Valuation analysis

- P/E

- Price

- High

- Median

- Low

- P/B

- Price

- High

- Median

- Low

- P/S

- Price

- High

- Median

- Low

- Dividend Yield

- Price

- High

- Median

- Low

Institutional View & Shareholder

Analyst Ratings

- Price--

- Highest--

- Lowest--

The following are the minutes of Marvell Technology's Q3 2026 earnings call. For an interpretation of the earnings report, please refer to "Marvell: Acquisition to Fill Gaps, Is the NVIDIA Alternative......

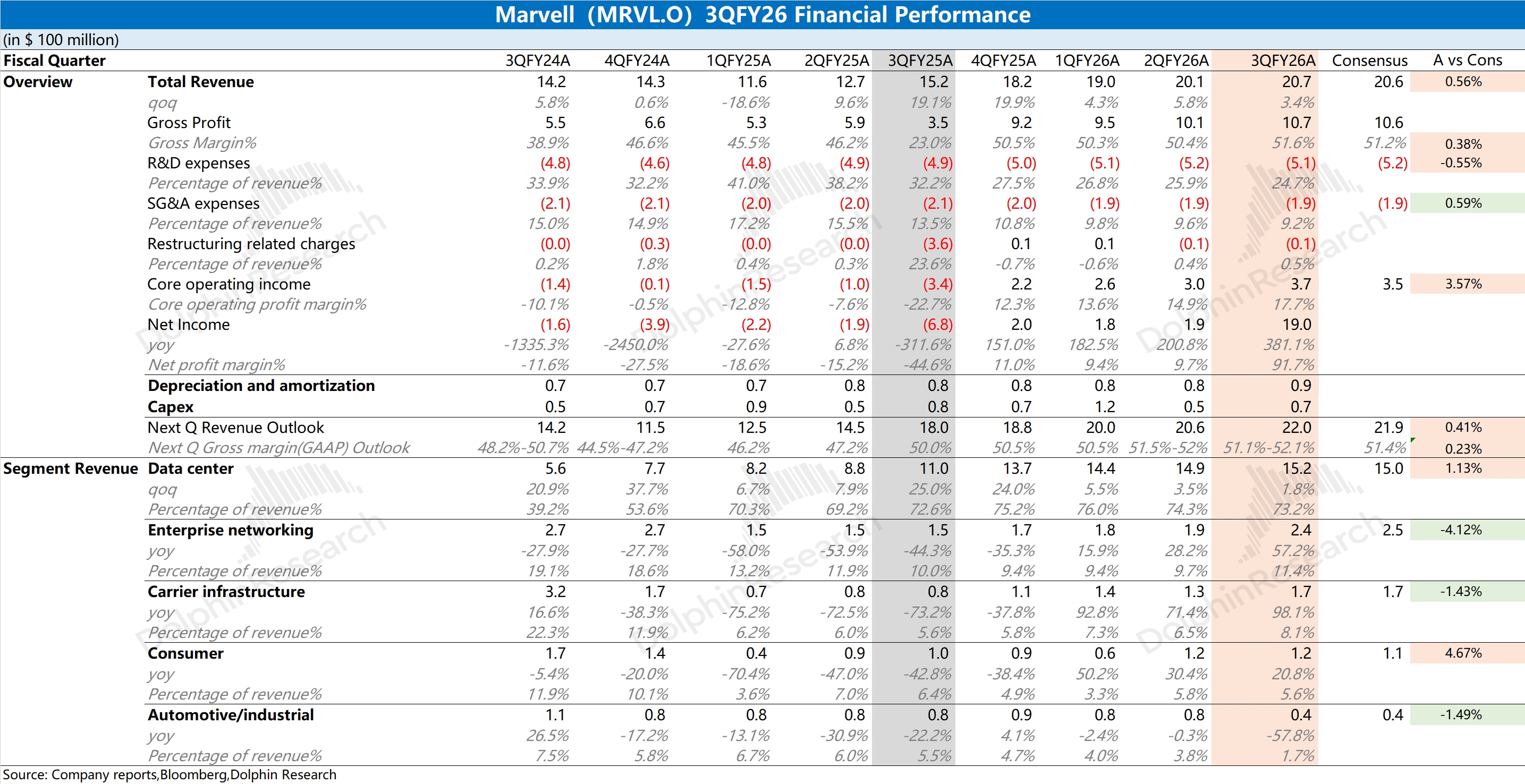

Marvell Technology Quick Interpretation: The company's performance this quarter and guidance for the next quarter basically met expectations. The quarter-on-quarter performance this quarter was not ma...

