Valuation analysis

- P/E

- Price

- High

- Median

- Low

- P/B

- Price

- High

- Median

- Low

- P/S

- Price

- High

- Median

- Low

- Dividend Yield

- Price

- High

- Median

- Low

Institutional View & Shareholder

Analyst Ratings

- Price--

- Highest--

- Lowest--

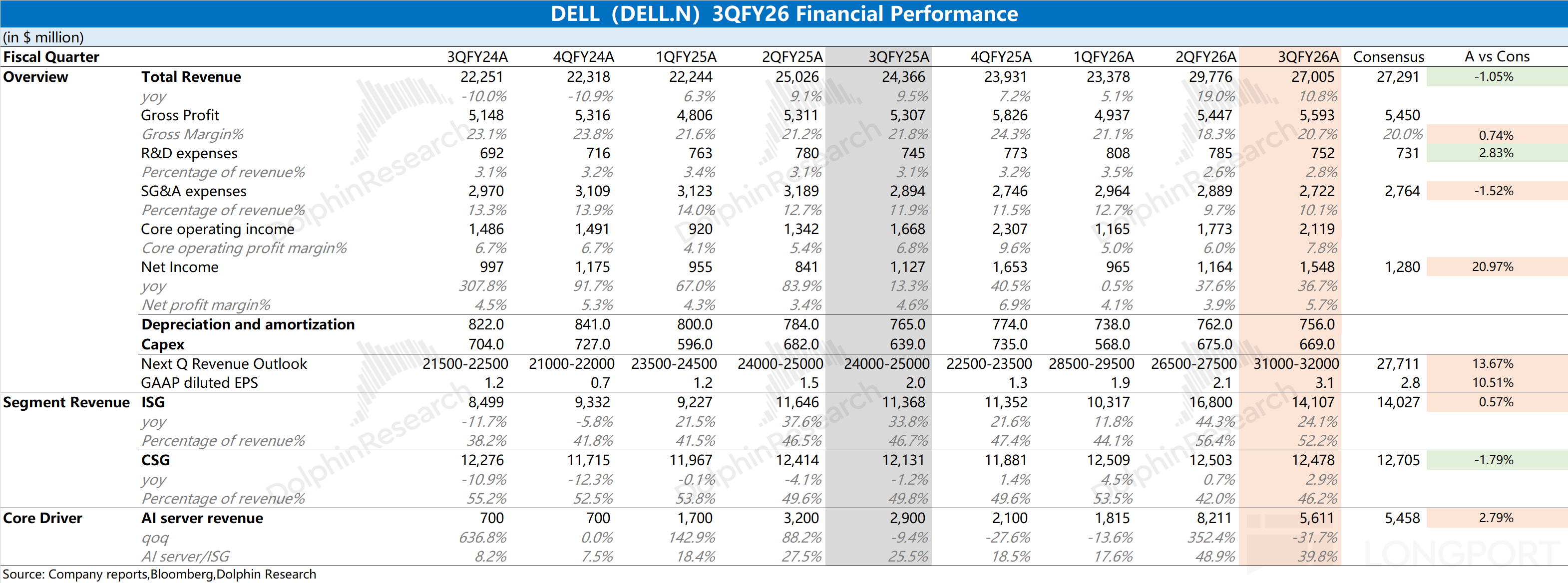

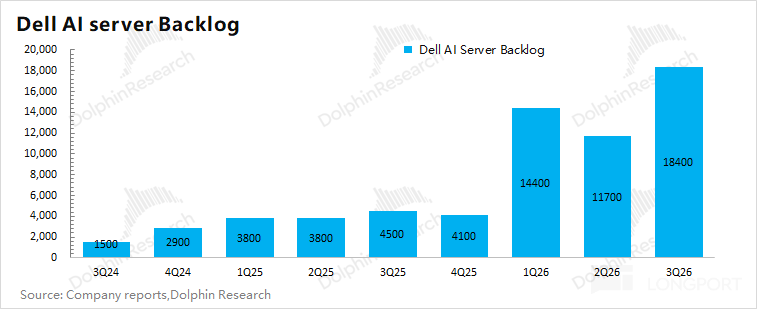

Dell Technologies (DELL.N) released its financial report for the third quarter of fiscal year 2026 (ending October 2025) after the U.S. stock market closed on November 26, Beijing time: 1. Core perfor......

1120 | Dolphin Research Focus: 🐬 Macro/Industry 1. The U.S. September non-farm payrolls are set to be released tonight. This is the first monthly employment report issued by the U.S. Bureau of Labor ...

