What is the US stock overnight session?

The overnight session refers to the trading period from 20:00 to 3:50 Eastern Time (ET) the next day, marking the start of the next trading day. Pre-market, regular trading, after-hours, and overnight sessions form the 24-hour trading system for the US stock market, supporting select stocks and ETFs.

1. Introduction to the US stock overnight session

Overnight trading hours run from 08:00 - 15:50 SGT during daylight saving time and 09:00 - 16:50 SGT during standard time.

During a daylight saving day, the first session of overnight trading begins on Monday morning at 08:00 SGT and concludes early Monday afternoon at 15:50 SGT, while the last session takes place on Friday morning at 08:00 SGT and ends early Friday morning at 15:50 SGT.

It's important to note that the start of overnight trading marks the beginning of the next trading day. Overnight trading, along with pre-market, regular trading hours, and post-market trading, form the 24-hour trading cycle of the US stock market.

For example, the overnight trading hours on Tuesday morning, spanning from 08:00 SGT to early Tuesday afternoon at 15:50 SGT, is considered part of Tuesday's U.S. trading day. The contract details for these trades will only be available in Wednesday's statement, alongside the U.S. pre-market, regular, and post-market trades.

2. What products can be traded in a U.S. overnight trading session?

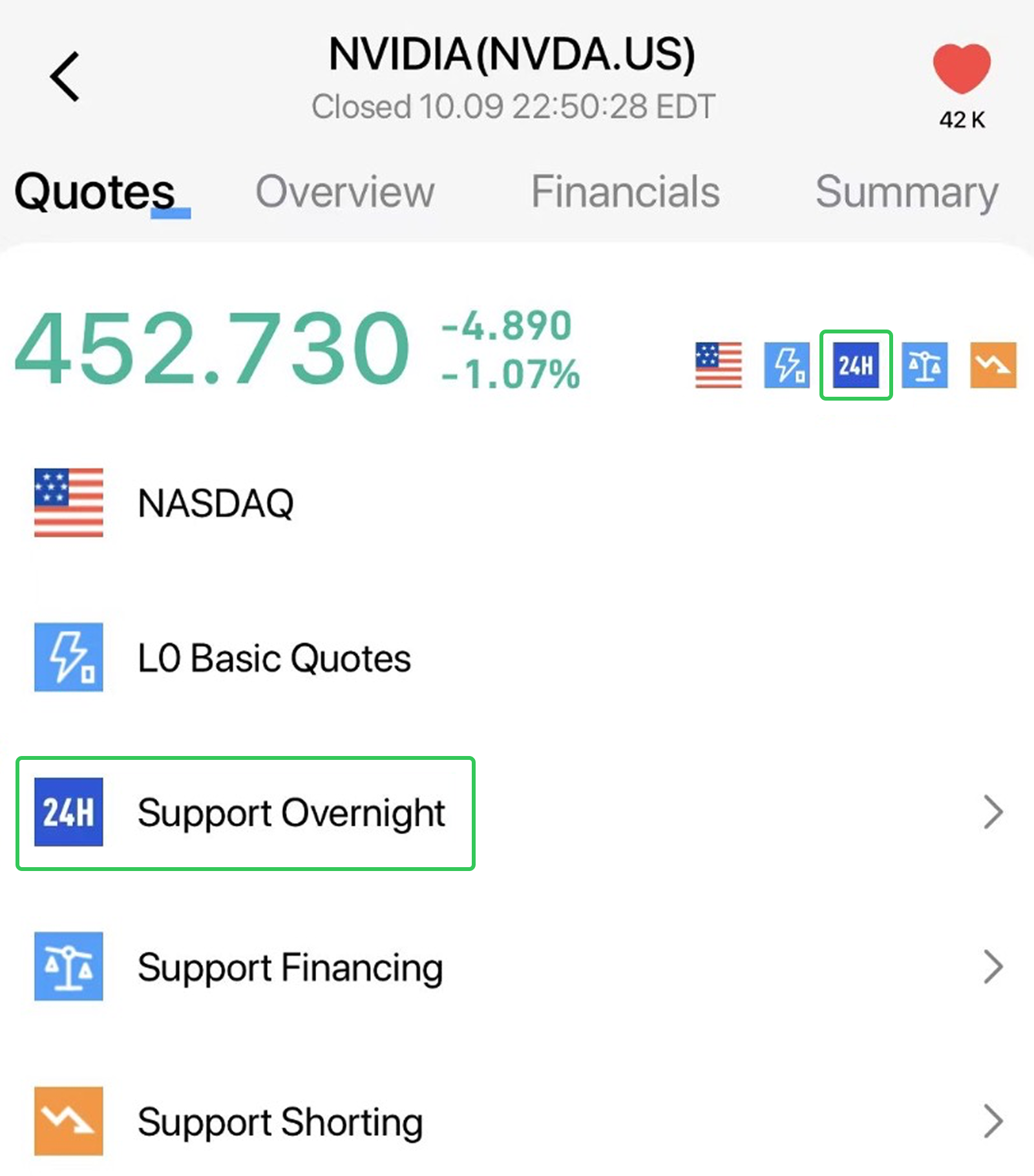

Overnight trading is applicable to both stocks and ETFs. You can identify these stocks by the '24H' label on the stock details page. The range of codes available for overnight trading is continuously expanding.

3. Is market data available for a US Overnight trading session?

You can access various types of market data, including overnight trade snapshots, intraday charts, transaction details, transaction statistics, and BBO (Best Bid & Offer).

