Company Encyclopedia

View More

Skyworks Solutions

SWKS.US

Skyworks Solutions, Inc., together with its subsidiaries, develops, manufactures, and markets analog and mixed-signal semiconductor products and solutions in the United States, Taiwan, China, South Korea, Europe, the Middle East, Africa, and the Asia Pacific. The company offers amplifiers, antenna tuners, attenuators, automotive tuners and digital radios, wireless ASoC, DC/DC converters, demodulators, detectors, digital power isolators, diodes, directional couplers, diversity receive modules, filters, front-end modules, hybrids, light emitting diode drivers, low noise amplifiers, mixers, modulators, and optocouplers/optoisolators. It also provides phase locked loops, phase shifters, power dividers/combiners, power over ethernet, power isolators, ProSLIC family of subscriber line interface circuits, receivers, system in package, switches, synthesizers, timing devices, voltage-controlled oscillators/synthesizers, and voltage regulators. The company sells its products through direct sales force, electronic component distributors, and independent sales representatives.

9.866 T

SWKS.USMarket value -Rank by Market Cap -/-

Valuation analysis

P/E

1Y

3Y

5Y

10Y

P/E

-

Industry Ranking

-/-

- P/E

- Price

- High

- Median

- Low

P/B

1Y

3Y

5Y

10Y

P/B

-

Industry Ranking

-/-

- P/B

- Price

- High

- Median

- Low

P/S

1Y

3Y

5Y

10Y

P/S

-

Industry Ranking

-/-

- P/S

- Price

- High

- Median

- Low

Dividend Yield

1Y

3Y

5Y

10Y

Dividend Yield

-

Industry Ranking

-/-

- Dividend Yield

- Price

- High

- Median

- Low

Institutional View & Shareholder

Analyst Ratings

- Price--

- Highest--

- Lowest--

News

View More

Posts

View More

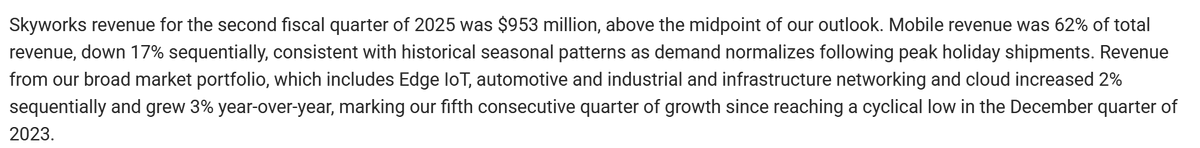

Skyworks QJun25: Six straight quarters of growth in non-mobile through QJun. Will grow in QSep too. Apple revenue up 4% y/y but will be down -9% y/y in QSep as SWKS loses 20-25% content in iPhone 17. ...

Skyworks sees 5 straight quarters of growth in non-mobile quarters through QMar. Apple revenue down 18% q/q. Apple 66% of revenue. 20-25% content loss in iPhone 17 cycle (previously communicated). Non...

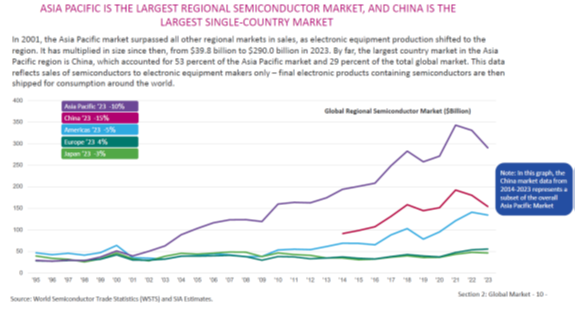

Tariffs are not easy: China faces trouble from own 125% tariffs on US semiconductors, despite exemption (imports $70-$80 billion a year)

-China electronics prices may rise at a time Beijing is actively............