Valuation analysis

- P/E

- Price

- High

- Median

- Low

- P/B

- Price

- High

- Median

- Low

- P/S

- Price

- High

- Median

- Low

- Dividend Yield

- Price

- High

- Median

- Low

Institutional View & Shareholder

Analyst Ratings

- Price--

- Highest--

- Lowest--

Elon just dropped the bomb, says Tesla Robotaxis will see a “MAJOR CHANGE” by end of year.

buckle up, the ride is about to get real. If $Tesla(TSLA.US) nails this, Uber and Lyft are toast.$Uber Tech(UBER.US) Traders Shrug Off Robotaxi Risks as Stock Powers to Record

- Uber shares have rallied 60% to a record this year due to partnerships with robotaxi startups and growth in new markets....................................................With the successful launch of Tesla's Robotaxi, which related players are worth paying attention to?

$Tesla(TSLA.US) rose more than 10% during the session. UBS believes Robotaxi will bring Tesla over $200 billion in annual revenue by 2040. Which players in the autonomous driving industry chain are wo...

$LYFT(LYFT.US)(LYFT.US) (+24% today): It wouldn’t surprise me to see $Tesla(TSLA.US) or another auto mnfr with autonomy ambitions buy $LYFT(LYFT.US)(LYFT.US) (Enterprise value $5.7B, $236 EV per acti......

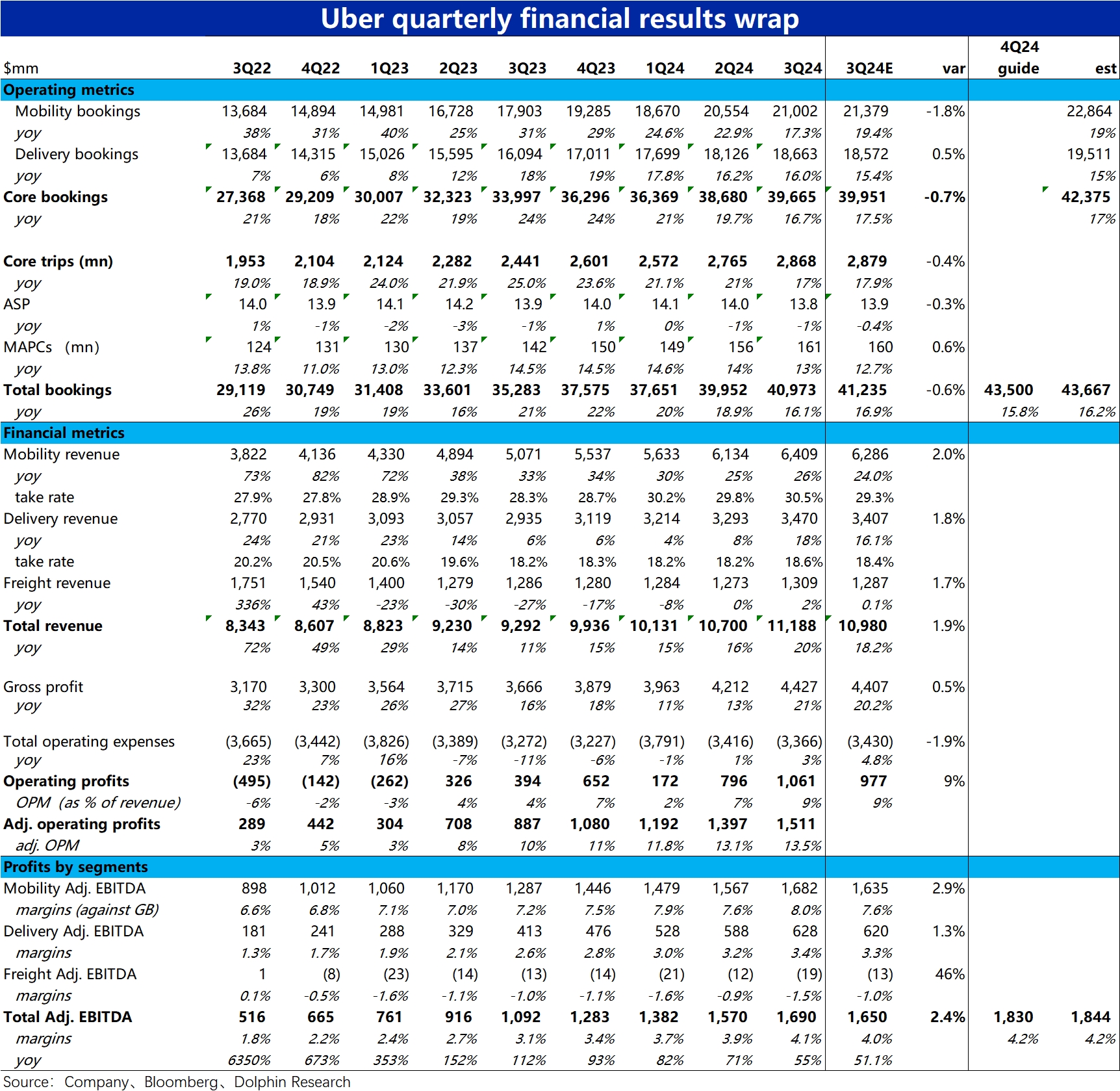

$Uber Tech(UBER.US) 3Q24 first take: As one of the consensus long leaders in U.S. stocks, Dolphin Research has always had strong confidence in Uber. However, after this earnings release, the pre-marke...