Didi 3Q25 Quick Interpretation: In early November, Didi updated the market with guidance on its 3Q performance, mainly mentioning two issues:

1. The investment in the food delivery business in Brazil (to gain a first-mover advantage over Meitu Keeta) will lead to a significant expansion of losses in overseas business; 2. The guidance also indicated that domestic subsidies and other investments would be concentrated in the second half of the year, resulting in a decline in the domestic business's adj. EBITA profit margin compared to the high point in the first half.

As this unfavorable guidance was digested by the market, Didi's stock price subsequently retreated by nearly 20%. The actual performance this quarter was largely in line with the previous guidance, with Bloomberg's consensus expectations being somewhat high due to untimely updates, while major banks have made corresponding adjustments. Therefore, overall, Didi's performance this season was expectedly poor.

Specifically:

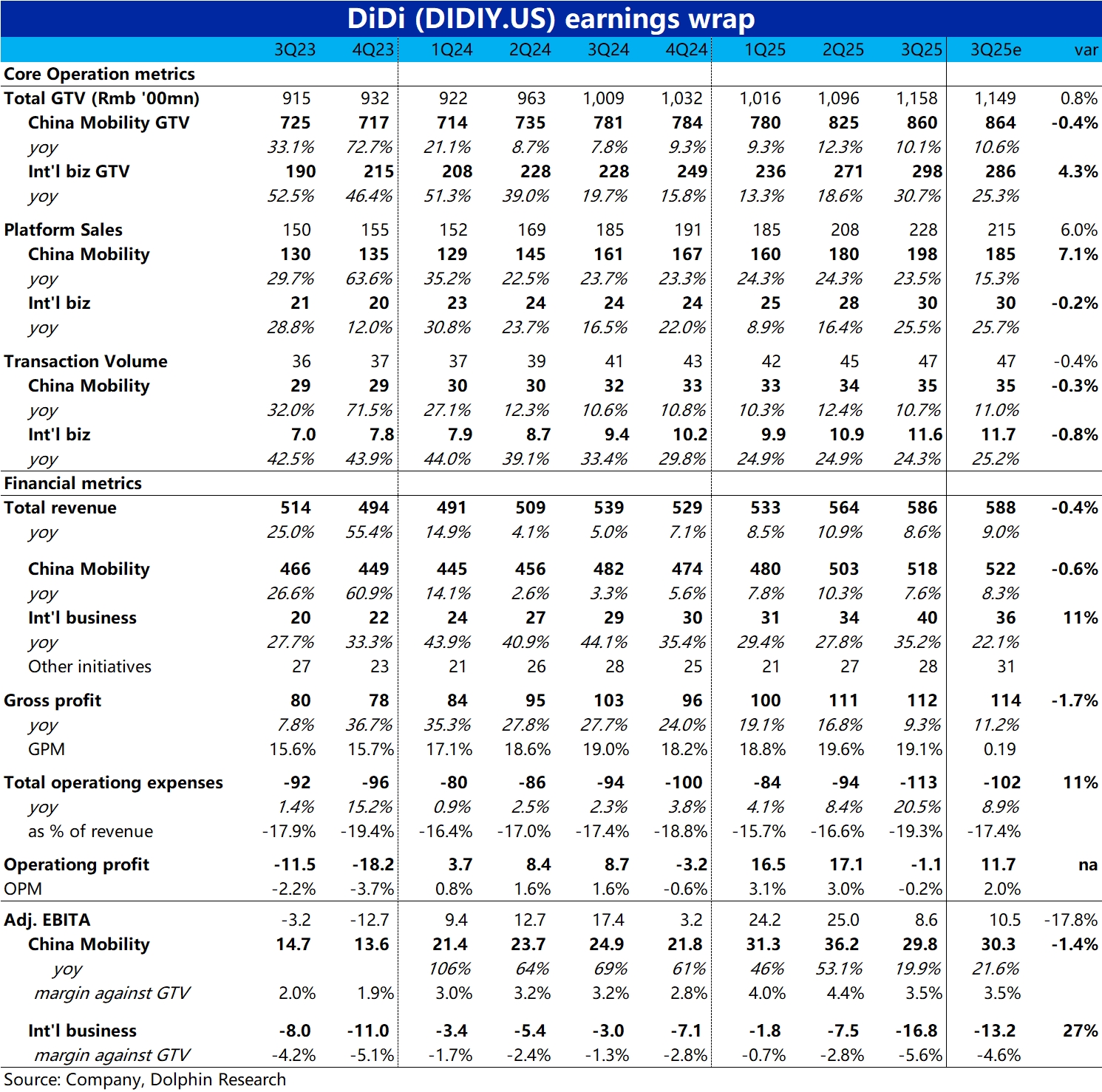

1) In terms of core growth indicators, the domestic travel segment's GTV grew by approximately 10% year-on-year, slightly slowing down by about 2 percentage points quarter-on-quarter.

The domestic business growth remains generally stable and largely in line with expectations. Meanwhile, the GTV growth rate of overseas business significantly increased to 31%, reflecting that the overseas investment indeed accelerated business growth, and it was notably higher than Bloomberg's consensus expectations.

2) In terms of profit, the domestic business adj. EBITA profit was 2.98 billion, slightly higher than the November guidance of 2.7-2.8 billion. However, the trend shows that this quarter's profit margin fell significantly from over 4% in the first two quarters of this year (based on GTV) to 3.5% this quarter, indicating a considerable decline.

Dolphin Research preliminarily judges that this is more due to the drag of weakening overall domestic ride-hailing demand (macro factors), while Didi's competitive landscape remains stable or further improved.

3) The overseas business's loss this quarter expanded significantly to nearly 1.8 billion, with the loss rate doubling quarter-on-quarter to 5.6%, which is generally in line with the updated expectations of major banks. As mentioned earlier, this is mainly due to the impact of investment in Brazil's food delivery. $DiDi(DIDIY.US)