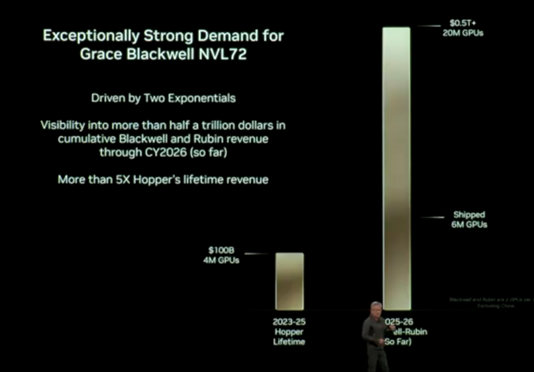

The following are the minutes of NVIDIA's FY2026 Q3 earnings call, compiled by Dolphin Research. For an interpretation of the earnings report, please refer to the article 'More Important Than Non-Farm...

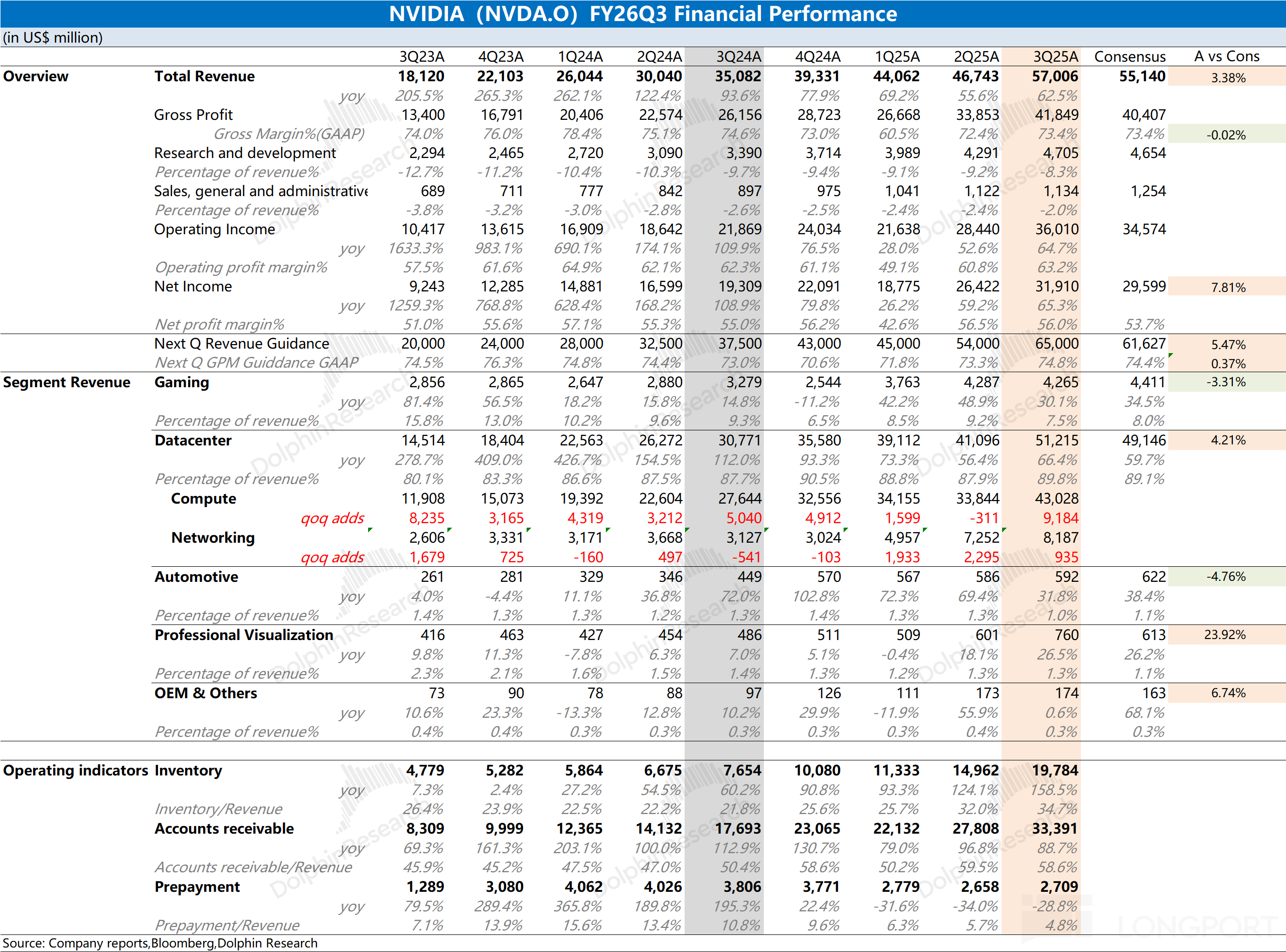

NVIDIA (NVDA.O) released its financial report for the third quarter of fiscal year 2026 (ending October 2025) in the early morning of November 20th, Beijing time, after the U.S. stock market closed. T......

The following are the minutes of AMD's Q3 2025 earnings call, compiled by Dolphin Research. For an interpretation of the earnings report, please refer to the article titled 'AMD: Partnering with Open ...