Valuation analysis

- P/E

- Price

- High

- Median

- Low

- P/B

- Price

- High

- Median

- Low

- P/S

- Price

- High

- Median

- Low

- Dividend Yield

- Price

- High

- Median

- Low

Institutional View & Shareholder

Analyst Ratings

- Price--

- Highest--

- Lowest--

Marvell QOct25

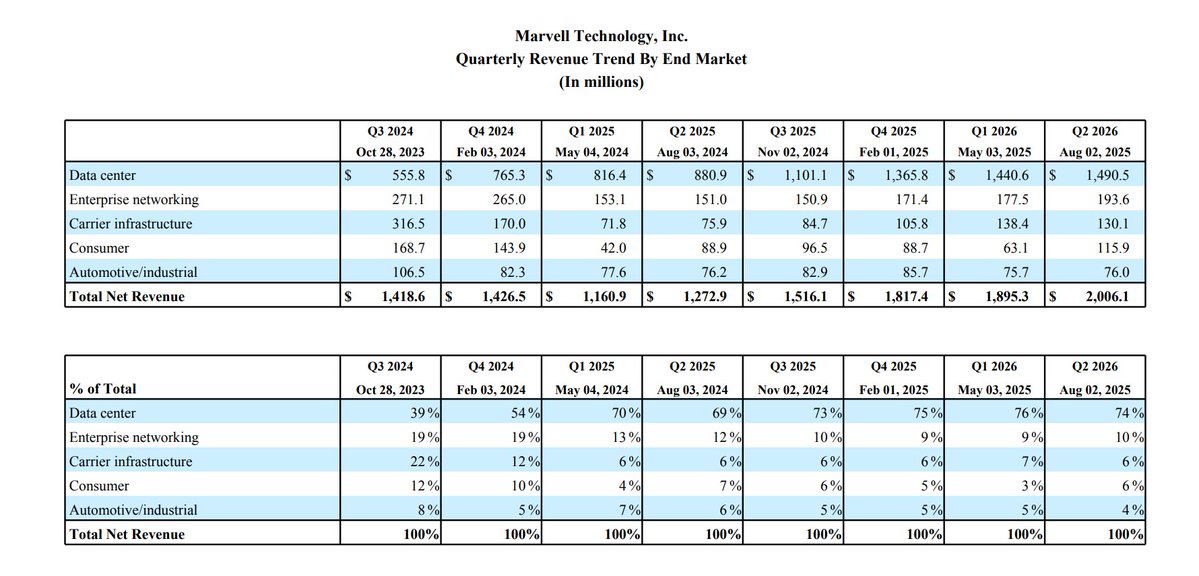

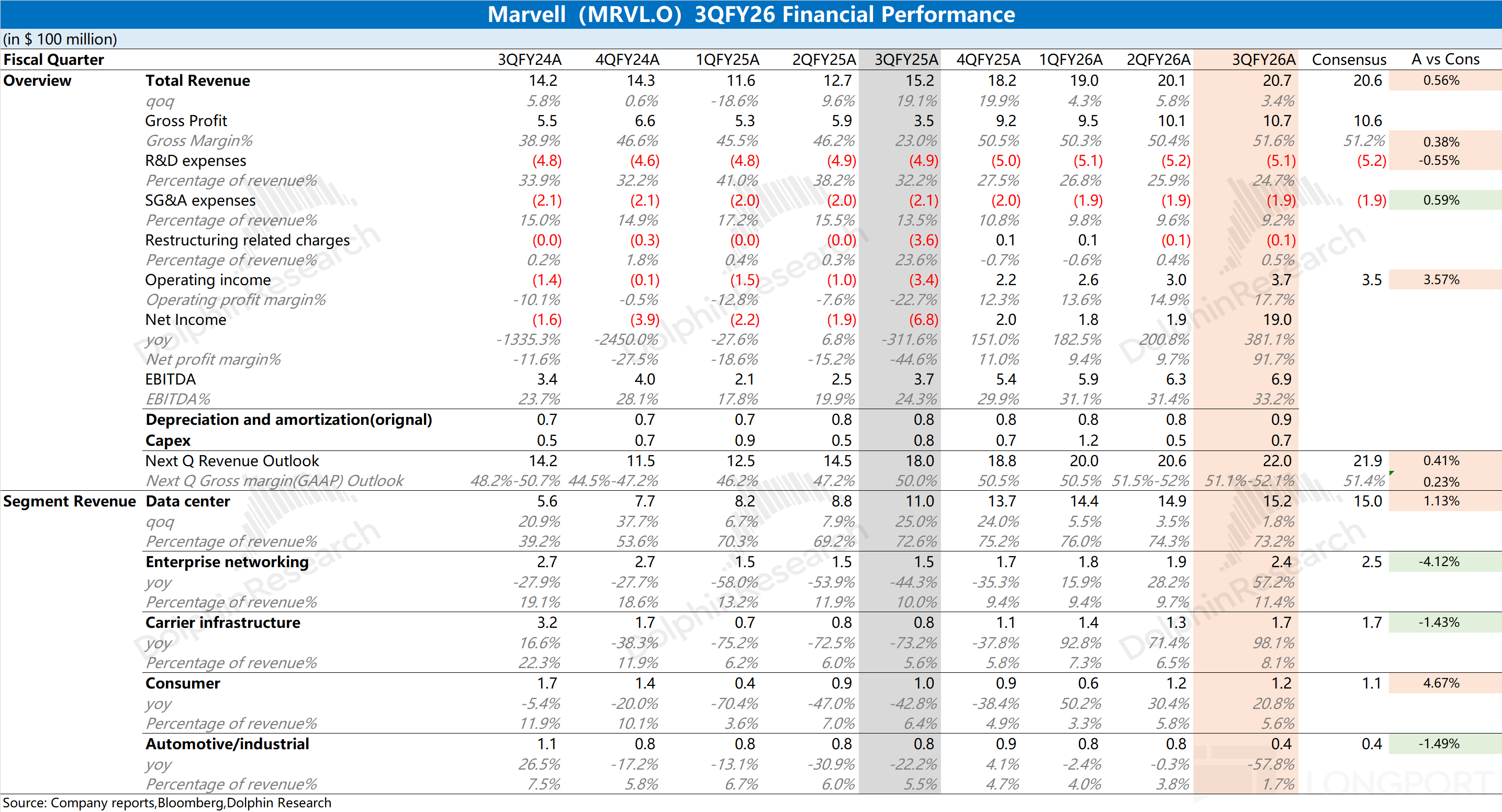

- Revenue up 3% q/q and 37% y/y to $2.075B (above mid point) at 51.6% GM; QJan26 to be up 6% q/q and 21% y/y- F27 revenue to be $10B with DC growing >25% (custom at least 20%) and comms ...............The following are the minutes of Marvell Technology's Q3 2026 earnings call. For an interpretation of the earnings report, please refer to "Marvell: Acquisition to Fill Gaps, Is the NVIDIA Alternative......

Marvell Technology (MRVL.O) released its third-quarter financial report for fiscal year 2026 (ending October 2025) in the early morning of December 3rd, Beijing time, after the U.S. stock market close......

Marvell may have the most interesting 3rd quarter report of the season on Tuesday (12/2). A global memory chip shortage has sent prices rocketing, and Marvell is king of memory/storage controller chip.....................

$NVIDIA(NVDA.US) +4.5% post market after reporting 3Q results that exceeded expectations, and posting 4Q rev guidance that also beat expectations. NVDA’s beat and raise will help offset concerns that............

.....................