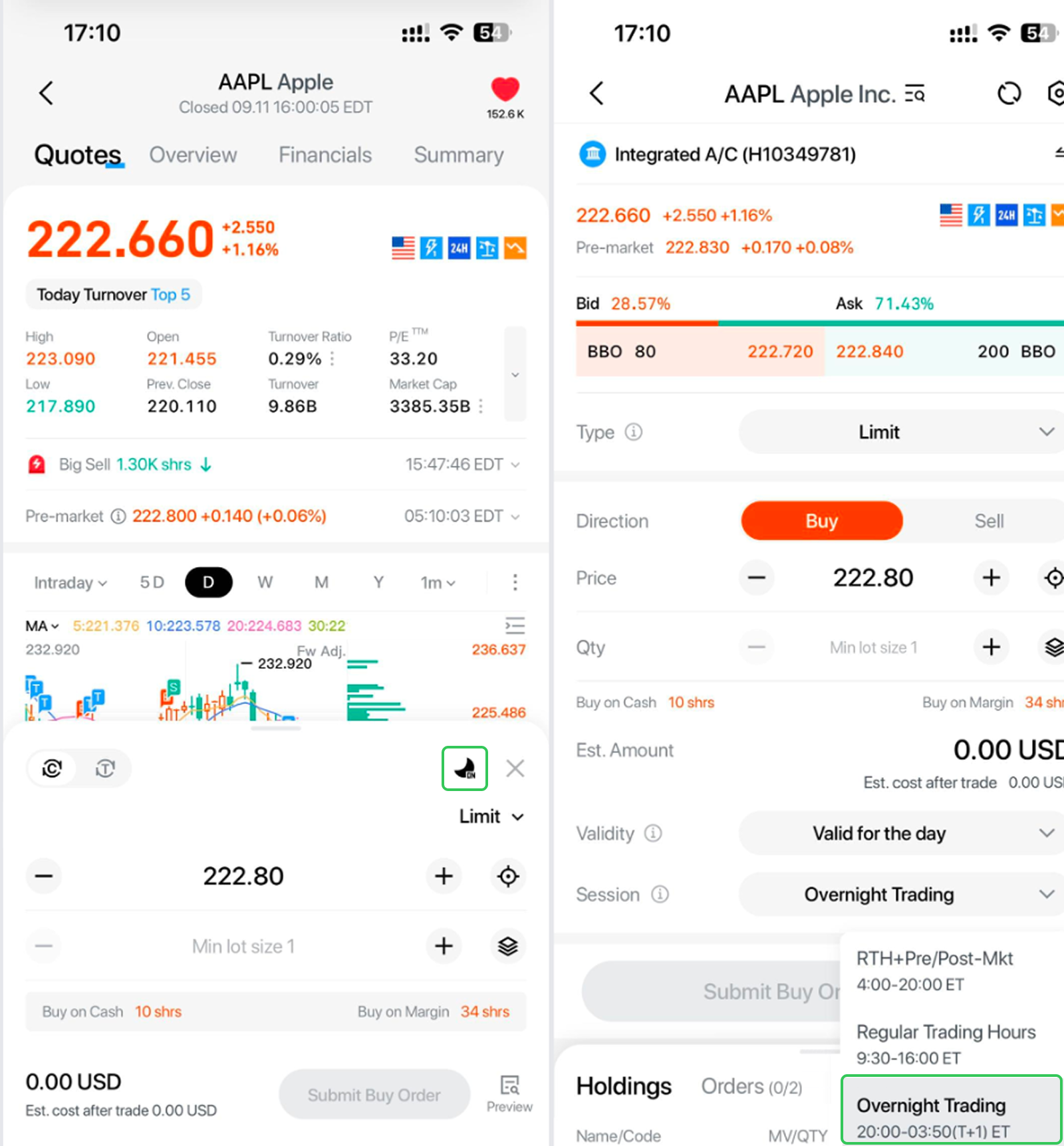

4. How can I place orders during an overnight session, and what types of orders are supported?

Overnight trading only supports limit orders, and their validity is restricted to the current trading day.

There are currently two ways to place an order during the overnight session:

