Company Encyclopedia

View More

Pro Gbl Listed Pvt

PEX.US

News

View More

Posts

View More

(Transfer) $Amazon(AMZN.US) exceeded expectations, and like the other three, the margin is good + higher capex, and capex exploded! $75 billion, nearly $5 billion more than market expectations. $Marve.........

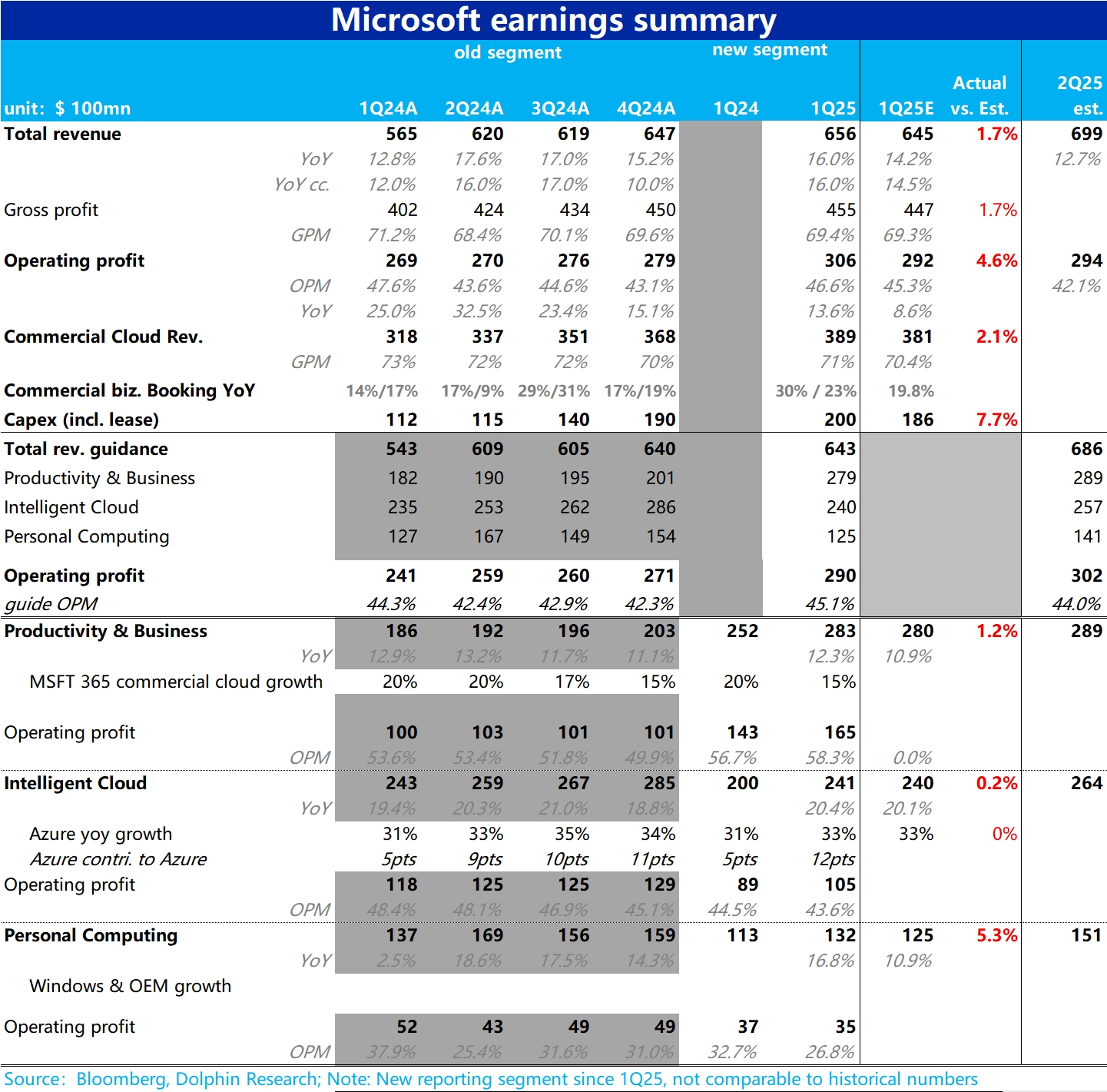

$Microsoft(MSFT.US) 1Q25 first take: As the first earnings report after the change in accounting standards, it does bring some impact on our understanding of the financial details, but it also gives u...