Company Encyclopedia

View More

Regency Centers

REG.US

Regency Centers is a preeminent national owner, operator, and developer of shopping centers located in suburban trade areas with compelling demographics. Our portfolio includes thriving properties merchandised with highly productive grocers, restaurants, service providers, and best-in-class retailers that connect to their neighborhoods, communities, and customers. Operating as a fully integrated real estate company, Regency Centers is a qualified real estate investment trust (REIT) that is self-administered, self-managed, and an S&P 500 Index member.

1.412 T

REG.USMarket value -Rank by Market Cap -/-

Valuation analysis

P/E

1Y

3Y

5Y

10Y

P/E

-

Industry Ranking

-/-

- P/E

- Price

- High

- Median

- Low

P/B

1Y

3Y

5Y

10Y

P/B

-

Industry Ranking

-/-

- P/B

- Price

- High

- Median

- Low

P/S

1Y

3Y

5Y

10Y

P/S

-

Industry Ranking

-/-

- P/S

- Price

- High

- Median

- Low

Dividend Yield

1Y

3Y

5Y

10Y

Dividend Yield

-

Industry Ranking

-/-

- Dividend Yield

- Price

- High

- Median

- Low

Institutional View & Shareholder

Analyst Ratings

- Price--

- Highest--

- Lowest--

News

View More

Posts

View More

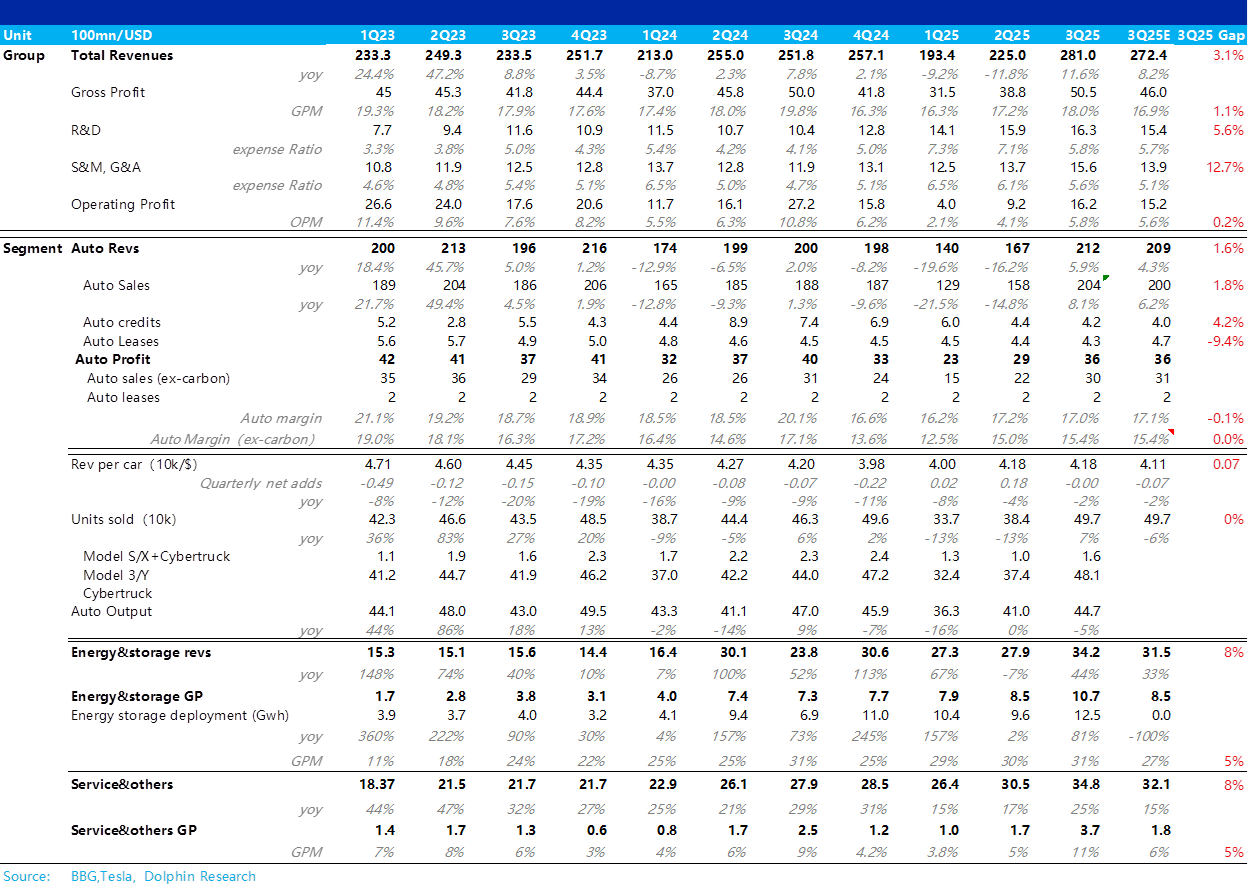

Tesla Quick Interpretation: Overall, regarding Tesla's third-quarter performance, the results are fairly decent. Both total revenue and total gross profit exceeded market expectations. However, net pr...

Focus Media (Minutes): Benefiting from the food delivery war, a peak in advertising is expected before the Spring Festival

The following are the minutes of the Q2 and H1 2025 earnings call of $Focus Media(002027.SZ) organized by Dolphin Research. For the earnings interpretation, please refer to "Focus Media: Short-term Pr...

$NONGFU SPRING(09633.HK) regarding the recent price war.

$NONGFU SPRING(09633.HK) Regarding this stock, its leading position in the drinking water sector is unshakeable. Recently, there has been a price war, so the market is pricing in some gross profit iss...