5. How are my position value and P/L calculated?

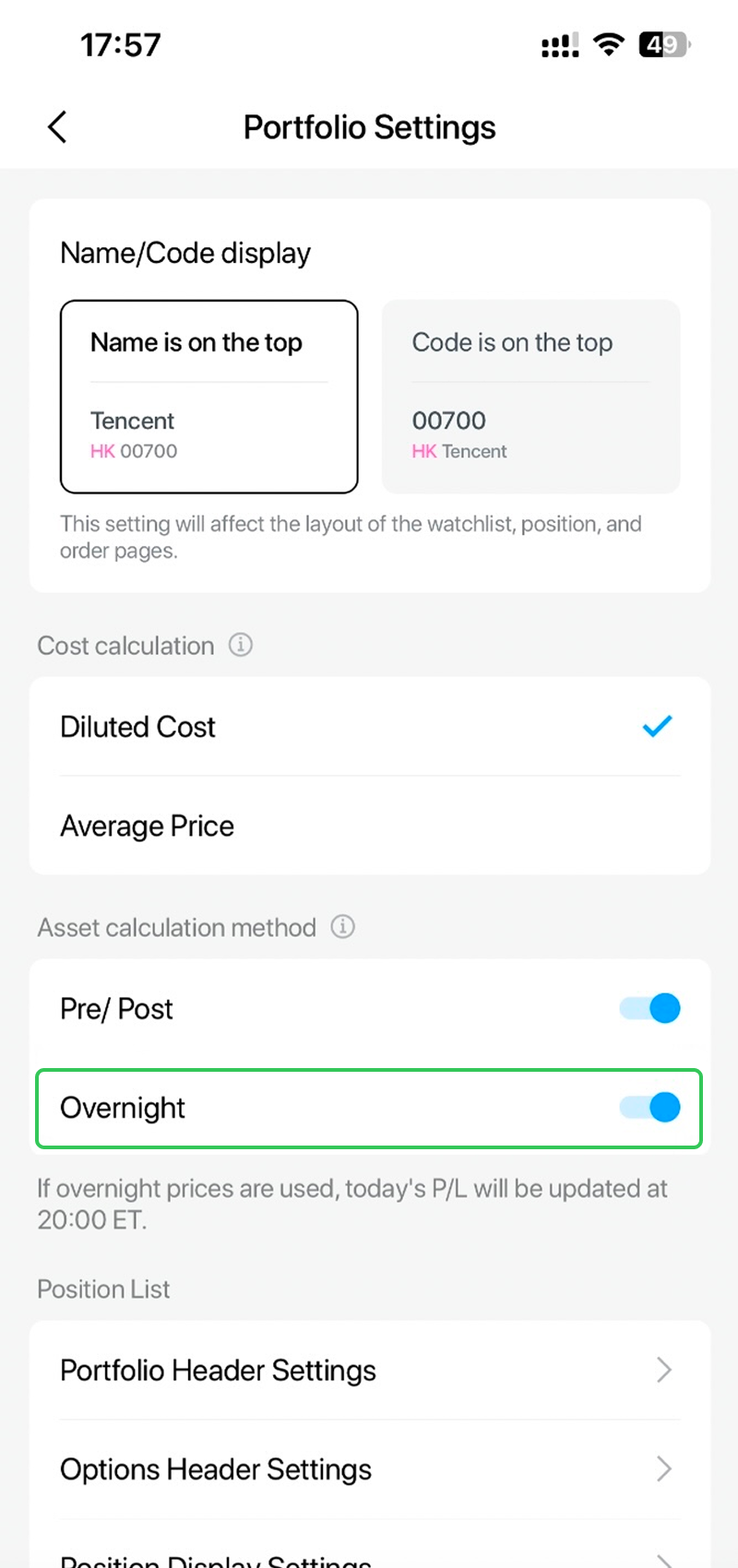

You can choose whether to incorporate overnight trading prices into your position and P/L calculations via "More Settings" > "Portfolio" > "Asset Calculation Method" option. When you opt for overnight trading prices, the latest prices during the overnight session will impact your position values and P/L calculations.

Key takeaways:

- Trading hours: The overnight session runs from 20:00 to 3:50 ET the next day, starting Sunday night and ending early Friday morning. Sessions are attributed to the next trading day.

- Eligible varieties: Available for select stocks and ETFs—identified by the 24H label on the details page. Coverage is continuously expanding.

- Market data: After overnight trading begins, you can access intraday charts, trade details, top bid/ask quotes, and more.

- Trading method: Only limit orders are supported, with day-only validity. Orders can be placed by enabling the overnight mode through the trading floor or quick trade.

- P&L calculation: You can choose whether to calculate the position P&L based on the latest overnight price underSettings> Portfolio Settings > Asset calculation method.

Notes

- Overnight trading is conducted over-the-counter (OTC), and upstream brokers may impose price restrictions on overnight orders.

- If a stock involved in overnight trading has corporate actions within a 3-day window, orders may be rejected by the upstream broker.

- The stock may be unavailable for overnight trading on the day of the corporate action, as well as the days before and after.

- Overnight trading only supports universal accounts.

- Due to generally lower liquidity and higher price volatility during overnight sessions, as well as potential restrictions from upstream securities companies and exchanges, your orders may be partially filled or not filled at all. Please be aware of the associated risks.

FAQs

Q1: Is overnight trading available during US holidays?

Overnight trading follows the exchange holiday calendar. Trading days for overnight sessions align with regular trading days, and no overnight trading occurs on holidays.

For example, if Friday is a holiday, there will be no overnight trading on Thursday night/Friday morning.

Q2: Do I need to open an additional account the overnight trading?

No additional account is required for overnight trading. As long as your account is enabled for US stock trading, you can participate in overnight sessions.

Q3: What are the service fees for overnight trading?

Service fees are the same as during regular trading hours.

Q4: Is short sale allowed during overnight trading?

Yes, short sale is supported.

Q5: Can orders be placed in advance for overnight trading?

No, orders can only be placed during the overnight session.

This article is for reference only and does not constitute any investment advice.