Company Encyclopedia

View More

QORVO

QRVO.US

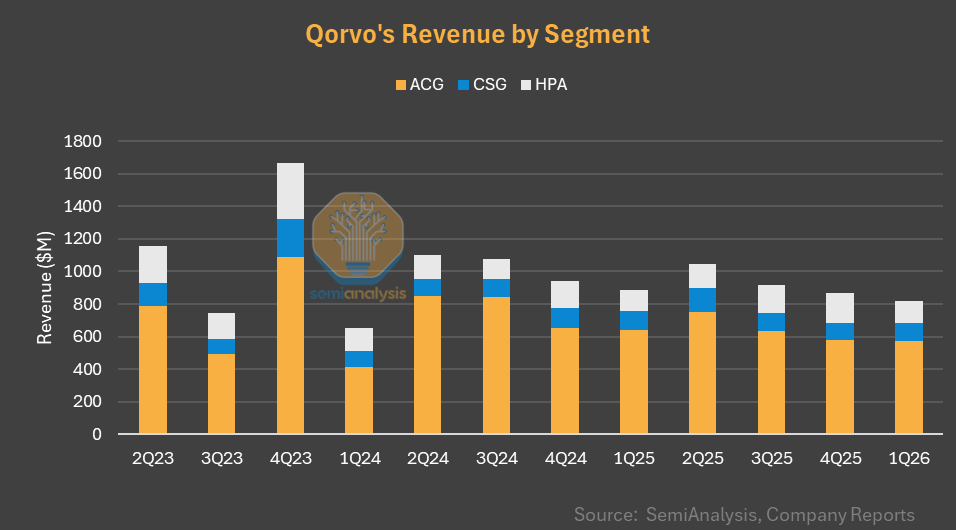

Qorvo, Inc. engages in development and commercialization of technologies and products for wireless, wired, and power markets in the United States, China, rest of Asia, Taiwan, and Europe. It operates through three segments: High Performance Analog (HPA), Connectivity and Sensors Group (CSG), and Advanced Cellular Group (ACG). The HPA segment supplies radio frequency and power management solutions for defense and aerospace, and 5G and 6G infrastructure markets.

9.866 T

QRVO.USMarket value -Rank by Market Cap -/-

Valuation analysis

P/E

1Y

3Y

5Y

10Y

P/E

-

Industry Ranking

-/-

- P/E

- Price

- High

- Median

- Low

P/B

1Y

3Y

5Y

10Y

P/B

-

Industry Ranking

-/-

- P/B

- Price

- High

- Median

- Low

P/S

1Y

3Y

5Y

10Y

P/S

-

Industry Ranking

-/-

- P/S

- Price

- High

- Median

- Low

Dividend Yield

1Y

3Y

5Y

10Y

Dividend Yield

-

Industry Ranking

-/-

- Dividend Yield

- Price

- High

- Median

- Low

Institutional View & Shareholder

Analyst Ratings

- Price--

- Highest--

- Lowest--

News

View More

Posts

View More

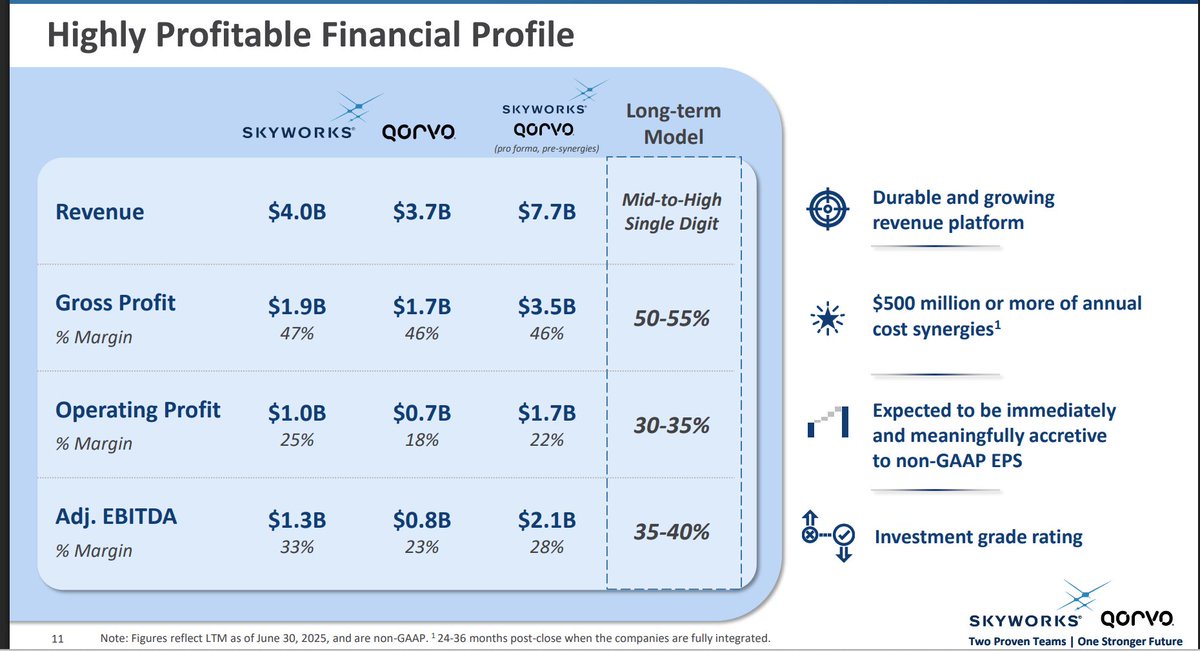

Qorvo-Skyworks merger. Unexpected one. Diversification beyond mobile play while consolidating mobile dominance. $7.7B combined revenue. 2/3rd mobile. >55% Apple exposure. SD % China Android exposure. ...

Qorvo QJun25

- >10% content growth at Apple this year (in line with expectation); Qorvo has exclusive envelope tracker slot in Apple modem platforms- Apple 41% of revenue in QJun; For now no change in .........Qorvo QMar25

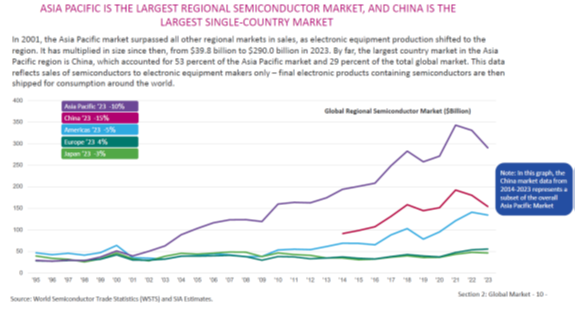

- Revenue down -8% q/q and -5% y/y to $869M; QJun will decline -11% q/q- Apple revenue grew 25% in FY25; Apple 47% and Samsung 10% in FY25Secured >10% content growth in iPhone 17 cycles; s...Tariffs are not easy: China faces trouble from own 125% tariffs on US semiconductors, despite exemption (imports $70-$80 billion a year)

-China electronics prices may rise at a time Beijing is actively............