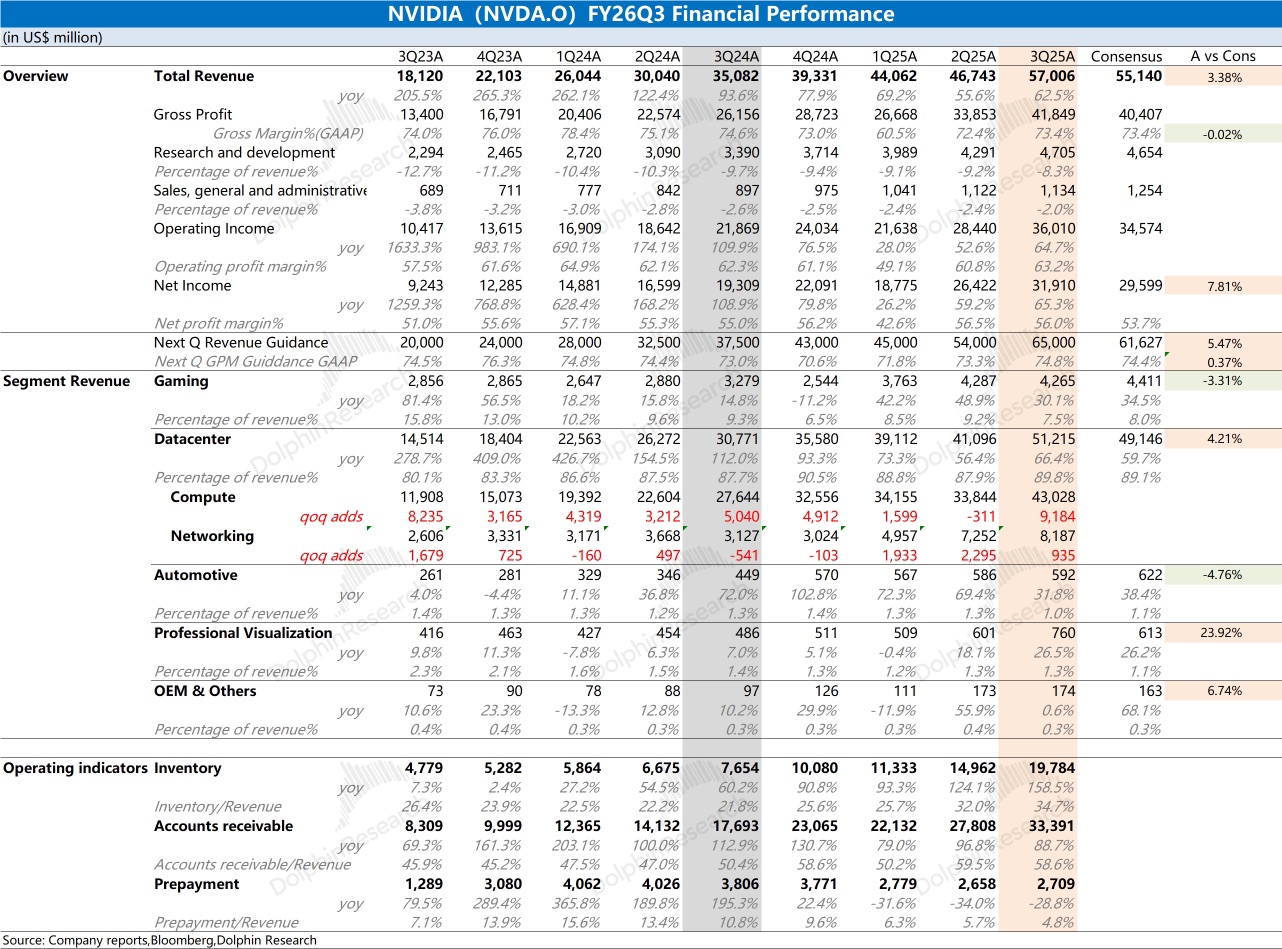

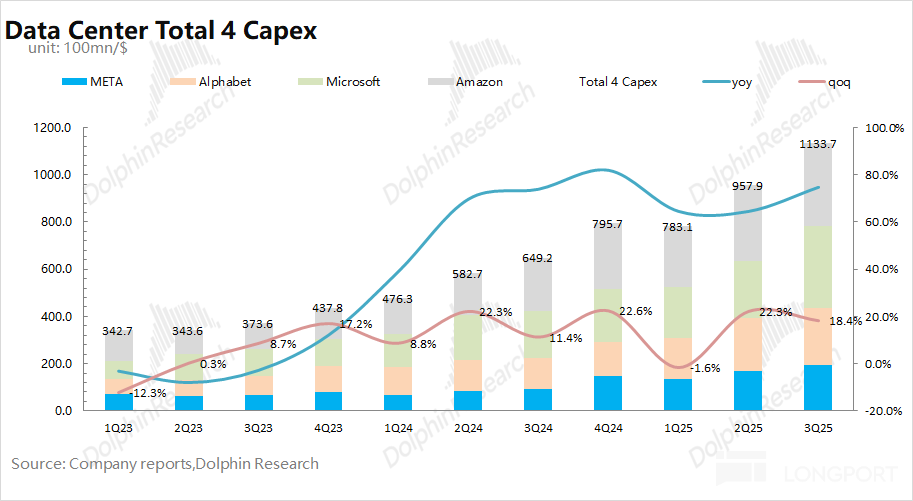

NVIDIA Quick Interpretation: The company once again delivered better-than-expected results this quarter, especially with a $10 billion quarter-over-quarter increase in revenue, which is quite impressi...

