Valuation analysis

- P/E

- Price

- High

- Median

- Low

- P/B

- Price

- High

- Median

- Low

- P/S

- Price

- High

- Median

- Low

- Dividend Yield

- Price

- High

- Median

- Low

Institutional View & Shareholder

Analyst Ratings

- Price--

- Highest--

- Lowest--

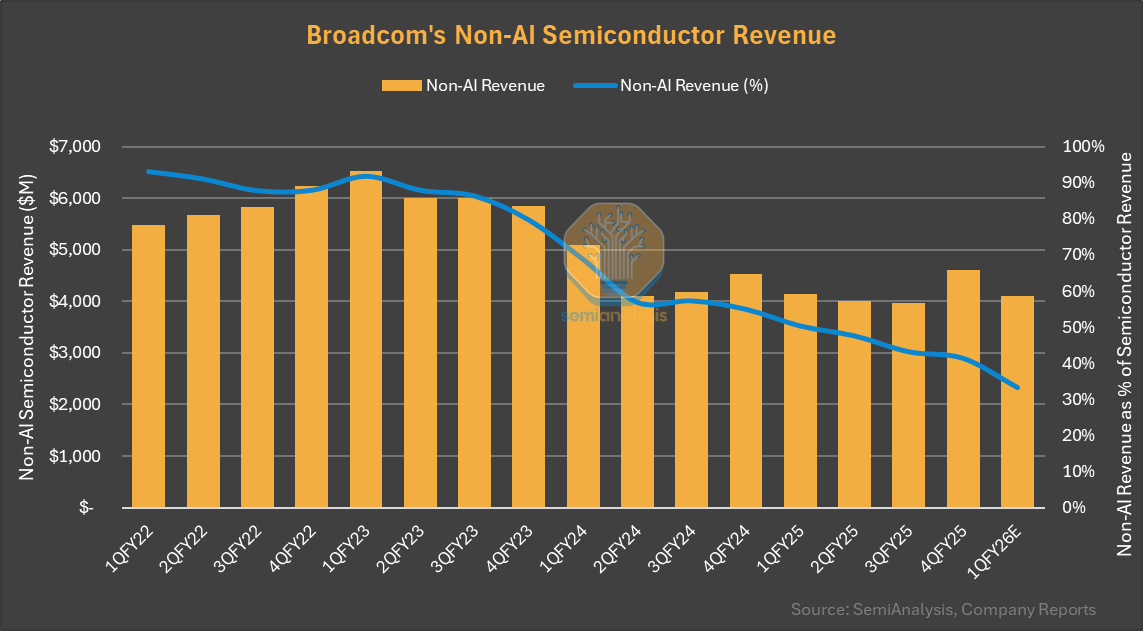

Broadcom's non-AI semi revenue saw first y/y growth in 9 quarters but still down 30% vs previous peak. Wireless is the lowest margin business in non-AI but rest of the non-AI has higher margin than XP...

Apple’s upcoming ‘Baltra’ AI server chip will be manufactured by TSMC on 3nm N3E) production lines, media report, while Baltra servers will be supplied by Foxconn, the iPhone and AI server giant. Appl............

$Broadcom(AVGO.US) As an AI-themed stock, can crypto-related stocks like this find a bottom this Friday? $Oracle(ORCL.US) $Coinbase(COIN.US)

market just feels exhausted tbh

no major headlines but once again seeing a rotation from tech to financials/healthcare$Broadcom(AVGO.US) and $Oracle(ORCL.US) continue down and pulling all the datacent...............The upcoming week is particularly crucial. The combination of Non-Farm Payrolls and CPI data, along with the Bank of Japan's potential rate hike decision next Friday, will significantly influence the ...............