Valuation analysis

- P/E

- Price

- High

- Median

- Low

- P/B

- Price

- High

- Median

- Low

- P/S

- Price

- High

- Median

- Low

- Dividend Yield

- Price

- High

- Median

- Low

Institutional View & Shareholder

Analyst Ratings

- Price--

- Highest--

- Lowest--

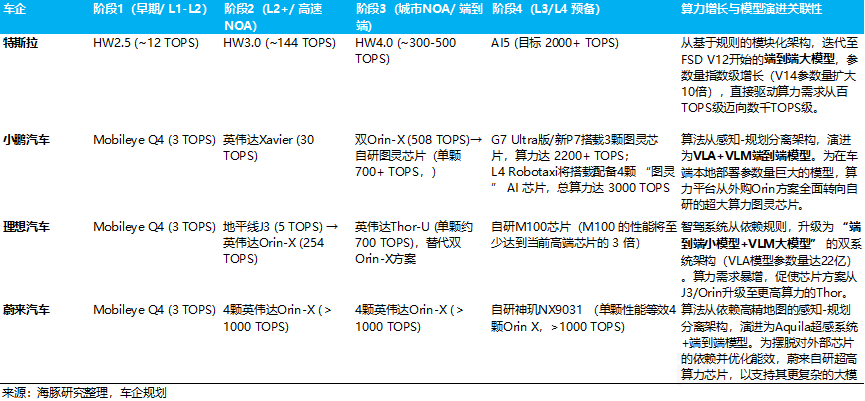

MediaTek, the smartphone and ASIC chip giant, sees automotive becoming its next US$1 billion business over the next 2-3 years due to a platform co-developed with Nvidia, mainly in China (BYD for one) ......

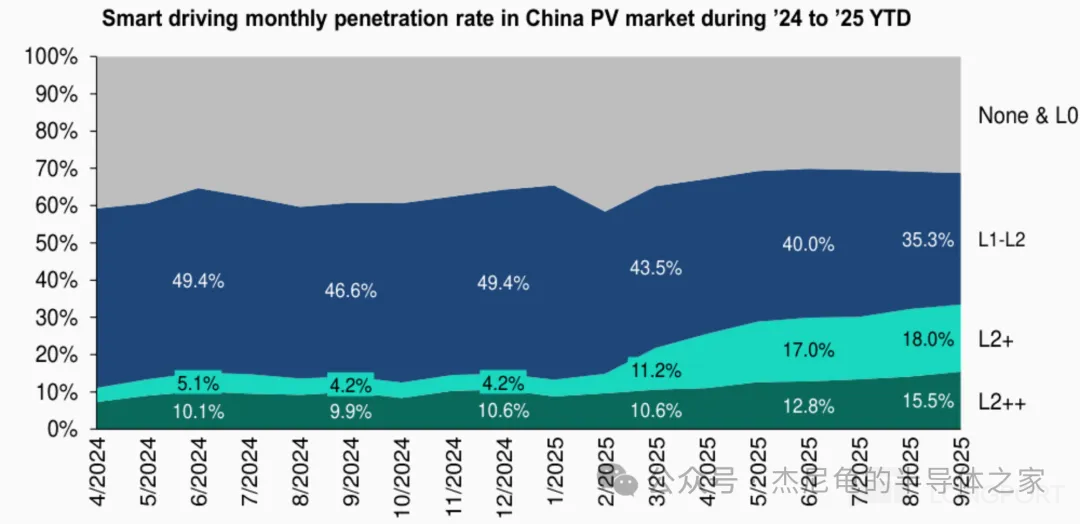

Horizon Robotics: An NVDA alternative for high-end autonomous driving?

1209 | Dolphin Research Focus: 🐬 Macro/Industry 1) Hong Kong Exchanges and Clearing Ltd. (HKEX) announced the HKEX Tech 100 Index, tracking the 100 largest Southbound Stock Connect-eligible tech name...