Novatek, Taiwan’s 3rd biggest chip designer, has invested over US$200 million to develop its ASIC chip design business for AI servers, combining decades of experience with key alliances to ecosystem g...............

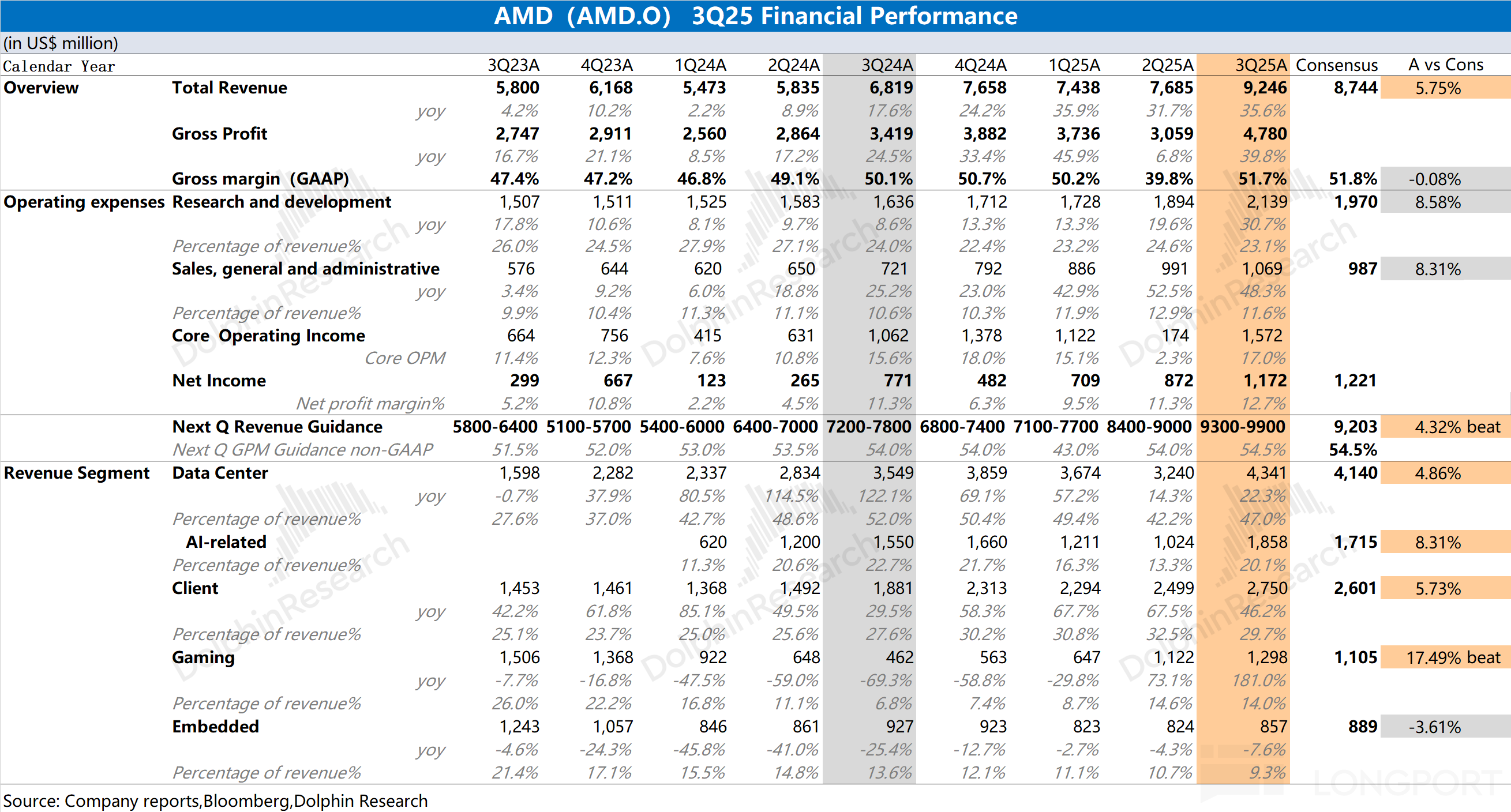

AMD (AMD.O) released its financial results for the third quarter of 2025 (ending September 2025) after the U.S. stock market closed on the morning of November 5, 2025, Beijing time. Key points are as ...