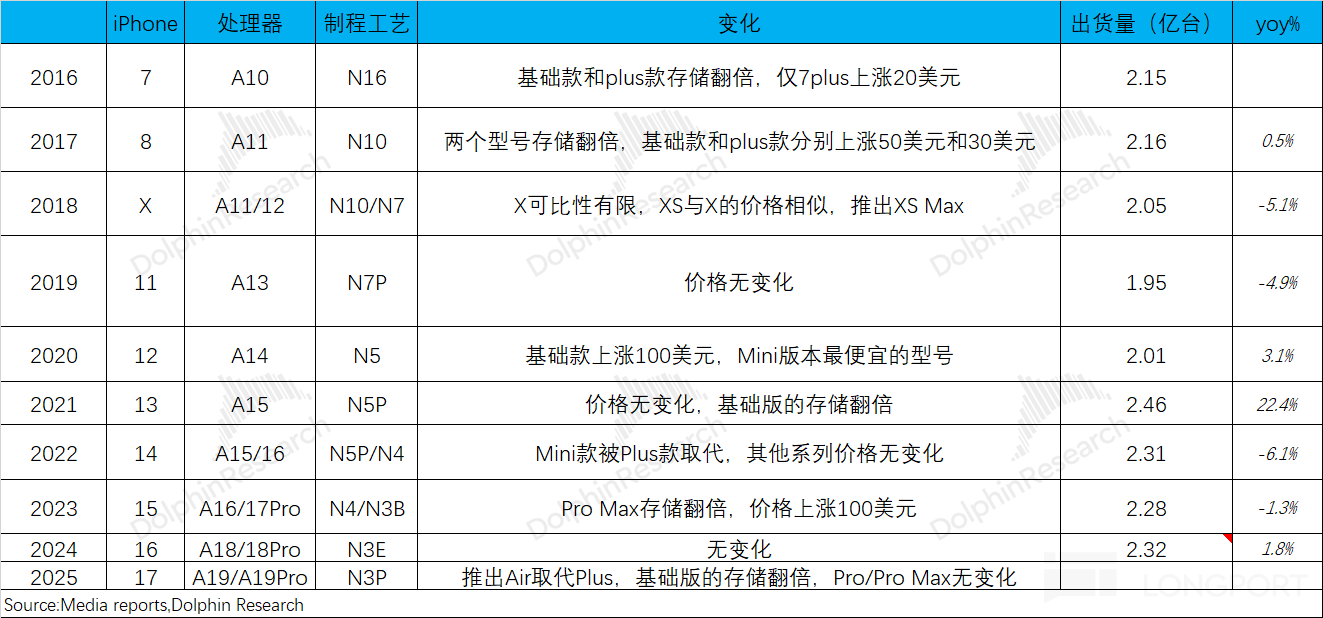

Apple (AAPL.O) released its financial results for the fourth quarter of fiscal year 2025 (ending September 2025) after the U.S. stock market closed on the morning of October 31, 2025, Beijing time. Th...

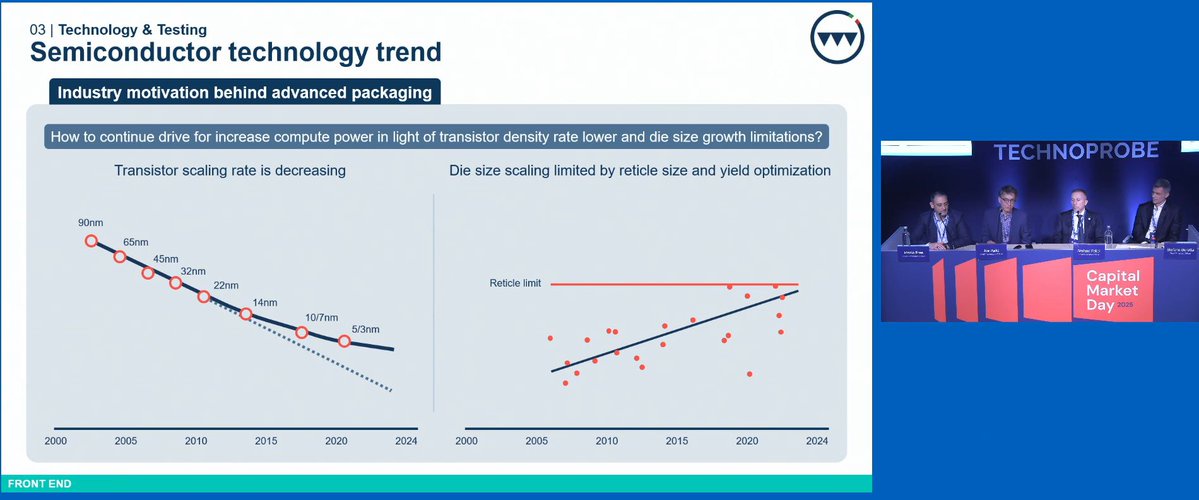

Joe Parks, formerly of $Intel(INTC.US) and currently CTO at $TPRO does a great job of explaining the motivation for Chiplets and Die Disaggregation in this CMD presentation (38:45-53:00)

What Joe dives............