Company Encyclopedia

View More

Venture

V03.SG

Venture Corporation Limited, together with its subsidiaries, provides technology solutions, products, and services in Singapore, the Asia Pacific, and internationally. The company provides manufacturing, product design and development, engineering, and supply-chain management services. It is also involved in manufacturing and trading of electronic products, components, equipment, devices and instruments; wholesale of computer hardware and peripheral equipment; manufacture and repair of process control equipment and related products; customisation and logistic services; manufacture and sale of terminal units; develop and market colour imaging products for label printing; manufacturing and assembly of electronic and other computer products and peripheral; letting of factory building; and manufacturing of medical devices. In addition, the company provides engineering, customization, logistics, design solutions and services, information system development and support; and manufacturing and sale of sub- assemblies, printed circuit board assemblies for communication/networking equipment, and medical and scientific equipment/instrumentation, consumer electronics, measuring equipment, testing equipment, navigating and control equipment, optical instruments and equipment, plastic precision engineering components and mould, and plastic injection moulds and mouldings with secondary processes.

5.278 B

V03.SGMarket value -Rank by Market Cap -/-

Valuation analysis

P/E

1Y

3Y

5Y

10Y

P/E

-

Industry Ranking

-/-

- P/E

- Price

- High

- Median

- Low

P/B

1Y

3Y

5Y

10Y

P/B

-

Industry Ranking

-/-

- P/B

- Price

- High

- Median

- Low

P/S

1Y

3Y

5Y

10Y

P/S

-

Industry Ranking

-/-

- P/S

- Price

- High

- Median

- Low

Dividend Yield

1Y

3Y

5Y

10Y

Dividend Yield

-

Industry Ranking

-/-

- Dividend Yield

- Price

- High

- Median

- Low

Institutional View & Shareholder

Analyst Ratings

- Price--

- Highest--

- Lowest--

News

View More

Posts

View More

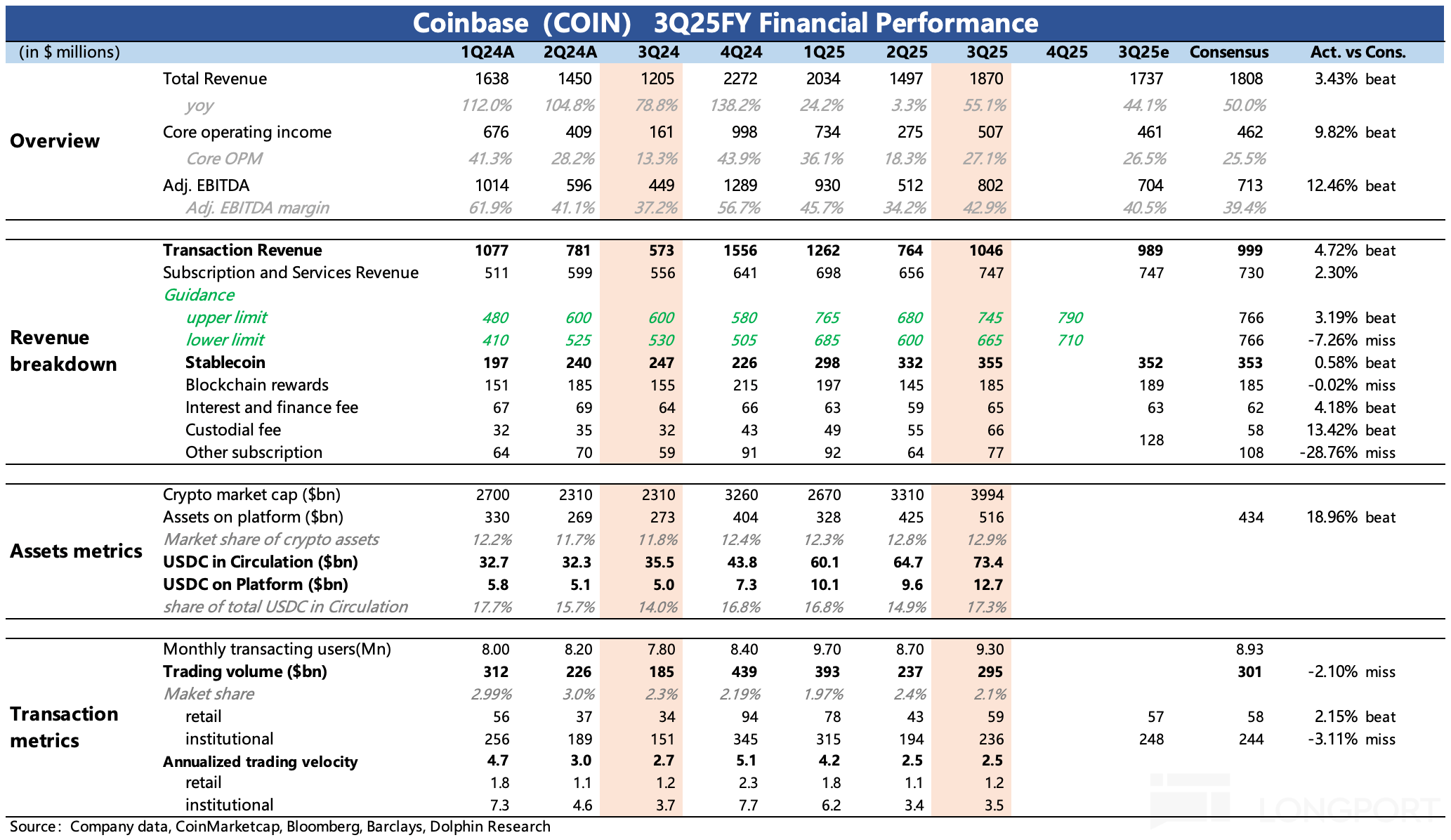

In the early morning of October 30th Beijing time, after the US stock market closed, $Coinbase(COIN.US) released its Q3 2025 financial report. Overall, the slight outperformance in trading revenue led...

TSMC will hold a board meeting in Tainan, south Taiwan Aug. 11-12, with topics likely to include the 2nd quarter dividend, seen no less than NT$5; the 2nm tech leak; the timeline of 2nm capacity expan.........