Company Encyclopedia

View More

Genetic Technologies Limited

GENE.US

--

GENE.USMarket value -Rank by Market Cap -/-

Valuation analysis

P/E

1Y

3Y

5Y

10Y

P/E

-

Industry Ranking

-/-

- P/E

- Price

- High

- Median

- Low

P/B

1Y

3Y

5Y

10Y

P/B

-

Industry Ranking

-/-

- P/B

- Price

- High

- Median

- Low

P/S

1Y

3Y

5Y

10Y

P/S

-

Industry Ranking

-/-

- P/S

- Price

- High

- Median

- Low

Dividend Yield

1Y

3Y

5Y

10Y

Dividend Yield

-

Industry Ranking

-/-

- Dividend Yield

- Price

- High

- Median

- Low

Institutional View & Shareholder

Analyst Ratings

- Price--

- Highest--

- Lowest--

News

View More

Posts

View More

$Recursion Pharmaceuticals(RXRX.US) Report date: December 13, 2025 Time range: December 6 to December 13, 2025 Report perspective: As long-term investors, we focus on the company's long-term value cre...

Recursion Pharmaceuticals (RXRX) $Recursion Pharmaceuticals(RXRX.US) In-depth Research Report: From Phenotypic Screening to Vertical Integration—Revaluation After Exscientia Acquisition and the New Pa......

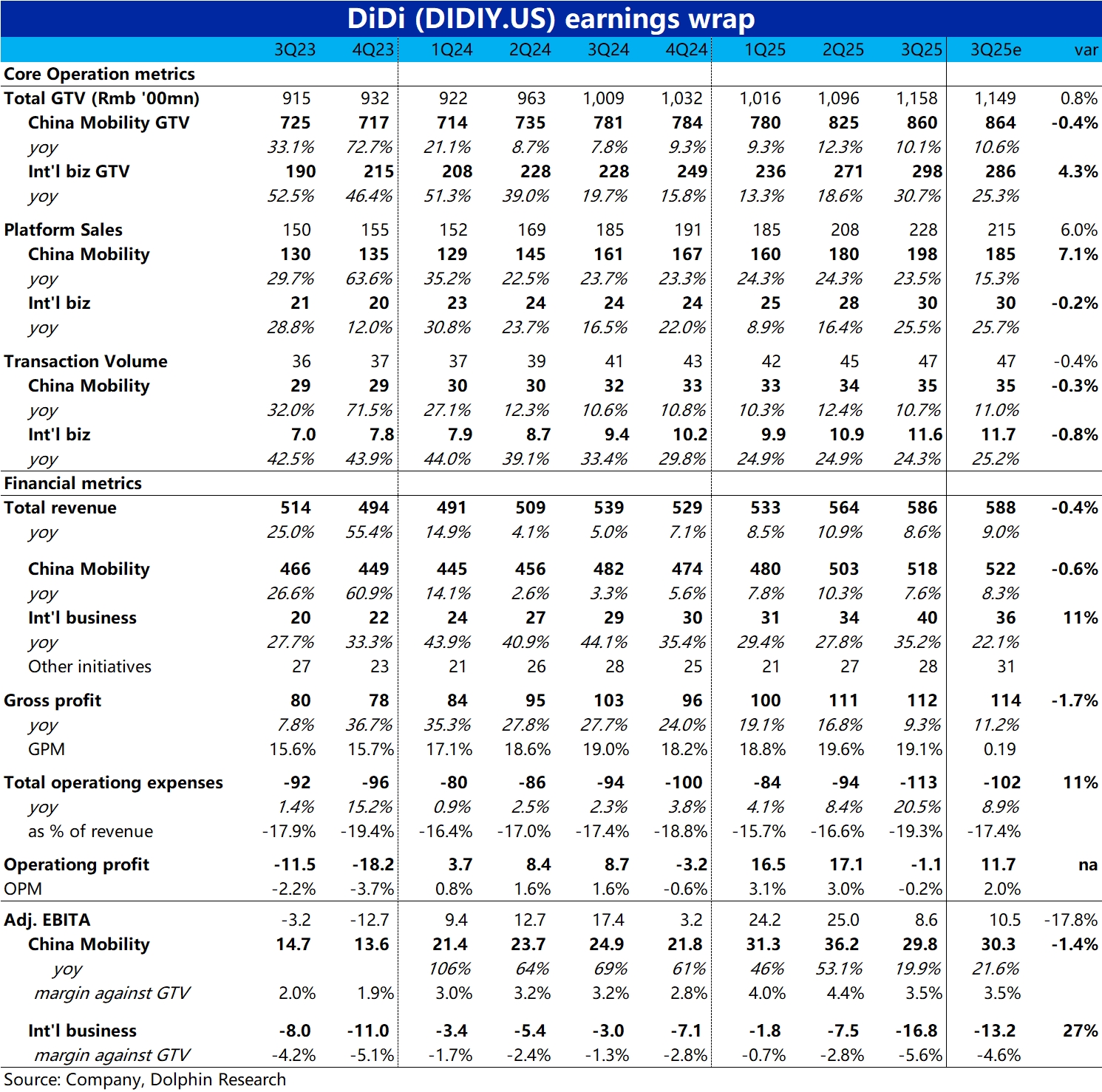

Didi 3Q25 Quick Interpretation: In early November, Didi updated the market with guidance on its 3Q performance, mainly mentioning two issues:

1. The investment in the food delivery business in Brazil ...

I don't’ understand why $Meta Platforms(META.US) is down 7%.

They effectively guided Dec revenue up by 3%. The actual mid point was $57.5B vs Street at $57.25. More importantly, the high end of the gui......