American Depository Receipt Custody Fees

This article provides a detailed introduction to American Depositary Receipts (ADRs) and the custody fees associated with them.

1. What is ADR?

American Depositary Receipt ("ADR") refers to a negotiable certificate issued by U.S. commercial banks to facilitate the trading of foreign securities in the U.S. stock market. This certificate represents a specified number of shares of non-U.S. companies that are held by a U.S. bank, which in turn issues ADRs representing the shares, but not necessarily at a 1:1 ratio; for example, 5 shares of a company may represent only 1 share of ADR.

2. How are ADR custody fees charged?

The Depository Trust Company (DTC) began charging brokerages or clearing firms for custody fees in 2008, which in turn charged investors who hold ADRs. This fee is therefore known as the “ADR custody fee”.

3. ADR custody fees

ADR custody fees range from 1 to 5 cents per share on average. The amount and timing of the fees charged vary by ADR. Please refer to the individual ADR prospectus for specific information or search online through the EDGAR search tool.

ADR custody fees are charged 1 to 4 times per year normally, the frequency might be be higher under special circumstances. The charge amount will be split accordingly. For example, if the annual ADR custody fee is 2 cents and the charging frequency is 4 times a year, 0.5 cents will be charged each time.

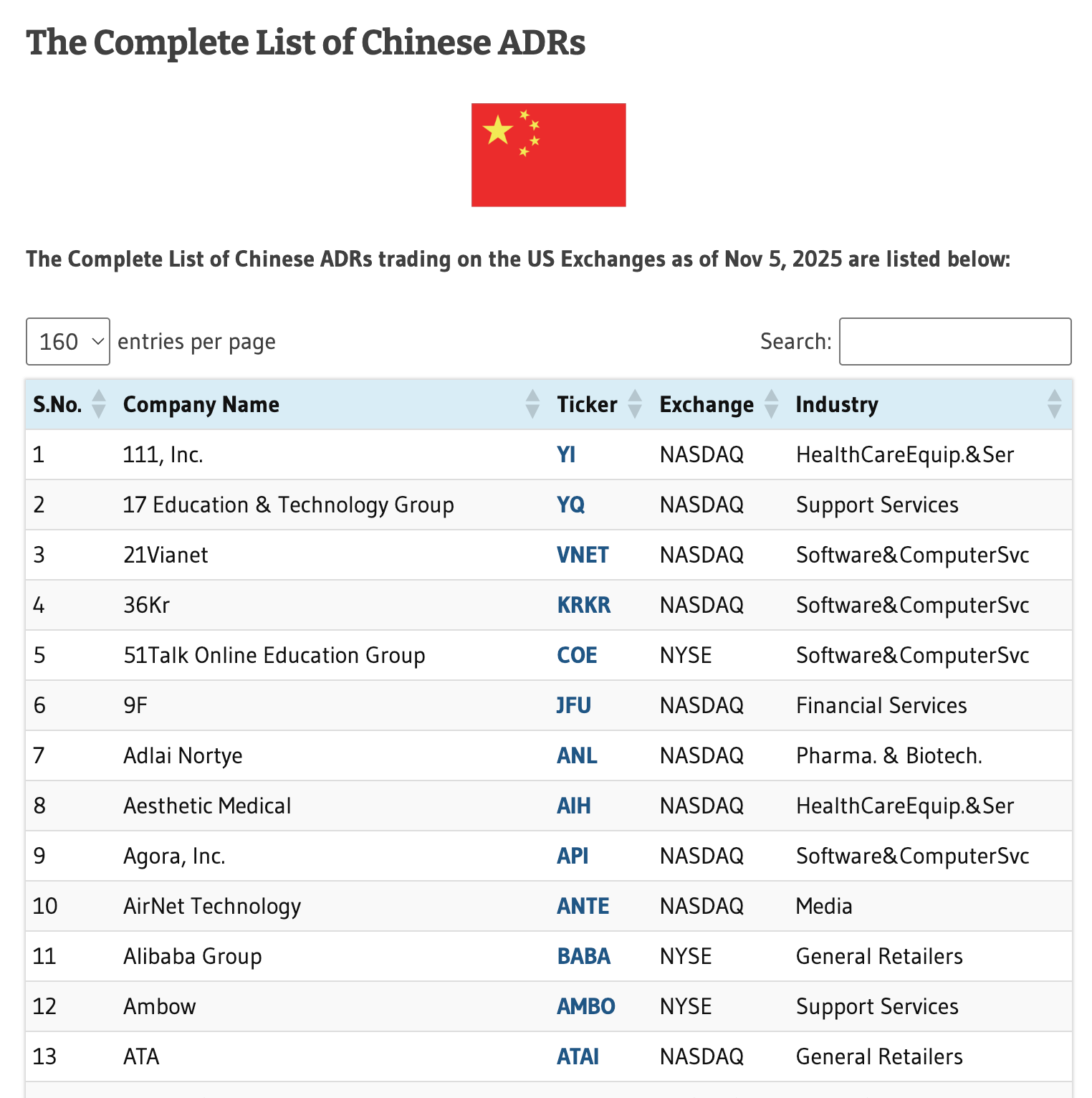

4. Search for ADR stocks

In general, non-U.S. companies trading in the U.S. secondary market may charge ADR fees.

Click here to view more information, as shown below.

5. ADR deduction details

Go to the Longbridge App > Portfolio > More > Fund Details to check ADR custody fee records.

Key takeaways:

- Nature of ADRs: ADRs are negotiable certificates representing shares of a non-US company, issued and custodied by a US bank (the ratio of company shares to ADRs is not fixed at 1:1, for example, one ADR may represent five shares).

- Source of fees: The DTC charges brokers ADR custody fees, which are then passed on to investors holding ADRs.

- Fee standard: The custody fee typically ranges from 1–5 cents per share, though the exact amount and deduction time may differ among ADRs.

- Check method:

- Confirm whether a stock is an ADR via the search tool provided by Longbridge.

- Path for checking fee records in the Longbridge App: Longbridge App > Portfolio > More > Fund Details.

Disclosures

This article is for reference only and does not constitute any investment advice.