......Your insights last week were nothing short of amazing. Ready to see more brilliant ideas in the spotlight? Let's dive into Community's Spotlight Ep.3 💯🔥

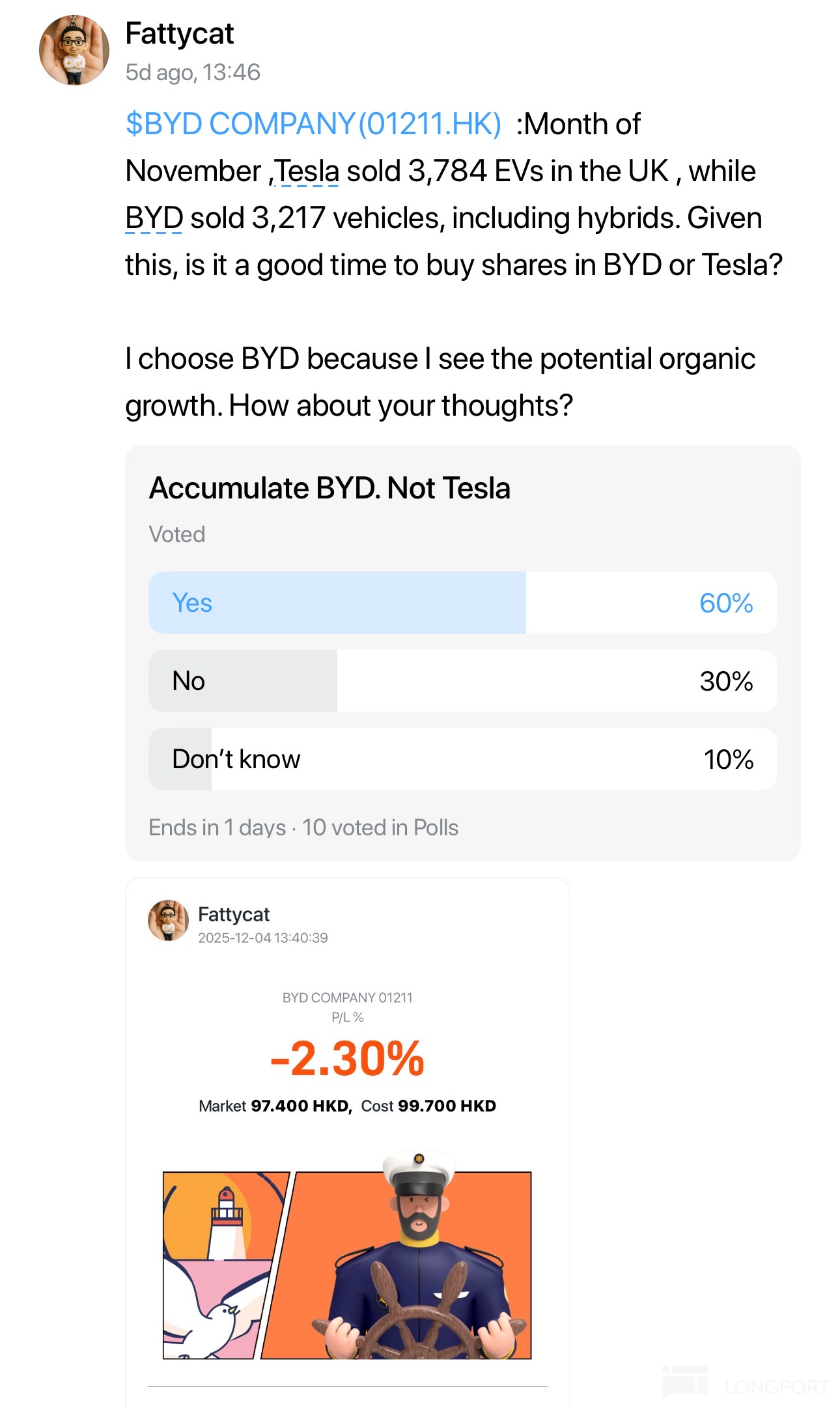

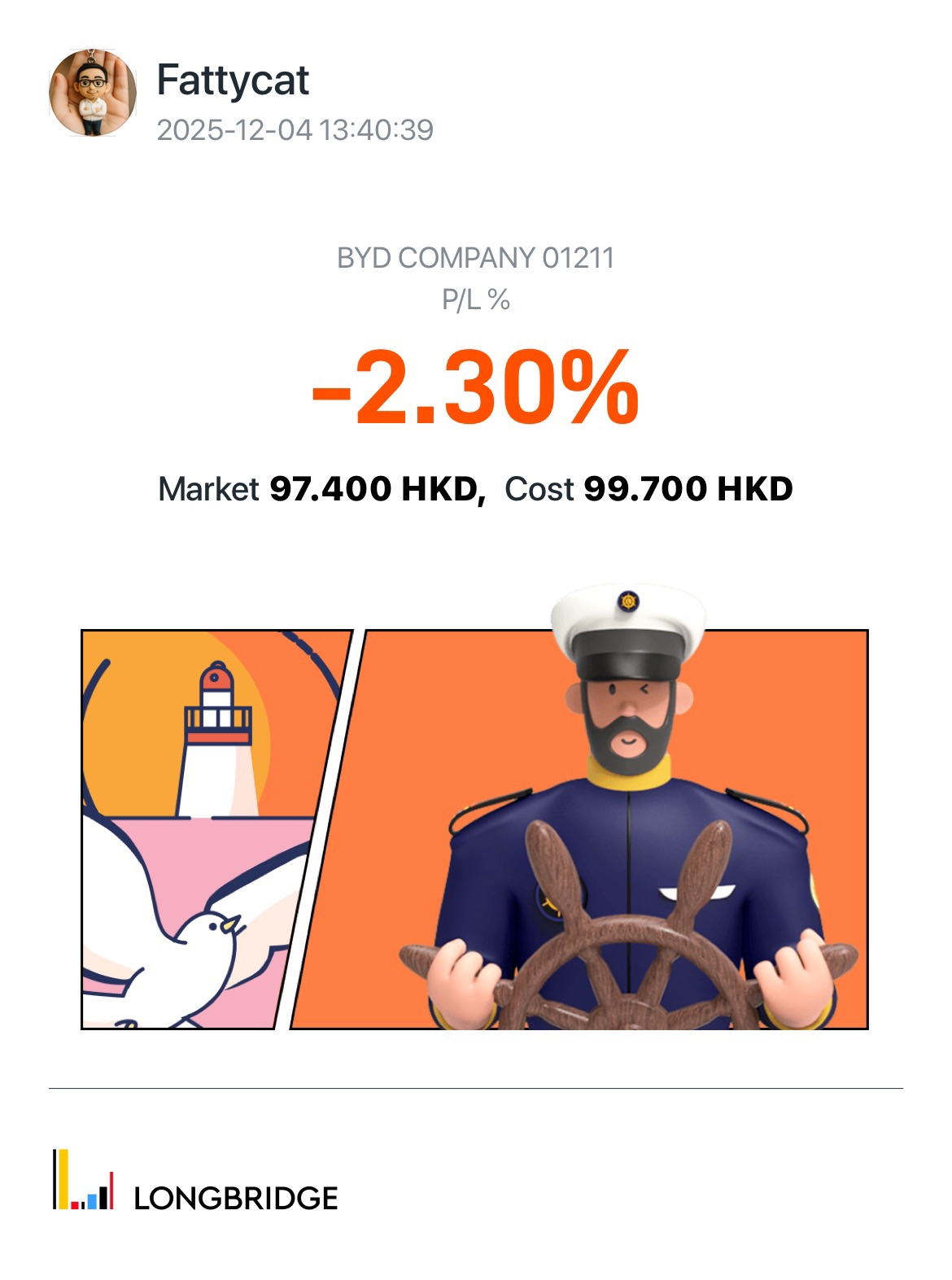

$BYD COMPANY(01211.HK) :Month of November ,Tesla sold 3,784 EVs in the UK , while BYD sold 3,217 vehicles, including hybrids. Given this, is it a good time to buy shares in BYD or Tesla?

I choose BYD b...

Accumulate BYD. Not Tesla

Single Choice

- Yes60%

- No30%

- Don’t know 10%