Take profit/stop loss

What are Take-Profit and Stop-Loss?

The take-profit/stop-loss feature lets you set price levels to automatically buy or sell stocks when they reach those prices, helping you manage risks and lock in profits.

- Take-profit order: Closes your position when the price reaches a certain profit level, locking in your gains.

- Stop-loss order: Closes your position if the price drops to a certain level, limiting your losses.

When to Use It and How to Access It

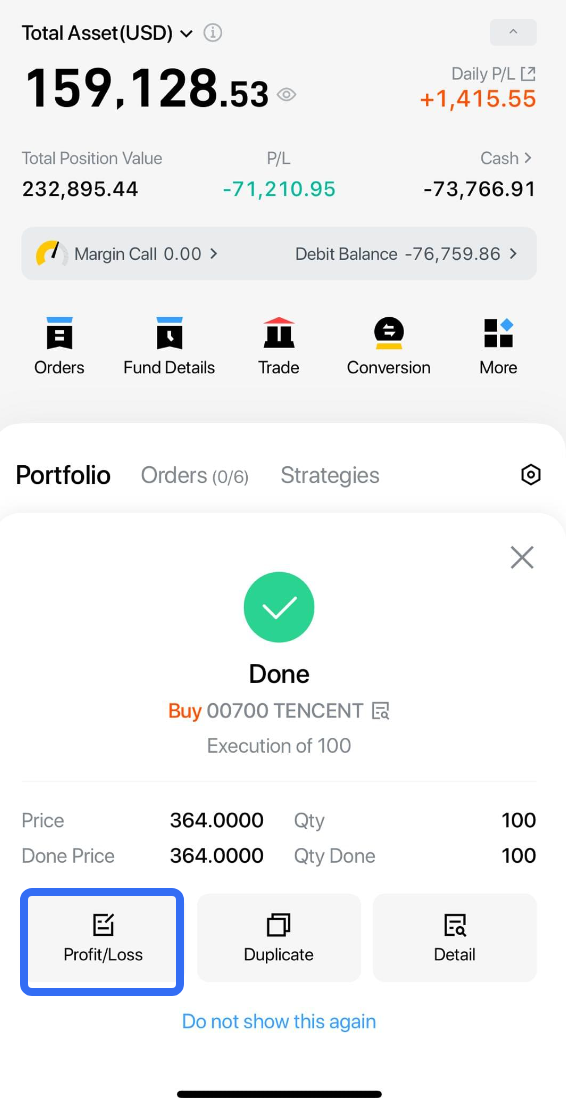

- After placing an order: Once your order is done, you can set take-profit and stop-loss levels using the order panel.

- Managing current positions: Alternatively, you can set take-profit and stop-loss levels for your current positions using the "Profit/Loss" button, as shown.

How to Use the Feature

- Set TP (take-profit) and SL (stop-loss) prices and the system will display your estimated profit or loss and the percentage change.

Using the image above as an example:

At TP price: 229.89;

Estimated profit percentage: +10.00%

Estimated profits*: +208.97USD

At SL price: 188.09

Estimated profit percentage: -10.00%

Estimated profits*: -209.03USD

*Estimated profits = (TP price - Cost price) * Qty

Estimated losses = (SL price - Cost price) * Qty

TP and SL toggle switch:

Enable both toggles to set both TP and SL prices. Note: If a TP order is triggered by the system, your SL order will automatically be cancelled, and vice versa.

TP only or SP only: Set either a TP or an SL order

For a detailed explanation, see: “Examples”

2. Order parameter settings:

Select “Limit” or “Market” to set order type

Limit Orders require input for TP and SL prices

Time in Force: Sets how long your TP and SL orders remain active.

Options: Good Till Cancelled, Day, or a custom period

Session

Selecting a trading session is required for US stocks

Note: Market Orders are only available during regular trading hours.

3. Price Settings

TP/SL price: Adjust the target price based on the percentage change from the cost price.

Qty: Set the number of shares based on your current position.

TP/SL (Order Price): Adjust the target prices based on your TP/SL prices.

Parameter Descriptions

- TP: If the market reaches or exceeds the set price, your position will be closed automatically

- TP Only: Focus on locking in profits by setting just the TP price.

- SL: If the market falls to or below the set price, the system will automatically close your position.

- SL Only: Focus on minimizing losses by setting just the SL price.

Note: If a TP order is triggered by the system, your SL order will automatically be cancelled, and vice versa.

Examples:

- Investor A has 500 shares of Stock XYZ purchased at a cost price of $10.00 per share. Investor A sets the ‘TP Price’ at $11.00, and the ‘SL Price’ at $9.50 for 100 shares by placing a Market Order in the “TP/SL” feature.

- Once the order is submitted, the system creates two conditional orders: (1) an SL order to sell 100 shares if price falls to $9.50 or lower; and (2) a TP order to sell 100 shares if the price rises to $11.00 or higher. If the price reaches $11.00, the TP order will be triggered and the SL order will therefore be automatically cancelled.

- Investor B opens a short position to sell 100 shares of Stock XYZ at a cost price of $10.00 per share. Investor B then places a Limit Order, setting the ‘TP Price’ at $9.00 and the ‘SL Price’ at $11.00 for 100 shares. The ‘TP (Order Price)’ is set to $8.90 while the ‘SL (Order Price)’ is $11.00.

- Once the order is submitted, the system creates two conditional orders: (1) a TP order to buy 100 shares at $8.90 if the price drops to $9.00 or lower; and (2) an SL order to buy 100 shares at $11.00 if the price rises to $11.00 or above. If the price reaches $11.00, the SL order will be triggered and the TP order will therefore be automatically cancelled.

Managing Your Take-Profit and Stop-Loss Orders

- After your orders are placed, view and manage them in the ‘Orders’ tab.

- Long position - two sell orders.

- Short Position - two "Buy" orders.

Important Things to Note

- Take-profit/stop-loss prices: The system defaults to setting prices at +/- 10% of your cost price. However, this does not apply if your cost price is $0 or lower.

- Limit Orders: Set take-profit/stop-loss prices according to the stock’s liquidity, as limit orders might not always be filled

- Quantity: Take-profit and stop-loss orders are conditional and do not affect your available shares. However, if you manually close a position, the orders might fail due to insufficient shares.

- Check your order's "Time in Force" and "Trade Sessions" settings to ensure they align with your trading plan. Note that Market Orders are not supported during pre- and post-market sessions for US stocks.

FAQs

Q: How can I amend an existing take-profit/stop-loss order?

A: Tap "Amend" on your order in the 'Orders' tab to adjust the order settings accordingly.

Q: Why was my take-profit/stop-loss order triggered even though the set price wasn't reached?

A: The price shown on the candlestick chart is a weighted average, while the system triggers your conditional order based on real-time transaction prices.